Markets Brief: A Consumer Spending Slowdown May Be Coming—Here’s What That Means for Stocks

A resilient consumer has been an important tailwind for the stock market.

Check out our weekly markets recap at the bottom of this article, with a look at stocks making some of the past week’s biggest moves—including Arm Holdings and J.M. Smucker.

One of the forces driving the stock market’s rebound this year has been the unexpected resilience in the American consumer, even amid rising interest rates, stubborn inflation, and recently, rising gas prices.

That strength “has kept the U.S. economy out of a recession,” says Bill Adams, chief economist for Comerica Bank. But analysts say consumers may not be able to keep spending the way they’ve been for much longer—and that could be a problem for the economy and, therefore, stocks.

The big concerns: The lagged effect of high interest rates, dwindling pandemic savings, and a slowing labor market could put a dent in consumer spending. In addition, some consumers may feel the bite of a resumption in student loan payments.

Why Is Consumer Spending So Important?

Forget about imports, international trade agreements, and artificial intelligence. The real power behind the U.S. economy is much closer to home. It’s the consumer: the person buying groceries at Kroger, potting soil at Home Depot, and school supplies at Walmart.

José Torres, senior economist at Interactive Brokers, points out that consumer spending accounts for roughly 70% of economic activity in the United States. A strong consumer is good for businesses, and that’s good for stock prices and financial markets more broadly. Companies that are confident that they’ll make sales aren’t likely to lay off employees, either.

“As long as consumer spending keeps growing, it would be very difficult for the U.S. economy to slip into a recession,” says Comerica’s Adams. “That’s the reason why the consumer is so vital.”

But the phenomenon goes both ways. A slower consumer means slower revenue growth for companies, says Interactive Brokers’ Torres. Companies then cut back on expenses to preserve their bottom lines, and that can weigh on stock prices.

Consumers Have Been Spending Despite Economic Headwinds

Despite the threat of a recession, rapid interest-rate hikes from the central bank, sky-high housing prices, and stubborn inflation, consumer spending has remained robust—at least so far.

Month-to-Month Change in U.S. Retail Sales

Retail sales rose 0.6% on a monthly basis in August, according to data released Thursday by the Census Bureau. That’s significantly more than the 0.1% that economists were expecting (though a large portion of that increase is attributable to rising gasoline prices). A report released this week by Bank of America showed that total credit card spending rose 0.4% on an annual basis in August and that credit card utilization rates remain below prepandemic levels.

Consumer strength has persisted even as disruptions caused by the pandemic begin to fade and buyers have turned back to services from the goods (like furniture and electronics) they favored during lockdowns.

“While that shift is happening, the overall economy and the consumer, in particular, have remained incredibly resilient,” Home Depot’s chief executive officer told investors on an earnings call in August.

Jaime Katz, a senior analyst at Morningstar who follows retail stocks, says third-quarter earnings “seem to show that consumers continued to prefer services over goods, such as travel, which has held up well. But in the most recent data, both services and goods spend are growing around a 3% rate, which might indicate an equilibrium for spending growth across the choices.”

“Consumers still have ‘dry powder’ to support their spending,” Bank of America’s analysts wrote.

Is the Consumer in Trouble?

But there’s no guarantee that will continue.

Michael Field, Morningstar’s European equity strategist, argues that “the last six to nine months suggest that the climate may be shifting.” He points to slowing spending on travel bookings in both the United States and United Kingdom as evidence that consumers are cutting back on discretionary spending as they deplete their pandemic savings.

Others are also pessimistic. More than half of respondents in Bloomberg’s most recent Markets Live Pulse survey expect personal consumption to shrink at the beginning of next year—that would be the first time consumer spending has trended down since the early days of the pandemic. Roughly one in five respondents said they anticipate the slowdown will happen even sooner, in the fourth quarter of this year.

Household Income Growth Expectations

The Federal Reserve Bank of New York’s August survey of consumer expectations showed that many Americans are expecting their income to grow more slowly next year and credit to be more difficult to come by. At the same time, measures of consumer sentiment from the University of Michigan and consumer confidence from the Conference Board both edged lower in August. Pessimism like that doesn’t bode well for spending.

