Your 2021 Medicare Fall Enrollment Checklist

How to effectively and efficiently re-evaluate your prescription drug or Medicare Advantage coverage.

If you're enrolled in Medicare, the clock is ticking. Every fall, you have an opportunity to review your coverage during the open enrollment season that runs from Oct. 15 through Dec. 7--so it's time to get busy.

Fall enrollment is the only chance most enrollees get to switch between the fee-for-service Original Medicare and Medicare Advantage, the all-in-one managed-care alternative to the traditional program. You also can re-evaluate your prescription drug coverage--whether it's a stand-alone Part D plan or wrapped in an Advantage plan. It's a good opportunity to make sure you're getting the coverage best suited to your healthcare needs--and perhaps to save some money on premiums and other out-of-pocket costs.

If you have Original Medicare and a Medigap policy and are satisfied with your coverage, there's no need to make a change. If you have a Medicare Advantage or Part D plan, review your insurance options even if you are happy with your current coverage, because plans change their pricing and benefits every year. Also, read the Annual Notice of Change, or ANOC, that Medicare sent to you in September (via mail or email). This lists the changes in your current plan, such as the premium and copays, and will compare the benefits in 2021 with those in 2020.

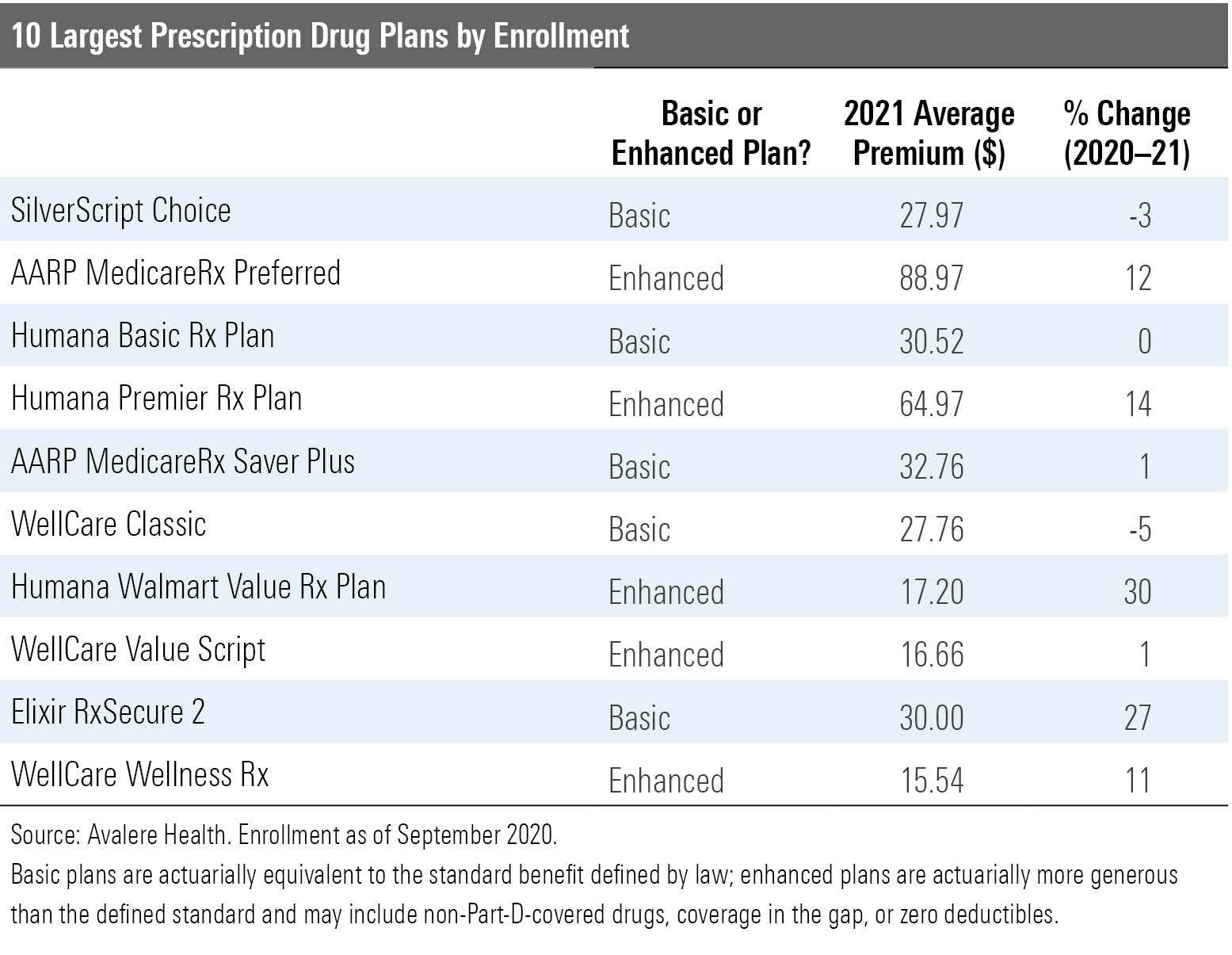

Among the 10 largest prescription drug plans, the average monthly premiums will decline 1% next year, according to Avalere Health. But what really matters is your own cost. As the table below shows, the actual changes are all over the map, with monthly premiums jumping as much as 30% or declining in some cases by as much as 5%.

And the premium is hardly the only thing you should consider. Also examine cost-sharing features and, critically, whether your drugs continue to be covered and under what terms. Part D plans often change their lists of covered drugs (formularies) from year to year, adding or removing drugs or changing restrictions on use. Your ANOC includes a summary of the formulary for your drugs, but you can get a full copy from your plan provider.

Review your monthly premium and updated drug coverage if you have a stand-alone Part D plan or if you receive your drug coverage through a Medicare Advantage plan. If you're enrolled in Advantage, also make sure the healthcare providers that you intend to use in 2021 are covered; these plans make changes in their provider networks frequently.

Also worth noting: Part D plans have several phases of coverage, including a deductible, an initial coverage phase, and a catastrophic coverage phase. The parameters of these phases change from year to year; the Kaiser Family Foundation offers a detailed analysis of the changes for 2021.

