Best Interest Advice for Your Clients

Reg BI Solutions Designed for Your Firm

We believe putting the investor first enables financial professionals to grow their practices while continuing to act as stewards of capital. We also champion the notion that efficiency is driven by consistency, integration, and connectivity of tools that financial professionals use. Our common data, research, and technology solutions can meet your firm’s regulatory requirements and enhance productivity in a way best suited to your business.

Information

Provide data and information for financial professionals to perform their own analysis and determine reasonable recommendations.

Research and Guidance

Surface curated analysis and insights, offering guidance for best-interest-based decisions and goal planning.

Advice

Deliver asset allocation and investment advice, developed through a common, codified process.

Determine Your New Standard

Evaluate the reasonableness of recommendations.

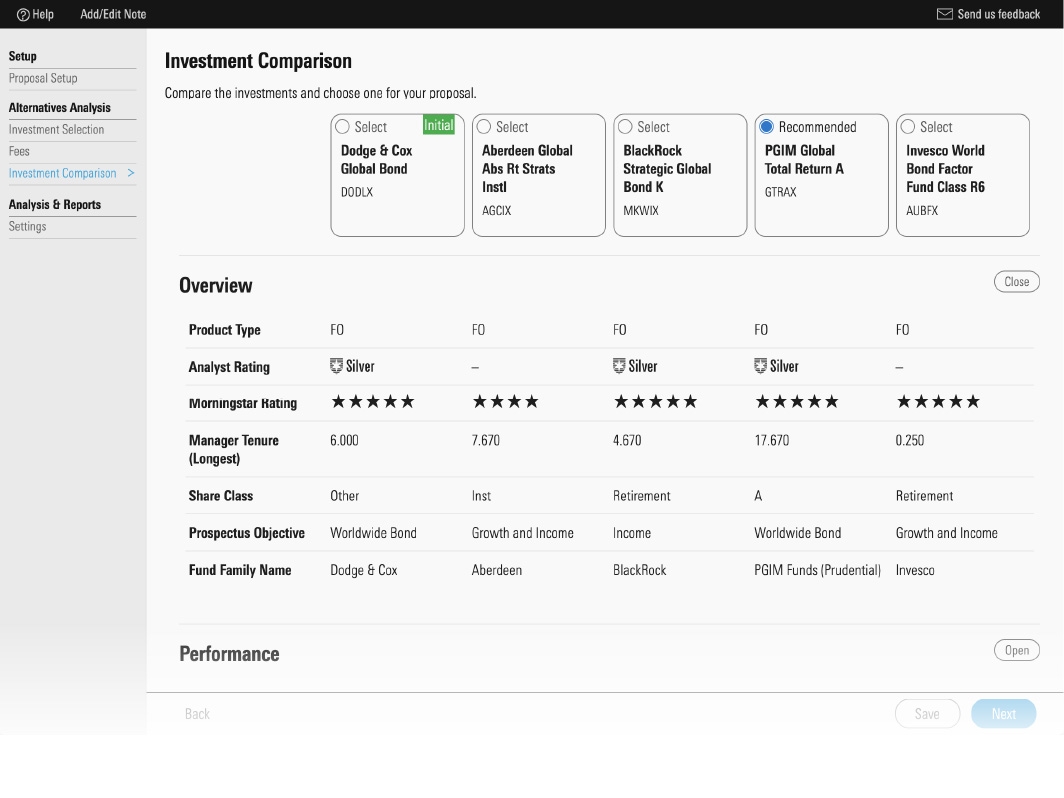

Empower financial professionals to select investments and determine reasonably available alternatives with data on performance, risk attributes, fees, and proprietary ratings.

Key financial professional activities:

Screen product shelf for alternative investments, including annuities

Compare alternatives on risk, ratings, fees, and performance

Validate and select final recommendation

Compare annuity contracts and establish beneficiaries

Generate and archive FINRA-reviewed reports

Explore related Morningstar offerings:

