A Russian Reminder

Russia's troubles highlight emerging-markets bond fund risk.

Russia's troubles highlight emerging-markets bond fund risk.

The holidays are usually a period of relative quiet for investors, but the opening weeks of December were anything but calm. One of the biggest stories was the dramatic drop in the value of Russian debt and the ruble, which took its toll on broad emerging-markets bond indexes and a number of funds dedicated to the space. We take a look at what drove Russian debt prices to plummet and examine what that means for some of the largest emerging-markets bond funds and, more broadly, what lessons investors can take away from the recent turbulence.

A Perfect Storm

Years of weak growth in Russia's oil-dominated economy left it particularly vulnerable to sanctions announced earlier this year. But the key destabilizing event in 2014 was the rapid fall of the price of oil, which had a negative impact on Russia's fiscal budget and trade balance, as well as the value of the ruble.

The situation intensified on Dec. 15, when the ruble tumbled 10% in one day, prompting the Bank of Russia to raise its key interest rate to 17.0% from 10.5%. The main culprit was a murky transaction between the Central Bank of Russia and Russia's largest oil firm. The central bank indirectly provided $11 billion to Rosneft to fund external debt repayments due before the end of the year. That stoked fears about the ability of Russian firms caught up in U.S. and European sanctions to repay or refinance the billions of foreign currency debt due in the next two years. These firms, along with a number of local banks, are currently unable to issue debt on Western capital markets. If sanctioned firms are forced to repay (instead of refinance) their external debts, a large outflow of U.S. dollars would result in additional downward pressure on the ruble.

Russian Debt Exposure and Fund Performance

Coming into December, Russian debt comprised roughly 8% of the hard-currency-focused JPMorgan Emerging Market Bond Index Global Diversified, 6% of the local-currency JPMorgan Government Bond Index-Emerging Markets Global Diversified benchmark, and 5% of the JPMorgan Corporate Emerging Markets Bond Index Broad Diversified, a corporate-only bogy.

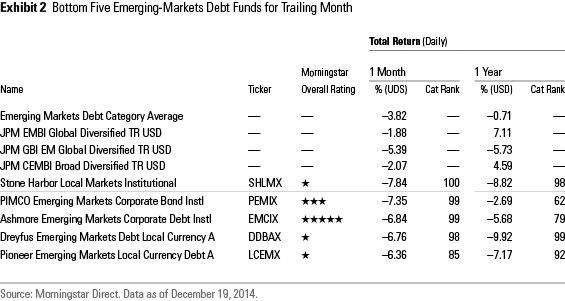

Within the emerging-markets debt landscape, Russian sovereigns and corporates were already some of the hardest hit for the first 11 months of the year when the bonds, and the ruble, experienced steeper slides in the opening weeks of December. The following table shows the five emerging-markets debt funds that shed the most for the trailing month through Dec. 19, as well as the aforementioned benchmarks and category average return.

At the time of their latest holdings reports (September or November), these funds had between 10% and 22% invested in Russian debt. While two funds on the list focus on corporate debt, which is typically denominated in U.S. dollars and euros, the other three faced additional headwinds because of their focus on bonds denominated in emerging-markets currencies. So far this year, almost all emerging-markets currencies have lost ground next to the U.S. dollar. However, the ruble was down 47% versus the dollar for the year to date through Dec. 19 and was the weakest performer for the period.

Morningstar analysts rate six funds in the emerging-markets debt category, and these funds sported exposures to Russian debt ranging from 5% on the low end for TCW Emerging Markets Income (TGEIX) to 21% on the high end for PIMCO Emerging Markets Bond (PAEMX). So it was no surprise to see the former hold up much better than the latter during the past month. PIMCO Emerging Local Bond (PELBX) held a lower stake in Russia (8%), but this fund was hit harder because of its single-digit exposure to the ruble and stakes in other emerging-markets currencies. The funds' returns for the trailing month and year through Dec. 19 were as follows:

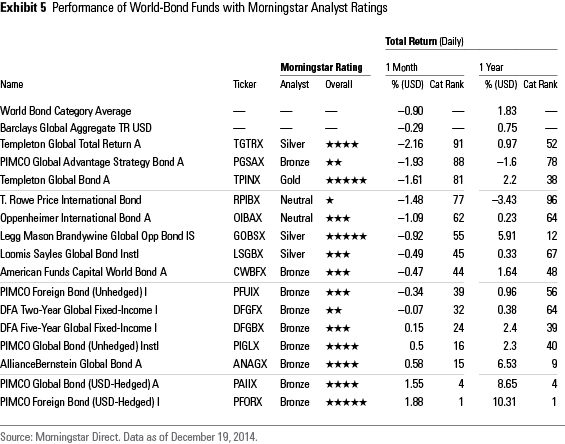

World-bond funds typically carry far less exposure to Russia. The Barclays Global Aggregate Index, a commonly used benchmark for such offerings, had less than 1% exposure to Russia. A few of the bottom five world-bond performers for the month in question had just less than 1% in Russian debt. Their results are as follows:

Morningstar analysts rate 15 world-bond funds, and their performance was largely driven by their emerging-markets and currency profiles during the month. A few of the bottom performers in this subset-- PIMCO Global Advantage Strategy Bond (PSAIX), Templeton Global Total Return (TGTRX), Templeton Global Bond (TPINX), and Oppenheimer International Bond (OIBIX)--held 3% or less in Russia. Stakes in other emerging markets, which were hit as well during the month, and significant nondollar exposure also served as headwinds. The best performers in this group eked out small gains for the month and had significant exposure to the strong U.S. dollar. These included the U.S. dollar-hedged versions of PIMCO Global Bond (USD-Hedged) (PAIIX) and PIMCO Foreign Bond (USD-Hedged) (PFORX), DFA Five-Year Global Fixed Income (DFGBX), and AllianceBernstein Global Bond (ANAGX).

