Some hiring motivations go beyond a specific financial concern—such as the wish to have guidance in making good decisions.

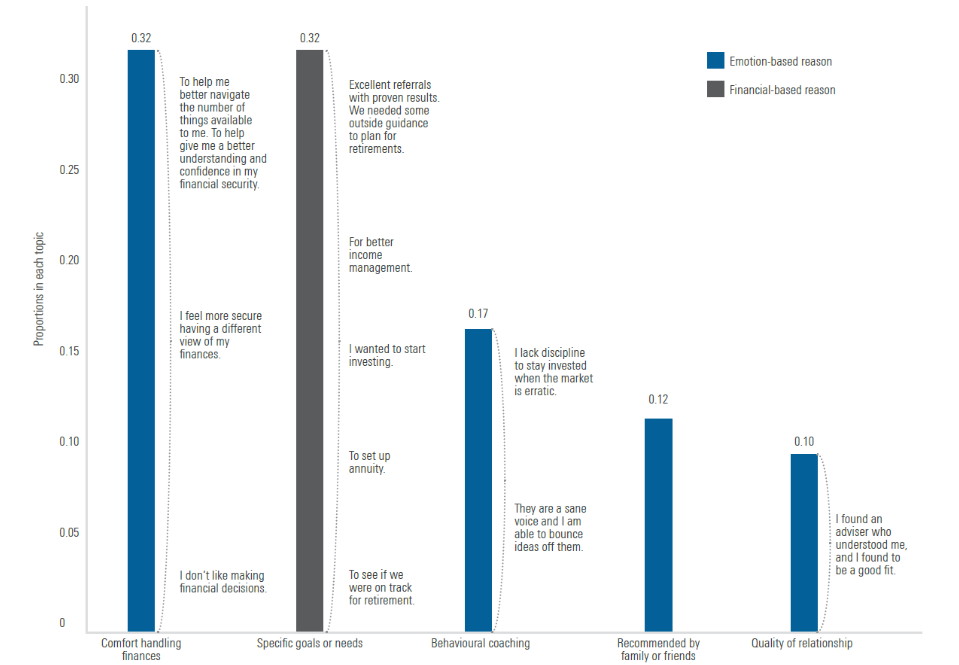

People choose to work with advisors for reasons related to discomfort handling financial issues as often as for a specific financial need.

New clients may not be willing or able to express their emotional needs. Still, advisors can address this obstacle by showing the ways they can help solve both financial and emotional concerns.

Client Engagement

Why Do Investors Hire Their Advisors?

Key Takeaways

Read Time: 4 Minutes

Every investor has different goals—and needs. So what motivates people to work with a financial advisor? From handling stock options to preparing for retirement, investors tend to seek help for a wide range of issues.

While the reasons for hiring a financial advisor may vary, common underlying factors can drive this decision. When you understand the traits people look for in advisors, it can be easier to guide initial conversations and grow your practice. Morningstar researchers analyze common motivations behind investors’ decisions to move forward.

To read the full research report, download a copy here.

Why Do Investors Hire Their Financial Advisors?

What to Know About Why Investors Hire Financial Advisors

Although one expected motivation for hiring a financial advisor is to address specific financial needs, Morningstar research reveals that motivations go beyond those money factors.

Yet despite the benefits of working with an advisor, not all investors do. Those who decide to get help are more likely to have a higher income, more investable assets, and more experience investing.

So why hire a financial advisor? The top reasons are:

Discomfort with handling finances.

Specific goals or needs that need support.

Recommendations from family or friends.

In other words, these findings suggest that there’s an additional thread of emotional drivers.

Here are three considerations for advisors to improve their practice.

Emotions come into play at every stage

While some advisors would like to keep the numbers and emotions of their clients separate, others understand that it’s impossible to separate a person’s psychology from their financial decision-making.

As an advisor, you need to address client emotions from the start, beginning with recruitment. Recognizing investors’ emotional needs is crucial—especially because ignoring those feelings can be a costly mistake.

By identifying the role that feelings can play when working with people, you can help investors make better decisions.

Some needs may remain unspoken

When you first meet a client, they’ll most likely tell you about a financial issue they’re hoping to resolve. However, they may not share their emotional-based reasons for seeking help.

Regardless of your investor’s approach, you can still address the value of a financial advisor. For example, share how your current clients feel peace of mind about their finances when working with you and how you can alleviate discomfort handling finances.

How you say it matters

Many people may not feel comfortable acknowledging their need for emotional support. However, it’s possible to share the emotional advantages of working with an advisor—depending on how you describe those benefits.

Strategies include:

Use colloquial language.

Provide an example.

Clarifying that these are issues all people face.

By addressing a client’s emotional needs in a tactful and subtle way, you can build stronger connections.

Deepening Client Relationships

Investors have a wide range of reasons for hiring financial advisors. When you’re able to address both the financial and emotional drivers behind those decisions, you can create long-lasting client connections and enhance your practice’s value proposition.

Better support your clients with Morningstar Advisor Workstation. The robust platform gives you the tools to communicate valuable advice, backed by research, and deliver strategies that align with your investors’ goals.