Manager Selection Services

Partner with our independent research team to analyse funds and create personalised investment solutions using our best fund ideas list and multi-asset model portfolios of funds. Our independent fund governance and oversight solutions help institutions ensure that client best interest is upheld.

Partnership With a Trusted Source

Assess your current lineup, improve internal investment processes, and enhance governance and oversight procedures by tapping into our experience covering funds and using our rigorous evaluation process.

Personalised Research Solutions

Improve internal processes and margins, grow AUM, and satisfy regulatory obligations using our flexible solutions, where Morningstar becomes integrated into a firm's investment and governance process.

Added Value for Investors

Leverage the research and analysis of our global fund, equity, and quantitative analysts covering thousands of funds, as well as Sustainalytics, a Morningstar company and global leader in sustainable investing.

Harness Consistent Insights for Multiple Uses

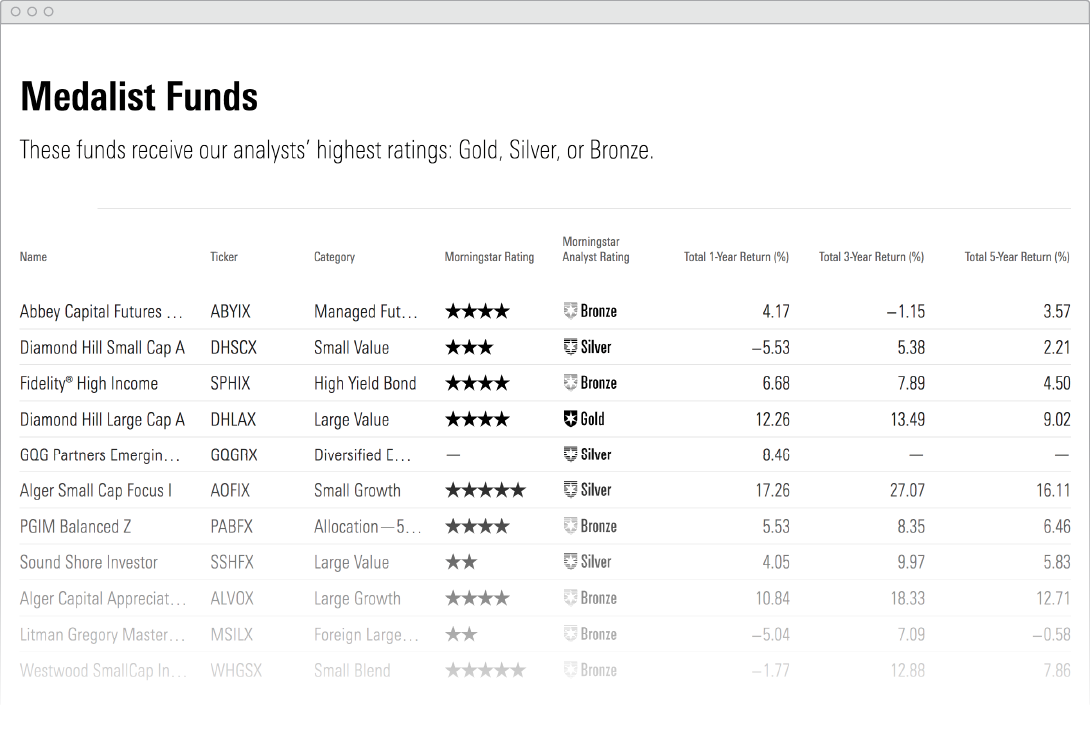

Utilize a list of our best fund ideas

A list of best fund ideas across a broad range of high-level asset classes chosen and blended to deliver high-quality investments to clients, or to utilize for internal use.

