According to Sallie Mae, there are three main reasons why American families saving for college don’t use 529 college-savings plans:

- They don’t think they have enough money to save in that type of account (22%).

- They don’t know enough about them (19%).

- They prefer to save for college a different way (12%).

Only 16% of American families currently saving for college use 529 plans, but as we mentioned in an earlier blog post, 529s can be an effective vehicle for families to support their goals, depending on how much parents save or where they live.

So, we conducted an experiment to test whether different techniques answered concerns that families might have about 529s. We focused on those who were currently saving for their children’s college education. For non-savers, we provided them with a hypothetical situation with the understanding that hypothetical values are far less reliable than real-money scenarios.

How structured our experiment on 529 savings behavior

In our experiment, we asked participants how much they were planning to save in 2019 and where they were putting that money—such as a savings account, checking account, investment account, certificate of deposit, 529, or other education plans.

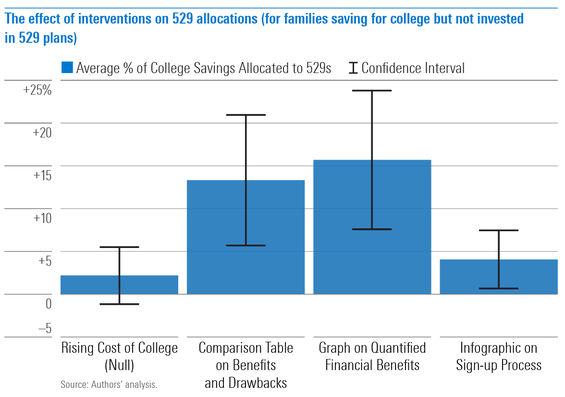

Then, we randomly assigned each participant to one of four interventions:

- A null intervention that provided general information about the rising cost of college. (We considered this our control.)

- A table summarizing 529 plan benefits and disadvantages. This was designed to overcome the problem of information overload with 529s.

- A graph quantitatively comparing the financial benefits of 529s against other account types. This was designed to overcome the challenge of calculating complex costs and benefits.

- An infographic showing how to sign up for 529s. This was designed to overcome uncertainty and fear about the sign-up process.

We then gave participants an opportunity to make allocation changes to their plans and measured the effectiveness of each intervention by analyzing what, if any, change they made to their 529 allocations afterward. The graph below shows the results of our experiment.

How advisors can help clients think about 529 plan benefits and disadvantages

For those families saving for college that didn’t have assets in 529 plans, we found that the graph and table interventions had a significant effect on planned allocations to 529s. This suggests that advisors can help their clients make better decisions about saving in 529s by clearly laying out 529 plan benefits and disadvantages in concrete terms—quantifying and summarizing all options.

The interventions, however, weren’t effective in increasing allocation to 529s for families that already invested in 529 plans. We hypothesize that increasing use is more difficult than adoption because families that already are investing in 529s have already figured out how much they can afford to save, so the effects of behavioral interventions aren’t significant.