- Fund flows measure changes in newly purchased or redeemed shares over a certain period.

- Recent performance, expense ratios, and firm reputation can affect fund flows.

- In theory, asset flows should move in the same direction as security prices. But, this doesn’t always prove true.

The Ultimate Guide to Fund Flows

Read Time: 10 Minutes

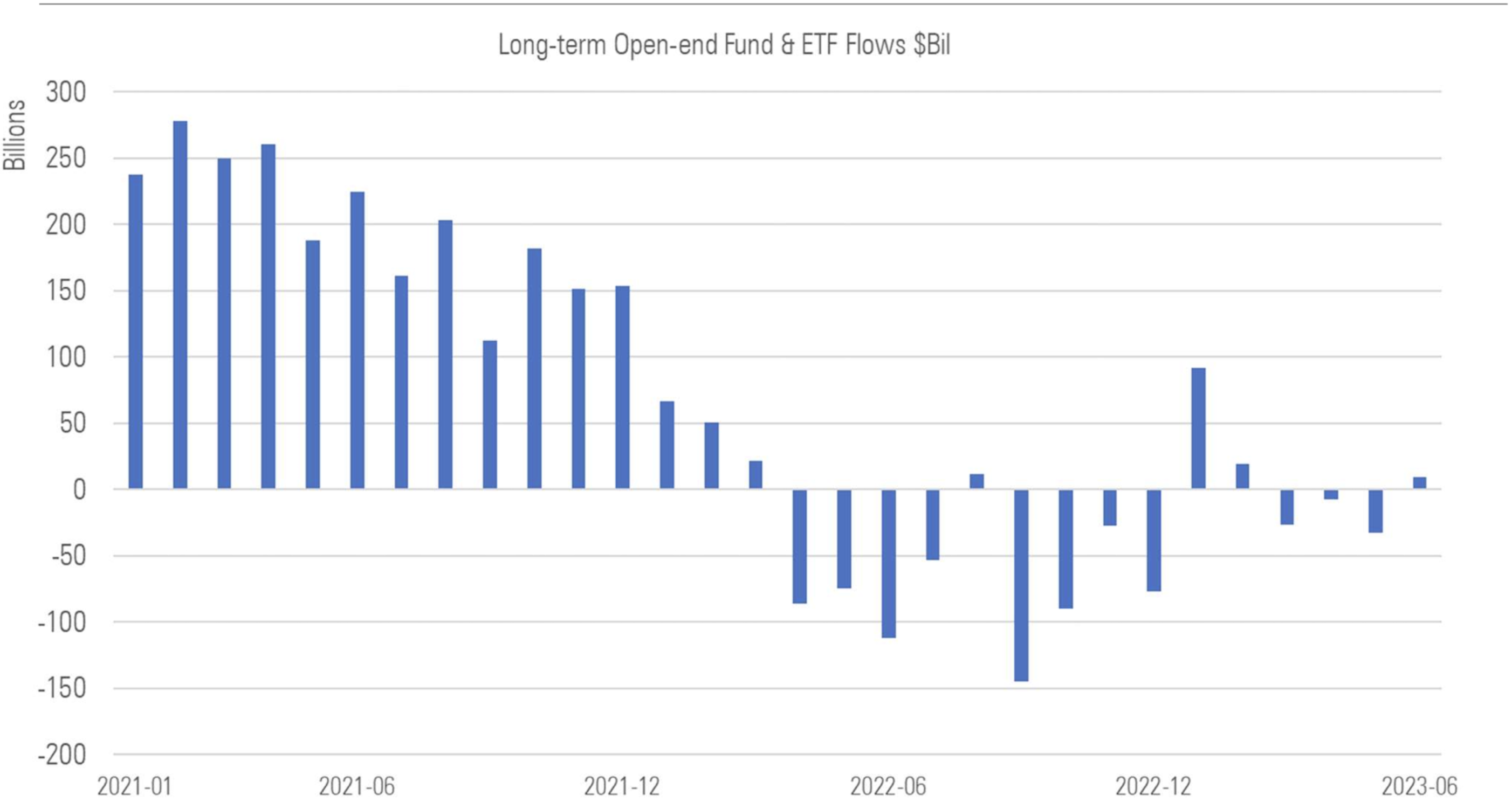

A relatively modest $54 billion flowed into global funds and exchange traded funds in the first half of 2023. Last year, money flowed out of global funds for the first time in 14 years, with actively managed vehicles being hit especially hard.

Fund flows show a wide-angle view of how investors and financial advisors behave. They can reveal patterns that reflect investor sentiment and contextualize emerging trends. How do investors react to market swings? Why do investors buy some products and not others?