Asset Classes

Predetermined options across government bonds, corporate bonds, developed market equities, and emerging-markets equities

Fund Universe

Positively rated by Morningstar analysts

Monitoring

Ongoing qualitative and quantitative monitoring

Changes

Funds adjusted by the Manager Selection Team when appropriate or due to changing client requirements

Fund List

Morningstar high conviction list of 50 funds

Reporting

Morningstar Fund Report

Condensed Analyst Report

Change Rationale Report

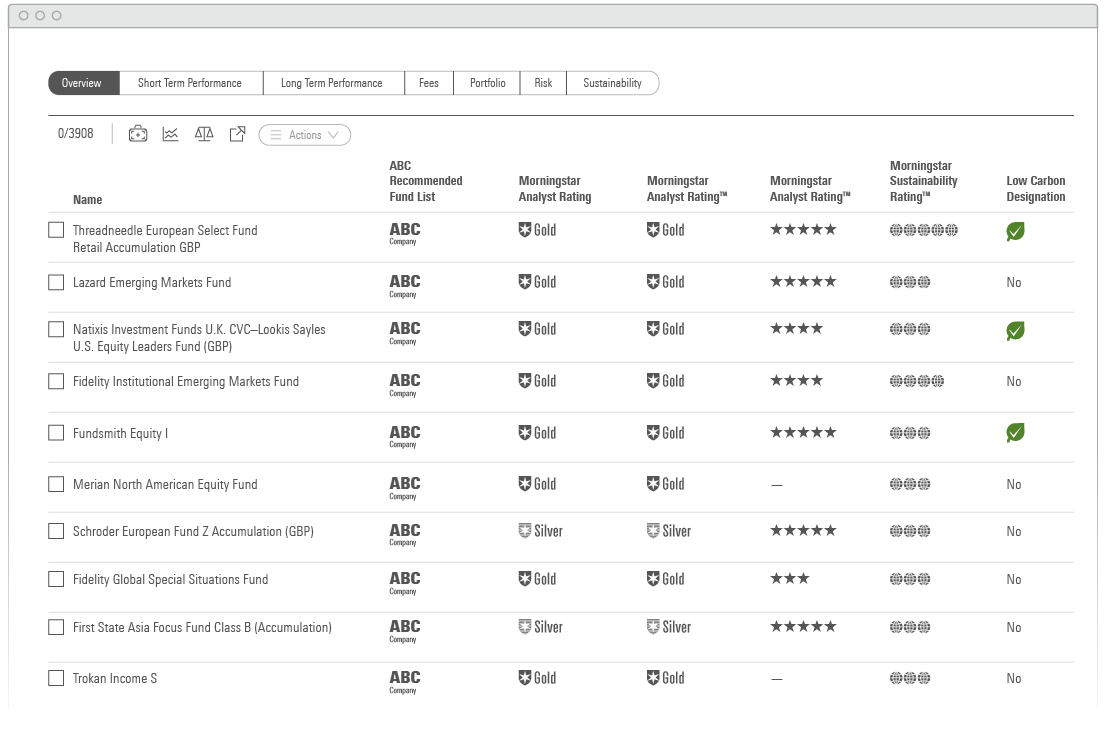

Enhance your investment processes and fund lineup

A sub-universe of funds chosen and blended to enhance an existing investment process. An internal research team can use this curated list by choosing funds for their own internal product creation or for use with specific client needs.

Asset Classes

Enhanced options across government bonds, corporate bonds, developed-market equities, emerging-markets equities, and regional funds

Fund Universe

Positively rated by Morningstar analysts and augmented by funds rated by the Morningstar Quantitative Rating

Monitoring

Ongoing qualitative and quantitative monitoring

Changes

Funds adjusted by the Manager Selection Team when appropriate or due to changing client requirements

