As many asset managers know, average mutual fund fees are dropping steadily over time. According to Morningstar research, one of the main drivers of this decline is investors’ shift to passive funds—that have, in turn, implemented aggressive fee cuts to encourage inflows.

But despite this occurrence, there are still huge variations in fees. For example, even though a majority of S&P 500 trackers are virtually identical in the most relevant characteristics, such as performance and holdings, their fees tell a different story. Rydex S&P 500 H (RYSPX) and Schwab S&P 500 Index Fund (SWPPX) are both S&P 500 trackers with correlation of returns and holdings similarity scores of greater than 99.9, yet their net expense ratios are 1.58% and 0.03%, respectively.

According to traditional economics, this occurrence doesn’t make sense. Why would investors pay more for essentially the same product? Some research points to the “price indicates quality” bias—where consumers perceive a product to be of a higher quality because it’s expensive. Our research shows, however, that this may not be the case.

Price does not indicate quality

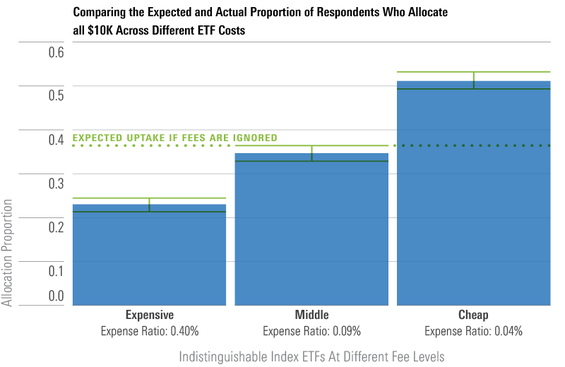

In our experiment, we asked participants to allocate a hypothetical $10,000 across three S&P 500 index ETFs. The funds are essentially indistinguishable in terms of performance and holdings but charge vastly different fees. In one of the conditions, participants had to allocate all of their money to only one of the three options. This helped us understand how fees are perceived—if significantly more money was allocated to the most expensive fund, this would suggest that people perceive more expensive products to be of a higher quality. Our results, however, show the opposite.

When participants had to allocate all of their money to only one fund, significantly more people allocated to the cheapest fund, suggesting that, on average, people are sensitive to fees and don't perceive more expensive investments to be of a higher quality than cheaper ones.

Above-average mutual fund fees may result in below-average sales

Overall, our research suggests that investors aren’t just depending on the "price indicates quality" bias, and they are at least somewhat aware of these price discrepancies. This is a realization that, given the shift from active to passive, we can presume will only grow over time. And given this shift, asset managers may benefit from offering investors lower fees and increased transparency.

2 key takeaways for asset managers:

- Focus on value. Research shows that there are a growing number of near-identical investments in the market, and this is true for S&P 500 index funds. Offering cheaper alternatives may be a way to attract investors.

- Justify higher costs. Since some asset managers cannot reduce costs, they may benefit from clearly stating why their fund is more expensive. Our results suggest that investors don’t believe that above-average mutual fund fees indicate above-average mutual funds. If your investment product costs significantly more than near-identical alternatives, it may be necessary to provide justifications for “buying up.”

Increasingly investors want to know exactly what they are buying into—a shift in investor culture that asset managers must prepare for. Whether that means clearly stating why certain funds are more expensive or lowering fees to stay competitive, asset managers must adapt to the new demands of investors.