In this ultimate guide to fund flows, we outline how asset managers can take the pulse of the competition.

Position Investment Products With Flows Data

Since 2002, more than 3,000 share classes were launched each month. In a seemingly ever-expanding pool of investment options, asset management firms need a way to showcase their products’ strengths.

Fund flows illuminate shared characteristics of growing investment vehicles that can validate your positioning.

If investor interest in ESG holds steady, firms could consider highlighting how they use environmental, social, and governance criteria. If one type of fund is flourishing in one region but stalling in another, firms might rethink where they concentrate their promotional efforts.

You can use this rich global data to:

- Find categories that attracted the most inflows.

- Understand who’s buying from your competitors: institutional investors? Retail investors on the direct market?

- Analyze how your products stack up against influential flow factors.

- Predict impending fund shutdowns.

- Monitor pivots in your competitors’ product strategy.

Free Download Library

2023 Global Equity Fund Flows

Fund Flows Commentary

Global Sustainable Fund Flows

A Guide to Asset Flows

European Sustainable Fund Flows

Guide to Thematic Funds

Key Takeaways

How Does Morningstar Measure Fund Flows?

Fund flows measure changes in newly purchased or redeemed shares over a certain period. Fund flows don’t measure changes in price.

To calculate net flows, Morningstar uses an industry-standard approach. Our team compares a fund’s total assets under management at the beginning and end of a period. Researchers back out price changes, distributions, and reinvested dividends to exclude them from net flows. From there, analysts adjust for infrequent corporate actions such as reverse share splits.

Asset flows data intends to show shifts in investor preference with movement between noticeably different investment strategies. When possible, Morningstar offsets outflows caused by movement to another fund with an identical mandate.

To calculate the organic growth rate and show fund flows as a percentage, analysts divide net flows by the total assets under management at the beginning of the period.

Morningstar’s approach assumes that fund flows occur at the same rate over the course of the month. While fund flows are estimates, the difference from the precise total is often negligible. Morningstar will overwrite our estimates with data from managers when available.

Source: Morningstar Direct Asset Flows. Data as of June 30, 2023.

What Factors Affect Fund Flows?

Morningstar analysts compared mutual fund flows data from 2003-14 and 2015-18. Some variables consistently lined up with investor preferences:

- Strong performance.

- Low fees.

- Positive firm reputation (measured by metrics like the Morningstar Analyst Rating).

- Recommended by independent rating agencies.

- Consider ESG criteria.

- Indexed.

Do fund flows drive stock prices?

In theory, asset flows should move in the same direction as security prices.

When investors put more cash into mutual funds, asset managers can buy more stocks and bonds, driving prices up for the fund itself. The opposite should also hold. When investors redeem or sell mutual-fund shares, asset managers sell off underlying securities, often depressing prices.

But this rule doesn’t always prove true.

Asset flows sometimes go against security prices. In 2020, U.S. equity funds suffered outflows even when the market surged. The pace of individual transactions can affect how prices respond.

Related Products and Services

Solutions for Marketers

Morningstar Direct

Research Portal

Key Takeaways

- Fund flows reveal a tidal shift in active vs. passive funds.

- Active funds have lost cash every year since 2015, while indexed ETFs continue to gain market share.

- Fund flows don’t always line up with security price changes.

What Are the Types of Fund Flows?

With the right analysis, fund flows information can tell a larger story about investors.

Passive vs. active fund flows

Over the last two decades, the U.S. market has undergone a tidal shift from active to passive investment vehicles. Market lows, when valuations drop, create a crunch for mutual fund managers who generate asset-based fees.

Asset flows can illuminate corners of the market where active management continues to drive mutual fund inflows. The choice between an active and passive investment strategy is a personal one. Asset flows by distribution channel can help understand the target audience of each approach.

Global fund flows

Fund flows by domicile show how investor behavior differs by country.

With detailed global data, asset managers can make informed decisions on upcoming product launches.

Flows by fund family

Fund family flows roll up all the funds by brand name for a big picture look at competitor performance.

Grouping flows by fund family can illustrate gaps in competitor coverage. You can see patterns in new product launches and pending fund shutdowns.

Morningstar Category fund flows

Category fund flows offer a detailed lens for analyzing investor preferences. The Morningstar category reflects the underlying securities, not the prospectus. In the United States, Morningstar organizes funds into 122 categories that map to nine category groups.

Fund Flows by Asset Class

Because funds can contain a range of products—bonds, stocks, alternative assets—fund flows also shine a light on how investors feel about the underlying asset classes.

What investments can weather market headwinds and tailwinds?

