Portfolio diversification protects you from a thief in the night.

By Dan Lefkovitz

Portfolio Construction

By Dan Lefkovitz

Read Time: 4 Minutes

For many investors, inflation was a concept from the history books until 2022. The U.S. saw 30 years of low inflation. Before 2022, the last time the annual inflation rate exceeded 4%, George H.W. Bush was president.

We can all use reminding that inflation represents a fundamental investment risk. Erosion of pricing power undermines living standards and is especially detrimental to retirees living off savings. For good reason, William McChesney Martin, a long-serving chairman of the Federal Reserve, anthropomorphized inflation as a “thief in the night.”

Inflation protection can be a useful portfolio allocation, as argued in recent research from Morningstar Indexes. Not only is there diversification benefit to inflation hedging, but diversification among inflation hedges is sensible.

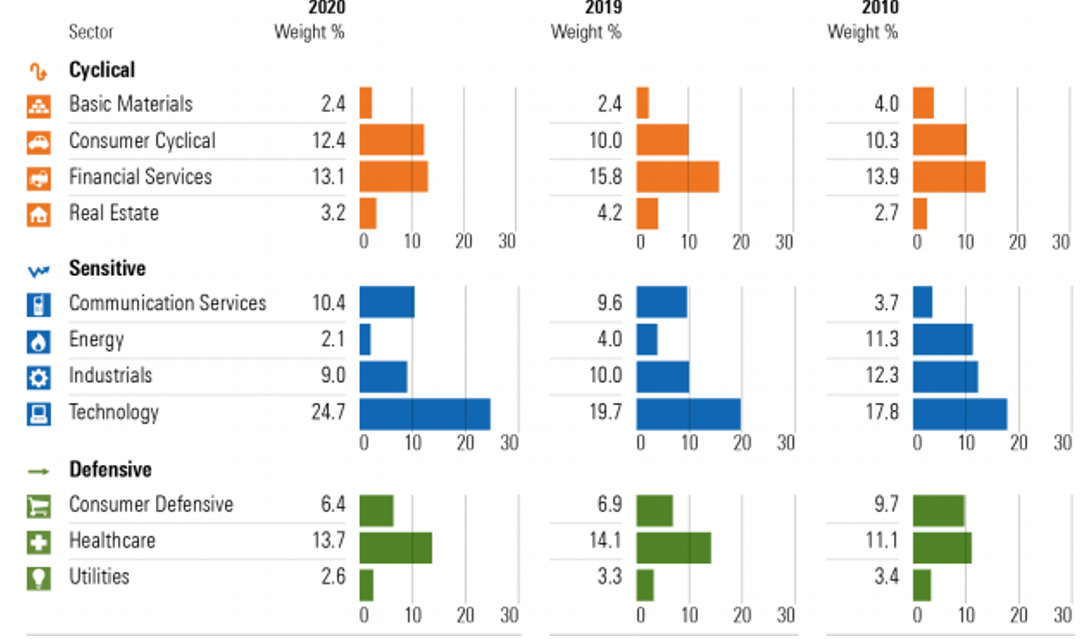

Many investors today hold portfolios light on inflation hedges. The composition of the stock market has changed dramatically over the past 10 years, with technology representing roughly one quarter of U.S. equity market value at the end of 2020, up from less than 18% in 2010.

Meanwhile, the energy sector fell from 11.3% of market weight in 2010 to just 2.1% in 2020, while basic materials went from 4% to 2.4%. Owners of broad equity market portfolios are skewed toward growth stocks, whose long-duration earnings are devalued during inflationary environments.

Morningstar U.S. Market Index Sector Weights Over Time

Source: Morningstar Indexes.

Traditional asset classes have a mixed record during inflationary periods. According to Morningstar’s John Rekenthaler, stocks, bonds, and cash all had negative real (after-inflation) returns during the raging inflation of the 1970s. Commodities, including gold, were the best performers that decade, while Real Estate Investment Trusts, or REITs, were slightly ahead of the inflation rate.

Real assets, including commodities, property, and infrastructure, are considered inflation hedges, because they are linked to tangible assets that possess intrinsic value. In inflationary periods, inelastic demand means that consumers absorb commodity price increases. Property prices and rents tend to rise at rates that track or exceed inflation while benefitting from surging demand in periods of economic growth. Bridges, toll roads, and utilities provide essential services and carry pricing often linked to inflation by regulation.

Then there are bonds. Treasury Inflation-Protected Securities tie returns to the U.S. Consumer Price Index. Both coupon payments and final principal are adjusted to account for inflation, thus offering investors a potentially stable real rate of return over the life of the bond.

A multi-asset approach to investing in liquid real assets offers diversification. The Morningstar U.S. Real Asset Index, for example, includes:

Multi-asset inflation protection is popular among mutual fund investors, with a variety of objective-oriented allocation funds focused on goals like real returns, real asset income, and inflation response.

According to Morningstar manager research, such strategies must balance diversification among inflation hedges with thoughtful portfolio construction that doesn’t lead to over-diversification.

Liquid versions of real assets are not perfect proxies, but they boast other advantages. Equities linked to commodities, property, or infrastructure assets are easily bought and sold. They don’t require large outlays and diversified baskets are easily assembled.

Commodity-related equities allow investors to avoid futures-market pitfalls that cause many products linked to commodity indexes to experience lower returns than the percentage changes in spot prices. Unlike physical commodities, they don’t require storage. REIT investors avoid all the management responsibilities of owning physical property.

Inflation is caused by a confluence of factors that are not completely understood. Labor markets, government spending, the money supply, household spending power, and markets for commodities and other goods can all drive price increases. Expectations matter, too. Then there are mitigating forces.

Technology and globalization were both credited for keeping inflation low in the 1990s. Demography is another factor—Japan’s deflation has been attributed to its aging population. Confidence in the Federal Reserve’s inflation-fighting powers can also moderate inflation expectations.

Whatever the future holds, 2021’s inflation scare gives us an opportunity to assess portfolio readiness. There’s no reason that the prolonged period of low inflation we’ve enjoyed since the 1990s will persist indefinitely. Nor is it completely clear what asset classes will best hedge inflation. It’s wise to diversify when safeguarding a portfolio from a thief in the night.

Dan Lefkovitz is a strategist for Morningstar's Indexes group.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.