The market impact caused by recent events in Russia has been jarring, particularly for emerging-markets debt investors. Morningstar analysts review such performance shocks to determine whether they translate into real concerns about the strategy or management of a rated fund. Analysts evaluate the magnitude of the position (both in absolute terms and relative to the benchmark), the initial investment thesis, whether the thesis is still intact, the manager's decision to add to or trim positions, and potential liquidity concerns due to the size of positions and/or outflows.

In gathering updates from managers who invest in Russian debt, the consensus view is that the likelihood of Russia defaulting on its debt is extremely low. A big driver behind the thesis is the country's strong balance sheet. Russia's extremely low debt level (14% of gross domestic product), its government's primary surplus, and ample foreign currency and gold reserves can help cover imports and support Russian firms that have been hit by sanctions. Another reason that has been cited to support the case for Russian debt is government policy action. Many believe that letting the ruble act as a shock absorber to falling oil prices has been the right response. Others viewed the central bank's interest-rate hike to 17% on Dec. 15 as proof that the country will do what it takes to prevent default. The central bank also introduced positive measures to ease stress on bank balance sheets last week.

The natural result of these moves is likely to be a recession, with some managers envisioning a 2%-4% economic contraction next year. Some have indicated that they are stress-testing their Russian positions at oil prices of $45 per barrel. While some see oil prices improving as early as next year, the less optimistic have remained comfortable with the ability of the country and quasi-sovereigns like Gazprom to continue to meet their obligations during the next few years at $45 per barrel. Managers are also paying close attention to tensions between Russia and Ukraine and the impact of sanctions on the economy. Even with all the negative news, several managers have indicated that prices for Russian sovereigns and corporates are now well below what's justified by the country's fundamentals. While some might like to take this as an opportunity to add to current positions, overall liquidity is down as a result of last week's volatility, so it might not be so easy to take advantage of the sell-off.

A Potent Reminder of Emerging-Markets Debt Funds' Long-Standing Risks

Last week's volatility could be here to stay, with continued weak oil prices and/or further tensions in Ukraine. And, for many, the recent slide has faint echoes of the Russian financial crisis of 1998 when the ruble plunged and the country defaulted on its debt. The worst of that crisis unfolded from mid-July to mid-September 1998, sending emerging-markets debt funds down 38% on average for the period. For that calendar year, these funds fell by 22% on average. The damage thus far has been much less severe. For the year to date through Dec. 19, emerging-markets debt funds are down 0.5% on average. Meanwhile, as discussed, many managers remain optimistic that the Russian government will continue to meet its debt obligations.

This most recent episode demonstrates why we've repeatedly highlighted the risks of emerging-markets debt funds in particular, and emerging-markets exposure (bonds or currencies) in world-bond funds. Despite broadly improving fundamentals for many emerging markets during the past decade, there are several investment risks to keep front and center. Emerging markets' fundamentals can change fairly quickly with changes in political regimes, commodities pricing, or geopolitical risk. Second, currency fluctuations can have a quick and pronounced impact on investors' assessment of the risks and valuations of emerging-markets bonds. Because of those risks, Russia is a reminder that emerging markets remain subject to swift and meaningful changes in capital flows.

The inter-related nature of those risks--particularly the relationships between policy, currencies, and capital flows--are and will remain extremely difficult to handicap. The relatively concentrated nature of commonly used emerging-markets debt benchmarks--notably, the JPMorgan Emerging Market Bond Index for hard-currency funds, the JPMorgan Government Bond Index-Emerging Markets for local-currency sovereign debt, and the JPMorgan Corporate Emerging Markets Bond Index for corporates--means that emerging-markets debt funds often have heavy concentrations in certain sectors, countries, and currencies, and some can be more sensitive to oil price movements. The potential for that concentration, coupled with the difficulty of handicapping emerging markets' risks, is a recipe for stomach-churning volatility, of which the latest Russia episode is only the most recent example.

Morningstar's data suggest that that volatility has made it more difficult for investors to use emerging-markets debt funds effectively. The table below shows the average total return, volatility (as measured by standard deviation), and Investor Return for the five most volatile fixed-income open-end fund categories over the trailing 10-year period through Nov. 30, 2014:

For the categories above, we calculated the Investor Shortfall, defined as the category's average return minus its average Investor Return (a measure accounting for flows into and out of the funds). Those shortfalls as a percentage of the category's average return are shown above. What this exercise suggests is that, on average, investors in emerging-markets bond funds have missed out on roughly 41% of the funds' total returns over the trailing 10-year period because they bought or sold the funds at inopportune times.

That gap is why we've urged investors considering emerging-markets bond funds to approach them as part of a long-term strategic allocation--that long-term perspective is necessary to ride out short-term volatility and increases the odds of capturing a bigger chunk of the funds' gains over time. From that perspective, investors holding an emerging-markets bond fund as a long-term allocation should wait out the volatility. Those unable or unwilling to ride out such periods might find Russia a good opportunity to re-evaluate whether they truly need an emerging-markets bond fund in their portfolio or to re-evaluate how much emerging-markets exposure they're willing to take in their world-bond fund holdings.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.