Original or Medicare Advantage? Medicare enrollees have two basic coverage choices. Original Medicare offers fee-for-service coverage and is accepted by most healthcare providers. Original Medicare usually is paired with a Part D prescription drug plan and a supplemental plan, which limits--or even eliminates--your additional out-of-pocket expenses. Supplemental coverage is provided by a commercial Medigap policy, or in some instances by former employers or unions.

Medicare Advantage is the managed-care alternative to Original Medicare. You're still in the Medicare program--Advantage plans are required to match all the covered benefits of the Original plan, and you retain all the rights and protections afforded to enrollees in Original Medicare (for example, the right to appeal the denial of a claim).

Advantage offers the convenience of all-in-one coverage and lower total premiums. In many cases, enrollees receive prescription drug coverage, gym memberships, and some level of dental, vision, and hearing care with no additional premium beyond the monthly Part B expense. For example, this year 78% of Aetna Medicare members were enrolled in these plans, a company spokeswoman says.

But your choice of healthcare providers will be limited by your plan's network. And your out-of-pocket costs will be less predictable--and perhaps higher than under the Original plan if you become seriously ill.

Advantage plan enrollment has doubled over the past decade, aided by federal policy and legislative decisions, but there's been no real debate about whether this is the best route for seniors' healthcare. The evidence is mixed on whether Original Medicare or Advantage produces the best health outcomes. And some critics point to high levels of denial of care by Advantage plans, which always can be a problem in managed-care programs.

The Kaiser Family Foundation reports that nearly all Medicare Advantage enrollees are in plans that require prior authorizations, generally for more expensive services such as inpatient hospital stays, skilled nursing facility stays, and some drugs.

"People often think there won't be any rules they have to follow, but they're wrong about that," says Diane J. Omdahl, co-founder and president of 65 Incorporated, a provider of fee-based Medicare enrollment advice.

But Advantage plans continue to pack in new benefits at a quick pace. For example, Avalere Health reports that one third of Advantage plans will offer supplemental benefits related to the pandemic next year, including care/relief packages, waived or reduced cost-sharing for COVID-19 treatment, and personal protective equipment. And more than 90% will offer dental, hearing, and vision coverage; coverage may be very basic, so look closely at any individual plan's offering before making a decision.

