Standout Teams Lift the Ratings of These Parnassus and BlackRock Funds

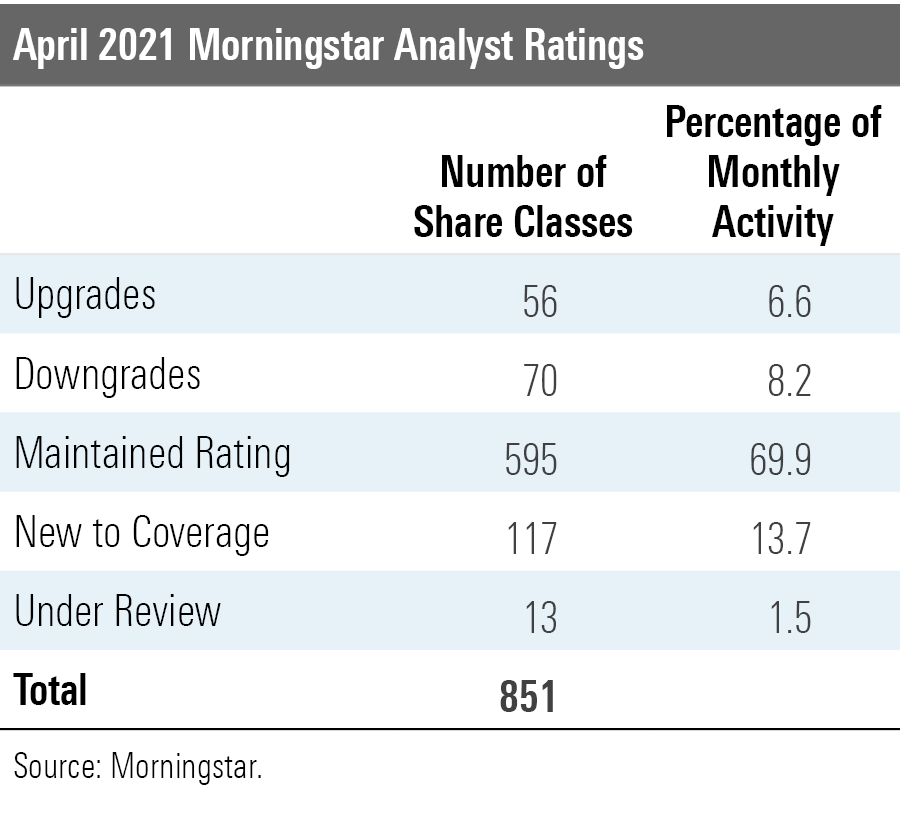

Morningstar analysts rated 851 share classes and vehicles and 203 unique strategies in April.

Morningstar updated the Analyst Ratings for 851 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in April 2021. Of these, 595 maintained their previous rating, 70 were downgrades, 56 were upgrades, 117 were new to coverage, and 13 were put under review because of material changes, such as manager departures.

Sifting out multiple share classes and vehicles, Morningstar rated 203 unique strategies in April. Of these, six received an Analyst Rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. Below are some highlights of the upgrades, downgrades, and funds new to coverage.

Upgrades

Increased confidence in the stable and experienced investment team at Parnassus Mid Cap Growth PARNX earned the strategy a Morningstar Analyst Rating upgrade to Bronze from Neutral. This strategy used to be a multi-cap core offering, but on May 1, 2020, Parnassus changed it to a mid-growth approach. The strategy is still in its early stages of its new mandate, but the fund is in capable hands. Comanagers Ian Sexsmith and Robert Klaber joined the strategy in 2013 and 2016, respectively, and each has at least 12 years of experience, all at Parnassus. A 12-person investment team and three-member environmental, social, and governance team support the pair. Like the rest of the firm, Sexsmith and Klaber still focus on companies with relevant products or services, sustainable competitive advantages, exemplary management, and ethical practices, only they stick to mid-cap stocks.

Some manager stability and deeper integration with other firm investment teams earned BlackRock Global Allocation's MALOX cheaper share classes an Analyst Rating upgrade to Silver from Bronze. BlackRock's global fixed-income CIO Rick Rieder took over here in April 2019 in preparation for the departure of longtime manager Dan Chamby. Rieder hadn't managed an asset-allocation strategy before, but he runs several Gold- and Silver-rated unconstrained bond strategies. His experience using BlackRock's solid macro and fixed-income resources is well suited for this strategy and a welcome change from the previous manager's more siloed approach. Rieder and his two comanagers combine macro views and bottom-up research to invest across asset classes, regions, sectors, and currencies.

Downgrades

Longtime manager Jeff Rottinghaus will retire on April 1, 2022, from T. Rowe Price U.S. Large Cap Core TRULX, resulting in a rating downgrade to Neutral from Bronze. Though the firm left a long runway for the transition, Rottinghaus' successor Shawn Driscoll does not have experience running a diversified fund. He joined the firm in 2006 and has managed natural-resources strategy T. Rowe Price Next Era PRNEX since 2013 with mixed results. Driscoll will join Rottinghaus, who has managed here since 2009, on Sept. 1, 2021, and will work under Rottinghaus until he departs. Fundholders can expect some changes when Driscoll comes aboard. The strategy should remain quality-oriented, but given Driscoll's background, the portfolio will likely be more value-leaning. He will, however, continue to lean on the firm's deep 60-person U.S.-focused equity research team.

Victory Munder Multi-Cap MNNAX has struggled since adopting a new cast of analysts and managers, warranting a downgrade to Negative from Neutral. Manager Michael Gura has led this strategy since its 2003 inception, but he has worked with a new team since 2015 after two comanagers departed. Poor stock selection has driven the strategy's underperformance since then, and the addition of comanagers Robert Crosby and Gavin Hayman hasn't improved results. The managers' lack of investment in the fund also doesn't inspire confidence. The team's high-turnover, short-term focus lacks an edge, and outflows have been hefty.

New to Coverage

Amy Zhang's experience and record as a small-company investor earn Alger Mid Cap Focus AFOZX its debut rating of Silver. Zhang came to Alger to manage Silver-rated Alger Small Cap Focus AGOZX in 2015 from Brown Capital Management, where she had been a manager on Gold-rated Brown Capital Management Small Company BCSIX during a period of strong results. Alger Mid Cap Focus launched in June 2019 as a natural extension of that strategy, which is now closed to most new investors. Zhang and her six-person analyst team look for firms with operating revenues of at least $500 million, healthy balance sheets, and durable business models. She prefers founder CEOs or management teams capable of delivering long-term growth. It's still early, but the strategy is off to a good start. From its June 2019 inception through April 2021, the Z share class gained a cumulative 104.5% and topped 95% of mid-growth Morningstar Category peers.

Calvert's target-risk series is sensible, but its asset-allocation process doesn't stand out. The three strategies--Calvert Growth Allocation CAAAX, Calvert Moderate Allocation CMAAX, and Calvert Conservative Allocation CCLAX--all receive Neutral ratings. Following Eaton Vance's acquisition of Calvert in 2016, comanagers Dan Strelow and Justin Bourgette took over the series. They set equity targets of 90%, 65%, and 35% for the Growth, Moderate, and Conservative strategies, respectively. They invest in a wide range of underlying strategies, including thematic equity funds, fixed-income offerings, and index-based options. While the strategies don't earn Morningstar Medalist ratings, their environmental, social, and governance approach earns a Morningstar ESG Commitment Level of Advanced.

/s3.amazonaws.com/arc-authors/morningstar/73478172-d83e-49a0-8810-5eb20b6f672a.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/73478172-d83e-49a0-8810-5eb20b6f672a.jpg)