ETF Flows Trend Down in April

ETFs collected $36 billion in April, their lowest sum since August 2023.

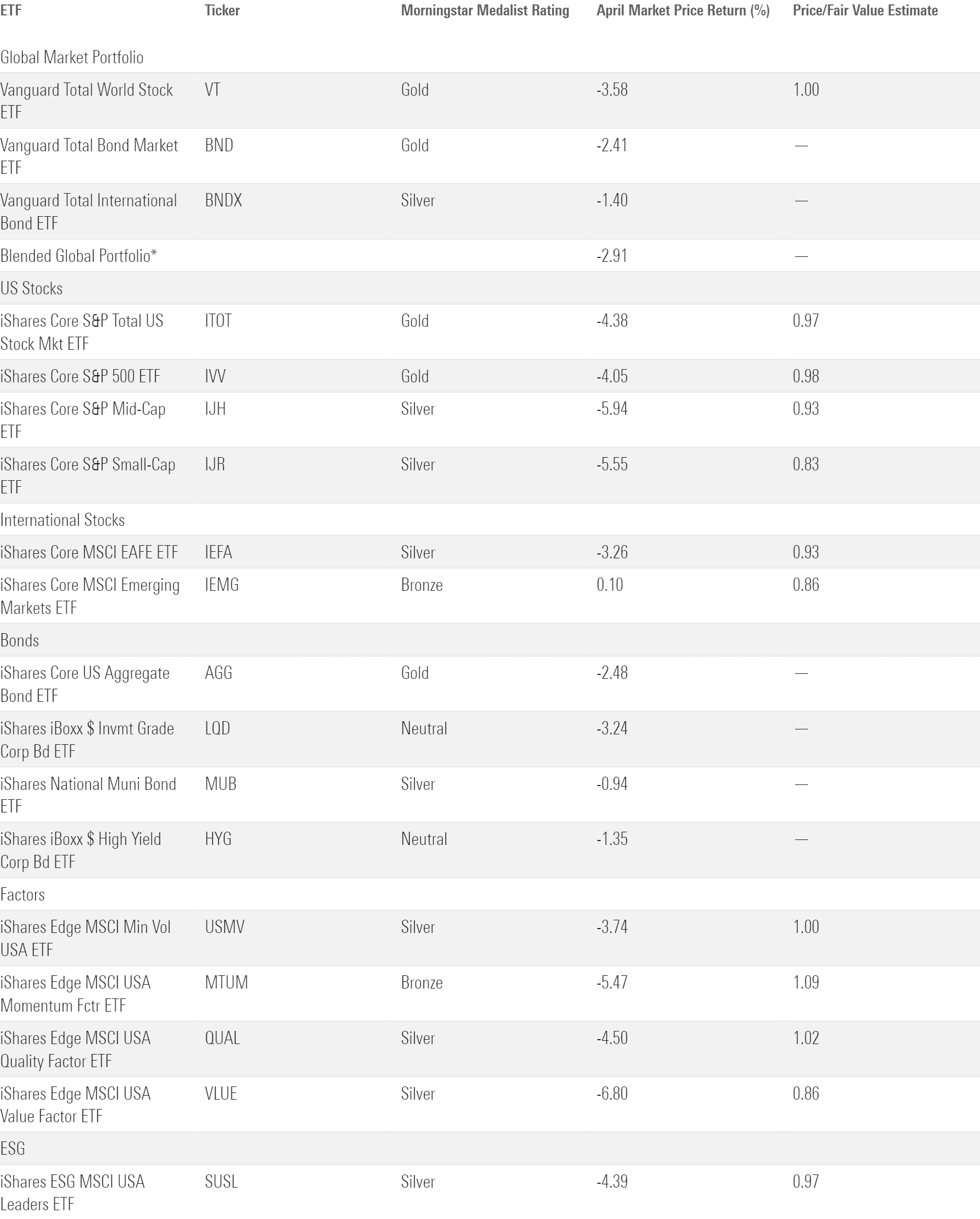

After a strong first quarter, a blended global portfolio pulled back 2.09% in April. Its global stock, US bond, and foreign bond holdings all finished the month lower than where they started.

Exhibit 1: April Market Performance through the Lens of Analyst-Rated ETFs.

