9 Undervalued Software Stocks

Notable names including Uber, DocuSign are trading at discounts.

Software application stocks have rebounded in 2023 after suffering double-digit losses in 2022. Despite rising returns, there are still quality stocks such as ride-share platform Lyft LYFT and video communications technology company Zoom Video Communications ZM trading at appealing discounts for long-term investors.

“The software industry has been undergoing some meaningful secular changes in recent years, as a transformational wave of modernization occurred within the enterprise,” writes senior equity analyst Dan Romanoff. “All these trends bode well for long-term software growth.”

The Morningstar US Software Application Index—which measures the stock performance of companies that operate in the software application industry in the United States—rose 35.6% in 2023 through Aug. 29, while the Morningstar US Market Index rose just 16.3%.

Morningstar US Software Application Index

What Are Software Application Stocks?

This index measures the performance of companies that operate in the software application industry of the technology sector in the U.S. Notable firms within this index include Salesforce CRM and Workday WDAY.

High-Quality Undervalued Software Application Stocks

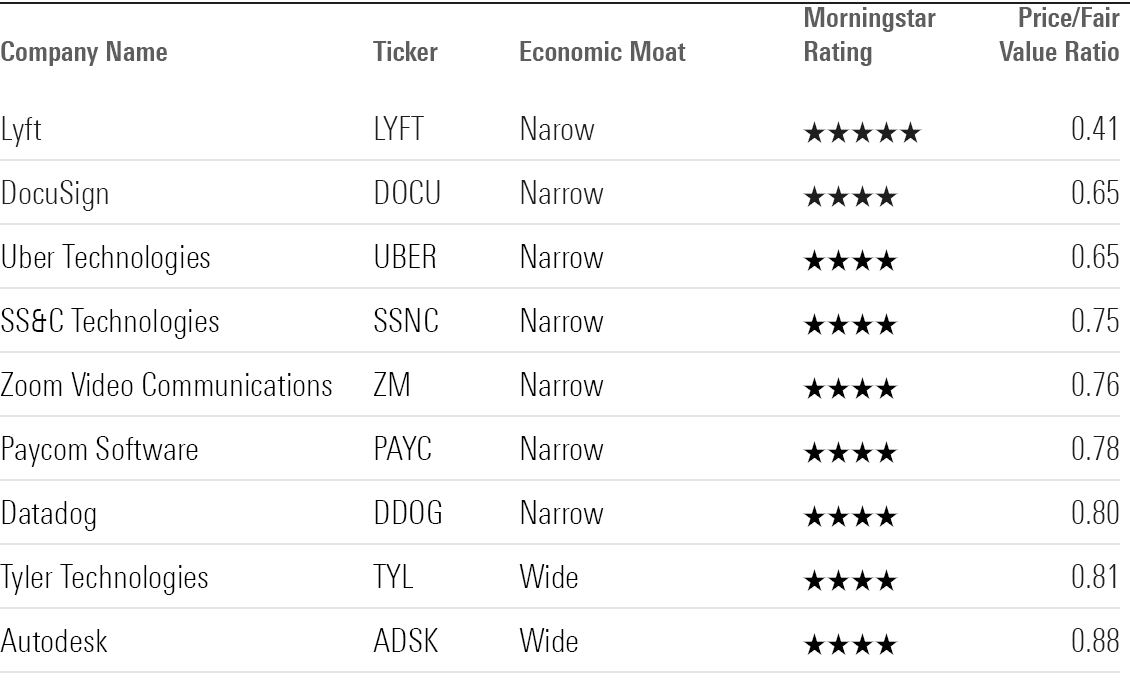

For this screen, we looked for the most undervalued stocks in the Software Application Index with a Morningstar Rating of 4 or 5 stars. As of Aug. 29, 11 stocks met this criteria. Next, we filtered that list for stocks that have also earned a Morningstar Economic Moat Rating of wide or narrow, meaning they have durable competitive advantages that are expected to last at least 10-20 years. Stocks with moats and low valuations historically tend to outperform over the long term.

Here are the nine undervalued software application stocks that made our list:

- Lyft

- DocuSign DOCU

- Uber Technologies UBER

- SS&C Technologies SSNC

- Zoom

- Paycom Software PAYC

- Datadog DDOG

- Tyler Technologies TYL

- Autodesk ADSK

The most undervalued stock is Lyft, trading at a 59% discount to its analyst-assessed fair value estimate. The least undervalued is Autodesk, trading at a 12% discount.