Fund List

Flexible sub-universe across asset classes and funds

Reporting

Morningstar Fund Report

Condensed Analyst Report

Change Rationale Report

Morningstar Quantitative Rating Report

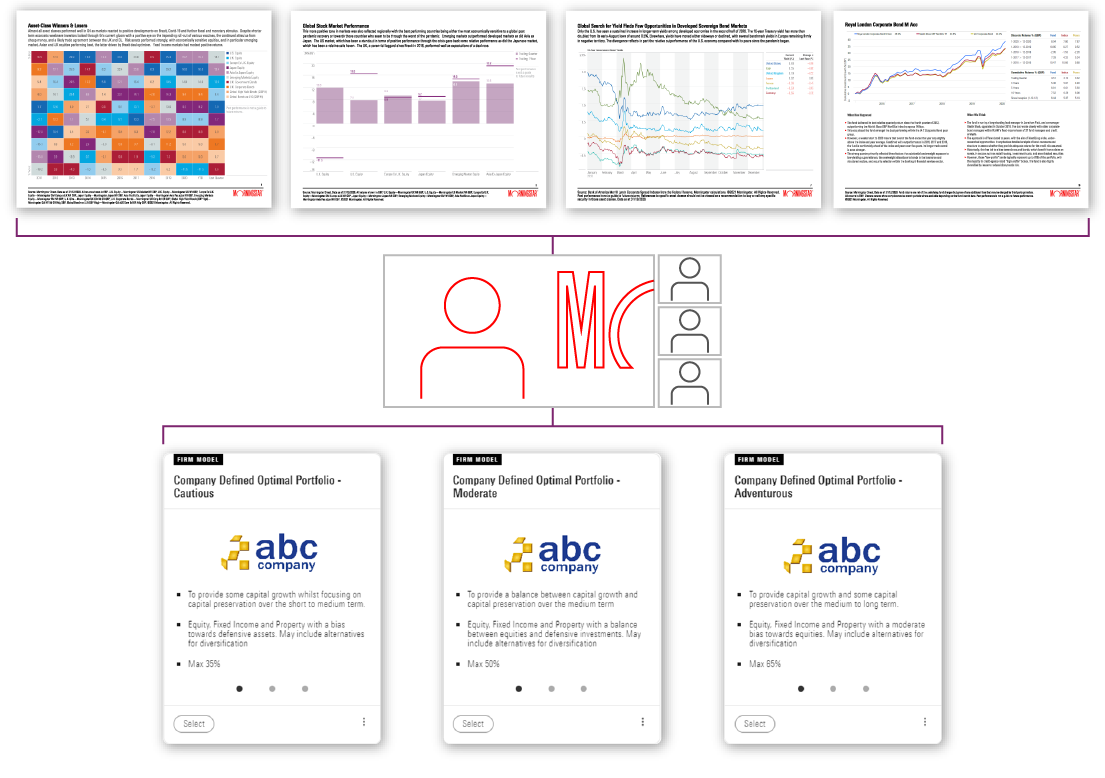

Utilize a partnership research solution tailored to client requirements

Our expertise embedded within a client's investment and governance processes, providing customised lists, expert fund recommendations, reporting, and regular client interaction.

Asset Classes

Specific to client requirements

Fund Universe

Positively rated by Morningstar analysts and augmented by funds rated by the Morningstar Quantitative Rating

Monitoring

Ongoing qualitative and quantitative monitoring. Senior Morningstar attendance at Investment Committees

Changes

Funds adjusted by the Manager Selection team when appropriate or due to changing client requirements

