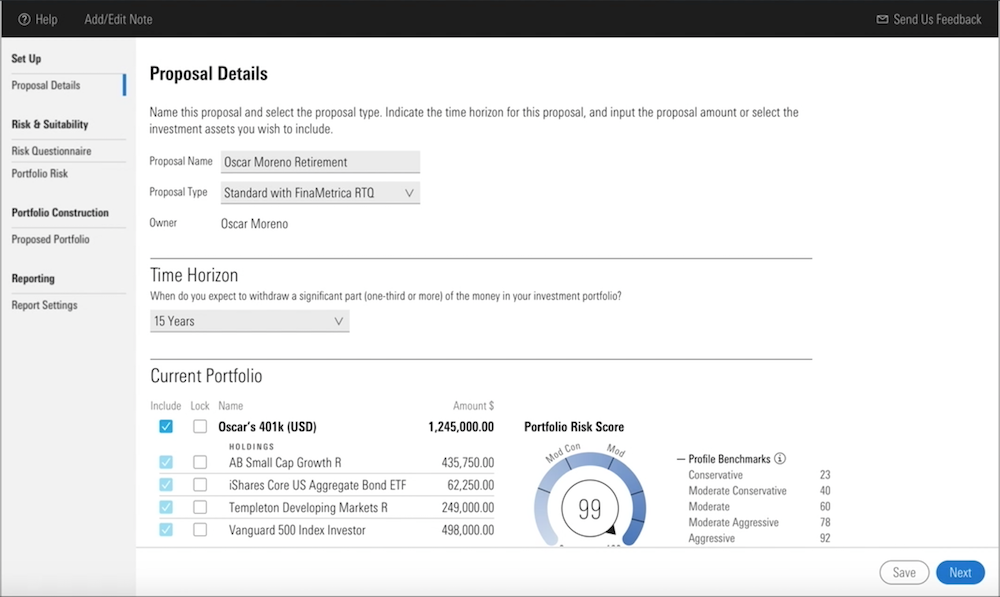

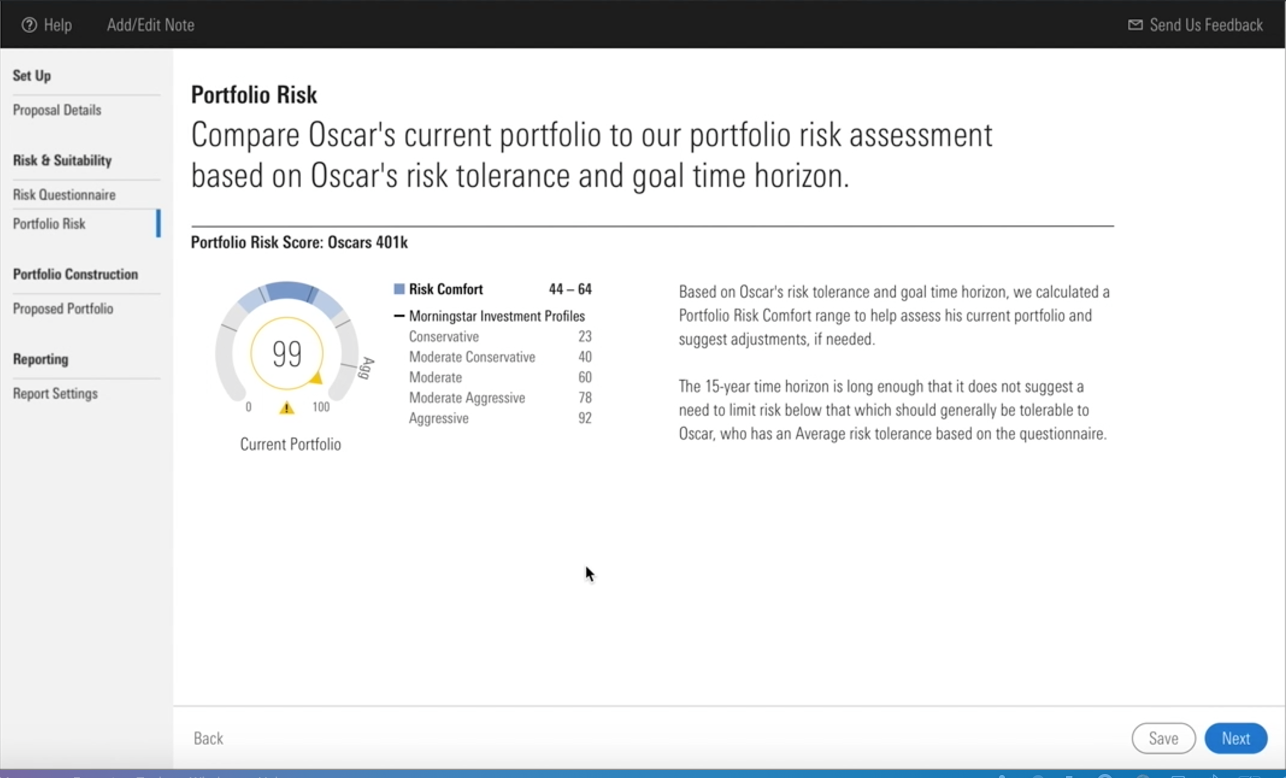

Risk assessments only work if they help advisors understand their clients’ true appetite for risk and then match them to appropriate investments. But with an unreliable risk profiler and portfolio risk analytics, you might be moving your client into an unsuitable portfolio.

The output of traditional risk profiles typically squeeze investors into one of five or six investment profile bands, which may limit what combination of products you can recommend.

You know that your client isn’t exactly like the other investors in that band—they have their own goals, timelines, and preferences. Yet you may be limited in your ability to truly personalize a portfolio for them.