Vanguard Total Bond Market ETF BND shed 2.4% in April, wiping out the March gains it mustered and leaving it with a 3.1% loss for the year to date. Once again, inflation was a thorn in the side of major bond indexes. Data released in mid-April showed hotter inflation than expected, further extending the projected timeline for interest-rate cuts.

Fixed-income strategies that target longer-term bonds bore the brunt of the pain. IShares 20+ Year Treasury Bond ETF TLT slid 6.5% on the month, its worst since September 2023. This fund looked to be trending up in late 2023, but the much-maligned strategy has fallen back out of favor. It’s down 9.9% for the year to date and down a cumulative 36.3% since the start of 2022. IShares Short Treasury Bond ETF SHV has held up much better, on the other hand, returning 1.6% on the year after scratching out a modest gain in April.

Stocks weren’t spared from the economic factors that weighed on bonds. Vanguard Total Stock Market ETF VTI lost 4.3% in April, as the combination of sticky inflation and low economic growth rattled markets. Real estate, the sector most sensitive to interest-rate changes, slumped the hardest, with Real Estate Select Sector SPDR ETF XLRE posting an 8.4% drawdown for the month. Utilities lived up to their defensive billing as the only sector to finish April in the black.

Large-cap stocks held up a bit better than their smaller peers in April, widening the gulf between the market-cap segments. IShares Core S&P 500 ETF IVV hung on to a 6% year-to-date gain even after a rocky April, while iShares Core S&P Small-Cap ETF IJR lost 3.3% over the first four months of 2024. This year is shaping up similar to last year, when IVV trounced IJR by more than 10 percentage points. Performance has been more balanced along value/growth lines. Vanguard Growth ETF VUG is up 6.2% for the year to date, but Vanguard Value ETF’s VTV 5.3% return leaves it well within striking distance.

Foreign stocks hung a bit tougher in April, as Vanguard Total International Stock ETF VXUS shed 2.3% on the month. Chinese stocks provided an unlikely shot in the arm. The Morningstar China Index notched a 6.2% April gain after plummeting 18% over the 12 months leading up to it. That jump rippled through emerging-market funds like iShares Core MSCI Emerging Markets ETF IEMG; its 22% stake in Chinese stocks helped it scratch out a modest gain in April.