Fund List

Flexible list tailored to client requirements

Reporting

Morningstar Fund Report

Condensed Analyst Report

Change Rationale Report

Fund Research Report

Morningstar Quantitative Rating Report

Quarterly Market Commentary

Exception Reporting for Select Lists

Select List Quarterly Fact Sheet

Investment Committee Presentation

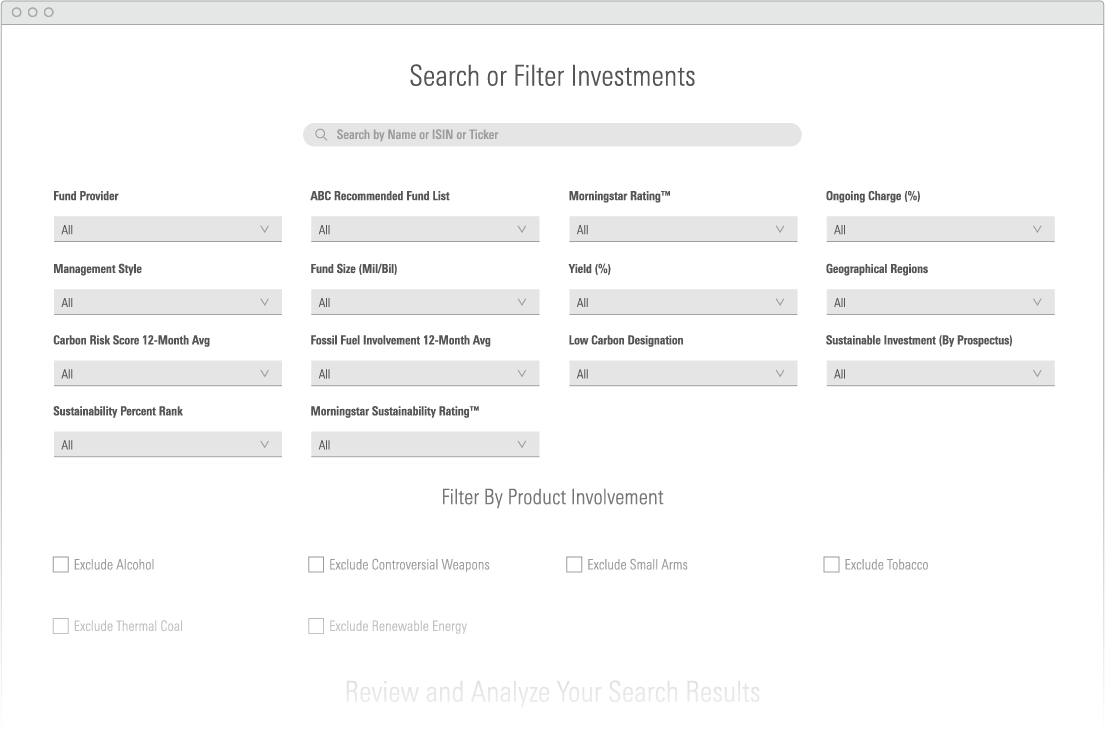

Customize for sustainable suitability

Fund list solutions chosen using our extensive sustainable research, data, and ratings. Solutions contain both active and passive funds with exclusionary, integrated, and impact fund options.

Asset Classes

Predetermined options across government bonds, corporate bonds, developed-market equities, and emerging-markets equities

Fund Universe

Rated by Morningstar Analysts and augmented by funds rated by the Morningstar Quantitaive Rating as well as funds that meet our ESG criteria

Monitoring

Ongoing qualitative and quantitative monitoring

Changes

Funds adjusted by the Manager Selection team when appropriate or due to changing client requirements

Fund List

Flexible sub-universe across asset classes and funds

Reporting

Morningstar Fund Report

Condensed Analyst Report

Change Rationale Report

Morningstar Quantitative Rating Report

Complement your fund governance process

Solutions that provides independent fund governance, due diligence, and oversight on a client's fund list to help satisfy regulatory obligations.

Primary Review

Coverage analysis by Morningstar analysts and augmented by Morningstar Quantitative Rating and Due Diligence Scorecard

Detailed Analysis

Areas of strength and weakness at asset class and fund level highlighted for potential sale or closure with replacement recommendations

Monitoring

Formal annual review supplemented by ongoing qualitative and quantitative monitoring, as well as quarterly reporting

Changes

Funds adjusted by the Manager Selection team when appropriate or due to changing client requirements