Undervalued Software Application Stocks

Lyft LYFT

- Fair Value Estimate: $25.00

“Lyft is the second-largest ride-sharing service provider in the U.S. and Canada, connecting riders and drivers over the Lyft app. Incorporated in 2013, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft also has entered the bike- and scooter-share market to bring multimodal transportation options to users.

“In the U.S. market, Lyft has quickly emerged as the number-two ride-sharing player, a position we think the firm will keep for years to come. It has successfully gained share going head-to-head against the market leader, Uber, in pursuing riders in an addressable market (including taxis, ride-sharing, bikes, and scooters).

“In our view, Lyft warrants a narrow economic moat and a stable moat trend rating, thanks to the network effect around its ride-sharing platform and intangible assets associated with riders, rides, and mapping data, which we think can drive Lyft to profitability and excess returns on invested capital.”

—Ali Mogharabi, senior equity analyst

DocuSign DOCU

- Fair Value Estimate: $74.00

“DocuSign’s vision is to modernize the contracting process by taking it from a disjointed and paper-based manual sequence of steps to an automated digital and collaborative system. We think the company has mastered the ‘sign’ step of the process and has used it to build the Agreement Cloud around, but there’s more to DocuSign than just e-signatures. The Agreement Cloud is a platform that includes tools to help users prepare contracts using intuitive drag and drop forms, negotiate, e-sign using a variety of enhanced security and identification means, automate agreement workflows for satisfying contract elements post-execution, allow for payment collections, and centralize account management.

“As use cases expand, we still expect the current primary driver of growth, the e-signature solution, to continue to grow rapidly thanks to the company’s entrenched leadership position and the more unpenetrated market.

“We assign a narrow moat rating to DocuSign as a result of high customer switching costs, which we believe have enabled the firm to generate returns on invested capital in excess of its cost of capital. We believe such excess returns are more likely than not to continue for the next 10 years.”

—Dan Romanoff, senior equity analyst

Uber Technologies UBER

- Fair Value Estimate: $68.00

“Uber is a technology provider that matches riders with drivers, hungry people with restaurants and food delivery service providers, and shippers with carriers. The firm’s on-demand technology platform could eventually be used for additional products and services, such as autonomous vehicles, delivery via drones, and Uber Elevate, which, as the firm refers to it, provides ‘aerial ride-sharing.’

“Uber has become the largest on-demand ride-sharing provider in the world (outside of China). It has matched riders with drivers completing trips over billions of miles and, at the end of 2022, had 131 million customers using its ride-sharing or food delivery services at least once a month. In light of Uber’s network effect between riders and drivers, as well as its accumulation of valuable user data, we believe the firm warrants a narrow moat rating.

“In our view, Uber Technologies’ core business, the ride-sharing platform, benefits from network effects and valuable intangible assets in the form of user data. We think these maintainable competitive advantages will help Uber to become profitable and generate excess returns on invested capital. For this reason, we assign Uber a narrow moat rating.”

—Ali Mogharabi, senior equity analyst

SS&C Technologies SSNC

- Fair Value Estimate: $75.00

“SS&C Technologies provides software products and software-enabled services to a variety of customers primarily in financial services but also healthcare firms … Overall, we believe SS&C has a narrow Morningstar Economic Moat Rating built on switching costs.

“SS&C GlobeOp provides fund administration services to alternative and traditional asset managers. In addition, SS&C provides portfolio accounting, portfolio management, trading, banking/lending, and other software to asset managers, banks, and financial advisors. SS&C’s purchase of Intralinks makes it a leading player in Virtual Data Room solutions. With its purchase of DST Systems, SS&C gained a foothold in the healthcare industry with pharmacy health management solutions and medical claim administration services.

“S&C, which stands for Securities Software and Consultants, introduced CAMRA, or complete asset management, reporting, and accounting, in 1989. Since inception, SS&C has acquired more than 50 companies, and acquisitions have been a big part of the firm’s growth strategy.”