ETF fund flows surge

When the market plummeted, ETF claimed dominance over inflows. Nonindexed ETFs grew at a 6% organic growth rate in the first half of 2023 and represent 5% of ETF assets globally. The U.S. dominates the category, with 78% of assets under management residing there.

While they hold a smaller market share, active ETFs have posted an annual organic growth rate of over 25% since 2015. Actively managed ETFs in Asia grew at a 78% rate in the first half of the year (albeit from a small base), the highest rate of any region by far.

The growth in active ETFs defies the broader shift toward passive investing. Active ETFs give investors the benefits of lower expense ratios, transparent pricing, and easy liquidity, paired with the intervention of asset managers.

Active ETFs defied the broader shift toward passive investing.

While they hold a smaller market share, active ETFs have posted an annual organic growth rate of over 25% since 2015.

Alternative funds hold investor attention

Alternative funds diversify portfolios with exposure to different risk factors than stocks and bonds. Some look for growth in any market conditions. Others provide exposure to specific events with their own flavor of risk. Others function like bonds, aiming for small but consistent returns.

Investors can miss out on the defensive benefit of alternative funds by waiting until other investment vehicles suffer before investing.

Alternative funds grew popular in 2020 and 2021 when interest rates were low, and the stock market was booming. In 2022, when asset valuations in the traditional market began to flag, they collected over $25 billion but lost momentum by year-end.

Some alternative funds performed strongly despite a tough 2022, providing shelter from interest rate–sensitive sectors.

In the first half of 2023, fixed-income funds were the only category group with inflows. They took in $236 billon. The U.S. accounted for $150 billion of that amount.

Inflows ebb for fixed-income funds

Fixed-income funds logged record-breaking paper losses in 2022. Bond funds posted their worst absolute outflows and organic growth rates in over two decades. When interest rates rise, government bonds lose purchasing power—and their appeal as an investment opportunity.

While the total 2022 outflows of $483 billion are significant, it looks small against the massive $968 billion inflows of 2021 alone, and even smaller compared to the $6 trillion of inflows into fixed-income funds from 2009 to 2021.

Allocation funds continue to slide

Asset allocation funds target a specific percent of equity fixed-income assets for a stable income stream. The category also includes target retirement funds that will rebalance aggressive and conservative investments as owners move closer to withdrawal.

In 2022, U.S. allocation funds continued their long slide with their eighth straight year of outflows. Asset allocation funds offer diversification but don’t allow for personal adjustments, instead locking investors into one risk tolerance level.

Key Takeaways

- Asset flows show that ESG criteria are essential for many investors, even in downturns.

- Overall, today’s investors think long-term about their financial goals.

- Propelled by an interest in lower fees, investors have sought out index funds at growing rates.

Fund Flows in Charts

ESG investing trends

Environmental, social, and corporate governance investing has reached the mainstream. But after a year of market turmoil, will investors hold on to their sustainable investments? Do they think of ESG criteria as “nice-to-haves” or essentials?

Asset flows give us context.

Despite—or perhaps because of—the backlash against ESG investing, investors have put more money into sustainable funds than non-sustainable funds for the year to date. The former tallied $51 billion, while the latter lapped up just $2 billion. Sustainable flows have remained robust in Europe but were negative in the U.S. in the first half of 2023.

Investors stick to their asset allocations

As the equities market rebounded after the 2008 market crash, investors let their stock allocation grow. Bond allocation has held steady in recent years, while money-market holdings have begun to dwindle.

The 2022 downturn proved the mettle of investors. Despite significant outflows, most assets stayed where they were. Overall, today’s investors think long-term about their financial goals.

