So Far, So Good for Q2 Bank Earnings

Banks face headwinds in deposit pricing and fees, but profitability and deposits are holding up well.

As the big banks have ushered in the second-quarter earnings season, the early news has been good for investors and the economy, all things considered.

Banks are facing headwinds from having to pay out higher interest on savings deposits, as well as a poor fee environment for other businesses against the backdrop of a potential recession.

But Morningstar equities strategist Eric Compton says the early bank results still look decent, with profitability holding well. Higher interest rates are bolstering net interest income, or NII, even with banks having to pay out more for deposits. And while customers have continued to shift their money from bank-run low-yield savings accounts into money market mutual funds, he says the pace of that exodus is manageable.

Compton believes the early read on second-quarter results is shoring up confidence around the profit outlook for the biggest banks: “I think it can be easy to get caught up in some of the negativity around some of the headlines around banks, but they’re actually not doing too bad.”

There are some positive implications for the economy in the news from the banks. For example, individuals still have cash balances in their accounts that are just as good as (or even better than) they were before the COVID-19 pandemic, which suggests that despite higher rates, consumers aren’t yet under much financial strain and continue to spend.

In addition, Compton says that if credit quality among borrowers isn’t worsening more than expected, “that increases the odds that we can get through this without either a severe recession or maybe without any recession at all. It’s still very much a debate everyone’s paying attention to.”

The next big catalyst for the banking sector will be the updated regulatory requirements that are coming in response to the regional bank crisis that occurred in March of this year. Those proposals will likely be released in the coming weeks or months.

Bank Stock Performance

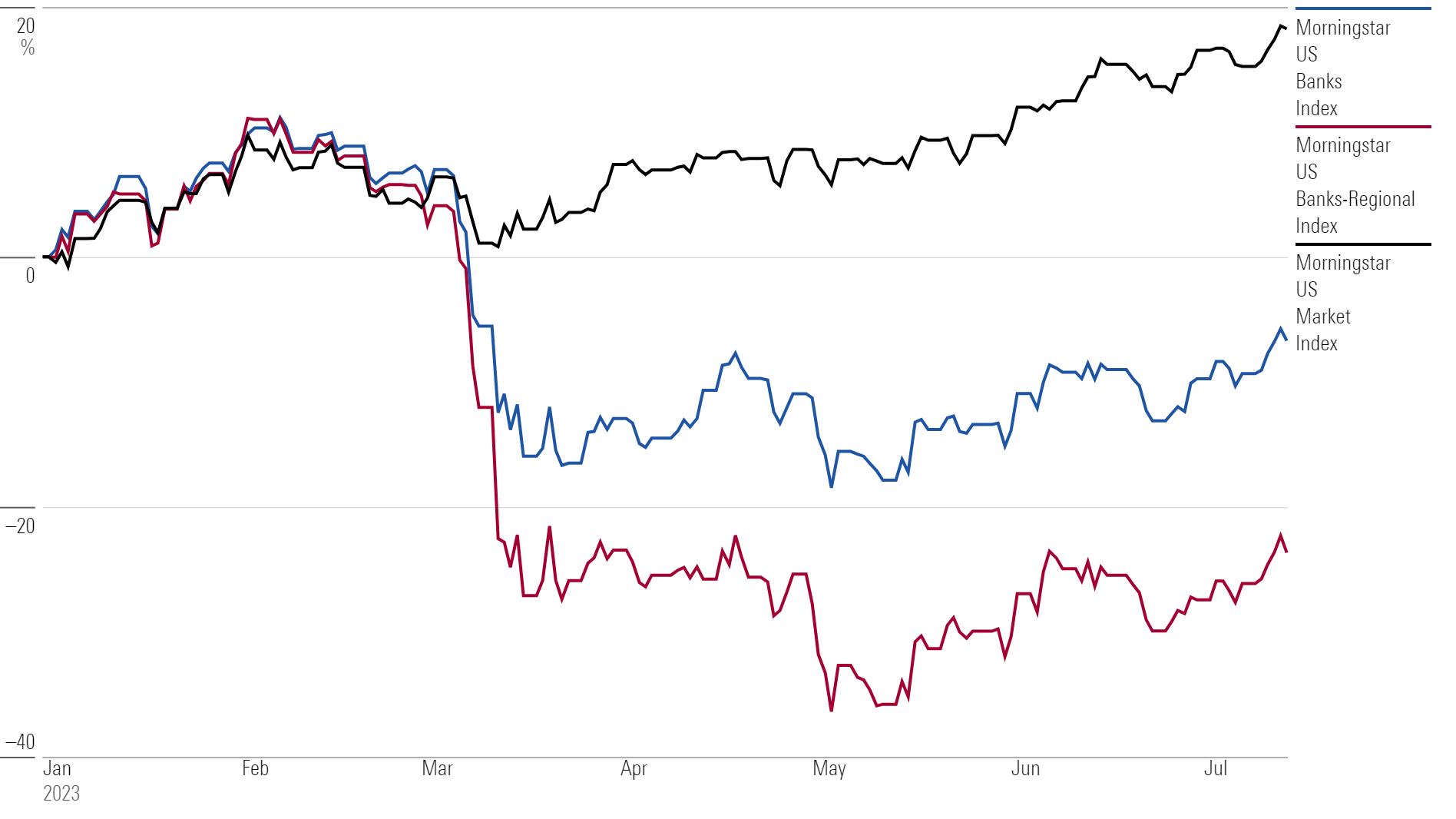

The Morningstar US Banks Index, which tracks the performance of stocks in the diversified bank, regional bank, and mortgage finance industries, fell 3.7% in the second quarter. That’s better than its 13% loss during the first quarter. Meanwhile, the broader equity market gained 8.5% during the quarter.