Fund List

Client list of existing funds

Reporting

Comprehensive formal report delivered and presented

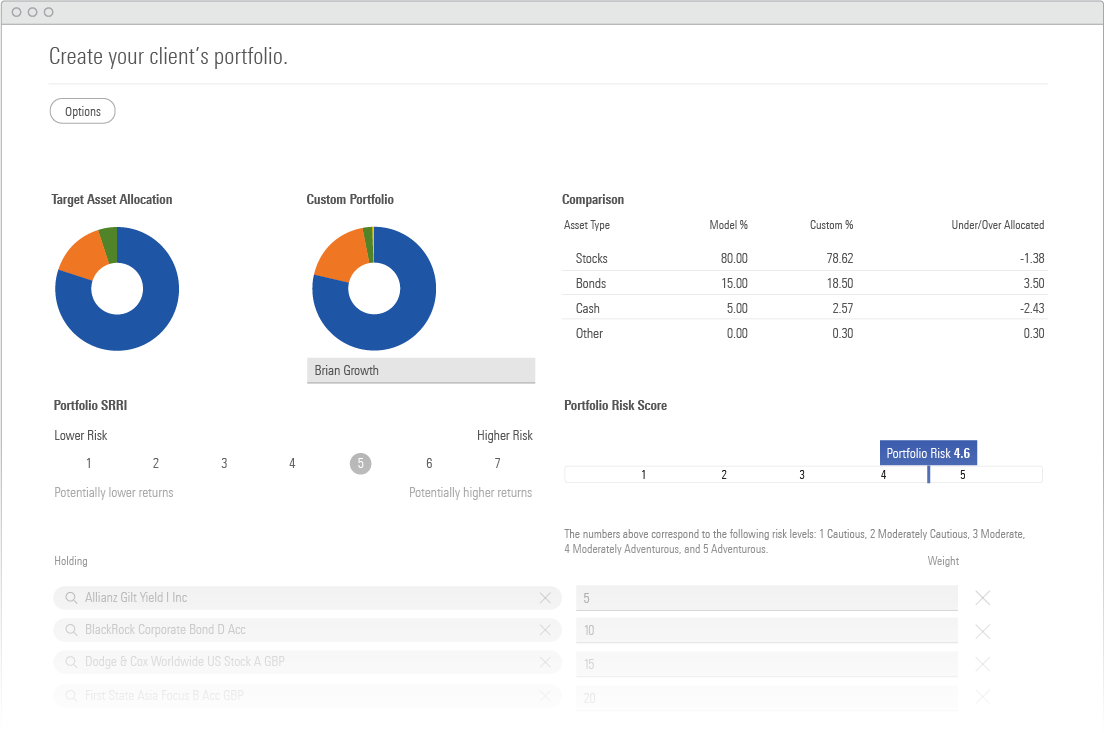

Expand your reach to satisfy portfolio recommendations

Multi-asset portfolios of funds covering a range of risk profiles delivered to clients that encompass Morningstar’s extensive asset allocation, index, and fund research resources and experience.

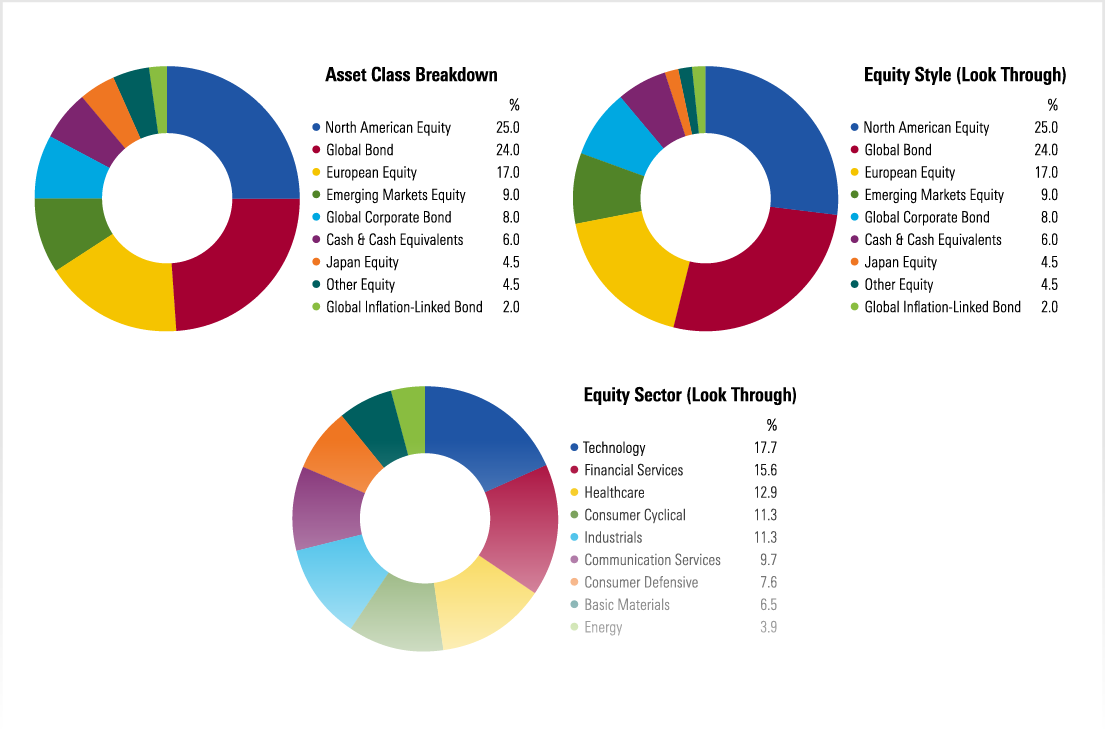

Asset Classes

Broad asset classes across fixed-income and equity subasset classes

Fund Universe

Positively rated by Morningstar analysts and augmented by funds rated by the Morningstar Quantitative Rating