Adams points to a declining personal savings rate as another worrying sign of consumer weakness, especially given that income growth has slowed. That suggests “that consumer spending growth is going to have to slow,” too, he says.

U.S. Personal Savings Rate

Some retailers are taking notice as well. In an August earnings call, Macy’s CFO, Adrian Mitchell, warned of “new pressures on the consumer” stemming from higher interest rates, the expiration of the federal student loan payment moratorium, and the slowdown in new job growth.

It won’t take long for those pressures to show up in the data.

When consumer spending turns south, Torres says, “it turns south really quickly and sharply.” No wonder investors are paying such close attention.

For the Trading Week Ended Sept. 15

- The Morningstar US Market Index fell 0.22%.

- The best-performing sectors were utilities, up 2.6%, and financial services, up 1.5%.

- The worst-performing sectors were technology, down 2.2%, and industrials, down 0.6%.

- Yields on 10-year U.S. Treasuries increased to 4.33% from 4.26%.

- West Texas Intermediate crude prices rose to $90.77 per barrel from $87.51 per barrel.

- Of the 857 U.S.-listed companies covered by Morningstar, 451, or 53%, were up, and 406, or 47%, were down.

What Stocks Are Up?

Arm Holdings ARM entered the U.S. public market on Sept. 14 with an initial public offering of 95,500,000 shares, each priced at $51. With a valuation of over $54 billion, the U.K.-based semiconductor chip designer became the largest IPO since auto manufacturer Rivian RIVN in December 2021. By the end of its first day of trading, the stock rose close to 25%.