—Rajiv Bhatia, equity analyst

Zoom ZM

- Fair Value Estimate: $89.00

“Zoom Video Communications provides a communications platform that connects people through video, voice, chat, and content sharing. The company’s cloud-native platform enables face-to-face video and connects users across various devices and locations in a single meeting.

“The company offers a differentiated peer-to-peer technology, complete with proprietary routing technology. Zoom is a recognized market leader in meeting software and is disrupting and expanding the $100 billion market for collaboration software with its ease of use and superior user experience. We think the pandemic lockdowns demonstrated the strength of the solutions, which combined with an expanding portfolio helps establish a narrow moat.

—Dan Romanoff, senior equity analyst

Paycom Software PAYC

- Fair Value Estimate: $370.00

“Paycom’s unified platform appeals to midsize and enterprise clients that prefer an all-in-one payroll and human capital management, or HCM, solution. The company’s platform is supported by a single database, which provides a single source of truth and allows efficient software development and maintenance.

“Paycom has garnered a narrow economic moat underpinned by high customer switching costs. Paycom also benefits from intangible brand assets, in our view, based on a growing track record of performance.

“To remain competitive and capture further share, we expect Paycom will need to continue to invest in internal software development to expand its portfolio of modules to meet changing client needs, as well as a maintained investment in marketing. In addition, we expect the company will face pricing pressure from an increasingly competitive operating environment. Despite this, we are comfortable that Paycom will be able to earn maintainable economic profits for at least the next 10 years.”

—Emma Williams, equity analyst

Datadog DDOG

- Fair Value Estimate: $115.00

“Datadog is a cloud-native company that focuses on analyzing machine data. The firm’s product portfolio, delivered as software-as-a-service, allows a client to monitor and analyze its entire IT infrastructure. Datadog’s platform can ingest and analyze large amounts of machine-generated data in real time, allowing clients to utilize it for a variety of different applications throughout their businesses.

“We believe Datadog merits a narrow moat rating owing to strong customer switching costs associated with its product portfolio. In brief terms, Datadog offers its customers a platform that can ingest, index, and analyze copious amounts of data while providing real-time monitoring and analysis capabilities. From a customer’s perspective, using Datadog to monitor its entire IT stack allows it to create better business outcomes due to greater IT- and operations-related efficiencies.

“With impressive upselling and retention metrics, a suite of inherently sticky product offerings, and a long runway for growth, we believe Datadog is more than likely to generate excess returns over the next 10 years and, therefore, merits an economic moat.”

—Malik Ahmed Khan, analyst

Tyler Technologies TYL

- Fair Value Estimate: $475.00

“We view Tyler Technologies as the clear leader in a slow-moving and underserved niche market of government operational software. We believe there is a decadelong runway for normalized top-line growth near 10% at Tyler, especially as demand for SaaS accelerates and the need to modernize local governments’ legacy enterprise resource planning systems intensifies.

“We assign a wide moat rating to Tyler Technologies, driven by higher customer switching costs and, to a lesser extent, intangible assets. Our position is that switching costs for software are driven by several factors. The most obvious of these is the direct time and expense of implementing a new software package while maintaining the existing platform.

“As it relates to intangible assets, we posit that Tyler benefits from building up a portfolio of software that would be difficult for a startup, or even an established software vendor without government expertise, to replicate. Further, we think Tyler has established a strong reputation for an underserved vertical market, with local governments being inherently different from enterprise buyers.”

—Dan Romanoff, senior equity analyst

Autodesk ADSK

- Fair Value Estimate: $247.00

“Autodesk is an application software company that serves industries in architecture, engineering, and construction; product design and manufacturing; and media and entertainment. Autodesk software enables design, modeling, and rendering needs of these industries. The company has over 4 million paid subscribers across 180 countries.

“Autodesk is considered the global industry standard computer-aided design software. Millions of industry professionals rely on Autodesk software to design and model buildings, manufactured products, animated films, and video games.

“We think Autodesk will remain the industry standard, as its switching costs and network effect continue to reinforce one another and Autodesk stays at the forefront of industry trends. Autodesk now has over 95% of revenue recurring, after a gradual transition from licenses the past eight years. We think the change enables Autodesk to extract greater revenue per user as it upsells its loyal and increasingly maturing base.”

—Julie Bhusal Sharma, equity analyst

3 Dividend Stocks for September 2023

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)