7 Questions to Ask Before Buying Any Multifactor Fund

A closer look at the growing menu of multifactor strategies and a tool kit to sort through it.

The menu of multifactor funds has expanded considerably over the past decade. As the options have grown, so has investors' research burden. These funds are diverse and often among the most-complex index strategies on the market. While many of these strategies may sound similar, there are important differences in their approaches to portfolio construction, which often yield very different portfolios and performance. Most of these funds have disappointed in recent years, illustrating that diversification across factors with strong theoretical support isn't sufficient to guarantee strong performance. Morningstar's passive strategies research team recently published a paper which provides a closer look at the growing landscape and outlines a framework to evaluate these funds' investment processes. Click here to view the full paper.

Key Takeaways

- The number of multifactor funds has grown considerably over the past decade, though there are signs the market is maturing.

- Multifactor funds' share of the strategic-beta market has held steady at between 4% and 6% for most of the past decade. This small market share is likely due to these funds' complexity and weak performance, which have hindered adoption.

- Most multifactor funds have underperformed their respective Morningstar Category indexes over the trailing three and five years through September 2020.

- Morningstar's framework for evaluating multifactor funds' approaches to portfolio construction includes several questions worth asking before buying any multifactor fund.

Diversification Benefits The case for multifactor funds is the case for diversification. Just as it's prudent to diversify across asset classes, sectors, regions, and securities, it's a smart idea to spread bets across multiple factors that each have a good chance of long-term success. Doing so can reduce risk and make it easier to stick with these factors through their inevitable rough patches.

