Is Renting Throwing Away Money?

Factors like freedom and career flexibility can offer intangible financial benefits--in exchange for a home equity opportunity cost.

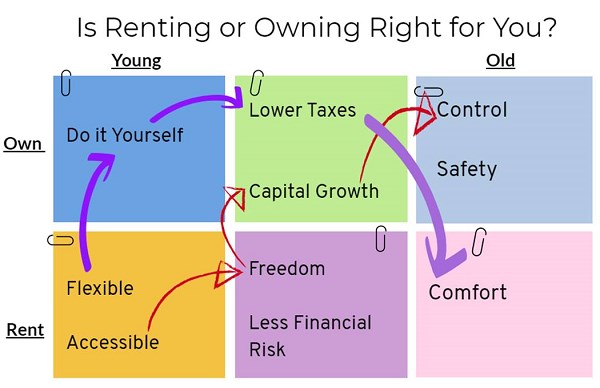

Yes, there are many advantages to owning your home. But renting brings other advantages that are even more important to some people. What argument weighs most heavily for you probably depends a lot on your age. Young people tend to start by renting, both because they lack the financial muscles to buy a home and because they value their freedom. While age is a key factor, other considerations, like the trade-off between risk and potential returns, apply to all.

But first, it is important to be aware of the genuine uncertainty about future home prices and the risks this creates, depending on how long term your ownership is. Around the world, there are extreme differences in price movement in local housing markets.

Doubling of Price, or 30% Lower?

The United States has seen real home prices rise 61.5% between 1990 and the first half of 2020, according to the Organisation for Economic Co-operation and Development. Canada, New Zealand, and Sweden have seen real home prices more than double in the last 30 years. But, in other countries like Germany and Switzerland, according to

The Economist

house-price index, prices adjusted for inflation have stayed on the same level as 30 years ago. And in Japan they are 32% lower than in 1990.

People’s expectations on future home prices are strongly influenced by local historical price trends. The title of this article makes more sense in a country with rising prices. In countries with negative ownership returns, people focus more on financial risk rather than opportunity cost when renting.

One of the most well-known experts on long-term home price movements is Robert Shiller, a professor at Yale University. His summary of research on home price movements during 100-year periods using the repeat-sales method (only including price movements of the same properties) shows that the very long-term trend is that home prices stay constant with household incomes. And outside dense urban areas, upward price movements are limited by construction costs. Based on this, countries with strong price increases in recent years should expect the supply to increase as well until prices fall back to the long-term trend.

Arguments for Renting

Young people moving away from their parents, especially students, often have no other choice than renting. And even after gaining steady employment, there are other temptations in life.

Freedom is the key advantage of renting--not only avoiding monthly bank payments and care of one's real estate but also having more flexibility when new opportunities appear. Avoiding the financial risk of homeownership means that you can be more flexible in the job market and that more of your long-term savings can be invested in the equity market, with higher expected returns.

The risks caused by homeownership depend on how long you expect to stay in a home. In the extreme case where you live in the same house until you die, the limit is what monthly cost you can handle. On the other hand, if you might need to move again in 12 months and must sell, adding a price decline to transaction costs could make the experience terribly expensive.

Arguments for Ownership

Many common arguments for ownership center around the potential for lower average cost. By doing repairs and upgrades yourself, using tax benefits, and hopefully realizing capital gains, in the end, you can afford a larger home. Also, ownership gives more control and added safety, especially in countries where rent contracts are time-limited.

By entering the ownership ladder, committing to investing in your home, paying down the mortgage, and, with salary increases, gradually moving to larger condominiums and houses, it is possible to gradually grow real estate wealth. In some countries, this is a dominant lifestyle of high-income families.

As illustrated in the diagram above, there are many potential paths, with different arguments causing people to move.

Let's look at two potential paths a person might take: Person A (indicated by the purple arrows) starts with renting, later decides to focus on upgrading a rundown condominium with some do-it-yourself renovations, and later also buys a larger condominium, hoping to gain by additional tax advantages. Person A realizes those gains at retirement by moving to a smaller rented flat with no responsibility for maintenance and housekeeping, leaving more to be spent on travel and comfort. Oh, the comfort of just calling the landlord when something needs fixing! Person B (red arrows) first gives priority to what is financially possible--with a touch of freedom. When finding well-paid employment in an urban center, a rented flat is ideal for helping one stay career-focused. Later, news stories of enormous capital gains in the housing market become too tempting, so Person B shifts to owning. After retirement, Person B's key argument changes to being able to control all aspects of the interior and garden design. Ultimately, there's no right or wrong answer when it comes to renting or owning a home. As with any financial decision, it's important to base the choice on your overall goals, risk appetite, and more. Jonas Lindmark has been editor and head of fund analysis at Morningstar Sweden since August 2000. Before that, he was personal finance editor and designed fund ratings during nine years at the weekly business magazine Affärsvärlden.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)