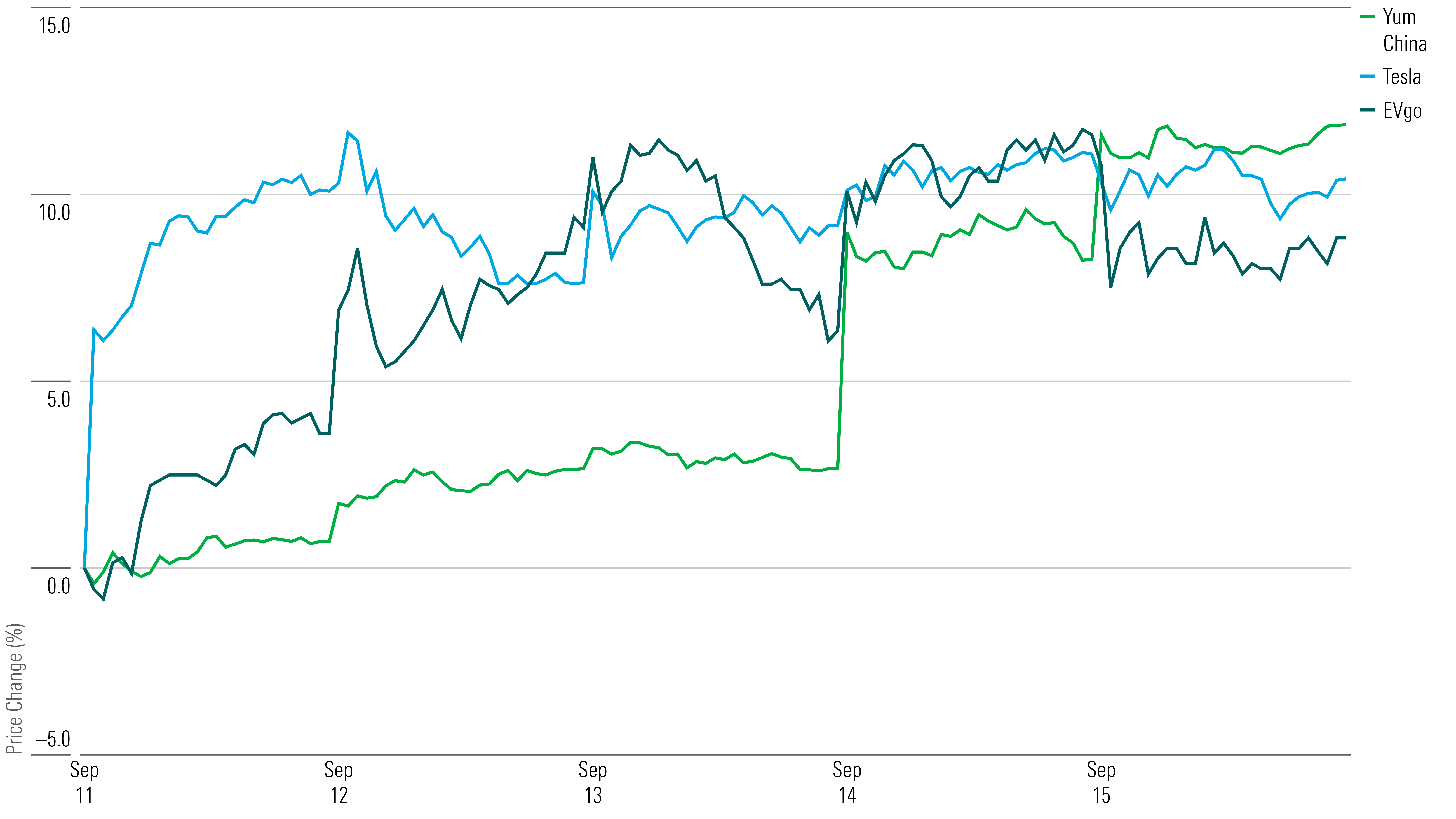

Yum China Holdings YUMC stock jumped after announcing new strategic initiatives to expand its network of locations, produce more sales, and boost revenue. The restaurant company raised its store-openings target for the year to a range of 1,400 to 1,600 from 1,100 to 1,300. Yum China also plans to broaden its use of artificial technology to improve services and management.

EVgo EVGO stock climbed after the company received its first shipment of chargers that comply with Build America, Buy America Act standards. The firm, which operates charging networks for electric vehicles, says it received 10 350kW fast chargers months earlier than expected from Delta Electronics’ factory in Plano, Texas.

The equipment purchased is required for all charging stations that receive federal funding from the Bipartisan Infrastructure Law, which set aside $7.5 billion to fund EV charging stations. The company says that the arrival of the chargers “marks a milestone in developing the robust domestic supply chain needed to support the rapid growth of EV adoption” across the United States.

Tesla TSLA stock rose after European Commission president Ursula von der Leyen announced an investigation into EV coming from China and being sold at artificially low prices. The president says that the EV market has been “flooded with cheaper Chinese electric cars,” putting European automakers at a disadvantage. Tesla, which made price cuts earlier this year, may stand to benefit as it accounts for close to a fifth of the EV market in the European Union.

With shares for these EV-related companies up, Morningstar equity analyst Seth Goldstein sees “strong opportunities for investors” in EVs, forecasting that they will account for 40% of car sales by 2030.

Highlighted Advancers

What Stocks Are Down?

