3 min read

Why Do Investors Keep Their Advisors?

The top reasons go beyond improving returns.

Key Takeaways

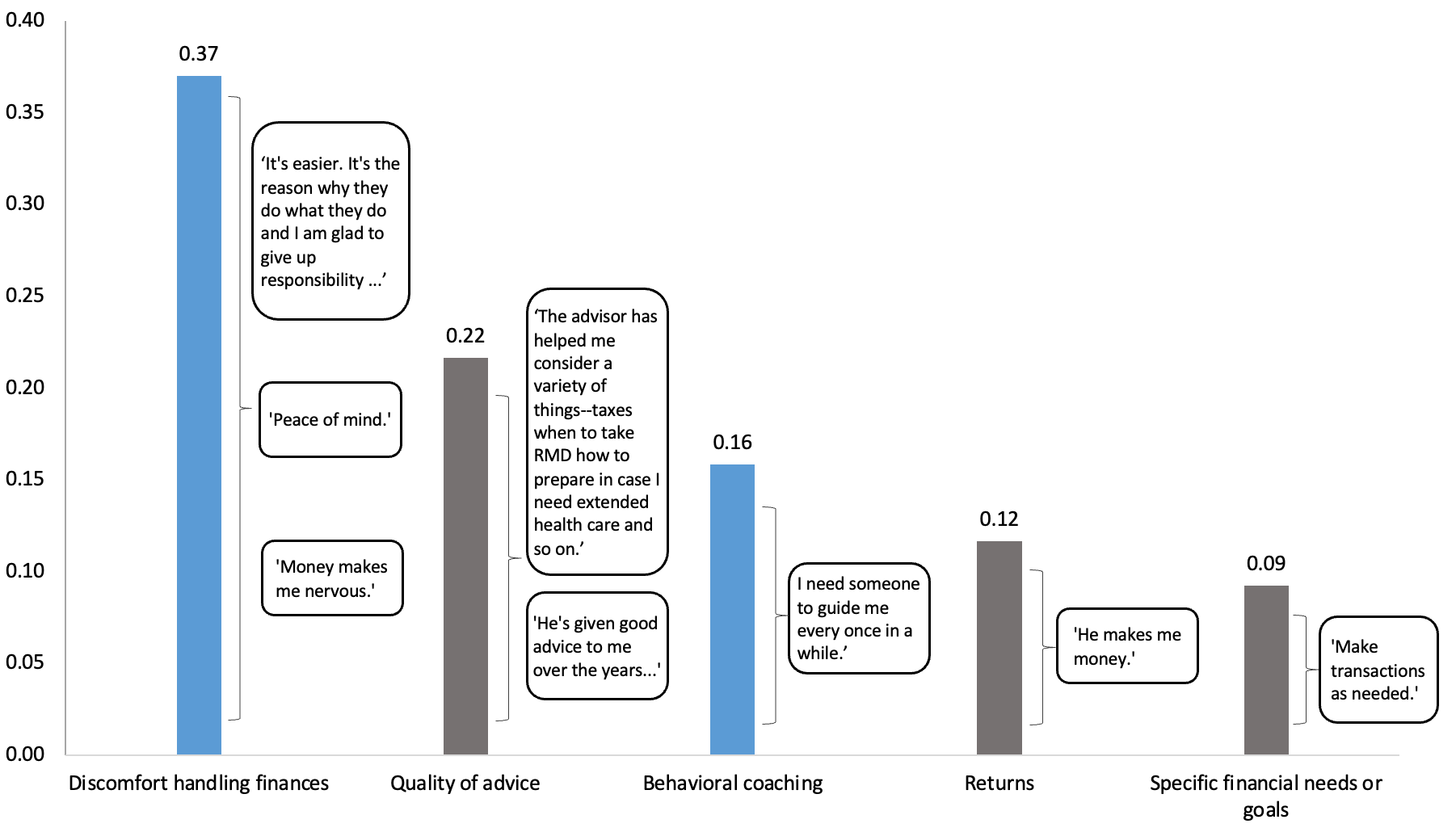

Clients keep their financial advisors for a slew of reasons beyond returns. The top three reasons clients cited were their discomfort in handling financial issues, the quality of financial advice they received, and the behavioral coaching their advisor provides them.

Our findings suggest the most common reason clients stay with their advisor is because of the comfort they get from the relationship.

The top three reasons point to the importance of meeting clients’ personal needs by inspiring their confidence, taking a goal-oriented approach toward financial planning, and providing support for decision-making.

Every good financial advisor wants to deliver value to their clients. Still, the methods to keeping investors satisfied aren’t always clear. So how can you build long-term relationships and retain clients?

While the reasons for why investors continue to work with their advisors can vary, it’s important to know common factors that can drive this decision. By understanding what investors prioritize, you can initiate more meaningful conversations and improve trust. Our Morningstar researchers share the top reasons investors stay—and how you can better address client needs.

To read the full research report, download a copy here.

A Closer Look at What Motivates Clients to Stay With Advisors

As an advisor, you know it’s important that your clients are happy with their services. And while it may be natural to point to performance as a key factor, new Morningstar research suggests that what investors value in an advisor has to do with more than just financial results. This discovery might not be surprising—our previous research also finds that returns don’t dominate clients’ motivations for hiring or firing their advisor.

So why do investors keep their advisors? The top reasons are:

- Discomfort handling financial issues.

- Quality of financial advice and services.

- Behavioral coaching.

- Return performance-driven factors.

- Specific financial needs.

Overall, we found that investors continue to work with their financial advisors for more emotional reasons than financial reasons, supporting the importance of the interpersonal aspect of an advisor’s role.

Here are three tips that can help advisors generate positive results—and boost client retention.

Build trust to create comfort

Investors may feel discomfort handling finance issues for a wide range of reasons—from general boredom to a lack of time. Regardless of where clients are on this spectrum, advisors can address this need by building and maintaining trust. Without this assurance, a worried client may not believe an advisor who says they’re on track to reach their goals, and a time-deprived client might not hand off tasks.

To have more productive discussions with clients that build trust, advisors can lean on ready-made tools, checklists, and discussion guides.

Demonstrate your value with goals-based communication

When investors are given advice, they want to know why that recommendation is good for them. In other words, advisors need to communicate their value, not just in generic terms but as they apply to the goals of each client.

However, advisors must not only take the time to help clients articulate meaningful goals but also ensure that communication regarding their portfolio (such as its construction and progress) highlights how the given advice is valuable to those goals. In many ways, it’s less about what the market did and more about how much progress the investor has made toward their priorities.

Provide behavioral guidance to instill confidence

Clients want to feel confident when they make financial decisions. That indicates it’s important for advisors to take the lead in providing behavioral guidance, even though this may be a service that clients don’t specifically request by name.

Advisors can support good decision-making for their clients by being a financial educator and helping them manage their finances under stress—a time when investors are most prone to falling prey to behavioral biases.

Improving Client Satisfaction

Today’s investors expect advisors to do more than simply create a financial plan. When you’re able to identify a client’s unique goals and show the value of an advisor, you can build loyalty and continue working with your clients.

Morningstar’s Advisor Workstation has the tools and research you need to easily deliver financial advice to investors. The all-in-one platform helps you improve client communications through personalized proposals and investment strategies backed by our trusted insights.