Funds That (Still) Buy Like Buffett, 2012

Funds with similar stock holdings to Warren Buffett have great long-term records.

Funds with similar stock holdings to Warren Buffett have great long-term records.

The upcoming Berkshire Hathaway (BRK.B) shareholder meeting in Omaha, Neb., means that Warren Buffett will be in the spotlight again. Buffett's health is bound to be a major topic of concern and conversation, after he revealed on April 17 that he has stage-1 prostate cancer. Although the cancer was caught early and isn't considered life-threatening, the news still highlights the fact that Buffett is 82 years old and won't be around forever. This health scare is bound to increase speculation about succession planning, a hot topic for Berkshire watchers in recent years.

Buffett did address the succession issue in this year's Berkshire shareholder letter, which you can read here. He wrote that his successor as CEO has been selected and approved by the board, though, as expected, he did not reveal the person's name. Buffett also discussed the recent hiring of Todd Combs and Ted Wechsler to run portions of Berkshire's investment portfolio. Presumably, Combs and Wechsler will eventually succeed Buffett in running the entire portfolio, which is a big deal because Buffett remains one of the most widely respected investors in the world. Anything he has to say about investing or the markets gets a lot of attention, and his investment moves are watched closely.

Berkshire's annual report lists the top stocks in Buffett's investment portfolio, and this year's report shows that his top 10 stock holdings as of Dec. 31, 2011, weren't much different from a year ago. The top holding is still Coca-Cola (KO), where Buffett is the largest shareholder, though the second-largest holding is newcomer IBM (IBM), which Buffett just purchased in March 2011. These are followed by longtime Buffett favorites Wells Fargo (WFC), American Express (AXP), Procter & Gamble (PG), and Kraft (KFT). Last year's sole newcomer, Munich Re (MUV2), remained in Buffett's top 10 this year, followed by Wal-Mart (WMT), Conoco-Phillips (COP), and U.S. Bancorp (USB).

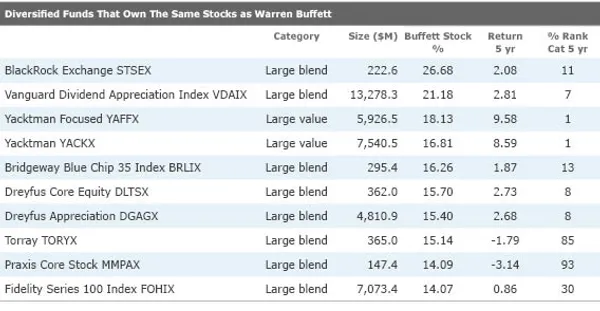

Plenty of mutual fund managers are Buffett fans who emulate his investment approach in one way or another. Following the release of the past two Berkshire Hathaway annual reports, we looked at the funds with the highest percentage of their portfolios in Berkshire's top 10 stock holdings at the end of 2009 and 2010. In honor of this weekend's shareholder meeting, we revisited the question and calculated what funds have the biggest weightings in Berkshire's latest top 10 holdings, as listed above. We left out sector funds such as Vanguard Consumer Staples Index (VCSAX) and Fidelity Select Consumer Staples (FDFAX), both of which would otherwise be in the top 10, as well as funds with less than $100 million in assets and those with less than a five-year track record. With those constraints, the following table shows the 10 funds with the most Buffett-like taste in stocks, including each fund's five-year return and percentile rank in its category as of April 30, 2012.

- source: Morningstar Analysts

This list is dominated by three management teams, who manage a total of five of the 10 funds. Not surprisingly, these managers all follow Buffett in liking big, profitable companies with strong competitive advantages, but they differ in other ways.

First, there's Donald Yacktman and his son Stephen Yacktman, who manage Yacktman Focused (YAFFX) and Yacktman (YACKX). They follow a Buffettesque strategy that focuses on profitable companies, usually with little debt, that are trading at substantial discounts to their estimates of the companies' intrinsic values. These funds have sometimes had significant weightings in small- and mid-cap stocks, but they're currently dominated by mega-cap blue chips of the type Buffett holds, and each of the funds has five stocks from Buffett's top 10 (Procter & Gamble, Coca-Cola, ConocoPhillips, US Bancorp, and Wal-Mart) among its top 22 holdings. Both funds have been outstanding long-term performers, and Donald Yacktman was a finalist for the Morningstar Domestic-Stock Fund Manager of the Decade in 2010.

Dreyfus Core Equity and Dreyfus Appreciation (DGAGX) are both managed by a six-person team led by Fayez Sarofim and his son Christopher. Their strategy is similar to the Yacktmans' in that it focuses on high-quality blue chips, though here there's somewhat less emphasis on valuation, which is why these funds land in the large-blend category rather than large-value. Also, the Yacktmans sometimes put up to one third of the portfolio into cash if they can't find enough bargains, similar to Buffett, whereas the Fayez Sarofim team stays fully invested. Both of the Dreyfus funds hold Coca-Cola, IBM, Procter & Gamble, ConocoPhillips, Wal-Mart, and Kraft from among Buffett's top 10, along with such similar blue-chip stocks as ExxonMobil (XOM) and Philip Morris International (PM). They've been strong performers over time but have tended to trail their peers in aggressive bull markets like 2009.

Finally, there's Praxis Core Stock , managed by Chris Davis and Ken Feinberg. Davis and Feinberg are well-known fans of Warren Buffett, and under their management Clipper (CFIMX) (which made this list last year) has often been one of the biggest holders of Berkshire Hathaway stock. Praxis Core Stock is less concentrated than Clipper, but it does hold a more modest position in Berkshire Hathaway. It also has Wells Fargo and American Express among its top five holdings, as does Davis Financial (RPFGX), a fund managed by Feinberg that would rank third on this list but is excluded because it's a sector fund. Both of these funds got hit hard in 2007 and 2008 by some ill-timed bets on financial stocks, but these managers have shown themselves to be savvy stock-pickers over the long term. Davis Financial has earned a Morningstar Analyst Rating of Gold, as have Clipper and its less-concentrated counterparts, Davis NY Venture (NYVTX) and Selected American Shares (SLASX).

The funds on this list have mostly been strong long-term performers, with all but Torray (TORYX) and Praxis Core Stock trouncing their categories over the past five years. Six of them have also outperformed Berkshire Hathaway stock over that time, a period that includes two years (2009 and 2011) when Berkshire badly trailed the S&P 500 Index. Still, of the 10 funds on this list, only the two Yacktman funds have beaten Berkshire over the past 10 years, illustrating how tough it is to beat Buffett over the long term. That long-term strength illustrates why so many people pay attention to Buffett's portfolio, and why emulating his general approach has been a winner over time.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

We’d like to share more about how we work and what drives our day-to-day business.

We sell different types of products and services to both investment professionals

and individual investors. These products and services are usually sold through

license agreements or subscriptions. Our investment management business generates

asset-based fees, which are calculated as a percentage of assets under management.

We also sell both admissions and sponsorship packages for our investment conferences

and advertising on our websites and newsletters.

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

To learn more about how we handle and protect your data, visit our privacy center.

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.