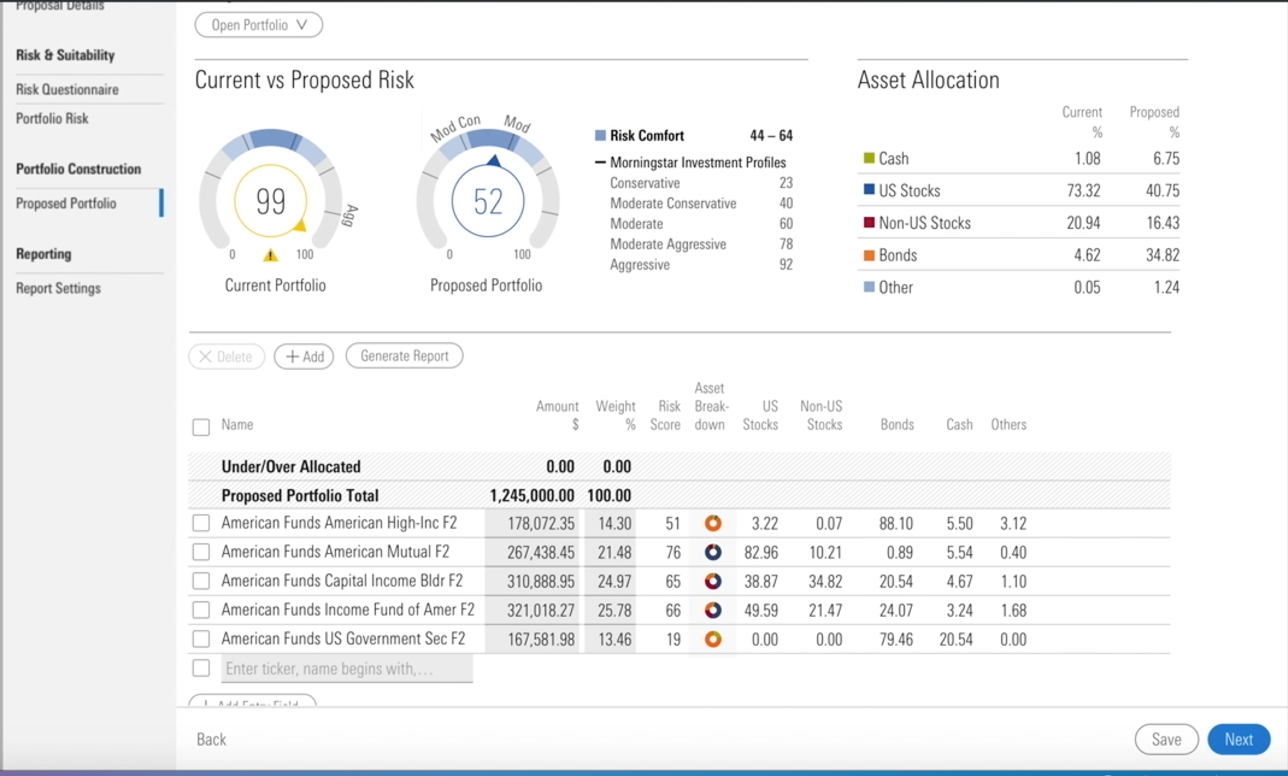

Most investment profiles include some sort of asset allocation target, but many ignore variations within asset classes. Maybe your target is a 60/40 stock/bond portfolio, but is your stock sleeve allocated to small or large caps? Growth or value? Developed markets or emerging? Are the bonds in high-yield or government instruments?

Morningstar’s Portfolio Risk Score is a powerful new tool to measure and compare investment risks at a holdings level, so you can more confidently find the right fit. Unlock new ways to personalize portfolios with our efficient, reliable risk assessment.