5 min read

How Investors Can Limit Climate and ESG Risk

Key Takeaways

Sustainable investing has transitioned from niche to mainstream in just under 20 years.

ESG risks are often less tangible and less immediately visible than traditional financial risks and can be harder to assess.

Accurate and reliable data is key to analyzing ESG risk.

The concept of sustainable investing is relatively new.

The term “ESG” was introduced in 2004 in a United Nations report entitled “Who Cares Wins.” The report said: “A better inclusion of environmental, social and corporate governance (ESG) factors in investment decisions will ultimately contribute to more stable and predictable markets, which is in the interest of all market actors.”

Nearly two decades later, sustainable investing has transitioned from idealistic and niche to mainstream.

In 2023, global sustainable funds gathered USD 63 billion. Assets in globalsustainable funds stood at USD 2.97 trillion at the end of 2023.

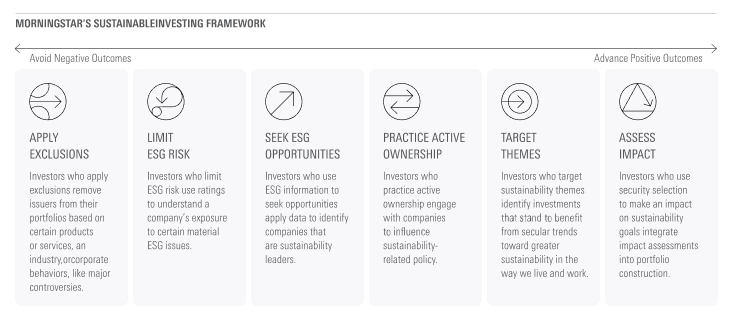

The increasing recognition that ESG factors can have a potential impact on investments and portfolio outcomes has led to the creation of new funds and new strategies. Morningstar’s new guide reviews one of the most common sustainable investing approaches: limiting ESG risk. It also introduces tips and tools to better align end investor preferences with the right sustainable investments.

For comprehensive analysis and recommendations, download the full guide.

What Are ESG Risks?

ESG risks are financially material risks related to the broader environmental, social, and governance contexts in which an industry and its firms operate. These risks are specific to each industry and can have real financial impact on companies.

Companies that ignore or mishandle ESG issues may face significant financial costs. It’s important for investors to assess a company's exposure to unmanaged ESG risk.

Environmental Risks

These risks include emissions, like greenhouse gases and pollution, as well as resource use, like whether a company is committed to recycled materials and what percentage of their waste winds up in landfills.

Companies that neglect to consider the effects of their policies and practices on the environment may be exposed to greater financial risk. Additionally, shareholder value could tumble if a company is found responsible for something like an oil spill and is subject to criminal prosecution or regulatory sanctions.

The specific probability and materiality of these risks vary depending on the industry and company.

Social Risks

These risks include employee development and labor practices, product liabilities regarding safety and quality, supply chain and controversial sourcing issues, and providing access to underprivileged social groups.

Governance Risks

These risks include shareholders rights, board diversity, executive compensation, and matters of corporate behavior, like corruption.

In 2024, investment teams need a firm grasp of how these risks affect investment strategies.

What Are Examples of ESG Risk?

ESG risks are often less tangible and less immediately visible than traditional financial risks. The potential long-term effects of climate change on a company’s operations and financial performance, for example, can be difficult to quantify or predict with precision. ESG risks can also vary greatly between industries and companies, making it challenging for investors to compare and evaluate them on a consistent basis.

The Covid-19 pandemic shows how an unpredictable event such as this can spark a further chain of events affecting multiple geographies and industries.

To meet the dramatic increase in demand for online shopping, companies have had to expand their logistics, data servicing systems, and warehouses, in turn increasing their exposure to carbon issues and associated operational costs. From more vehicles to transport goods to more energy to supply warehouses and an overall increase in packaging waste, companies have become more vulnerable to additional ESG risks.

Russia’s invasion of Ukraine is another prime example.

It has caused supply chain and logistical risks, reputation risks, and financial risks all to increase for companies operating in the country. The conflict has also had an impact on the transit of natural gas from Ukraine to Europe, which has contributed to price hikes in some countries.

More and more, investors want to know the companies they invest in take these risks into consideration.

How Do You Manage ESG Risk?

Managing ESG risk in a portfolio starts with analysis and screening.

Prioritize investments in companies and funds that have strong ESG performance and a demonstrated commitment to addressing ESG risks. With independent ESG ratings, investors can identify top performers in specific areas of interest. A best-in-class strategy naturally means divesting from companies with poor ESG performance.

Diversification remains just as critical a component in sustainable investing as non-sustainable investing. Selecting a range of industries and geographies reduces the risk that a single company or sector will have a significant impact on the portfolio’s overall ESG performance.

How Can Investors Assess ESG Risk?

Investors may soon have access to deeper data on corporate sustainability. A new SEC rule could soon require firms to disclose more information on ESG considerations.

As regulations progress, investors can turn to trusted third-party data providers for more insight.

Sustainalytics’ ESG Risk Ratings measure the degree to which company's economic value at risk is driven by ESG factors.

Sustainalytics analyzes over 1,300 data points to assess a company's exposure to and management of ESG risks. In other words, ESG Risk Ratings measures a company's unmanaged ESG risks represented as a quantitative score.

Based on their quantitative scores, companies are grouped into one of five Risk Categories (negligible, low, medium, high, severe). These risk categories are absolute, meaning that a “high risk” assessment reflects a comparable degree of unmanaged ESG risk across all subindustries covered.

It’s All About the Data

To effectively assess and manage ESG risks within their portfolio, investors need access to the right resources to identify risks, compare companies and industries, and understand the potential magnitude of the risks themselves.

Morningstar's Guide to ESG Risk details how to evaluate and limit ESG risk. The report covers a variety of metrics, like sustainability scores and ratings, carbon risk, country risk ratings, and company analysis.