Morningstar is asking financial advisors what they want technology to help them achieve. So far, here are the top three responses that advisors have ranked as most important in the Morningstar Tech Survey:

- Increase responsiveness to clients

- Better connect tech solutions to make daily work easier

- Automate certain tasks, so more time can be spent helping clients pursue their financial goals

To better understand how advisors are pursuing these goals, we're asking advisors about the tools they use and the biggest obstacles they encounter. Here’s a broad look at what we're seeing from our survey, which remains open to responses from independent advisors.

The complexity of technology overload

One of the biggest obstacles confronting advisory practices is the multitude of technology solutions they rely on to handle their back office. The list of common software applications is long, and it includes: practice management; portfolio management; performance reporting; rebalancing and trading; fee billing; customer relationship management; risk modeling; financial planning; and other specialized tools, depending on the unique service model of the firm. Mature firms have evolved their IT infrastructure with the growth of their business. But as technology vendors expand their offerings, many firms find themselves using a patchwork of legacy systems. These are often woven together with newer offerings that have incremental improvement, and become difficult to maintain and upgrade over time.

In our survey, 90% of respondents have reported using four to seven primary platforms in their practice, and the remaining 10% said they used eight to 10 platforms.

So how can any firm manage so many disparate systems? The short answer is they can’t.

Using a variety of technologies that weren’t built to work together, combined with aging infrastructures, puts advisors’ data at risk and increases the time it takes to complete work. This reduction in productivity is made worse by outdated workflows, exception processing, overlapping features, duplicating data, gaps in capabilities, and system integrations that rely on multiple vendors to maintain. Legacy platforms are not only a source of frustration and inefficiency, but they also expose firms to risk that may come from data input errors or from the vulnerabilities of out-of-date cybersecurity standards.

The administrative cost of using too many financial advisor tools

As an advisor, you know that the data used in your practice must be timely, accurate, secure, and high quality. But it can be hard to find the time and resources to make sure that’s happening across all of your systems. There’s a high administrative price to pay when you or a member of your team must manually input data from system to system. Or when you need to do hands-on work to gather your clients’ data across all of their accounts. Or when you need to do billing and quarterly reporting. All this hands-on work increases the probability of errors, and it takes time away from clients.

Advisors surveyed say the most time-consuming activities they regularly handle are:

- Building a financial plan: from three hours to more than a day

- Communicating to clients after a market event: from three hours to more than a day

- Completing quarter-end reporting: from three days to more than two weeks

Add to this time to all the preparation for client meetings, and advisors can spend a lot of time not advising. Consider these average time estimates for daily tasks:

- Research investments: 1.5 hours

- Prepare for a client meeting: 1.5 hours

- Prepare a portfolio proposal: 2 hours

- Rebalance a portfolio: 1 hour

Time is not the only cost. The opportunity costs can be immeasurable. Firms that haven’t streamlined their workflows and automated repetitive tasks can quickly find themselves unable to grow. Each new client adds to the administrative burden.

The financial cost of financial advisor technology

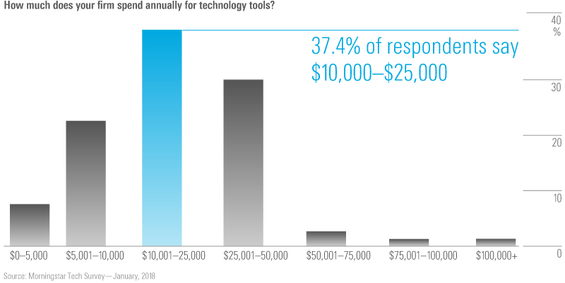

There’s also the monetary costs. When asked about their annual technology budgets, firms say they typically spend between $10,000-$50,000 on tech tools alone, with a small percentage investing more than $100,000.

The changing client expectations for financial advisor technology

Client expectations are evolving with the rapid changes in technology. Advisors are being challenged to provide holistic advice that goes beyond investment management, and they must engage with clients when and where they are. Clients are used to instant results and immediate feedback. They want their favorite TV shows and their financial information available 24/7, so they can catch up as their schedules permit.

Yet, in response to this increasing demand for real-time information, only 11% of advisors in our survey use a client web portal to provide an up-to-date financial picture on a weekly or daily basis. Instead, 49 percent continue to rely on personal emails while 38 percent use phone calls to fill information gaps on a weekly or daily basis. This can quickly become unmanageable during a market correction or other significant event that prompts concern from clients.

Choosing financial advisor technology that’s fit for a modern practice

The business of advice has changed fundamentally. And investors have come to expect the type of on-demand access to information they get from their banks, shopping, and entertainment. Modern advisors are looking to transform their practices to increase responsiveness to their clients, so they focus more of their time on helping clients pursue their financial goals.

Karyn Dejong is a marketer for the Morningstar software product group.