While most regional banks have yet to post their quarterly results, their shares have so far similarly done better than their 23.5% plunge during the first quarter. The Morningstar US Banks-Regional Index lost 5.2%.

US Bank Indexes vs. US Market Index in 2023

What to Watch in Q2 Bank Stock Earnings

Large commercial banks kicked off earnings season on July 14, with JPMorgan Chase JPM, Wells Fargo WFC, and Citigroup C releasing their second-quarter results. Bank of America BAC and PNC Financial Services Group PNC posted their results on July 18. Smaller regional banks—which include M&T Bank MTB, U.S. Bancorp USB, Zions Bancorp ZION, Truist Financial TFC, Fifth Third Bancorp FITB, KeyCorp KEY, Comerica CMA, Huntington Bancshares HBAN, and Regions Financial RF—will follow over the rest of the week. Cullen/Frost Bankers CFR will share its results on July 27.

“The big caveat is that for the regional banks, there could be some slightly different trends,” Compton says. These trends include deposit levels and rates, NII performance, credit changes, provisioning increases, and fee environments.

In the wake of the March crisis, there has been a focus on profitability and the weakness in deposit bases, since banks face having to save higher interest rates on those deposits. When Silicon Valley Bank collapsed, threatening savers with the loss of their deposits, clients rushed to exit in favor of money market funds, which also offer relatively higher yields. However, as large banks have reported decent second-quarter results, Compton says it appears that balances aren’t declining significantly from the first quarter.

Another area of concern has been problem loans, especially in commercial real estate. However, increases in provisions for bad commercial real estate loans are coming in as expected, according to Compton.

The fee environment at the big banks has been subpar, with investment banking fees still low and wealth-related fees still recovering from the first quarter. “The fee environment could be a little weaker, but net interest income and deposits are holding up pretty well,” Compton says.

Mixed Impact of Higher Interest Rates

Higher interest rates have helped banks on the asset side, with business owners and individuals paying more on their debts. For mortgage rates, for example, Compton says that banks on average are charging over 6%, up from a typical rate of 3.5% between 2019 and 2021.

But banks are also feeling pain on the funding side from deposit outflows, thanks to the increased competition higher rates have brought. To retain money, banks must pay more on deposits, but that money ends up going back to clients, Compton says. For consumers, he adds that the tradeoff is that they can put their money in a savings account and earn about 4% before earning zero.

He highlights how banks are still better positioned where they were in 2022, which was a lower-rate environment. “Compared to last year, the positives at least are still better, even though the negatives are accelerating,” he says.

Uneven Bond Portfolio Loss Reports

Another significant issue for banks has been unrealized losses on their bond portfolios following the big jump in interest rates in 2022. As of the end of the second quarter, the yield on the U.S. Treasury 10-year note was higher than it was at the end of the first quarter but still below where it was at year-end 2022. This is “going to put incremental pressures on some of those unrealized losses,” he says.

But Compton hasn’t yet seen a clear trend among the banks that have reported losses on their bond portfolios. Large unrealized losses on bond investments were a key factor in the collapse of Silicon Valley Bank, and they loom large in worries about other regions. Among the largest banks, JPMorgan reported a lower level of unrealized losses, Citi recorded an increase, and Wells Fargo was mostly flat.

“I would expect maybe some slight increases in unrealized losses because of the rising yields, but it’s not a big deal,” Compton says. “It’s not going to be a huge movement, so I don’t think we’re going to see any major surprises on that front.”

Clients Favor Higher-Yielding Money Market Funds

While Wells Fargo reported a slowdown of movement cash deposits out in its wealth unit, the banking industry continues to see clients moving assets out of savings accounts in favor of higher-yielding money market funds.

However, Compton believes the trend will slow as the Federal Reserve winds down its interest rate hikes. “We probably aren’t quite at the equilibrium just yet, but I think we’re closer,” he says.

Q2 2023 Results for Individual Banks

JPMorgan enters the second half of the year in a strong position, achieving peak NII, according to Compton. In the second quarter, the bank reported earnings per share of $4.75, beating Compton’s estimate of $3.95. He attributed this to the bank’s stronger NII, improved trading results, and lower-than-expected expenses from its acquisition of First Republic Bank.

Also exceeding Compton’s expectations, Wells Fargo’s decent results led the bank to raise its NII outlook from a growth of 10% to 14%. Compton says the results are in line with the forecasts for the bank’s deposit balance and pricing, with “much of the outperformance being driven by better repricing on the asset side.”

Citi’s second-quarter earnings per share of $1.33 was just a penny shy of Compton’s estimate. NII outperformed, leading the bank to raise its outlook by $1 billion, but markets, investment banking, and wealth remain under pressure, he says.

The first regional bank to report its results, PNC, lowered its full-year NII outlook, but Compton says it did not deteriorate as much as feared, and that he expects continued growth. He adds that the deposit cost increases came in better than expected.

Bank of America’s earnings came in stronger than expected, primarily due to higher NII and trading results. The bank gave its first full-year guidance for NII of a little above $57 billion, which is a bit better than Compton’s forecast. He notes that while the NII story was positive, the bank’s expenses are creeping higher.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KIQMCCUZ2RGWZKSCKM2Z4ZULFU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MGEDEFIRZJFHTAFNLDHG46SDXI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6HLXVGQ6DFCQDC3WHBZC6TLS2U.png)