ETF Flows Taper

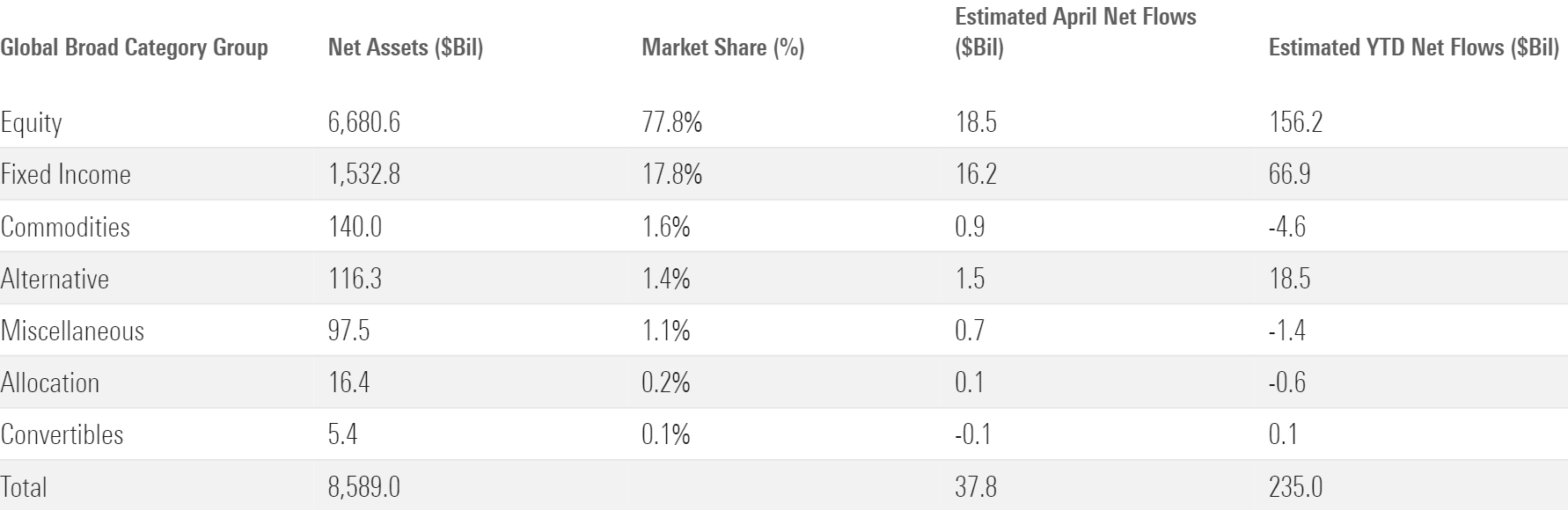

Investors placed about $38 billion into US exchange-traded funds in April, the lowest monthly total since August 2023. Much of that likely owes to lackluster performance from stocks and bonds. Seasonality could play a role, too. From April 2014 through March 2023, average flows in April ranked second lowest among all months, ahead of only August. April is a notoriously rough month for money market funds because investors frequently redeem them to pay their taxes. ETFs may be subject to the same effect when tax season rolls around.

Exhibit 2: April Flows across Morningstar Broad Category Groups.

Stock ETF Flows Sputter

Stock ETFs gathered $19 billion in April. US equity funds constitute more than half the overall ETF universe yet garnered just $13 billion, or 34% of ETFs’ total, in flows.

