See how our suite of solutions help Asset Managers, Advisors and Institutional Investors thrive.

Evolving Investor Insights

Essential Takeaways to Build a Modern Advisory Practice

While the fundamentals of investing haven’t changed, how people invest has. Explore our educational resources on new investment types, growing investment platforms, and shifting client priorities to grow your practice and deepen current relationships.

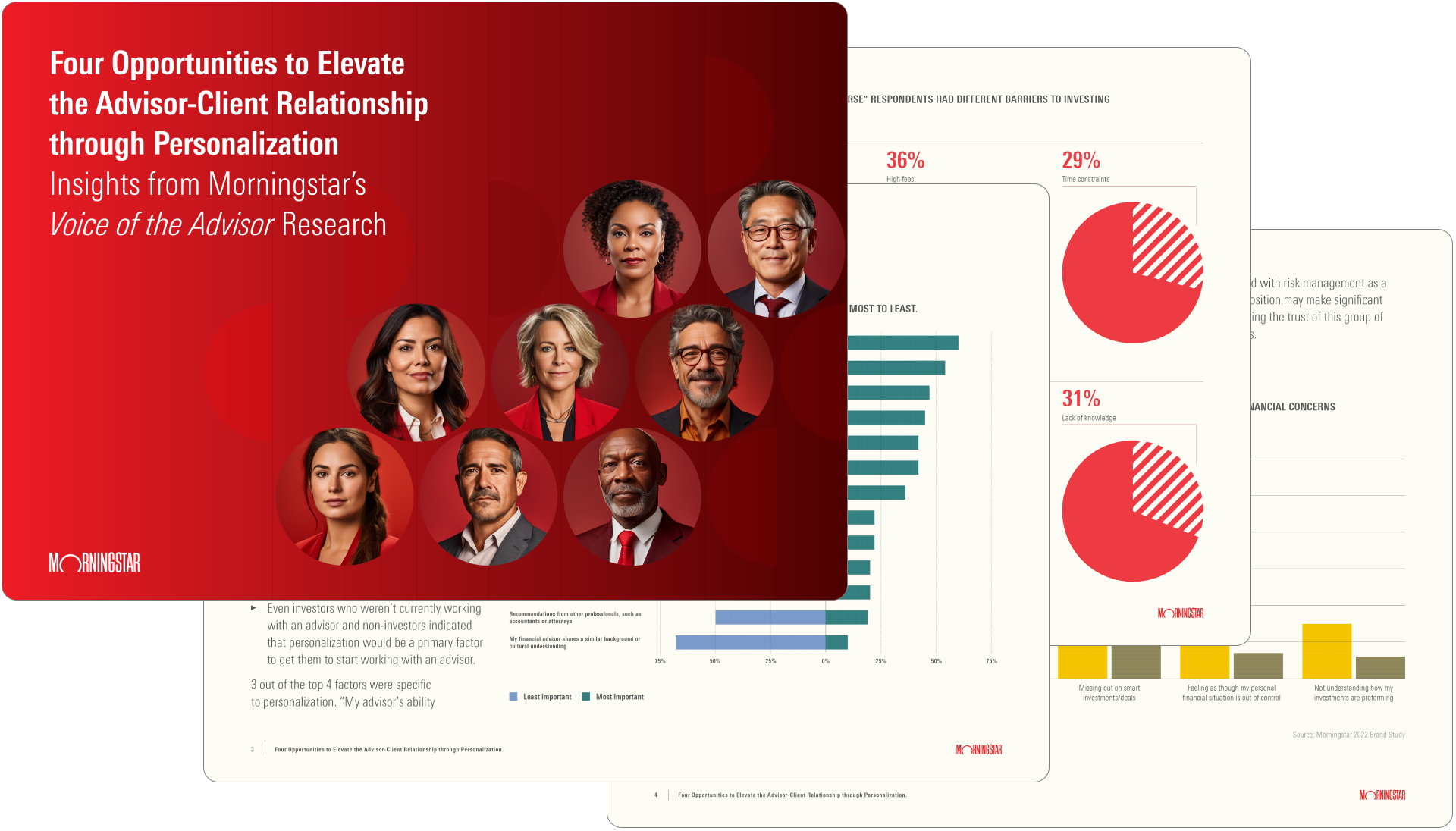

Voice of the Advisor

Four Opportunities to Elevate the Advisor-Client Relationship through Personalization

