Even After Rally, Some Bargains Remain in Energy Sector

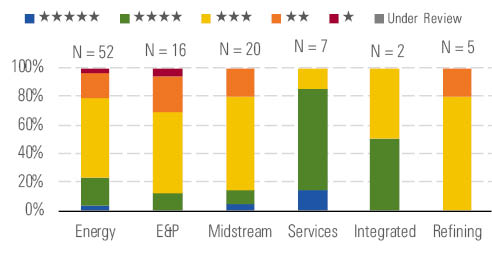

Services and integrated firms trading at discounts to fair value.

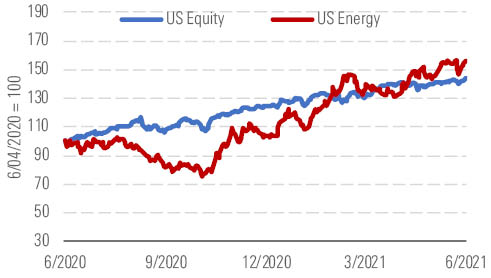

For the third quarter in a row, the Morningstar US Energy Index has eclipsed the overall market, outperforming the aggregate index by roughly 670 basis points as of June 25. Though the COVID-19 delta variant presents a new challenge, we do not expect it to stifle the global recovery. The outbreak in India is subsiding after May’s peak, and we believe the country is on the right path. Meanwhile, mass vaccinations in developed markets continue to provide the necessary backdrop for a full recovery in demand by 2022.

Energy stocks outperformed after a tough 2020. - source: Morningstar

Even with the rally year to date, we have energy as fairly valued, with the median stock trading at a price/fair value ratio of 1. Opportunities exist across all segments, particularly services and integrated, which trade at a 29% and 10% discount to intrinsic value, respectively. Exploration and production stocks have surged in the last three months, and on average the group is 8% overvalued (though a handful of 4-star stocks are still underappreciated, in our view).

Global demand should surpass 2019 levels by 2022. - source: Morningstar

The ongoing mass rollouts of COVID-19 vaccinations in developed markets will be the main catalyst for year-on-year demand growth of 5.1 million barrels per day in 2021. Our updated demand estimates for 2021 and 2022 are 96.2 mmb/d and 100.4 mmb/d, respectively. While optimistic about demand improvements, producers remain hesitant on the supply end.

During its June 1 meeting, OPEC+ confirmed it will go ahead with modest volume increases of 350 and 450 mb/d in June and July, respectively (which means the group will still be withholding at least 2 mmb/d). And U.S. shale drillers—which have historically acted as swing producers, like OPEC—have steadfastly refused to increase capital budgets to take advantage of higher oil prices, preferring to prioritize free cash flows and distributions to shareholders.

As a result, we now anticipate global demand will outpace supply this year by 1.0 mmb/d. These dynamics have pushed oil prices to what we consider frothy levels, with the West Texas Intermediate benchmark currently 33% higher than our $55/bbl midcycle forecast. Without an abrupt change in strategy from OPEC or the U.S. shale industry, the oil markets will remain tight this year, and short prices could climb even higher.

Top Picks

Schlumberger SLB Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $47 Fair Value Uncertainty: High

Although rallying share prices have removed much of our oilfield-services coverage from deeply undervalued territory, investors can still get industry leader Schlumberger for a bargain. We expect industry activity to recover from COVID-19, with long-run activity in international markets (where Schlumberger focuses) even surpassing prepandemic levels. We think Schlumberger will continue its historical record of leading peers in technological progress and generating high returns on capital.

EOG Resources EOG Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $96 Fair Value Uncertainty: Medium

EOG doesn't like overpaying for assets. The firm mostly avoids expensive corporate mergers and acquisitions, focusing instead on overlooked or underexplored acreage. But that hasn't stopped it from assembling a top-tier shale portfolio encompassing the major U.S. oil plays. The firm's competitive edge is strengthened by its scale and technical prowess, and we're confident the firm can stay near the front of the pack on profitability, given its deep inventory of premium drilling opportunities. That sets the firm up well for sustainable free cash generation under a wide range of commodity scenarios, supporting further dividend hikes. Unlike some peers, EOG already has a rock-solid balance sheet, so it doesn't need to divert any operating cash to repay debt.

Equitrans Midstream ETRN Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $15 Fair Value Uncertainty: Very High

We believe the market is pricing Equitrans as if the Mountain Valley Pipeline will fail, as it trades at a material discount to U.S. midstream peers. However, Equitrans has laid out a transparent and comprehensive plan to address its remaining permitting issues and has derisked its balance sheet. With the failure of the Atlantic Coast Pipeline, the MVP now has incremental contracting opportunities given the new demand from former ACP shippers. We expect the pipeline to be on line by mid-2022.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)