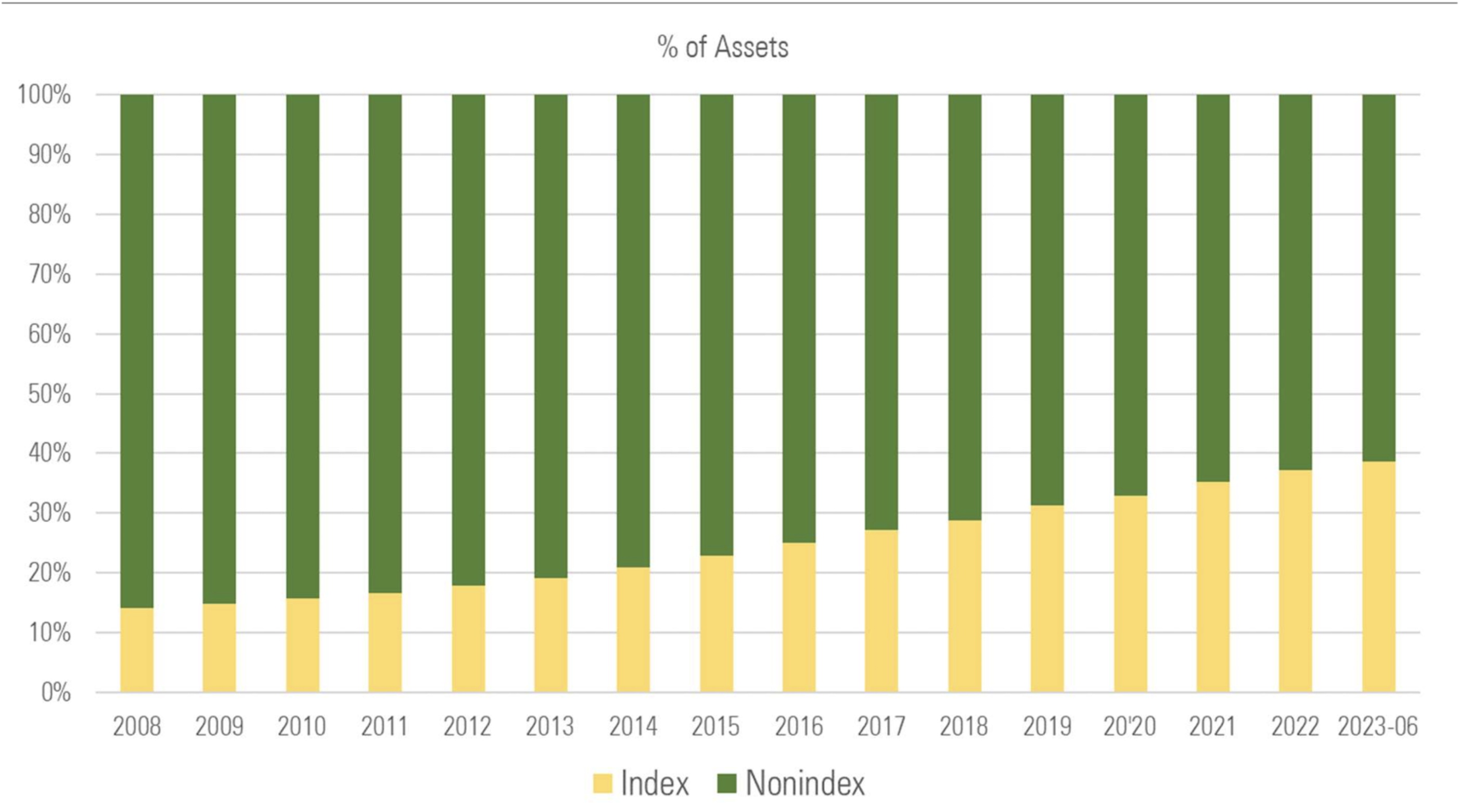

Trends in active vs. passive fund management

Propelled by an interest in lower fees, investors have sought out index funds at growing rates. Indexed vehicles had $747 billion in inflows in 2022, while their actively managed counterparts shed $1.28 trillion.

Index funds have eroded the market dominance of non-index funds at an annual 1% rate since 2013. In recent years, that pace has accelerated. Indexed assets’ market share increased by 2.3% to 38% in 2022. Investors’ preference for passive vehicles has increased to 39% today from 31% at the end of 2019.

Source: Morningstar Direct Asset Flows. Data as of June 30, 2023.

Where Can I Find ETF Fund Flow Data?

In Morningstar Direct, asset management firms can dig into the underlying data to contextualize the market. Every month, a Morningstar mutual funds report recaps U.S. trends. Our researchers publish a global retrospective each year.

2023 Global Equity Fund Flows

How Can Asset Managers Use Fund Flows Information?

Flows can help inform marketing as a window into investor preferences. Do investors choose funds based on their recent performance or low expenses? How can fund managers position their products in line with investor expectations?

Asset flows can also help firms prioritize which funds to promote in what regions. Shift resources to products that reflect investor interest.

Fund flows shed light on AUM trends across major fund families. Find gaps in the competition and discover ways to differentiate your firm.

Asset Flows in Morningstar Direct

Morningstar Direct gives users the data, research, and analysis they need on over 600,000 collective investments. In the platform, asset managers can show how their investment stories relate to the broader markets, compare products with the competition, and present their findings in compliance-friendly reports.

Morningstar’s asset fund flows data dates to 2008, with forecasting models for future growth rates. Direct includes all fund flows data at one price with its performance reporting, presentation, and search capabilities. The Direct team also supports new users with onboarding, training materials, and 24-hour customer service.

Customize your fund flows research. Schedule a demo today!