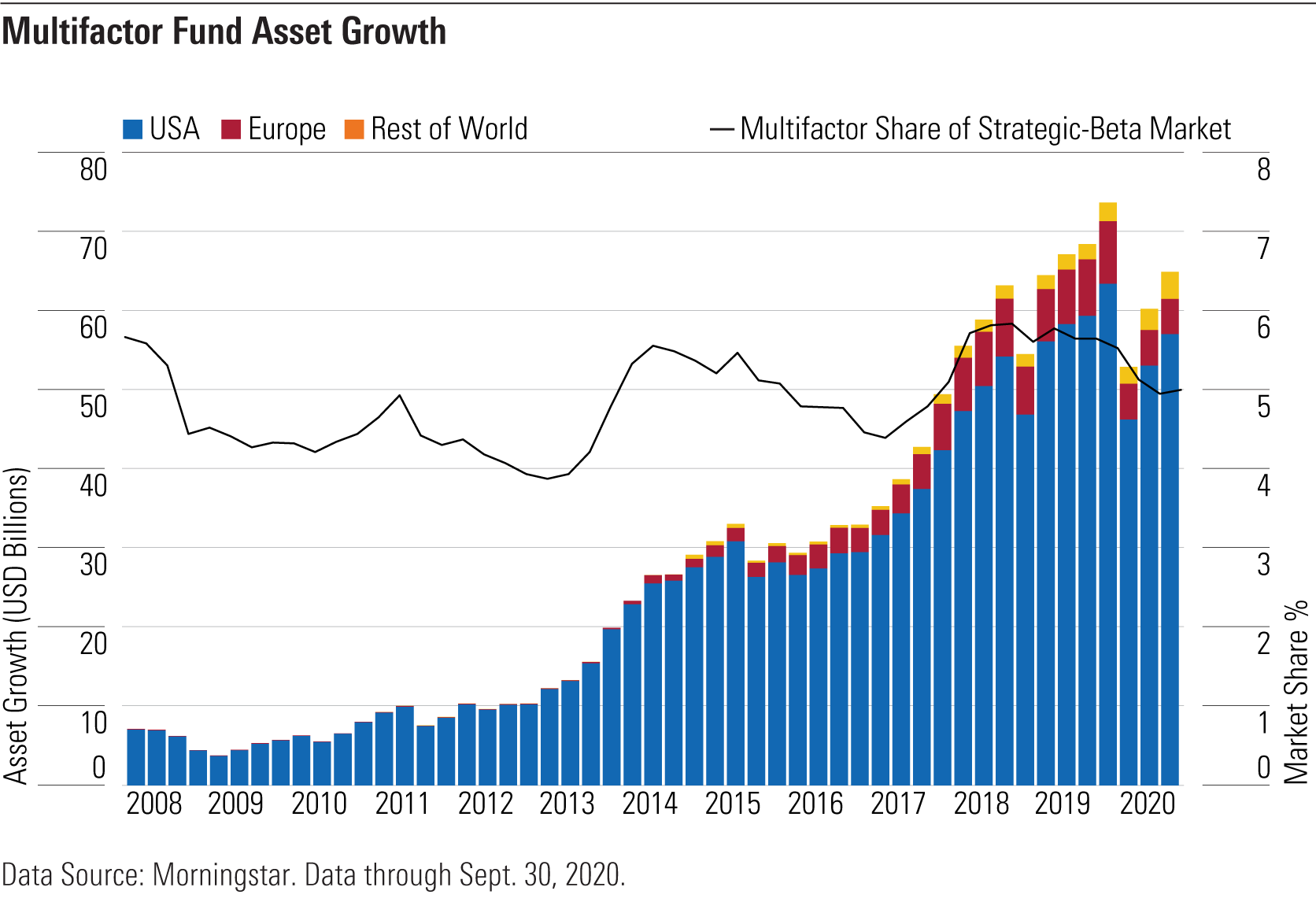

A Growing, But Maturing Landscape Interest in multifactor funds has grown over the past decade. Assets invested in multifactor index funds grew to $65 billion globally at the end of September 2020, up from $7 billion a decade earlier, as Exhibit 1 shows. Most of these assets were held in U.S.-listed funds, which accounted for $57 billion.

Exhibit 1

This growth rate was similar to that of the broader market for strategic-beta funds. Multifactor funds' share of this market has held has steady at between 4% and 6% for most of the past decade. Multifactor funds enjoyed an estimated $44 billion in net inflows over the past decade. However, flows turned negative over the trailing 12 months through September 2020, during which these funds shed $4.3 billion.

It's a bit surprising that these funds have gained as much traction as single-factor funds, as they are often more suitable as core holdings and take away the challenge of figuring out how to combine factors in a portfolio, which many investors are not well-equipped to tackle. These products' complexity has likely hindered adoption. They often more closely resemble quantitative active strategies than passive index portfolios. As such, investors often wait to see how these funds perform before buying them.

There are many multifactor funds vying for attention. The menu of funds has expanded considerably over the past decade. At the end of September 2020, there were 294 multifactor funds on the market, up from 45 at the end of 2010. Most of these funds haven't been on the market long. Only 79% of the multifactor funds currently on the market were around five years ago.

However, new product growth has slowed in recent years, particularly in the U.S., as the market has become increasingly saturated. Fund closures exceeded launches through the third quarter of 2020, reflecting the saturation of the market, disappointing performance, and asset managers' efforts to shutter smaller funds.