Monitoring

Ongoing monitoring of portfolios

Changes

Utilises our long-term strategic asset allocation, reviewed every three years

Reporting

Comprehensive reporting packages and fund fact sheets

Close the Gap Between Complexity and Communication

Morningstar Rating™ for Stocks and Funds

Uncover the true value of stocks and find buying and selling opportunities with our forward-looking star rating for stocks. For funds, our star rating illuminates historical performance relative to peers.

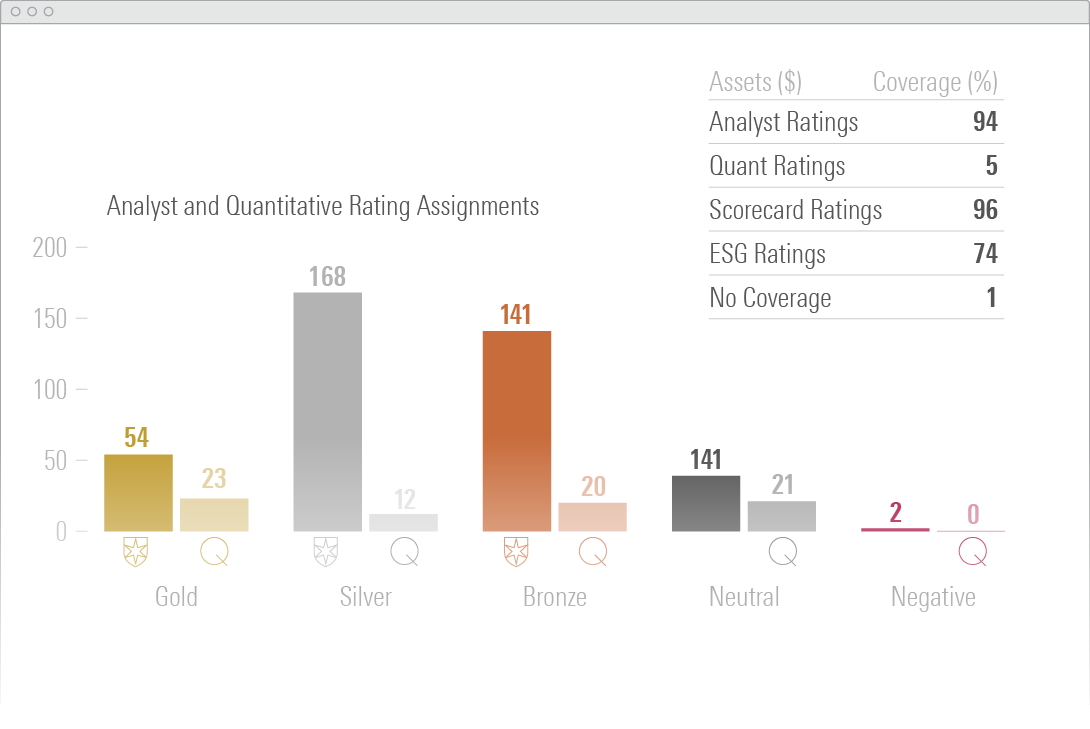

Morningstar Analyst Rating™

Identify funds and managed investments we expect to outperform peers on a forward-looking basis. We use a five-tier scale for actively and passively managed investments.

Morningstar® Economic Moat™ Rating

Understand how a company’s sustainable competitive advantages impact its ability to generate economic profits over the long term. We use a signature methodology focused on evaluating a firm’s economic moat.

Morningstar Quantitative Rating™ for Stocks

Help investors identify a broader set of investment opportunities across geographies, sectors, and styles. We use a forward-looking machine-learning approach that mimics our analyst-driven ratings process.