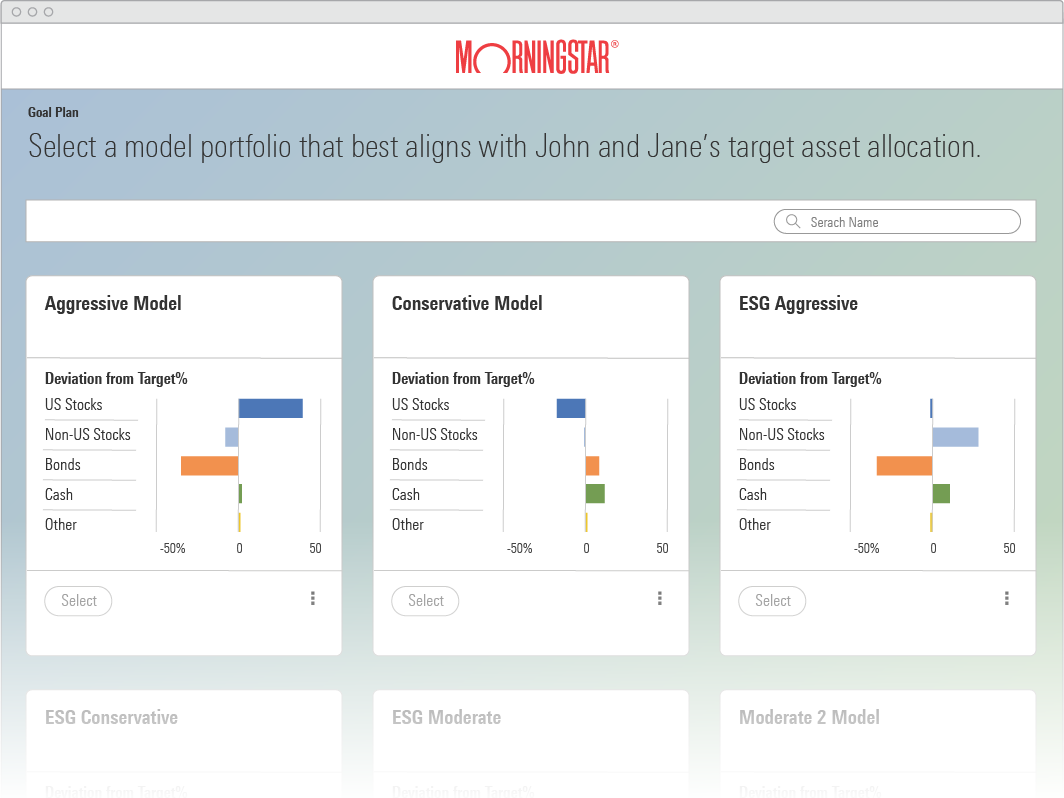

Align portfolios with investor’s goals.

Capture, prioritize, and align client goals to asset allocation and investment portfolios. Then document and communicate client’s best interests seamlessly.

Key financial professional activities:

Know your client

Document client objectives

Make a plan with your client

Link goals to investment plans

Generate and archive reports

Explore related Morningstar offerings:

