Economics often dominates the news with ominous headlines as everyone speculates about interest rates, inflation, and economic growth. This impacts markets directly. Asset prices change not just in response to economic change, but also in anticipation of it. Portfolio construction must account for economic change, both expected and unexpected.

Our U.S. economic outlook is optimistic about GDP growth and inflation for the next several years, relative to expectations. By planning ahead, investors can make the best decisions to make progress toward their long-term goals.

Here’s what financial advisors need to know about economic conditions and how to support clients in 2024.

For a full picture of the 2024 economy, download the outlook. If you’re a financial advisor, download the report here. If you’re an investor, please visit morningstar.com or consult your financial advisor.

2024 Predictions for GDP Growth

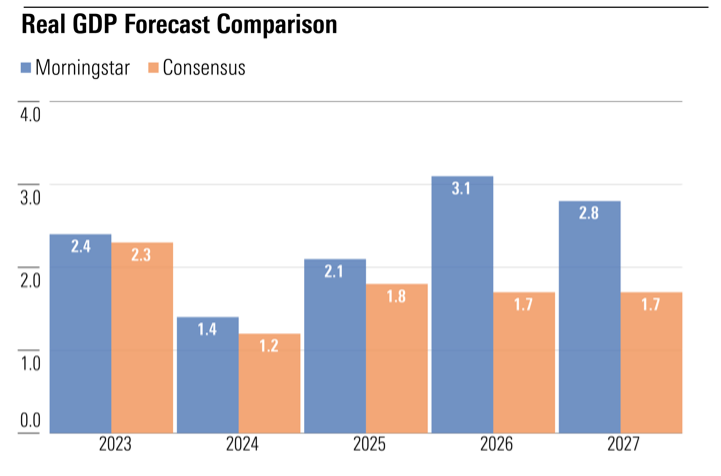

While Morningstar economists expect real GDP growth to slow in 2024, our longer-term outlook is optimistic.

Our researchers predict the U.S. economy will feel the lagged effects of the Federal Reserve’s interest rate hikes. Consumers also seem cautious as household excess savings deplete.

However, our economists expect GDP growth to rebound over 2025 through 2027. Slowed growth and normalizing inflation could induce the Fed to cut rates aggressively in 2024. And after the lows of the COVID-19 pandemic, increased labor supply and productivity could also spur economic growth.

Source: Morningstar

Action Steps for Financial Advisors

- Monitor economic developments. Ignore the hype and stay up to date with a trusted independent source. Economic outcomes can shift based on swing factors like geopolitical risk and technological innovations. Staying informed—and explaining to clients how you do so—can quiet their anxiety.

- Head off client inquiries with proactive outreach. Recessions can be stressful for investors. Create opportunities for clients to discuss their concerns over the phone or email.

- See market fluctuations as an opportunity to demonstrate your expertise. Advisors can provide investment research that shows their value as a resource. Make sure newsletters are easy to read to dissolve confusion instead of enhancing it.

Economists Forecast That Inflation Is Likely to Stay Lower for Longer

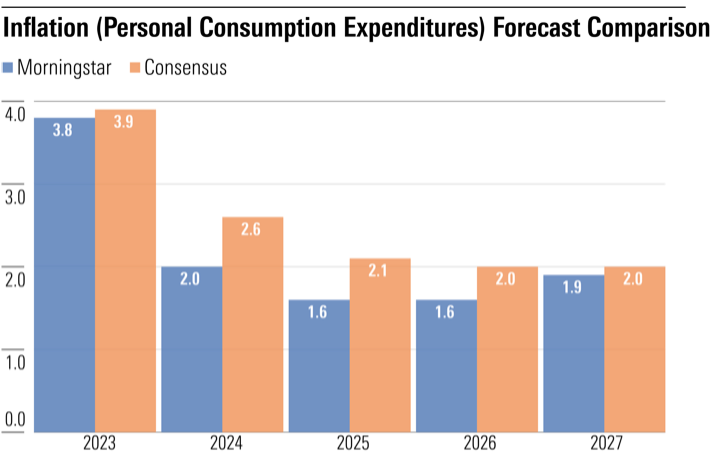

While everyone talks about “higher for longer” interest rates, our economists predict that inflation will fall back to central bank targets in 2024 and remain low.

