3 High-Quality Undervalued Basic Materials Stocks

Notable names are trading at discounted prices.

Basic materials stocks started the year off in a rally. While the pace of their gains has started to slow, Morningstar analysts see a few high-quality opportunities with room to run. That includes the stocks of moaty companies like Corteva, which develops seed and crop chemical products, and Ecolab, which produces cleaning and sanitation products for hospitality, healthcare, and industrial organizations.

The Morningstar US Basic Materials Index rose 8.3% in 2023 through Sept. 14, while the Morningstar US Market Index rose 18.3%. Over the past 12 months, basic materials stocks are up 14.7% while the broader market gained 15.2%.

Morningstar US Basic Materials Index

What Are Basic Materials Stocks?

The basic materials sector includes companies that manufacture chemicals, building materials, and paper products, as well as companies engaged in commodities exploration and processing. Notable basic materials firms include Sherwin-Williams SHW, Dow DOW, and Linde LIN.

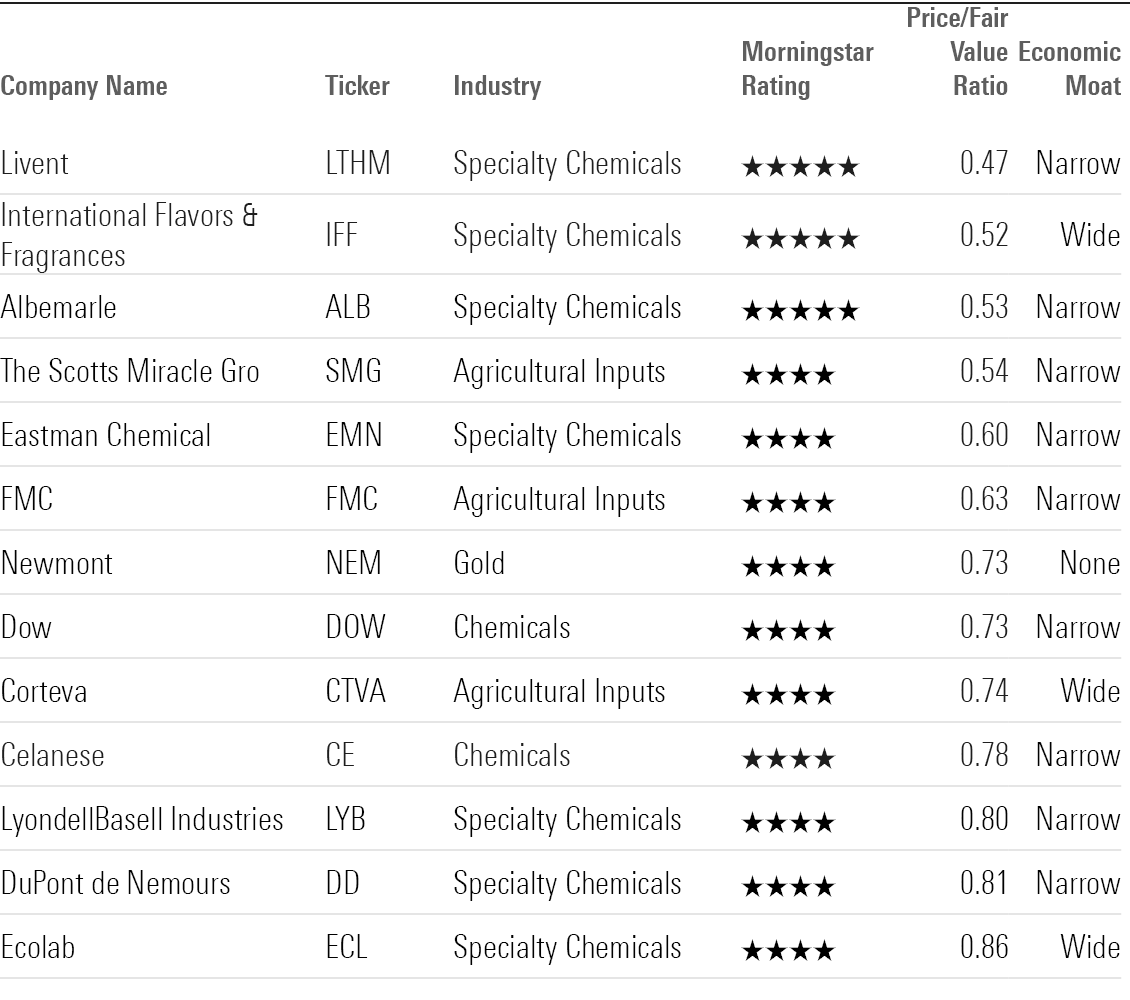

Undervalued High-Quality Basic Materials Stocks

For this screen, we looked for the most undervalued stocks in the Consumer Cyclical Index with a Morningstar Rating of 4 or 5 stars. A total of 13 stocks met these criteria as of Sept. 14. Next we filtered that list for stocks that have also earned a Morningstar Economic Moat rating of wide, meaning they have durable competitive advantages that are expected to last at least 20 years. Stocks with moats and low valuations historically tend to outperform over the long term.