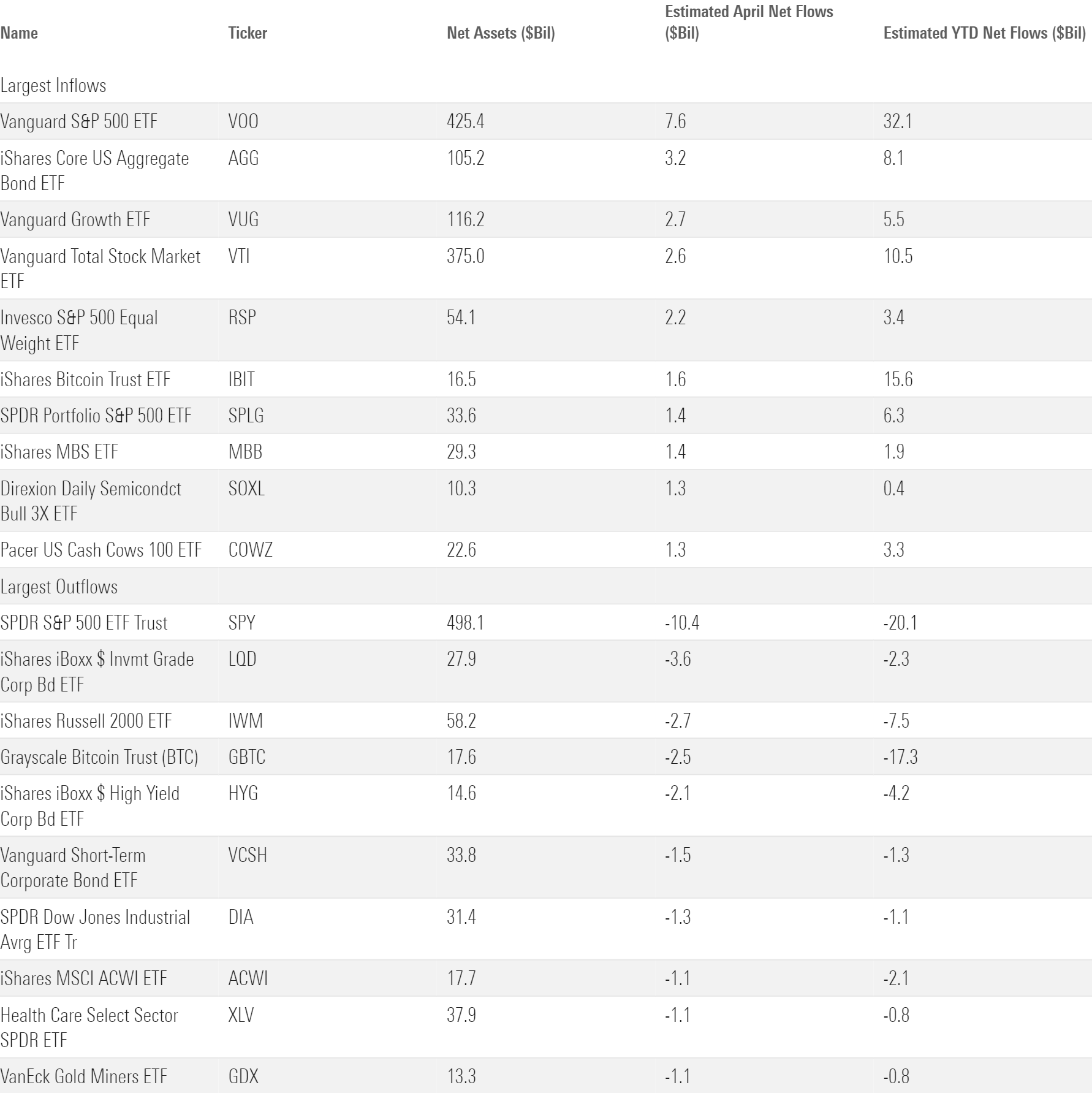

Enormous flows into US large-blend ETFs are normally as certain as taxes, but this April brought only one of those things. The large-blend Morningstar Category gathered about $7 billion last month, its lowest sum since August 2023. The steady Vanguard S&P 500 ETF VOO led all funds with nearly $8 billion of inflows alone, but outflows from iShares’ and State Street’s S&P 500 products held back the broader cohort.

Other mainline US equity categories did little to pick up the slack. Large-growth funds followed up a red-hot first quarter with about $4 billion of inflows, their weakest since last September. And large-value strategies still haven’t gotten off the ground. Their $350 million April intake didn’t move the needle for the $605 billion category. Large-value index funds have fared particularly badly in 2024: Investors have pulled about $175 million from them on the year while dumping $4 billion into active large-value offerings.

Exhibit 3: Morningstar Categories with the Largest April Flows.

The story wasn’t much brighter for international equity funds. Their $6 billion of April inflows translated into slightly better organic growth but marked a step back from a good first quarter. Most of that money rushed into the foreign large-blend category, as usual. IShares Core MSCI EAFE ETF IEFA and VXUS set the pace with more than $1 billion of inflows apiece. Also staying hot: The Japan-stock and India-equity categories. Their April flows ranked second and third in the cohort despite entering the month with the sixth- and 11th-largest asset bases. The heftiest April outflows came from the diversified emerging-markets and China stock categories—two of the best-performing areas in April.

Bond ETF Investors Turn Back the Clock

Bond ETFs hauled in $16 billion in April—hardly a banner month, but a stronger effort than the much larger stock ETF universe. The patterns of bond ETF flows resembled those of 2023 when the ultrashort bond category thrived and investors eschewed short-term and credit-based offerings in favor of duration bets and Treasury-laden portfolios.

Ultrashort bond funds probably won’t match their stellar 2022 and 2023 inflows because of a lethargic first quarter, but their $8 billion April haul marked a return to that form. A unique ensemble cast made it happen. Janus Henderson AAA CLO ETF JAAA picked up nearly $1 billion in its best month to date. Pimco Enhanced Short Maturity Active ETF’s MINT $800 million inflow was a breath of fresh air. And overnight celebrity Alpha Architect 1-3 Month Box ETF BOXX punched above its weight, collecting nearly $650 million of new money. All cashlike in nature, these distinct strategies are united by their safety. As the economic environment remains cloudy, investors could be using them as a hideout until the forecast clears.

Exhibit 4: ETFs with the Largest April Flows.

For the past two-plus years, each new batch of economic data delivered a fresh blow to long-term bond funds. That said, investors have dutifully marched into them. From January 2022 through April 2024, long-term diversified and government bond portfolios racked up nearly $94 billion of inflows; their short-term counterparts jointly collected $3 billion. That trend continued in April, when the long-term categories’ collective inflows ($2 billion) practically mirrored outflows from the short-term ones ($3 billion). Since 2022, investors who bought long-term bond funds expecting rate cuts were too early. Time will tell whether that’s true for those who joined them in April.

