3 min read

What’s Holding Advisors Back From Effective Marketing?

A Morningstar survey explores the priorities and pain points of marketing for financial advisors.

To better understand advisors and the investors they serve, Morningstar surveyed 663 financial professionals. While our surveys were comprehensive—identifying pain points, business goals, and more—they also yielded meaningful insight about a hot topic for financial professionals: marketing.

How Do Financial Advisors Market Themselves?

In Morningstar’s 2019 Advisor Insights Survey, researchers asked about advisors’ business priorities, pain points, client-management techniques, and overarching goals.

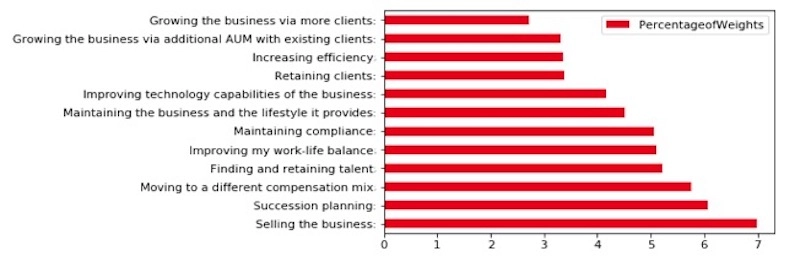

When asked to rank their business goals for the next five years, most advisors ranked “growing the business via more clients” as most important. The full list of advisor priorities is shown on the chart below.

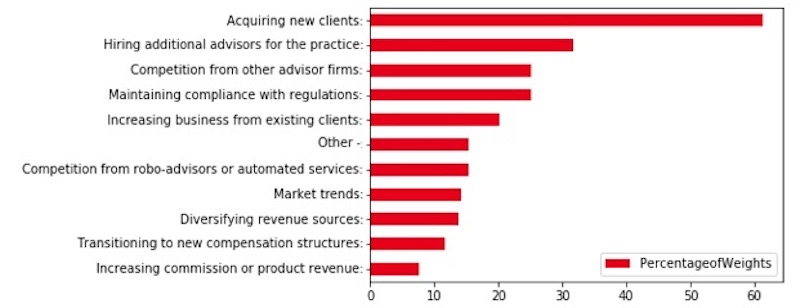

However, most advisors also ranked “acquiring new clients” as their number-one challenge to growing their business—suggesting that finding new clients is both a priority and a pain point. The full list of advisor challenges to business growth is shown on the chart below.

And this makes sense. The proliferation of robo-advice, independent advisors with broad-reaching investment products, and easily accessible financial information means that being a financial advisor is more competitive than ever. Plus, the emerging group of investors tend to have different values and preferences than previous generations.

These factors mean that in order to keep their businesses afloat, financial advisors must continue to demonstrate the evergreen value of their advice.

To better understand how advisors are responding to this challenge, our survey drilled down into the strategies that advisors use to try to grow their business. “Getting referrals to acquire new clients” was chosen by 85% of clients, and 78% selected “increasing business from existing clients.” But the percentage of advisors who reported using marketing to acquire new clients was only 33%.

Marketing for Financial Advisors Is All About Knowing the Investor

In another Morningstar study, researchers Sam Lamas, Ryan Murphy, and Ray Sin asked two groups to rank 15 attributes of financial advisors in order of importance.

The first was a group of investors who were asked: “What do you value most when selecting a financial advisor?” The second was a group of advisors who were asked: “What do you think investors value most when working with a financial advisor?”

In a perfect world, advisors and investors would be completely aligned about which advisor offerings the investor finds valuable. However, findings from Morningstar’s research team suggest a substantial disconnect between what advisors think investors value and what investors actually value.

The biggest gaps in attributes that advisors and investors found valuable were:

- Can help me maximize my returns, which investors ranked as the fourth most important attribute and advisors ranked as the second least important attribute.

- Helps me stay in control of my emotions, which investors ranked as the least important attribute and advisors ranked as the 11th most important attribute.

- Understands me and my unique needs, which investors ranked as the seventh most important attribute and advisors ranked as the most important attribute.

Overall, the study’s findings also suggest that investors seemed to undervalue advisor offerings related to behavioral coaching, like “helps me stay in control of my emotions” and “acts as a coach/mentor to keep me on track.”

Our findings expose a major pain point that could be inhibiting an advisor’s ability to market themselves to new clients. If advisors are disconnected with what attributes investors value in financial coaches, then they may be making strategic mistakes when advertising themselves.

Specifically, if investors are undervaluing certain advisor offerings, then advisors need to add an educational component to the way they market themselves in order to appropriately bridge that gap and demonstrate the value of those offerings.

Empathy: The Heart of Marketing for Financial Advisors

Conventional wisdom can brand marketing as a time-consuming, expensive endeavor. Therefore, technologies that can help advisors communicate their value to clients in easy-to-understand, customizable investment reports are essential to staying competitive in the financial industry.

Still, at the heart of marketing is empathy, which entails “walking around in your client’s skin” to understand their stories, needs, and challenges. And empathy doesn’t require emptying the bank.

Ultimately, it’s about communication: Talking to prospects and clients more directly about what they value and are willing to pay for. Buying a cup of coffee so you have a chance to hear a client’s thoughts might be the best $5 an advisor ever spends on marketing.

Once empathy is achieved, advisors can begin to close the marketing gap and effectively demonstrate that, more than ever, empowering smart financial decisions starts with good advice.