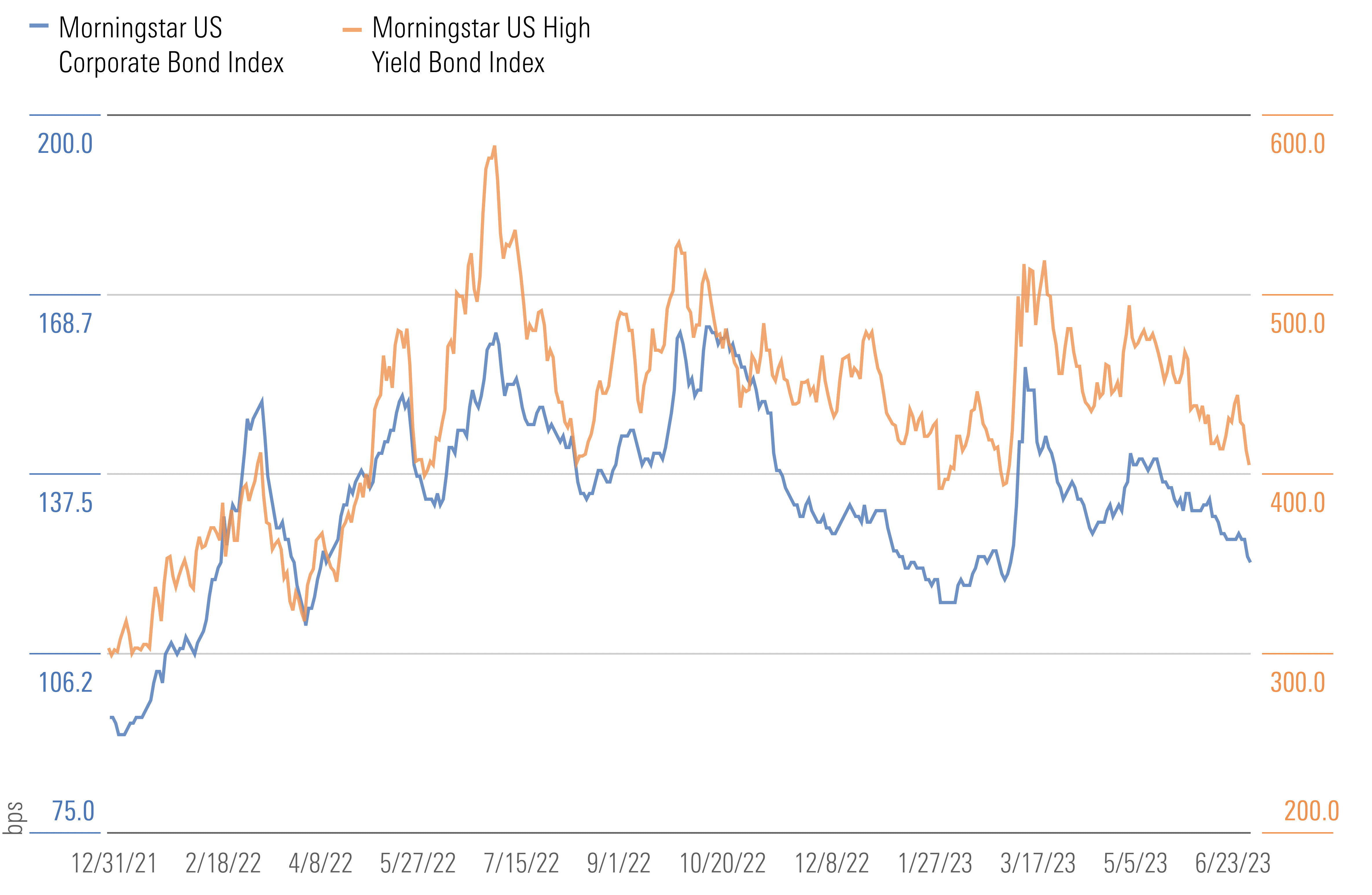

The interest rate reset doesn’t come without risks. It’s not just about chasing yields in different asset classes—investors need to think about credit risk and dividend stability. Recent bond volatility has also heightened uncertainty for investors, which could lead to knee-jerk reactions.

And higher interest rates could create a challenging environment for businesses, which could deflate stock prices.

Action Steps for Financial Advisors

1. Focus extra attention on retired clients. In the improved income landscape, retirees could produce cash flows from their assets without chasing yields. Reach out to baby boomer clients to discuss safe ways to increase spending.

2. Educate clients on their asset allocation. In volatile markets, clients often seek out outside opinions. Discuss the strategies available and explain why you recommended their current structure.

3. Regular outreach on timely topics can address what’s on clients’ minds. You can reach more clients at once with white-labeled research, quarterly webinars, or a newsletter.

A Closer Look

Higher rates can be intimidating, but they also open opportunities. Our analysts believe it’s all about turning adversity into an advantage. For a full view of income-producing asset classes, download the 2024 outlook.