Our Outlook for the Economy

More modest growth may go hand-in-hand with a longer, more durable recovery.

More modest growth may go hand-in-hand with a longer, more durable recovery.

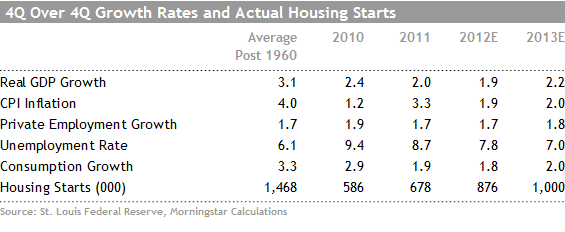

My 2013 economic forecast seems to center around the number 2. I suspect that real GDP growth, inflation, and consumption will come in at 2% or slightly more in 2013 with employment growth pulling up the rear at 1.8%.

Because of productivity growth, employment is almost always destined to trail total economic growth. With the exception of higher housing starts and lower unemployment, the forecast doesn't look much different than the likely results for all of 2012.

Compared with long-term averages, GDP growth and consumption growth are lower than average, at least partially due to lower population growth. But at least a couple of pieces of good news are embedded in that slower growth rate.

First, slower growth continues to keep a lid on inflation, with the inflation rate running just about half the rate of the long-term average. And it appears that more modest growth may go hand-in-hand with a longer, more durable recovery. Four of the last 10 economic recoveries (since World War II) were already over by now, and we should match the length of yet a fifth recovery early in 2013. By the way, the recovery is now approaching 3.5 years in length.

A Slow-Rolling Recovery

While the consumer has been a relatively durable contributor to the recovery, exports, manufacturing, and business spending have had their ups and downs. For example, year-over-year growth in industrial production peaked at 7.8% but is currently running at a more modest 3.2%. Housing, normally the go-to factor in jump-starting a recovery, is just now making a net contribution. Ditto for industrial construction.

And although government made some nice early contributions to the recovery, it's been pretty much downhill since mid-2010, with only one quarter of growth (3Q 2012) since that time. This almost unprecedented trend is weighing on the economy more than many might suspect. Since winding down the World War II war machine and the Korean War effort in the 1950s, government spending has never declined as fast as the 4% year-over-year decline experienced in mid-2011.

Housing the Big Change Factor in 2013

Looking to 2013, the recovery growth drivers are likely to change again. Although housing clearly began to turn in 2012, the effects were relatively muted. While direct housing investment will be a meaningful contributor in 2013, some of the ancillary goods and services that are housing related will also finally kick in. I am talking about things like mortgage brokers, furniture sales, and remodeling fees that may take longer to recover than housing starts, which are already way off their bottoms.

Consumer Spending Stable to Modestly Higher in 2013

The consumer is one thing that is not changing a lot. That's good news and bad news. The consumer represents about 70% of the U.S. economy, making it difficult for overall economic activity to move more slowly than the consumer, but it's also hard for it to grow faster.

The news for the consumer has been surprisingly good in 2012 and could look at least slightly better in 2013. Good news for the consumer includes slow but steady employment growth, stable inflation, rising financial assets, and a nicely improving real estate market. On the downside, unemployment remains high, and we still haven't recovered all the jobs lost in the recession.

No matter exactly how the fiscal cliff is resolved, it remains clear that taxes, at least on the federal level, will be higher in 2013, especially on high-earning individuals. Although my overall consumer spending growth rate is higher in 2013 than 2012 at 2.0%, I suspect that lower income and especially middle income earners will do better than high income earners in 2013. Higher taxes and potentially smaller capital gains in 2013 may put high earners in a more negative mood. Middle income earners will likely be bigger beneficiaries of rising home prices (and their newfound ability to refinance those homes).

