Morningstar research shows that despite the overall growth of sustainable funds, fossil-fuel-free funds still make up a small percentage of this universe.

By Jon Hale, Morningstar Research Services LLC

Sustainable Investing

By Jon Hale, Morningstar Research Services LLC

Read Time: 3 Minutes

On the whole, sustainable funds are on the rise, with a total of 303 funds as of the end of 2019 (up from 270 at the end of 2018). But these funds tend to have different definitions of what it means to be sustainable—they might focus on green bonds or invest specifically in renewable energy.

In the latest Sustainability Landscape report, we highlight a couple of types of sustainable funds that specifically contribute to climate action: fossil-fuel-free and low carbon. Here, we outline our findings on these categories.

Funds define fossil-fuel free differently. For example, three State Street ETFs use the term “Fossil Fuel Reserves Free” in their names. These funds exclude companies that own “proved and probable coal, oil, and/or natural gas reserves used for energy purposes,” but they still have overall fossil-fuel exposure ranging from 4.3% to 7.4%.

From Morningstar’s perspective, fossil-fuel involvement is defined more broadly as a portfolio’s percentage exposure to companies that derive at least 5% of their revenue from thermal-coal extraction, thermal-coal power generation, oil and gas production, or oil and gas power generation, or 50% of their revenue from oil and gas products and services.

By this definition, only a few sustainable funds avoid investing in fossil fuels altogether. By prospectus, just 91 of the 303 sustainable funds say they are fossil-fuel-free or even low carbon. And when we apply our definition of fossil-fuel involvement to the portfolios of diversified sustainable equity funds, only 10% are not involved.

Across the diversified U.S., non-U.S., and global-equity sustainable equity funds, we found:

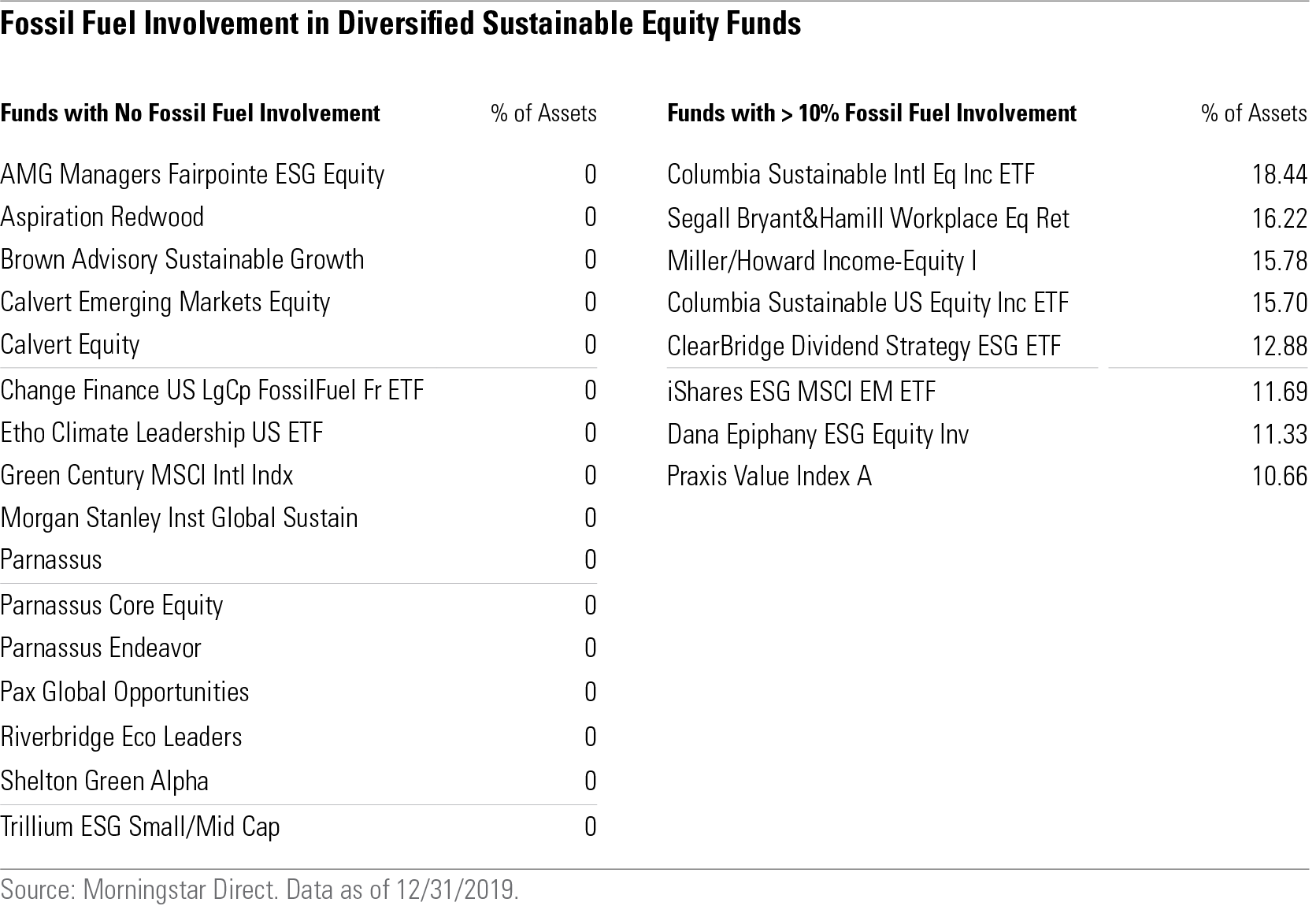

The table below lists the funds on both sides of this spectrum: the 16 without fossil-fuel involvement and the eight with more than 10% fossil-fuel involvement.

Another measure of funds’ fossil-fuel involvement is the Morningstar® Low Carbon Designation™, which is given to funds that have lower-than-average fossil-fuel involvement (but not necessarily complete avoidance) and low levels of carbon risk, which is the risk to companies in a portfolio of financial impacts in the transition away from fossil fuel. Of the 303 funds available at the end of 2019, 98 received the Morningstar Low Carbon Designation.

When it comes to exposure to thermal coal—considered the fossil fuel with the worst carbon impact—sustainable funds have higher levels of avoidance:

Just as investors have their own takes on what it means to invest sustainably, so too do funds. Investors should know that they won’t necessarily be avoiding fossil-fuel involvement completely by simply putting their money in sustainable funds—or even in funds that use the phrasing fossil-fuel free in their names.

To ensure avoidance of fossil fuels and investments in low-carbon options, investors should take care to evaluate funds using additional criteria such as our fossil-fuel involvement measure and the Morningstar Low Carbon Designation.

Get the full analysis in our annual Sustainability Landscape Report.

Learn how impact fits into the broader sustainable investing ecosystem and the suite of solutions and datasets available in Morningstar Direct.

Important Disclosures

The information, data, analyses, and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete, or accurate.

The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses, or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar.

Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.