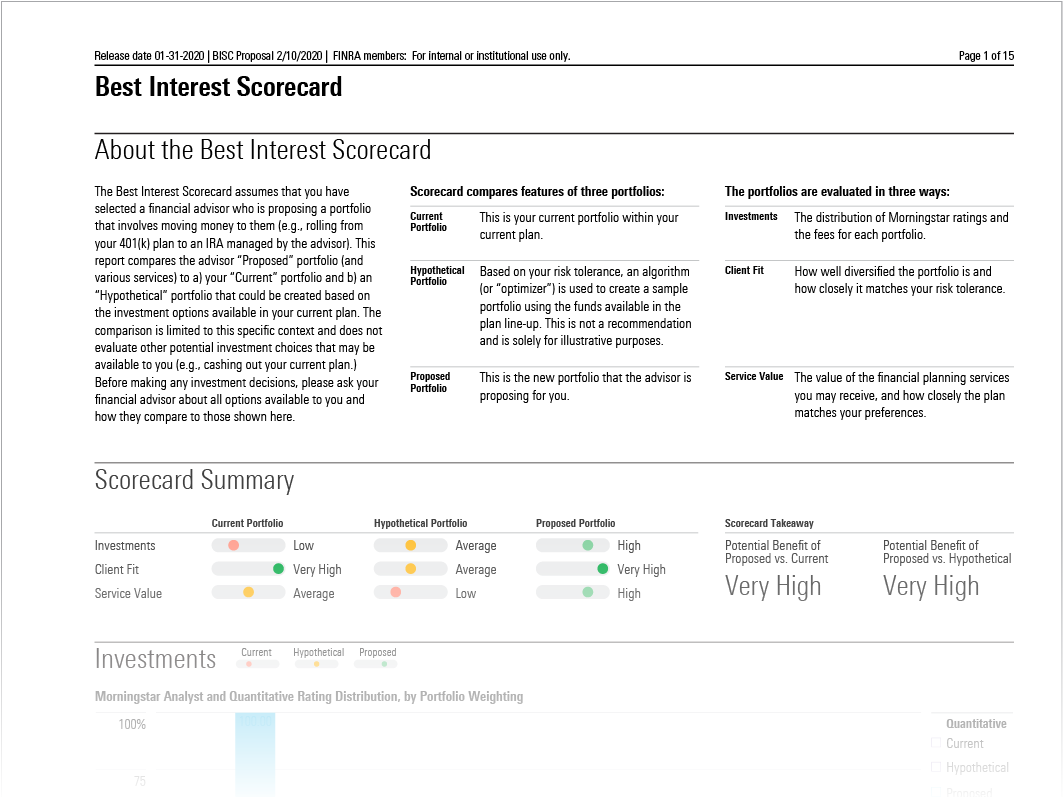

Rollover with confidence using portfolios focused on transparency.

Empower more informed recommendations surrounding defined contribution plan rollovers to IRAs or annuities in your clients’ best interest.

Key financial professional activities:

Search DC Plan lookup

Evaluate fee details

Assess client fit

Make an investment or model selection

Review best interest scorecards

Generate and archive reports

Explore related Morningstar offerings:

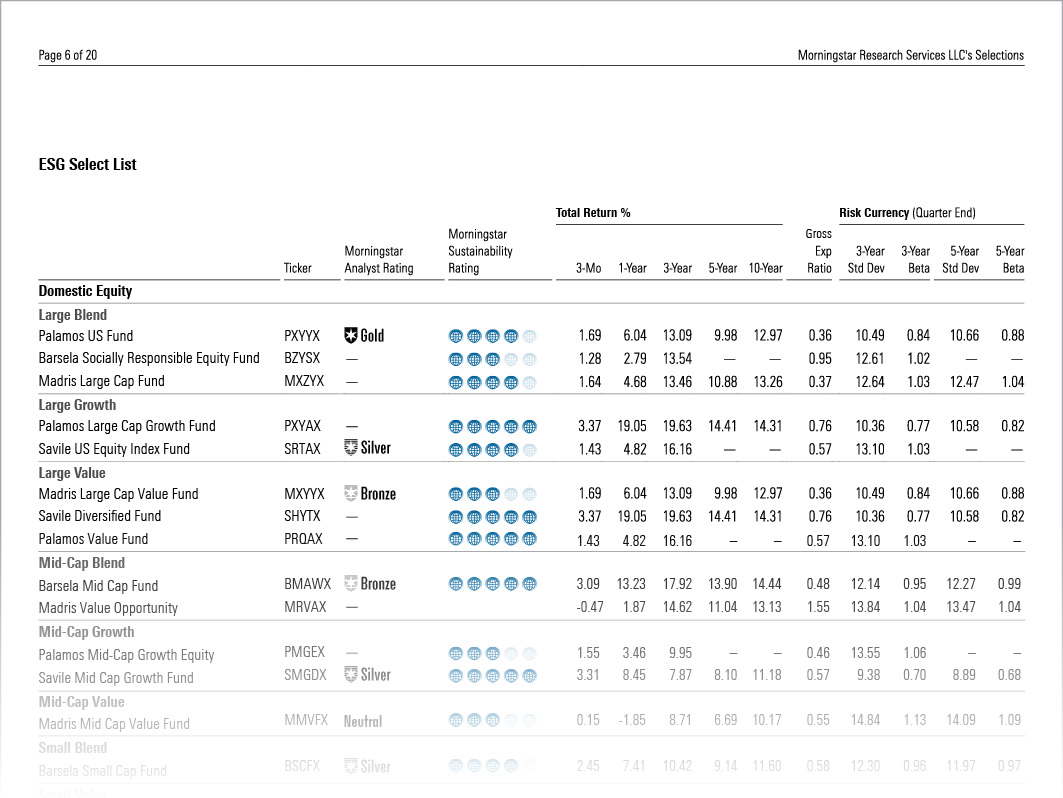

Design investment lineups that serve clients’ best interests.

Support informed decisions with due diligence scorecards and reports, select lists, and data coverage on prospectus fees, share classes, and more.