Slow World Economy Could Keep Inflation Below 2% in 2013

Tame inflation should also help the consumer again in 2013. Unfortunately, my 2% inflation forecast comes with less confidence than most other components of my analysis. Combined energy and food prices represent more than 20% of consumer prices, and these two data are nearly impossible to project solely on economic factors. Slow worldwide economic growth and more controlled commodity demand from emerging markets would point to slower food and energy prices in 2013 driving overall inflation potentially down as low as 1.5%. However, the drought of 2012 and the potential for another crop disaster in 2013, along with oil prices that seem more influenced by geopolitical events than supply and demand, cause me to add at least a small fudge factor in my inflation forecast.

As Long as Inflation Remains Below 4%, I Am Not Too Worried

I can say with some degree of certainty that as long as inflation remains under about 4%, the consumer will continue to power the economy ahead, and a recession is not the most likely outcome. The track record of high inflation forecasting a recession is extremely solid. And remember it is total inflation, including the volatile food and energy sectors, that counts. Even though the "core" inflation levels that exclude food and energy prices may look more muted or tame, consumers have to eat and drive, and more money spent on those items means less available for other expenditures.

Worries About Expansive Fed Seem Premature

Although I've talked of inflation mainly as a factor of worldwide supply and demand, at least some economists are beginning to worry about inflation from an excessively easy Federal Reserve. The discussions of the fiscal cliff served to hide what was one of the more expansive moves by the Federal Reserve during this recovery. The credit market outlook in this quarter-end report details some of that news.

Perhaps the most noteworthy piece of information in the Fed's December press release was that purchases of longer-term bonds would no longer have to be matched by selling shorter-term notes or bills, essentially printing more money instead. However, I note that continuing tight lending requirements should keep the Fed's largesse from igniting inflation in day-to-day goods. A lot of money is sloshing around on bank balance sheets, but it remains difficult to find qualified borrowers to lend it to. Until those lending standards get meaningfully easier, price increases are likely limited to houses, financial assets, and perhaps commodities.

Private Sector Employment Growth Steady as She Goes; 1.8% Growth Possible

The monthly employment reports remain topsy-turvy from month to month, but year-over-year averages have been relatively consistent at 1.8% growth for some time.

At this rate, we won't have recaptured all the jobs lost in recession until sometime toward the end of 2014. However, employment growth of 1.8% can easily support GDP growth in excess of 2% due to higher productivity levels. For reference purposes, that translates into approximately 170,000 private sector jobs, which basically mirrors the growth level of 2012.

Professional service (which includes temporary help), education, health care, retail, and leisure (mainly hotels and restaurants) were the biggest contributors to job growth in 2012. I suspect health care could be an even bigger contributor in 2013 as the Affordable Care Act begins to kick in and becomes the law of the land.

Housing- and construction-related employment growth was nonexistent in 2012, despite improved housing starts. In 2013, I suspect housing- and construction-related employment will help along the monthly employment reports and is likely to help the temporary-help category as well. Retail hiring was a big help at the end of 2012 but may suffer at least some slowing in early 2013 before rebounding later in the year.

Unemployment Rate Will Likely Move Down

In a totally static economy, the 2 million or so jobs created could drop the employment rate as low as 6.5%. However, each year a new class of graduates enters the job market and another set retires. The ranks of retirees are increasing each year as the baby boomer cohort retires while the number of new job-market entrants is relatively stagnant, but it is still running higher than retirements. Still, the net labor market is likely to increase by about 1 million in 2013 (compared with about 1.3 million in 2012). That translates into a drop in the unemployment rate from an estimated 7.8% in 2012 to 7.1% by the end of the 2013. At this rate, the unemployment rate could fall below the Fed's 6.5% watch point by the end of 2014, earlier than it seems to be contemplating now.

U.S. Decoupling Really Did Happen in 2012

Although I think the IMF's estimated U.S. real GDP growth rate for the full year 2012 may be a little high, it still seems that U.S. economic growth in 2012 was very close to the same level as 2011.

At the same time, Europe moved into a recession, and growth in China and other developing markets slowed dramatically (though in many cases, growth rates were at a higher level than in the U.S.). The U.S. economy benefited from higher oil production, an improved auto industry, decreased commodity prices, and a turn in the housing market--avenues of growth that were not available in a lot of other countries.