While investors didn’t shy away from duration, they fled strategies focused on credit risk in April. The corporate-bond and high-yield bond categories—both coming off lucrative first quarters—each shed roughly $3 billion last month, the worst among all categories. Fundholders may have determined that the upside was no longer worth the risk. Entering April, credit spreads were at their narrowest in more than two years.

Around the Horn

A few other observations from the month in ETF flows:

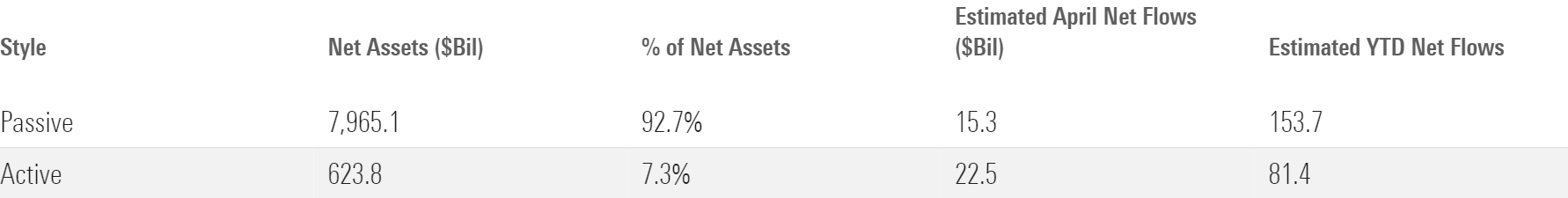

- We needed no further evidence that active ETFs have arrived, but April provided some anyway: They pulled in $23 billion, beating out the $15 billion that flowed into index products. Active ETFs led the way in the taxable-bond and international-stock cohorts and nearly pulled even in the US equity arena, a terrain long dominated by passive funds.

- Flows into bitcoin ETFs—and the price of the cryptocurrency itself—came back down to earth in April. The “new nine” spot bitcoin ETFs collectively gathered about $2 billion last month after hauling in $20 billion over the previous two months. Bitcoin’s price dropped about 15% in April.

- Buffer ETFs splashed onto the scene during the 2022 market downswing, sensible timing given the protection they offer. But smoother markets haven’t slowed them down. Investors have poured $12 billion into buffer ETFs and another $5 billion so far in 2024, including nearly $2 billion in April.

- JPMorgan Nasdaq Equity Premium Income ETF JEPQ grabbed the baton from JPMorgan Equity Premium Income ETF JEPI in the covered-call ETF market. It reeled in $1 billion in April, propelling the derivative income category to more than $2 billion of inflows.

- Sustainable ETFs shed nearly $400 million in their fifth consecutive month of outflows.

Exhibit 5: April Flows into Active and Passive ETFs.