Morningstar Quantitative Rating™ for Funds

Expand investors’ breadth of coverage for more comprehensive decision-making. We base this rating on a machine-learning model that leverages past rating decisions to support analogous forward-looking ratings.

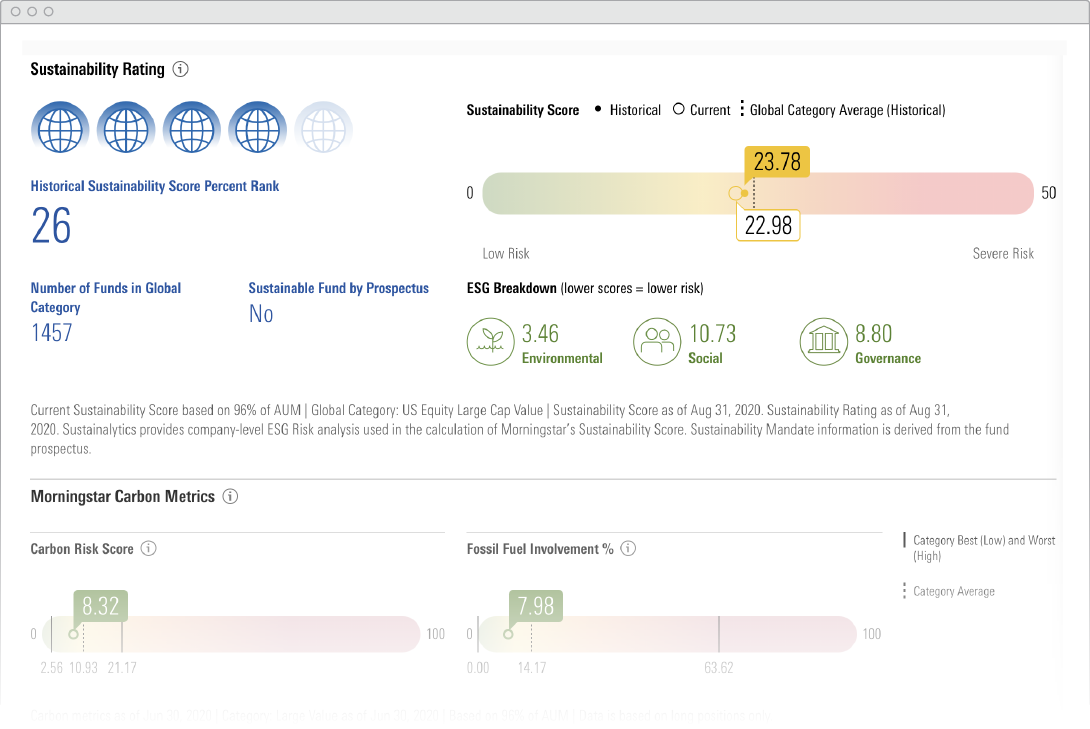

Morningstar Sustainability Rating™

Show investors how the companies in their portfolios manage ESG risks relative to their peers. A refined design aims to establish systematic, reliable measures for this growing area of interest.

Extend Your Research & Investment Selection

Select

Use Fund Screening tools to view Morningstar’s best fund ideas for use in portfolio construction or when selecting funds for client use.

Analyse

Track your investment portfolio, evaluate your strategy, and create watchlists of potential opportunities using detailed analysis and fund comparison chosen by Morningstar.

Report

Access a comprehensive reporting package covering funds on Morningstar’s best fund idea lists coupled with market and thematic commentary.

Power Actionable Decisions With Thematic Research

See our Research in Action

Q1 Markets Observer

Learn new and timely macroeconomic and market data you can use with clients to discuss trends, set appropriate risk and return expectations, and explain investor behavior.

Ready to See for Yourself?

See how Manager Selection Services can help you help investors build a better financial future.

Manager Selection Services are offered by Morningstar Research Services LLC, a subsidiary of Morningstar, Inc. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission. In the European Union, the Manager Selection Services group is part of Morningstar Investment Management Europe Limited, which is authorized and regulated by the UK Financial Conduct Authority to provide services to professional clients.