Key financial professional activities:

Qualitative research, ratings, and reports

Investment selection

Analyst access

Global fund reports

Comprehensive data feeds

Explore related Morningstar offerings:

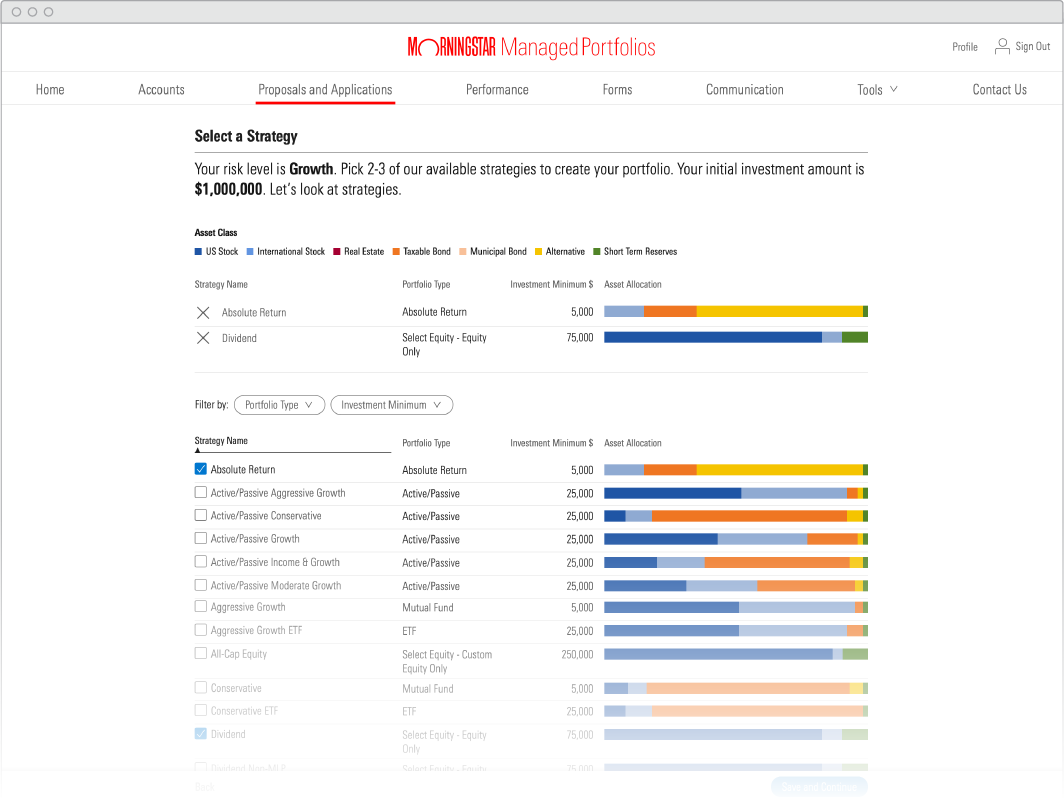

Spend more time on client engagement with vetted investment strategies.

Access a wide range of multi-asset and separately managed portfolios that are built and managed to help you focus holistically on your clients.

Key capabilities:

Asset allocation strategies

Outcome-based strategies

Select equity strategies

Explore related Morningstar offerings:

Review Regulatory Insights

Learn About RegBI and the Consequences of Inaction

Understand the Impact of RegBI on Your Business

Explore How Technology Enhances RegBI Practices

Explore the Difference

Seamless Scalability

Access solutions built on existing data and technology in a manner that meets your scale requirements.

Unique Interoperability

Leverage common data and research applications with the flexibility of component technology that easily embeds into any workflow.

Integrity Born of Quality

Tap into our foundational data offerings—steeped in the most meticulous quality assurance —to deliver timely, accurate data inputs.

A Trusted Source

Adopt a category system that sets the industry standard for determining Reasonably Available Alternatives.

Experience and Thought Leadership

Draw upon vetted expertise to develop innovative approaches to asset allocation, research, and portfolio management

Seamless Delivery

Implement tailored solutions integrated with your existing systems through APIs, SSO, or data feeds - creating centralized data consistency.

Ensuring Regulation Best Interest Preparedness

Brokers may be anxious about how the new SEC ruling, Regulation Best Interest, will change their firms day-to-day now that it’s gone into effect. FINRA may have also shared communications about required adjustments to ensure a client’s best interest was part of a recommendation, beyond providing a Customer Relationship Summary (CRS). Investor preference for transparency, fee-based investing and lower-cost investments will continue to shape the industry and addressing trends like these now can help strengthen client relationships and differentiate providers. In this checklist, we offer a list of steps broker/dealers should take to ensure their firm is prepared for an eventual Regulation Best Interest examination.

Ready to See for Yourself?

See how Morningstar’s Regulation Best Interest solutions can help you help investors build a better financial future.

Morningstar’s Regulation Best Interest solutions are part of Morningstar’s Financial Planning Solutions.