Invesco Taps an Overlooked Formula

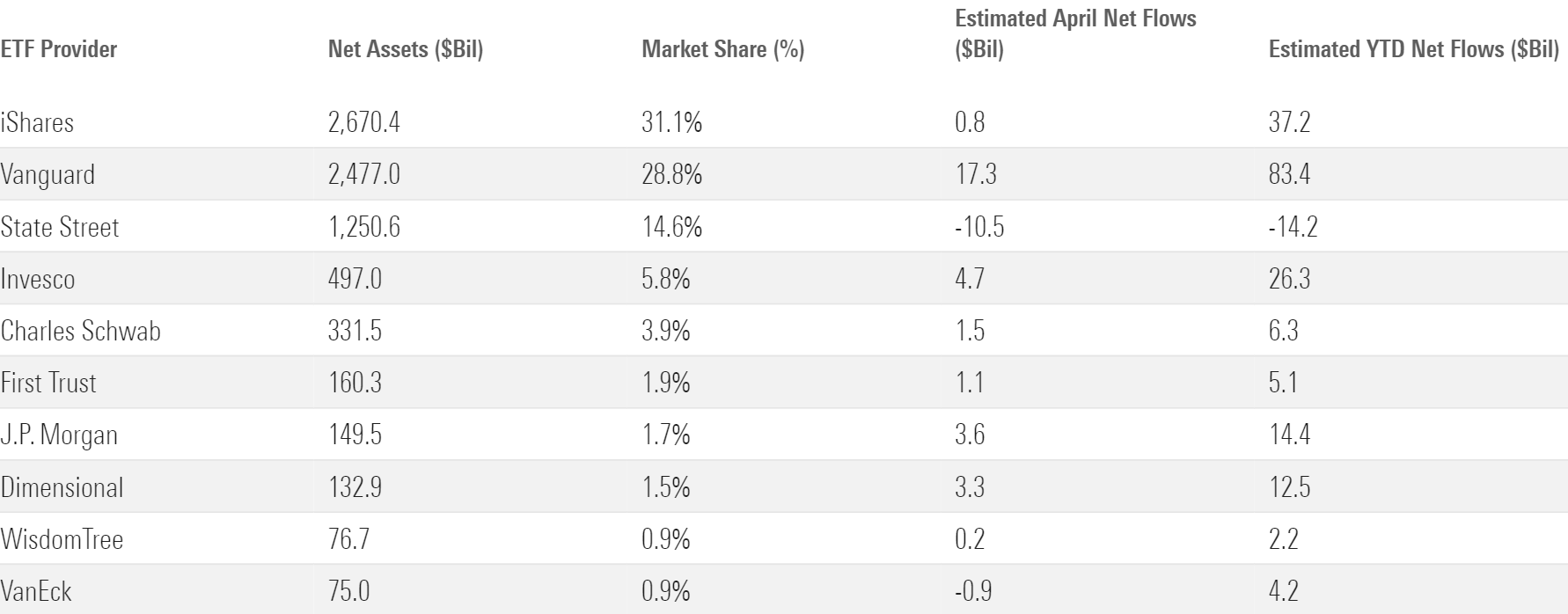

One third of the way through 2024, the ETF provider flows race is taking familiar shape. Vanguard has racked up $83 billion of new money on the year after tacking on a fresh $17 billion in April. Its closest April competitor was Invesco, which reeled in nearly $5 billion.

Exhibit 6: April Flows for the 10 Largest ETF Providers.

Invesco is the fourth-largest ETF provider in the US, but in terms of size it’s a tier below number-three State Street. Roughly half of its assets sit in Invesco QQQ Trust QQQ, its $248 billion crown jewel.

Invesco has accumulated about $26 billion of inflows in 2024, second-most among all ETF providers. Roughly $14 billion of that streamed into QQQ and its younger offshoot Invesco Nasdaq 100 ETF QQQM. But Invesco’s strong start to the year goes beyond its most prolific strategy. It has received a jolt from a segment that has taken a back seat to active ETFs over the past couple of years: strategic beta.

Invesco’s roster of strategic-beta funds—index strategies that track non-market-cap-weighted benchmarks—has pulled in about $7 billion on the year. Invesco S&P 500 Equal Weight ETF RSP stands out. It has absorbed more than $3 billion on the year as investors presumably pivot from more concentrated traditional index funds. Its suite of quality funds has pulled in $3 billion, led by Invesco S&P MidCap Quality ETF XMHQ. A handful of Invesco momentum funds have chipped in a collective $2 billion as well. It hasn’t been entirely smooth sailing—poor returns have driven capital out of risk-oriented funds like Invesco S&P 500 Low Volatility ETF SPLV—but Invesco’s strategic-beta funds have made for solid satellites around their heavy hitters.

Overall, strategic-beta funds have been losing steam in recent years. Leaning on them hardly guarantees that Invesco will preserve its market share, let alone expand it. But it has worked well in 2024, setting the firm on pace to break its annual flows record from 2021.

Where’s the Value?