Take action on opportunities to deepen relationships with clients and attract new prospects, compare your client engagement strategy with your peers, and benchmark your business model against the strengths and weaknesses that are common for your firm type. In this report, we’ll explore:

- How important is personalization to investors?

- What do investors mean when they ask for personalization?

- How are advisors’ practices evolving in response?

Respond to the Investor Mindset in Real Time

The market is changing minute-to-minute in step with rapid technological innovation and emerging client expectations. Embrace their mindset to tailor your advice to their attitudes and behaviors.

5 Things Advisors Need to Know about the Evolving Investor

27% of investors ranked “finding the best financial advisor to meet my unique investing need” as their #1 investment strategy. Explore the mindset and challenges of today’s investors to build trust with all types of clients. Get the guide →

Profile of the Crypto Investor

About 60% of investors with assets in cryptocurrency work with financial advisors. Build trust with crypto investors by understanding their mindset. Understand the Alternatives Mindset →

Future-Proofing Your Business: The Next Generation of Advice

What does the next generation of investors want from financial planning? Informal meeting settings. Virtual conversations. And above all – relatability. Learn how advisors can reach new investors with guests Chanelle Pattinson and Ollie Smith. Listen on your commute →

Unlock Talking Points for Today’s Industry Trends

There’s no crystal ball for investor outcomes amidst market volatility. Whether the topic is inflation, how aging is transforming, or a bird’s-eye view of 2023 asset flows, Morningstar sheds light on next steps for advisors who want to dig deeper.

AI, Marketing, and Goal-Based Planning: 4 Industry Trends for New (and Veteran) Financial Advisors

Are you keeping up with the latest financial advisor industry trends? See how your peers are responding to modern investor expectations. See the trends →

4 Inflation Talking Points with Larry Summers

Guide clients through inflation concerns and recession anxiety with four talking points from the former U.S. Secretary of the Treasury. Get inflation tips →

A New Map for Financial Longevity Planning

Life expectancy doubled in the 20th century. As investors live longer, they’ll need new approaches to accumulation, drawdown, and legacy creation. Learn about planning along the lifespan →

The Evolving Investing Landscape

Online trading platforms, cryptocurrency, and direct indexing present advantages and pitfalls. Support clients with new tools and background on 2023 investment trends. Get your copy →

Meet the Moment for Your Clients

From goal planning to portfolio strategies to client retention, the winning strategy might be just a click away. Maximize client engagement with tools and solutions designed for every step of the investor’s journey.

3 Strategies to Build a Modern Financial Advisory Practice – Whatever Your Firm Type

Whether you’re an RIA or Wirehouse advisor, these technological and strategic trends can lead to a successful advisory firm strategy. See the trends →

3 Opportunities When Becoming an Independent RIA

Becoming an independent RIA has challenges, but also opportunities. How do you compare to your peers? Learn from other advisors →

Why Investors Fire Their Advisors

32% of investors fired their advisor because of the quality of advice and services – but 21% pulled the plug because of the quality of relationship. Get insights on building advisors’ relationships with their clients and prospects. Get your copy →

How to Answer Your Clients’ Biggest Question: Will I Reach My Goal?

With a 30-minute exercise, advisors can facilitate client conversations on timelines, savings, and risk tolerance – all in service of helping investors meet goals on their own terms. Watch now →

Guiding Principles for Portfolio Blending

In uncertain times, potential approaches for pairing portfolios can help investors achieve balance. Watch now →