The Original or Advantage decision is best made at the point of initial enrollment in Medicare. At that point, the program's "guaranteed issue" rules forbid Medigap plans from rejecting you--or charging a higher premium--because of any pre-existing conditions. But after that time, Medigap plans in most states are permitted to reject your application or charge higher premiums.

During the annual fall enrollment period, you can shift to Original Medicare with a Medigap plan, but be sure to investigate whether you will be able to obtain supplemental coverage and at what cost.

For more on the Original versus Advantage decision, check out my podcast interview last fall with Dr. Gretchen Jacobson, an associate director with the Kaiser Family Foundation's Program on Medicare Policy.

COVID-19 and Medicare During the pandemic, Medicare (Original and Advantage) is covering coronavirus-related testing, telehealth, and prescription refills.

Testing is covered under Part B; you pay nothing if you have Original Medicare and see a participating provider, or if you are enrolled in Advantage and see an in-network provider. If and when a vaccine is available, it will be covered under Part B with no cost-sharing.

Coverage of care provided through virtual telehealth services has been expanded dramatically during the pandemic, including hospital and doctors' office visits, behavioral health counseling, and preventive health screenings. The usual cost-sharing applies, and if you are enrolled in Advantage, ask your plan provider about cost and coverage rules.

Telehealth may well be here to stay as a permanent feature of Medicare. Aetna Medicare will offer telehealth in all of its plans next year, notes its president, Christopher Ciano.

"We see this as not only important during the pandemic, but also as an evolution of how seniors will access care in the future," he says.

By the way, about those gym memberships--most of those programs are operating virtually now because of the pandemic, with video workouts, live online classes, and the like.

New Benefit Features Next year, Part D is adding a new program to help diabetic patients cope with insulin costs. Under the Senior Savings Model, participating Part D plans will charge no more than a $35 copayment per insulin prescription each month. Drug plans are not required to participate, but those that are can be found by using the Medicare Plan Finder to sort for insulin savings, notes Omdahl. Or contact a drug plan directly to learn if it is participating in this program.

Under legislation approved by Congress in 2018, Medicare Advantage plans now can pay for services designed to support older adults living at home with chronic conditions. The Chronic Care Act allows plans to pay for services such as grocery deliveries, caregiver support, and retrofitting homes. A small number of Advantage plans rolled these services out this year, and availability remains scarce.

"It's something we are continuing to test and learn about," says Ciano.

The Medicare Plan Finder does not allow you to sort Advantage plans for these benefits--you'll need to consult a broker or call individual insurers.

How to Shop Start your search using the Medicare Plan Finder, the official government website that posts stand-alone prescription drug, Medicare Advantage, and Medigap offerings. Critics of the plan finder argue that it's been difficult to use, and it underwent an overhaul last year that brought some improvements.

But the new site didn't allow users to sort plans by total costs, including premiums but also deductibles, copays, and coinsurance payments. Now, it is possible to sort plans by premium plus total drug costs, which provides a more accurate view of expense.

When it comes time to enroll, the Medicare Rights Center recommends calling Medicare to sign up directly (1-800-MEDICARE). This is the best way to protect yourself if any enrollment problems crop up--take notes on the conversation, including the date, representative's name, and the outcomes or next steps.

Special Enrollment Periods Aside from fall enrollment, it's possible to use a Special Enrollment Period, or SEP, to switch between Advantage plans or to join Original Medicare during the Medicare Advantage Open Enrollment Period that runs from Jan. 1 to March 31. This option is available only if you already are enrolled in an Advantage Plan.

There's also a SEP that permits you to switch into a plan with a five-star rating on the plan finder. This SEP can be used only once per calendar year.

People who are eligible for the Low-Income Subsidy, or Extra Help program for drug coverage, can change their Part D plans once per calendar quarter in the first three quarters of each year.

For more tips on the fall enrollment season, check out my recent podcast interview with one of the nation's top Medicare consumer advocates, Frederic Riccardi, president of the Medicare Rights Center.

Mark Miller is a journalist and author who writes about trends in retirement and aging. He is a columnist for Reuters and also contributes to WealthManagement.com and AARP The Magazine. He publishes a weekly newsletter on news and trends in the field at Retirement Revised. The views expressed in this column do not necessarily reflect the views of Morningstar.

Mark Miller is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)