We expect inflation to return to the Fed’s 2% target in 2024 and stay there in the following years. The supply constraints that caused a surge in inflation in 2021-22 are now easing. This allowed inflation to fall dramatically in 2023 despite GDP growth. This process still has much room to run.

Against this backdrop, central banks could cut interest rates aggressively from mid-2024 into 2025. This is a potential positive but not a certainty.

Source: Morningstar

Action Steps for Financial Advisors

- Revisit your asset mix. Under the threat of future inflation, investors might feel pressured to rebalance their portfolios. Short-term bonds may be positioned to guard against the risk that longer-term bonds face.

- Talk to retirees about long-term strategy. Given their fixed incomes, retirees might be worried about future inflation. Allocating more to inflation-linked bonds instead of nominal bonds can provide a hedge against inflation.

- Research inflation-fighting funds and portfolios. No asset class can perfectly prevent the negative impacts of inflation, which means diversity is key. Assess vehicles like a TIPS portfolio, commodities, emerging-market bonds, real estate, and gold. Some funds and managed portfolios can provide exposure to these diversified assets.

- Help investors balance inflation protection against risk tolerance. Cash likely won’t beat inflation over time, so taking risks is necessary for investment returns. That means some inflation-hedging vehicles won’t be appropriate for all clients.

Recession Risk Alive, But Not Our Base Case

Questions about potential recession risks and the inflation outlook will likely persist. While our U.S. base case involves a soft landing with no recession, we could see a wide range of potential outcomes.