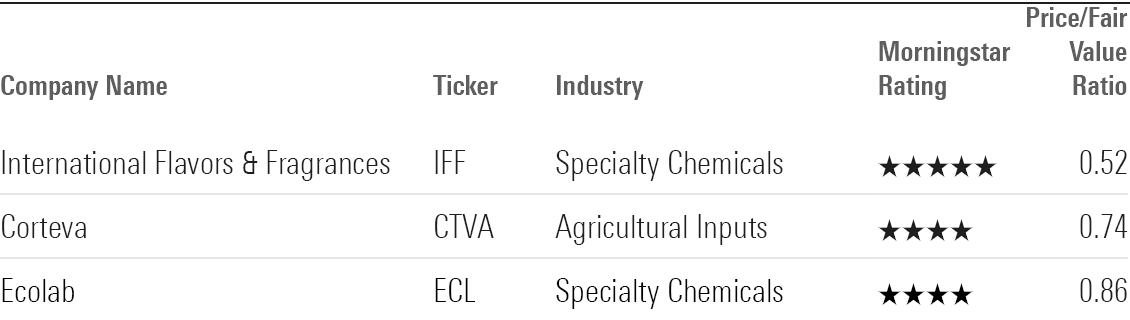

Here are the three undervalued basic materials stocks with wide moats:

The most undervalued stock is IFF, trading at a 48% discount to its analyst-assessed fair value estimate. The least undervalued is Ecolab, trading at a 14% discount.

Undervalued Basic Materials Stocks

International Flavors & Fragrances

- Fair Value Estimate: $130.00

“International Flavors & Fragrances is the largest specialty ingredients producer globally. The company sells ingredients for the food, beverage, health, household goods, personal care, and pharmaceutical industries. The company makes proprietary formulations, partnering with customers to deliver custom solutions. The nourish segment, which generates roughly half of its revenue, is a leading flavor producer and also sells texturants, plant-based proteins, and other ingredients. The health and biosciences business, which generates around one-fourth of revenue, is a global leader in probiotics and enzymes. IFF is also one of the leading fragrance producers in the world. Additionally, the firm sells pharmaceutical ingredients such as excipients and time-release polymers.

“Moaty businesses that operate in this space tend to benefit from switching costs, intangible assets, or cost advantages. For IFF, we cite intangible assets and switching costs. The company’s highly valuable intangible assets (in the form of proprietary formulations) provide significant pricing power, and switching costs help ensure the durability of economic profit generation.”

—Seth Goldstein, strategist

Corteva

- Fair Value Estimate: $70.00

“Corteva is an agriculture pure play formed in 2019, spun off from DowDuPont. The company is a leader in the development of new seed and crop chemicals products. Seeds and crop protection chemicals each make up around half of profits. Although Corteva operates globally, around half of revenue comes from North America.

“Although Corteva’s market share in seeds is second to that of Bayer (Monsanto), the firm holds a solid portfolio of proprietary genetically modified seed platforms. GMO seeds make crops resistant to damaging insects while also allowing farmers to spray more effective chemicals to control weeds. Over the next decade, Corteva plans to launch 10 new corn and soybean products. While anti-GMO consumer sentiment may limit Corteva’s growth in developed markets such as Europe, the need to improve crop yields globally should lead to eventual GMO adoption in emerging markets.

“We award Corteva a wide economic moat based on its portfolio of patented biotech seeds and crop chemicals. The company’s patented products command pricing power, as they protect farmer yields and reduce other expenses such as insecticides. Corteva’s intangible assets stem from the research and development spending required for the continual development of proprietary seed and crop chemical formulations. As patents expire and bugs develop resistance to current products, seeds with new traits and new chemical formulations must be developed. As a result, moaty businesses in this space must continue to invest in R&D. Corteva’s R&D as a percentage of sales tops all major competitors, with the company investing roughly 8% of sales in new product development each year. This level of investment gives us confidence that Corteva is investing enough to continue to successfully develop new products.”

—Seth Goldstein, strategist

Ecolab

- Fair Value Estimate: $210.00

“Ecolab produces and markets cleaning and sanitation products for the hospitality, healthcare, and industrial markets. The firm is the global market share leader in this category, with a wide array of products and services, including dish and laundry washing systems, pest control, and infection control products. The company has a strong hold on the U.S. market and is looking to increase its profitability abroad. Additionally, Ecolab serves customers in water, manufacturing, and life sciences end markets, selling customized solutions.

“We view high switching costs as the key moat source that allows Ecolab to generate excess returns. The firm’s installed base and consumables model—commonly known as the “razor and blade” model—is the most important driver of its switching costs. The company leases proprietary cleaning equipment and devices to its clients and then sells a steady stream of the consumables required to keep the machines running. Ecolab also minimizes downtime for key pieces of customers’ machinery, allowing its business processes to proceed without costly interruptions. Customers are motivated to avoid the costs associated with swapping to new equipment and retraining staff.”

—Seth Goldstein, strategist

Undervalued Basic Materials Stocks

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)