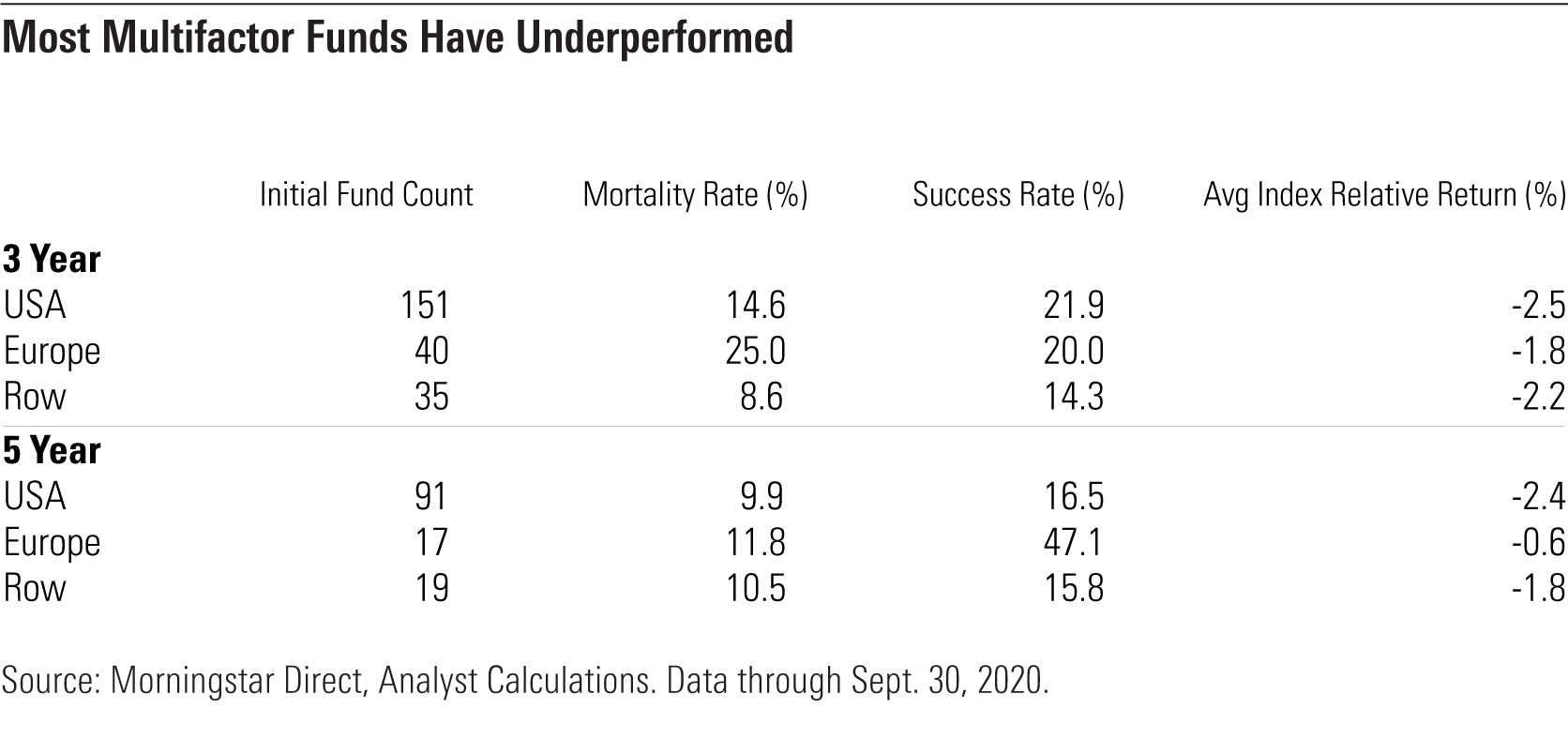

Disappointing Performance Most multifactor index funds have disappointed in recent years, which may help explain why these funds haven't grown faster than other types of strategic-beta funds. For example, of the 91 multifactor index funds listed in the U.S. at the end of September 2015, only 16% survived and outperformed their respective category benchmarks over the next five years. The funds in that group that survived lagged their category benchmarks by 2.4 percentage points annually on average during that period. The results weren't much better in other regions or over the most recent three-year period, as shown in Exhibit 2.

Exhibit 2

Much of this underperformance is due to the poor performance of value (and small size in the U.S.), which many of these funds lean into. While these funds' inclusion of other factors tended to partially offset this performance drag, it often wasn't enough to overcome it. This demonstrates factor diversification doesn't eliminate the risk of underperformance, even over lengthy periods.

While different multifactor funds may often seem alike, there was considerable dispersion in their performance (and holdings). These funds often differ with respect to the factors they target, how they measure and combine those factors, and how aggressively they pursue them.

Framework for Evaluating Portfolio Construction Multifactor funds are diverse, but the key questions investors should ask to evaluate these strategies are the same. The following framework offers a useful way to compare multifactor funds.

1. What's the fund's starting point? This is the selection universe that a fund winnows down to build its portfolio, which is typically a broad index. This is often a good benchmark for the fund's performance. It may also offer insight into the fund's potential to outperform.