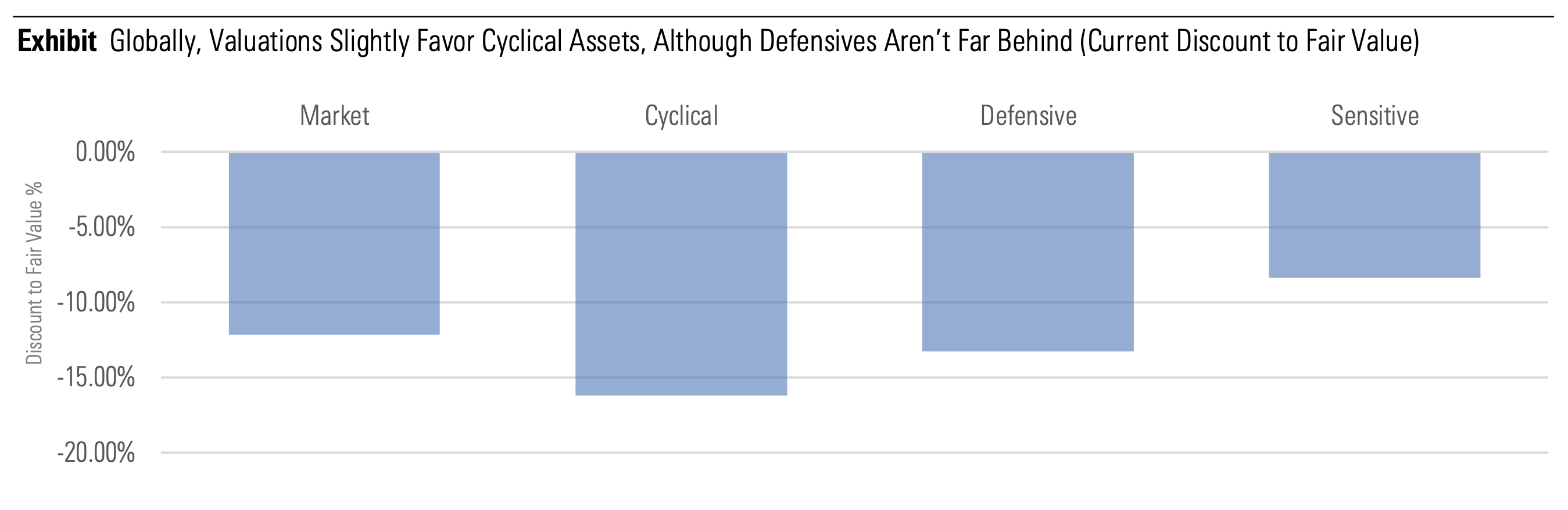

To assess how the market is pricing economic expectations, segment stocks by cyclical, defensive, and sensitive factors and compare their relative valuations. If a recession were top of mind, we’d expect a steep discount in cyclical and sensitive stocks, but higher valuations within defensive stocks.

However, while we see valuation dispersion between cyclical and defensive stocks, in aggregate both are offering discounts while sensitive stocks are closest to fair value. This pricing is closer to a soft-landing expectation and suggests a recession could catch broad markets off guard. However, utilities, communication services, and financial services all seem to price in an economic deterioration.

Source: Morningstar Equity Manager Research. Sector roll-up includes Cyclical (materials, consumer cyclicals, financial services, real estate), Defensives (healthcare, utilities, consumer staples) and Sensitives (communication services, energy, industrials, technology). Numbers reflect the average discount across the U.S., Europe, and Asia. Data as of November 15, 2023. For illustrative purposes only.

Action Steps for Financial Advisors

- Revisit clients’ financial goals. Goals-based financial planning can help advisors set more relevant definitions of success than an arbitrary dollar amount. It can also clarify the value of advice in making progress toward those goals and personal guidance

Map actions that investors can take to prepare for a recession. Are there places where they can reduce their monthly spending? Can they allocate a little more of each paycheck to emergency savings or paying down debt?

- Remind clients that the economy is cyclical. Recessions are common, temporary, and followed by economic recovery. The long-term view helps ensure investors take on the right amount of risk for their goals.

Investment Ideas for the 2024 Economy

This outlook comes amid recent volatility and a wide range of possible outcomes. In the coming years, we anticipate a complex macroeconomic playing field, influenced by various global influences and resultant investment implications. From a portfolio management perspective, these fluctuations carry both risk and opportunity.

Scenario testing reveals key portfolio positions to support robustness. For Morningstar Investment Management’s best investment ideas, download the full outlook.

Related Tags

You might also be interested in...

For general educational use only.

This commentary is for general educational and informational purposes only. The information, data, analyses, and opinions presented herein are designed to provide general information about investing, to inform investors about developments in the broader financial ecosystem, and/or to help investors interpret market and regulatory shifts. This material is not an offer of our investment advisory services or an offer to buy or sell a security.

References to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell a specific investment. We will not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use.

Diversification and asset allocation are methods used to help manage risk; they do not ensure a profit or protect against a loss.

All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Customers should seriously consider if an investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision.

The commentary contains certain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause the actual results to differ materially and/or substantially from any future results, performance, or achievements expressed or implied by those projected in the forward-looking statements for any reason.

©2023 Morningstar Investment Management LLC. All rights reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. Morningstar Investment Services LLC is a registered investment advisor and subsidiary of Morningstar Investment Management LLC. Morningstar Investment Management LLC is a registered investment advisor and subsidiary of Morningstar, Inc.

Morningstar Wealth is made available through Morningstar’s Investment Management Group and includes such products as: (i) the Morningstar Wealth Platform; (ii) Morningstar OfficeSM, Morningstar’s RIA portfolio software service; (iii) Morningstar® ByAllAccounts®, Morningstar’s investment data aggregation service; and (iv) Morningstar.com®, Morningstar’s individual investor site offering.

Morningstar’s Investment Management Group consists of certain Morningstar subsidiaries that are authorized in the jurisdictions in which they operate to provide investment management and advisory services. In the United States, these subsidiaries are Morningstar Investment Management LLC and Morningstar Investment Services, LLC.