Tesla Stock vs. Alphabet Stock: Which Is the Better Buy Today?

Both may be mega-cap growth stocks, but only one is undervalued today.

They’re two of the world’s most valuable companies by market capitalization. They’re popular names in exchange-traded funds and mutual funds that favor large-growth stocks, too. And they’re both disruptors: Alphabet GOOGL has changed the way we think about online search (after all, who hasn’t said “I’ll Google it”), while Tesla TSLA is leading the charge in taking electric vehicles mainstream.

We’re pitting these two companies against each other to determine which is the better investment opportunity today based on a few of Morningstar’s proprietary metrics.

As part of this feature, we're providing access to the full Analyst Reports for both companies to readers for free for a few weeks; Analyst Reports are a part of our paid Premium Membership. By using the Analyst Reports for Alphabet and Tesla, you can dig into some of our proprietary metrics more deeply and find out what our analysts have to say about each company's business strategy, competitive advantages, valuation, and risk. You'll also have access to similar metrics about close competitors and what the bull and bear cases are for each stock.

Take a look:

Alphabet's Analyst Report Tesla's Analyst Report

Who wins this stock versus stock cage match? That depends on what Morningstar metrics matter most to you. Let’s run each company through a few of them.

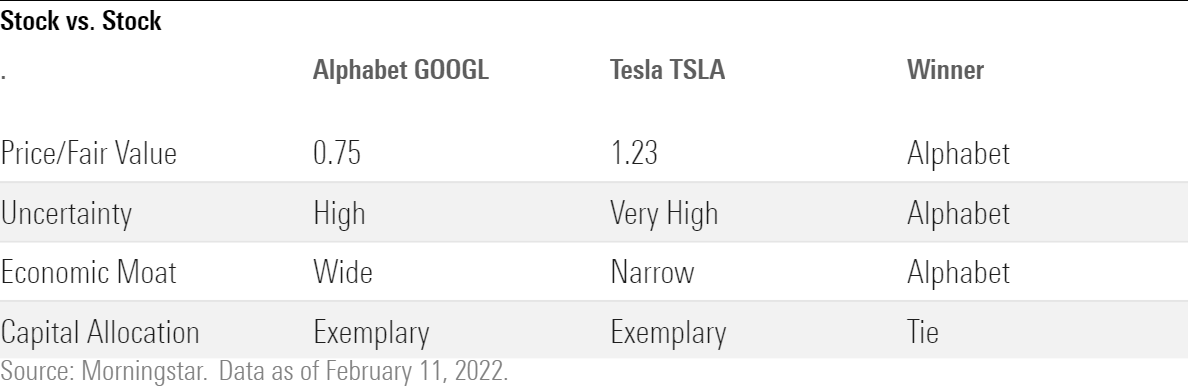

Price/Fair Value Winner: Alphabet Morningstar's analysts calculate a fair value estimate for each stock they cover. The fair value estimate represents the intrinsic value of a stock, based on how much cash we think the company can generate in the future. A stock's price/fair value is simply its current market price divided by the fair value estimate. A stock trading below 1.0 is undervalued; a stock trading around 1.0 is fairly valued; and a stock trading above 1.0 is overvalued.

As of this writing, we think Alphabet’s stock is about 25% undervalued, while Tesla’s stock is 23% overvalued. The winner from a price perspective is Alphabet; it is trading at a more attractive price today.

Watch: The Morningstar Fair Value Estimate

Uncertainty Winner: Alphabet Morningstar's uncertainty rating represents the predictability of the company's future cash flows and, therefore, the level of certainty we have in our fair value estimate of a given company. Companies that enjoy sales predictability, modest operating and financial leverage, and limited exposure to contingent events carry low uncertainty; those with less predictable sales, significant leverage, and significant exposure to contingent events carry higher uncertainty.

Our analysts think Alphabet’s cash flow uncertainty is high--but Tesla’s uncertainty is even higher. Alphabet wins for its relatively lower uncertainty because we’re more confident in our fair value estimate of that stock.

Economic Moat Winner: Alphabet The Morningstar Economic Moat Rating represents a company's sustainable competitive advantage. A company with an economic moat can fend off competition and earn high returns on capital for many years to come. A company whose competitive advantages we expect to last more than 20 years has a wide moat, one that can fend off its rivals for 10 years has a narrow moat, while a firm with either no advantage or one that we think will quickly dissipate has no moat.

Our analysts think Alphabet has carved out a wide economic moat, while Tesla has only built a narrow economic moat. Alphabet for the win on this metric.

Watch: The Morningstar Economic Moat Rating

Capital Allocation Winner: Tie The Morningstar Capital Allocation Rating represents our assessment of how well a company manages its balance sheet, investments, and shareholder distributions. Analysts assign each company one of three ratings--Exemplary, Standard, or Poor--based on their assessments of how well a management team provides shareholder returns. Adept corporate managers can make a good company even better.

Both Alphabet and Tesla earn our top rating when it comes to capital allocation.

Watch: Introducing the Morningstar Capital Allocation Rating

Overall Winner: Alphabet At the end of the day, the "winner" of any cage match from Morningstar's perspective is the stock that's trading at the largest discount to our fair value estimate after being adjusted for uncertainty. The Morningstar Rating for stocks encapsulates just that. Stocks rated 4 and 5 stars are undervalued after being adjusted for uncertainty, stocks rated 3 stars are fairly valued, and stocks rated 1 or 2 stars are overvalued after being adjusted for uncertainty.

Alphabet earns a 4-star rating as of this writing, while Tesla earns a 2-star rating. Alphabet is the much better value today from Morningstar’s perspective.

Watch: The Morningstar Rating for Stocks

Start your free 14-day trial of Morningstar Premium. Understand the difference between a good company and a great opportunity. Unlock our analysts' fair value estimates and get continuous research and analysis to help you make the best decisions.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)