6 min read

What Are Sustainable Funds and How Have They Performed?

Investor appetite for U.S. sustainable funds waned in 2023 despite improved performance.

Key Takeaways

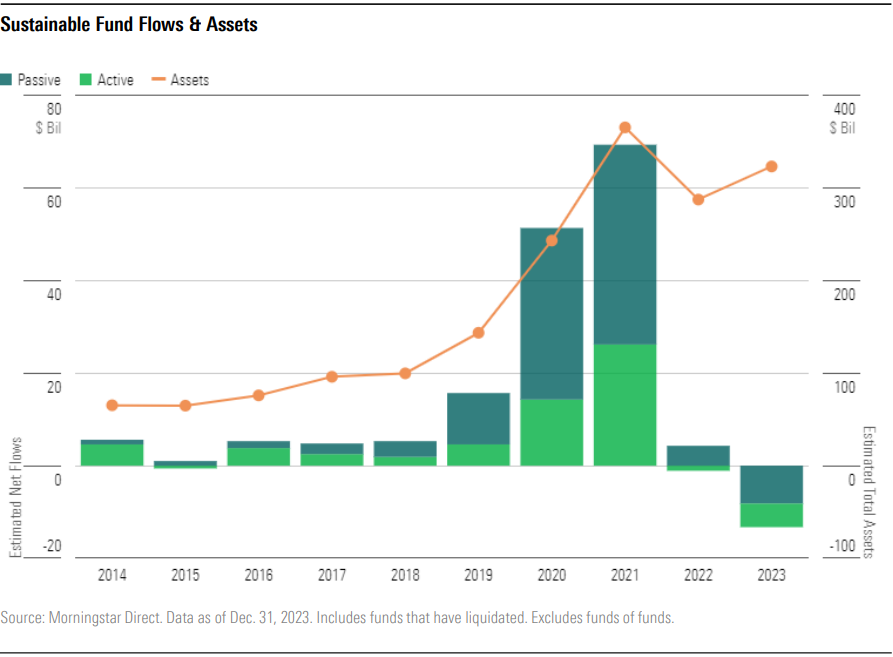

U.S. sustainable funds recorded their first year of net outflows in 2023.

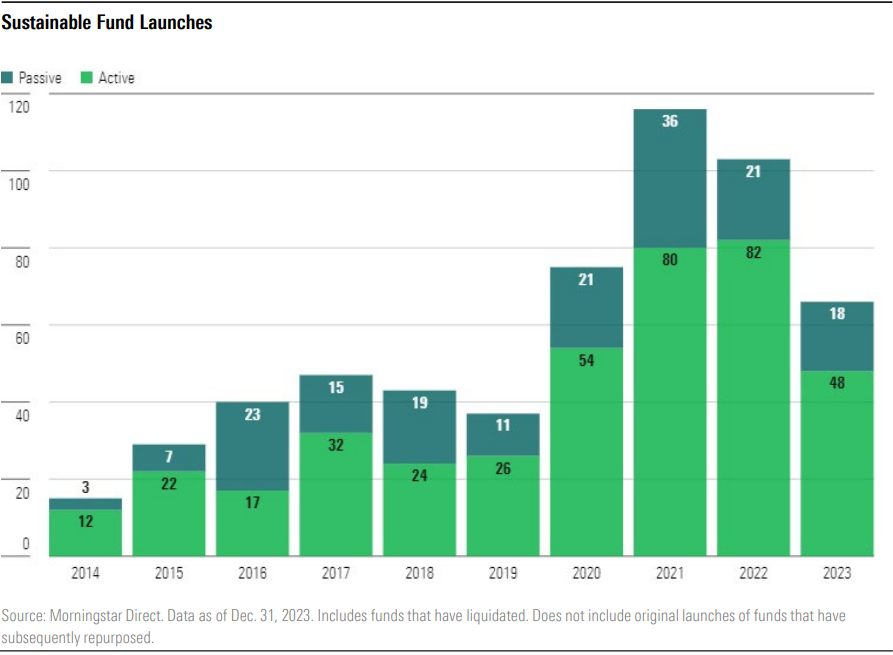

A total of 66 new sustainable funds launched in 2023 compared to 87 in 2022.

Sustainable funds lagged their conventional peers by a small margin.

What Are Sustainable Funds?

Sustainable funds are funds that use environmental, social, and corporate governance (ESG) criteria to evaluate investments or assess their societal impact. They may pursue a sustainability-related theme or explicitly aim to create measurable social impact.

The sustainable-fund universe can and should be distinguished from funds that simply employ values-based criteria, such as those that exclude so-called “sin stocks,” like tobacco, alcohol, and gambling, or those that use faith-based criteria to restrict their investments.

Certainly, there are values-based elements to sustainable investing; namely, the recognition that investors can have an impact on the creation of a low-carbon global economy that works for more people.

But sustainable investing also has a value-driven component that many investors find at least as salient: The idea that integrating ESG into an investment process can add valuable material information that might otherwise be overlooked in traditional financial analysis and thereby may be able to help reduce risk or generate alpha.

The annual Morningstar U.S. Sustainable Funds Landscape report covers sustainable fund flows and performance in great detail.

For a more global outlook, check out the latest global quarterly report.

