How Income and Savings Affect the Racial Wealth Gap

Our analysis shows further proof that income disparity affects the ability to build wealth over time.

Editor’s Note: Here are initial findings based on a new dataset we’ve just released on Morningstar's Github site. By sharing this dataset, we hope to enable future research and a thoughtful discussion about decreasing the racial wealth gap.

The racial wealth gap in the United States is well documented: The median Black household has 12 cents for every dollar in wealth of the median white household, and the median Hispanic household has 14 cents. It’s a gap that has persisted for at least half a century.

Why it exists, however, isn’t clear.

Today we’ve released a new report sharing our preliminary analysis of the causes of the gap, and potential ways to shrink it. The analysis is based on our cleaned and standardized version of the longest-running household finance survey in the world, the Panel Study of Income Dynamics, which we are also making publicly available for other researchers to use.

In our analysis, we've found that lower income is a direct cause of lower savings rates among Black and Hispanic households; the combination of income and lower savings rates appears to be the primary driver of the racial wealth gap. In addition, we find that for the majority of American households, day-to-day saving is far more important in wealth accumulation than capital gains, inheritances, or other factors. Thus, solutions to the wealth gap start in addressing income and saving inequality, rather than in other areas. You can read the full report here.

Understanding the Racial Wealth Gap

There is an active debate on the racial wealth gap’s causes. For example, researchers and policymakers have studied the role of inheritances, historical and ongoing discrimination, family structure, spending patterns, and a range of other factors. Researchers have also noted that there are clearly different patterns of saving and investing between groups, which appear to contribute. But that analysis has been incomplete to date, largely because of insufficient data on household finances.

To better understand the role of saving and investing in wealth accumulation and the racial wealth gap, Morningstar spent nearly a year studying saving behavior, spanning the different ways people save (from businesses to the stock market) and across different market conditions.

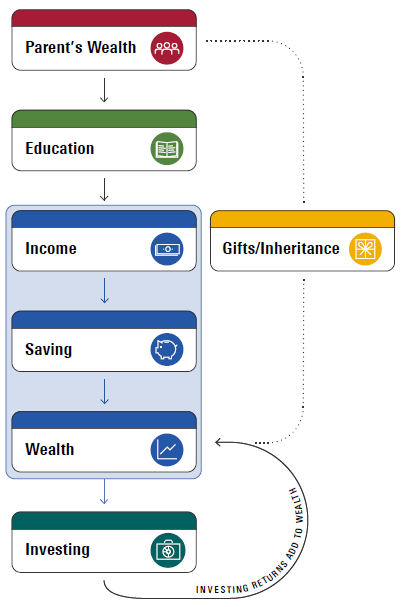

We find that saving and investing are part of a complex process that plays out over time, in which families build wealth across generations, and disparities flow through education, income, and saving. We think of this as a cycle of wealth accumulation, shown in Exhibit 1.

- source: Morningstar Analysts

When we look specifically at saving, investing and wealth, the overarching story that emerges across the past three decades is powerful: Income disparities drive differences in savings rates, and that drives disparities in wealth accumulation and the racial wealth gap.

Specifically, we saw that:

- Savings rates among lower-income (40th percentile and below) and Black households have remained between 0% and 2% for the entire 30-year period. Savings rates among higher-income, white, and (to a lesser extent) Hispanic households do show an upward trajectory--6% to 8%, and 2% to 5%, respectively.

- Many factors, from personal preferences to household situation, affect savings rates; most of these factors cancel out at an aggregate level, though. The racial difference in saving rates is primarily explained by differences in income, not behavioral factors.

- Contrary to what some may think, for most of the past 30 years active saving appears to be a more important factor in wealth accumulation than capital gains for a large majority of the population. Most Americans simply don't hold enough wealth, for a long enough period, to earn significant capital gains. Similarly, most Americans do not receive a sizable enough inheritance for inheritances to change the picture of wealth accumulation.

What does this mean for investors and for finance professionals?

For investors who are interested in helping close the racial wealth gap, there are two big lessons:

- You can use data on fair hiring and pay practices to help guide your investments: Equalizing unemployment rates and income would make a major difference.

- Avoid false narratives about the racial wealth gap. The biggest factor behind the gap appears to be income differences--not that any particular group doesn't want to save or makes bad investments.

For financial professionals, there are also clues on what we can do to improve the situation:

- Few companies or people intend be discriminatory, but sometimes inequitable outcomes still happen. It behooves companies to review their practices and see if they are hiring and promoting fairly, in addition to having good intentions.

- Support policy efforts to help non-savers save, such as baby bonds and the saver's credit. Color-blind policies like these can help close the racial wealth gap, by helping minority families who disproportionately have lower income and lower saving rates.

- If your companies--or your client's companies--aren't currently providing a workplace retirement plan vehicle, do so immediately. In the full report, we show how one of the main gaps for minority households is workplace retirement savings.

Background on the PSID

For researchers or those who support research in this field, here is a brief description of the dataset and code we are releasing alongside the report.

For the past 50 years, the PSID has tracked the finances of a nationally representative sample of American households as they marry and have children, save for the future, and retire. They’ve also periodically added new families over time, to make the dataset represent the changing picture of America.

The PSID is unfortunately very difficult to use: Its very richness is also its greatest limitation. To help unlock this rich data source for our analyses and for the broader research community, Morningstar developed a system to standardize and clean the PSID. We also developed a methodology for separating intentional, active savings from capital gains, inheritances, and changes in household composition, building on pioneering work by academic researchers Dynan et al. (2004), Gittleman and Wolff (2004), and Juster et al. (2006).

The result is a unified dataset showing the saving and investing behavior of over 5,000 American households. We calculated capital gains and active savings for each household across 10 asset classes--from businesses, to personal checking and savings accounts, to retirement savings--across a 30-year timespan. Researchers can use this dataset to analyze the complex dynamics of saving, investing, passive income, and interfamily transfers (gifts and inheritances).

The code and data can be found on Morningstar's Github site and we encourage fellow researchers and policymakers to use and build upon it.

What’s next?

We find signs of hope, and actions we can take, from our analysis of this powerful dataset. We know however, that this research is only one step on a long path. By releasing the underlying data, and the code used to generate it, we look forward to working with the research and finance communities to gain an even clearer understanding of the racial wealth gap, and what we can do about it.

/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)