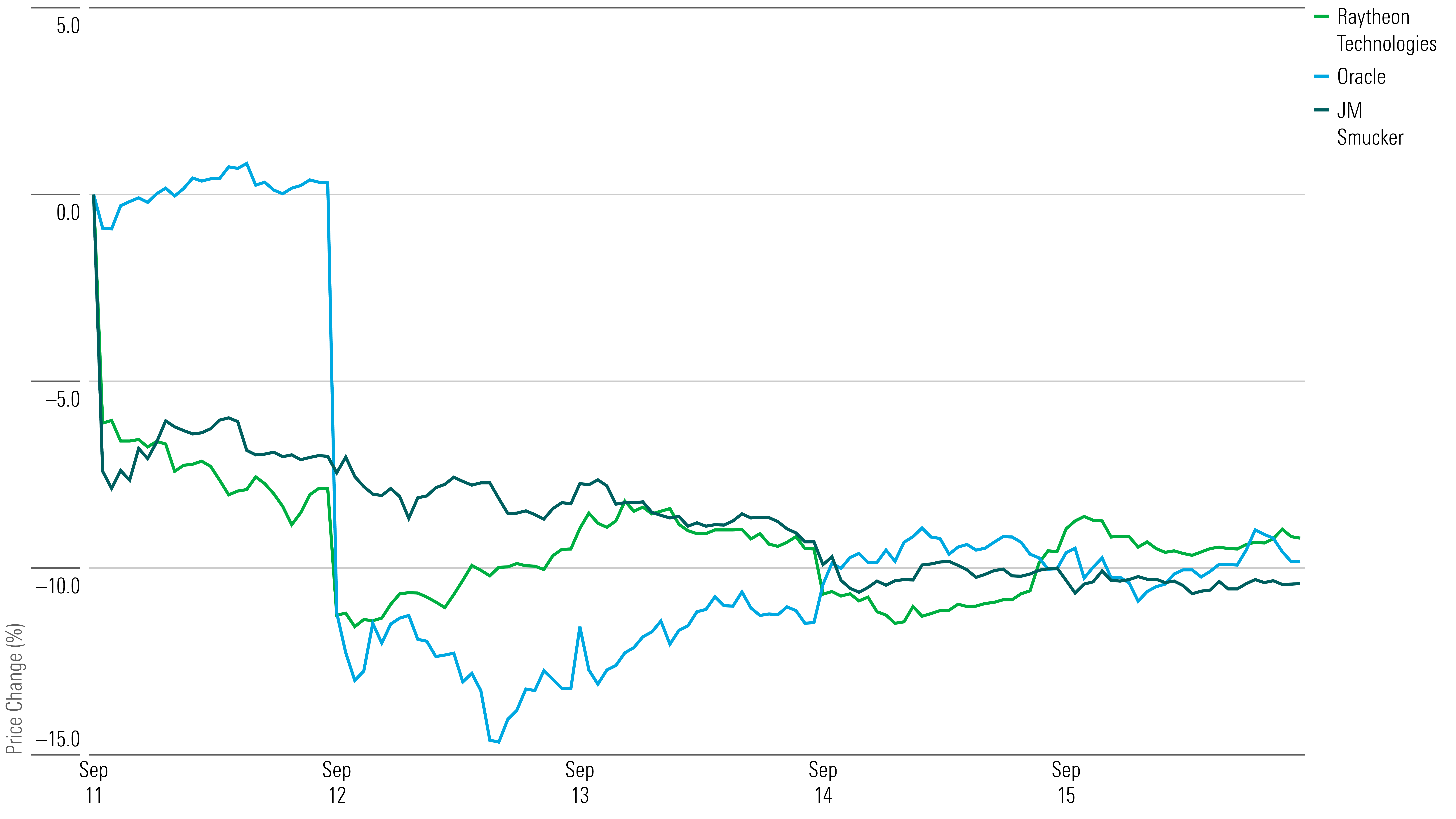

Shares for J.M. Smucker SJM fell after the packaged food company acquired Hostess Brands TWNK for an approximate value of $5.6 billion, which includes about $900 million in debt. “Paying 45% above the unaffected share price, we think Smucker will struggle to create value, having given most of it to Hostess shareholders,” Morningstar equity strategist Kristoffer Inton says. He adds that Smucker’s brands—including Folgers, Uncrustables, and Meow Mix—are squished in an “ultracompetitive space,” and he expects growth to fall short of the company’s expectations.

RTX RTX stock declined after the aerospace and defense conglomerate updated its guidance regarding costs from inspecting and replacing core parts of its Pratt & Whitney engines. Because of a metallurgical flaw in the engines, the firm will take on eventual costs of over $3 billion in cash flow over the next couple of years.

“RTX estimates that over the coming months, several hundred affected aircraft will be out of service at a time,” Morningstar equity analyst Nicolas Owens says. “80% of the cost to RTX will come from payments it will make to airlines to compensate for lost flight time.”

Oracle ORCL stock dropped after the software company’s fiscal first-quarter revenue fell short of expectations and light top-line guidance spooked investors. The firm reported a 10% decline in revenue for cloud and on-premises licenses. Morningstar equity analyst Julie Bhusal Sharma thinks that “the market is overly optimistic about the level of cloud network share Oracle can get to in the long term” but still sees potential for near-term growth with the company’s data centers rollout.

Highlighted Decliners

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A7YHHS6HQJB7RJU76FB5C2TXV4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)