U.S. Sustainable Funds Record First Year of Outflows in 2023

While conventional peers saw inflows, U.S. sustainable funds recorded their first year of net outflows in 2023. Headwinds like political scrutiny and greenwashing concerns endured and macroeconomic pressures such as high interest rates continue to feature in 2024 outlooks. However, despite the outflows, assets in sustainable funds rose on the back of market appreciation, surpassing the $300 billion mark once again.

Sustainable Fund Product Development Slows

Sustainable fund launches slowed compared with previous years. In 2023, 66 new funds came to market, well above the 15 seen 10 years ago but down from the incredible 100-plus funds launched in 2021 and 2022. Active management continues to be the go-to for product development teams despite steady investor preference for index-tracking options. In 2023, nearly three fourths of all new sustainable funds were actively managed, slightly above average for the past 10 years. The only year that passive funds made up the majority of new sustainable fund launches was in 2016, when Nuveen and iShares each launched five new sustainable offerings.

Sustainable Funds Delivered Mediocre Returns in 2023

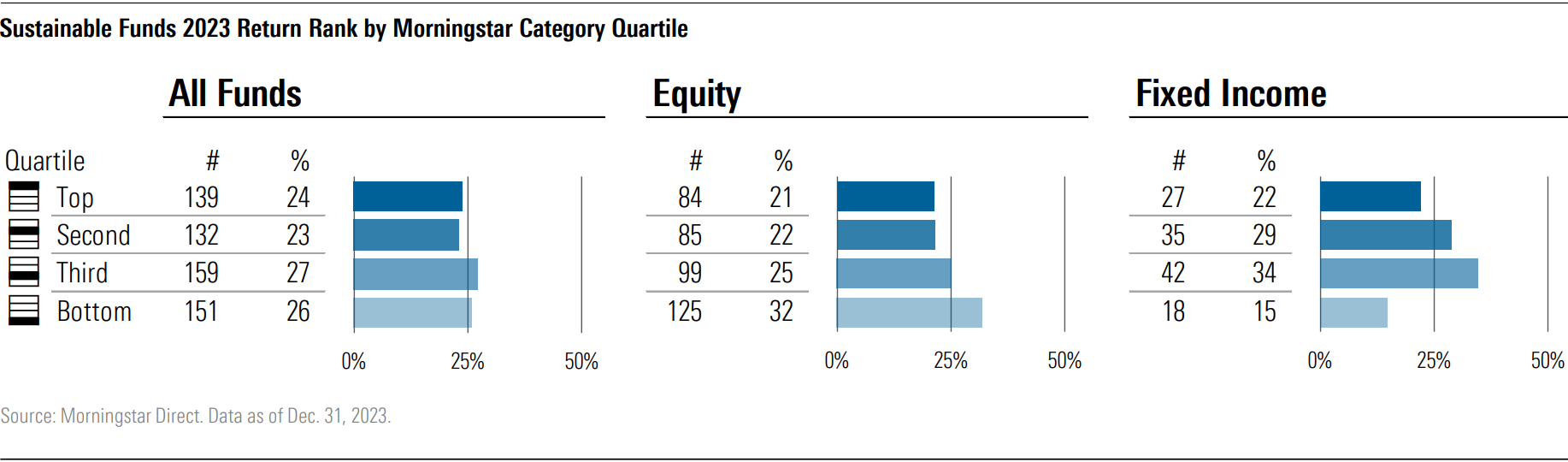

To evaluate the investment performance of sustainable funds, we can compare how their returns rank relative to their respective Morningstar Category peers. In terms of total returns, sustainable funds lagged their conventional peers slightly in 2023, with 53% of sustainable funds landing in the bottom half of their respective Morningstar Categories.

Equity funds suffered the worst of the underperformance, and 32% of sustainable equity funds dropped to the bottom quartile relative to peers. Among large-blend equity funds (the largest grouping within the U.S. sustainable funds landscape), the median return for sustainable funds was 24.4% in 2023. This beat the 23.9% median gain for the overall category (encompassing both sustainable and conventional funds) by a small margin but lagged the 26.4% gain for the Morningstar US Market Index.

In the case of fixed-income funds, roughly one third of sustainable offerings landed in the third quartile relative to peers. However, they did a better job than peers at avoiding the lowest returns, and only 15% landed in the bottom quartile.

What to Expect Going Forward

Although demand for U.S. sustainable funds has moderated over the past two years, the pace of outflows and product closures comes nowhere close to the growth this landscape has seen over the longer term. Sustainable funds have been around since at least the 1970s in the U.S, but a switch flipped in 2019 when sustainable funds recorded their first annual inflows greater than $10 billion. Since then, the offerings have not only proliferated but have also grown in sophistication because of improving data quality and increased attention from investors and regulators.

Performance and demand may ebb and flow, but the investment case for these funds is based on long-term trends. Mitigating and adapting to climate change will require trillions of dollars of investment over the next few decades, and individual investors seem ready to dive in. Sustainable investing is here to stay.

Check out the comprehensive U.S. Sustainable Funds Landscape report for more analysis and commentary. Additional topics include:

- While BlackRock remains the largest firm in terms of sustainable fund assets, it fell to last place in terms of annual net flows in 2023.

- Volatility within the energy sector, combined with sustainable fund’s underweighting to energy, affected performance.

- More than 300 sustainable funds earn our higher ratings under the Morningstar Medalist Rating system.

- Climate Action funds delivered 27 percentage points more exposure to positive, climate-related impact.

This research was conducted using Morningstar Direct. If you’re a user, you have access. If not, sign up for a free trial.