The payoff to most investment factors has historically been the greatest among the smallest stocks, likely due to greater mispricing in that segment. So--all else equal--funds that include small-cap stocks in their selection universe likely have greater room to outperform (or underperform) than funds that are limited to large- and mid-cap stocks.

2. Which factors does the fund target? There are only a handful of factors that truly matter for stock investors. These include value, momentum, quality, low volatility, and small size. While there are myriad other factors, they either are not widely accepted, not investable at scale (like illiquidity), or just repackage one or more of these core factors. It is best to stick to funds that target a combination of the core factors.

It’s also prudent to look for complementary factor pairings. For example, value tends to work well when momentum doesn’t, and vice versa. Similarly, quality’s returns relative to the market are negatively correlated with small size.

3. How does the fund measure its targeted factors? There are many ways to measure stocks' exposure to each factor. Rarely is one definition clearly superior to others. What matters is that the chosen metrics are:

- Simple

- Transparent

- Clearly representative of the investment style

- Diversified

The specific metrics chosen tend to move the needle less than whether the fund measures each stock's factor characteristics relative to its sector peers or the entire universe. A sector-relative approach improves comparability and leads to less-pronounced sector biases, which can be a source of uncompensated risk. The drawback is that it may reduce the fund's factor purity, causing it to own stocks with weaker absolute factor characteristics than it would if it measured each stock against the entire universe.

4. How does the fund combine its targeted factors? There are two main approaches to combining multiple factors in a portfolio: considering factors separately (mixing) or considering them jointly (integration). Funds that follow the mixing approach split their portfolios into individual sleeves that each target a distinct factor.

The mixing approach is simple and makes it easy to gauge the impact of each factor on the fund’s performance. The drawback is it tends to dilute the fund’s overall factor exposures because there is usually little overlap between the holdings in the different sleeves.

Funds that use the integration approach can achieve stronger factor exposures. They pursue stocks with the best overall combination of factor characteristics. This allows them to allocate the entire portfolio to stocks with exposure to the targeted factors.

The downside of the integration approach is that it can lead to greater active risk, which increases both the potential for outperformance as well as underperformance. It is also more complex than the mixing approach, making it harder to attribute portfolio performance to distinct factors.

5. How strong are the fund's factor tilts? Funds with greater exposure to their targeted factors have greater potential to outperform the market than their less aggressive counterparts when those factors are in favor and greater risk of underperformance when they are not. Portfolios with higher thresholds for stock selection and more frequent rebalancing should have higher factor exposures than those with less demanding criteria and longer periods between updates.

The Morningstar Factor Profile, which is available for all equity funds, makes it easy to view how each fund’s factor exposures compare against its peers, based on the most recent holdings data.

6. Do the fund's factor tilts wash out, or does one factor dominate? If a fund's factor exposures largely offset, it probably won't benefit much when any one of those factors pays off. Offsetting is more likely if the fund follows the mixing approach to combining factors or takes little active risk. It is rare that all of a fund's factor exposures offset. But often, one or two factors have greater influence on the portfolio than the others. If that is the case, the portfolio may not be as well-diversified as it first appears. Small size and low volatility often have greater sway on a portfolio than other factors for funds that include them.

Some funds intentionally place more emphasis on one factor than another. If that aligns with investors' desired exposure, it's not necessarily bad. However, many funds have unintentional biases to certain factors, which limits factor diversification and can have a considerable impact on performance. Be aware of these potential biases before selecting a multifactor fund.

7. Are there any constraints on the portfolio? The most common portfolio constraints applied by multifactor funds include limits on:

- Sector weightings

- Stock weightings

- Country weightings

- Risk

- Turnover

These constraints can help improve diversification, reduce risk, and curb transaction costs. While they also limit a portfolio's exposure to the factors it targets, that’s often a worthwhile tradeoff.

No Silver Bullet Even the best multifactor funds aren't immune to lengthy stretches of underperformance. It's important to be selective and patient.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)