In addition, at just 14% of GDP, exports represent a smaller portion of economic activity than in other countries. And a lot of what the U.S. does ship is composed of basic necessities or falls under long-term contract, including food, refined oil products, and jetliners. Therefore, the U.S. economy was not as drastically affected by the world economic slowdown as many had feared.

S&P 500 earnings growth slowed more dramatically in 2012 than the overall U.S. economy and was less immune to the worldwide economic slowdown. It is not unusual for large, multinational firms to derive as much as 20%-40% of their revenues and earnings from non-U.S. markets. However, a lot of those overseas revenues are derived from goods produced outside of the United States. Therefore, corporate earnings soared this recovery, even as U.S. employment growth remained lethargic.

Now the roles are reversed as U.S. employment growth has remained stable and multinational earnings growth has slowed dramatically. A stronger dollar also contributed to weaker corporate growth overseas. As emerging markets show signs of stabilization, there may be more room for earnings improvement again in 2013. However, I think Europe could still be problematic in 2013 as its fiscal issues remain far from solved.

Morningstar Analysts Have Positive U.S. View, Negative European Outlooks, and Mixed Views on the Chinese Economy

A lot of the sector-based quarterly outlooks in this report are fairly consistent with my outlook. A number of teams commented on and were worried about European growth. For a change, many of the reports indicated that the U.S. might be the best place to be, with the domestic auto and housing industries driving a lot of activity.

The outlooks on China were more varied with some sector analysts convinced of a turn while others felt that the slowdown was not yet complete. Others argued that even as China improves, growth was likely to be more muted and driven more by the consumer and less by investment. This in turn would temper the rebound in commodities and metals, which have been the typical beneficiaries of the Chinese growth story.

Morningstar Teams Guardedly More Optimistic, Though Few Bargains Remain

Being typical Morningstar, overall enthusiasm was muted, but still just a tad more bullish than quarterly reports earlier this year. Unfortunately, most teams commented that while equities were relatively fairly valued, very few stocks represented true bargains. Several analysts noted that stock buyback activity, special dividends, and mergers/divestitures seemed to be relatively important factors for corporations attempting to generate more shareholder value. Generally, it appears that EPS growth has been helped along more by these types of maneuvers than revenue growth as we approached the end of 2012. The fiscal cliff and especially the potential for large sequestrations of both defense and health-care spending also seemed to garner a fair number of mentions in the sector-based quarterly outlooks. I am still skeptical that these cuts will actually get made when the final deal is struck, although it obviously has given more than a few businesses cause for concern.

Weather conditions also got some attention in several reports. Our energy team seemed particularly concerned that we may have one of our warmest winters in U.S. history. On the other hand, a hot summer in 2012 managed to finally draw down some of the massive piles of coal at U.S. utilities. Likewise, the drought and higher food prices are hurting some consumer-related stocks but could help companies serving what is expected to be a very strong U.S. spring planting season. Yet another summer drought would dash some of that enthusiasm. Warm weather could also favorably shift some housing statistics at the beginning of the year but hurt sales of winter goods and apparel.

U.S. Economy Likely to Look Better Than the Sloppy Results in 4Q

Hurricane Sandy, machinations in the U.S. auto production schedules, gyrating soybean sales, and odd weather patterns served to scramble and depress a lot of economic data, especially in the fourth quarter of 2012. GDP growth is likely to drop from very close to 3% in the third quarter to a measly 1%-2% in the fourth. The true strength of the U.S. is probably an average of these two extremes, or about 2%.

With some favorable weather trends and a successful resolution of the fiscal cliff, the first quarter of 2013 could look better than 4Q. Don't be fooled by economists who have pulled out their favorite tool, a ruler, to conclude that if we grew 3% in 3Q and 1% in 4Q, the next number in the series will reflect the same 2% decline in growth rates that we saw between 3Q and 4Q, producing a 1% decline in GDP for the first quarter.

More Quarter-End Outlook Articles

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.