Research has shown that employers’ ability to automatically enroll workers into investment defaults within defined-contribution plans—provided by the Pension Protection Act of 2006 (PPA)—led to a significant increase in participation rates and a reduction in self-directing participants.

However, many studies that plan sponsors, consultants, and investment advisors use to identify best practices for participants were conducted prior to the introduction of the PPA. The potential impact of smaller core investment menus may not have the same effect when most participants are ending up in the default-investment option today.

In “ Bigger Is Better: Defined-Contribution Menu Choices With Plan Defaults ,” we explored the relation between core investment menu size and two key participant investment decisions: the acceptance of the plan’s default-investment option, and the efficiency of portfolios among participants who were self-directing their accounts.

Here, explore some of our key findings from this research.

Increasing core investment menu size increases default-investment acceptance

We analyzed a data set of more than 500 defined-contribution plans with approximately half a million participants, where core menus varied between approximately 10 to 30 investment options. We found that acceptance of the default investment increases for defined-contribution plans with larger core menus.

The effect sizes noted in the analysis are large enough to have an economically significant impact on retirement outcomes for participants.

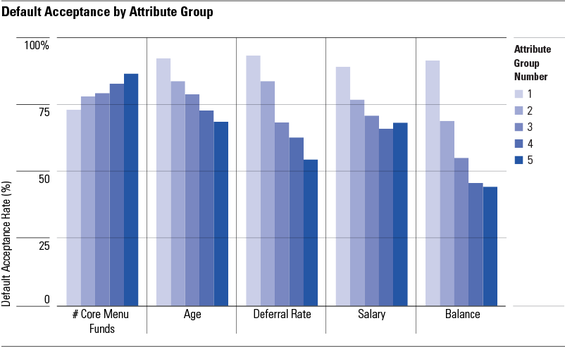

For example, default-investment acceptance increases by approximately 0.7% for each additional fund that a plan adds to the core investment menu (moving from 10 to 30 funds). The chart below shows that default-investment acceptance in the lowest decile of plan menu sizes (10 funds) is 74%, versus 87% for the highest decile (30 funds).

Source: Morningstar.

Through additional regressions, we found that effect remains after controlling for variables associated with default-investment acceptance, including age, deferral rate, salary, and balance (which are all negatively associated with default acceptance).

Increased default-investment acceptance within plans that offer larger core menus is consistent with the concept of choice overload, or the phenomenon that people have a difficult time making decisions when faced with numerous options.

Participants in plans with smaller menus may feel more capable of building portfolios themselves, while participants in plans with more funds may feel overwhelmed and therefore remain in the default-investment option.

Larger core investment menu sizes improve outcomes for self-directed participants

The research also found that portfolios constructed by self-directed participants in plans with more funds have higher risk-adjusted returns. This is primarily because participants in plans with more funds include more funds in their portfolios.

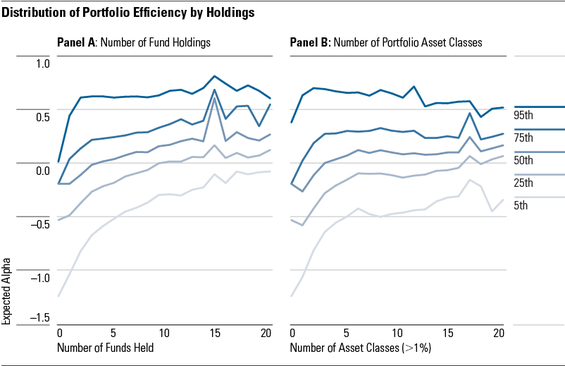

Specifically, we found that participants in plans with about 10 funds had an average of 4.4 holdings in their portfolio; participants in plans with around 30 funds had an average of 8.6 holdings. Risk-adjusted performance increases, on average, by 3.6 basis points for each fund included in the client portfolio. Therefore, increasing a fund menu from 10 funds to 30 funds, which would result in an average increase in holdings of approximately three funds per participant, would result in an estimated increase of alpha of 11 basis points for those participants self-directing their accounts. The relation between portfolio size and portfolio efficiency is detailed in the chart below.

Source: Morningstar.

It’s not entirely clear whether improved portfolio efficiency is the result of access to a broader range of high-quality investment options or naïve diversification in which self-directed participants simply spread their portfolio among a larger number of funds.

Either way, we can extrapolate the expected portfolio-efficiency benefits estimated for self-directed participants to the default-investment acceptance analysis. Then, we can determine that the aggregate plan-level increase in expected alpha for a plan moving from 10 to 30 funds in the core menu is approximately 10 basis points.

Why maintain a larger core investment menu?

These findings demonstrate a relatively easy way for plan sponsors to work to improve likely retirement outcomes for participants. While there are additional administrative and monitoring costs that need to be considered when maintaining a larger core menu, those costs are likely significantly lower than the expected benefits.

Overall, large core investment menus appear to have the dual benefit of nudging more participants to use the default-investment option while getting self-directed participants to build more-efficient portfolios. When it comes to core menus, bigger is better.