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

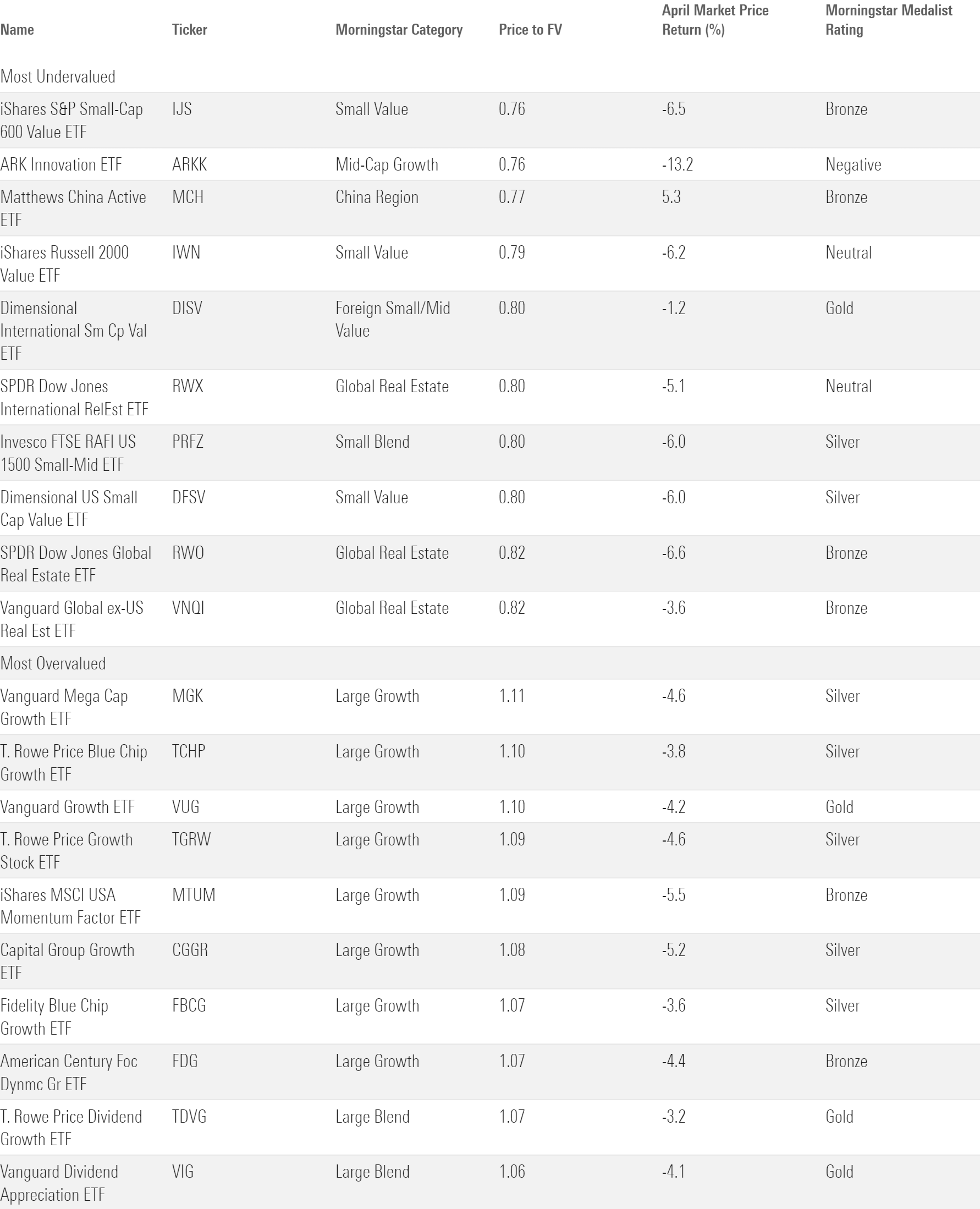

Exhibit 7: The 10 Most Under- and Overvalued Analyst-Rated ETFs.

Morningstar chief US market strategist David Sekera recently published the US stock market outlook for May 2024, a report that draws on the price/fair value ratio.

The outlook highlights small value as the cheapest corner of the US market. Three funds on the undervalued side of Exhibit 7 sit in the small-value category. IShares S&P Small-Cap 600 Value ETF IJS is the cheapest among them, trading at a 24% discount as of May 2, 2024. This fund’s very small market-cap orientation has made for tough sledding. It posted a negative 3.3% return over the first four months of the year, trailing IVV by more than 9 percentage points and ranking in the bottom quintile of the small-value peer group.

But there is reason for optimism. Beyond its attractive valuation, the fund’s quality orientation and diversification earn it a Bronze Morningstar Medalist Rating. Dimensional US Small Cap Value ETF DFSV is another good option in the category, sporting a 20% discount to its fair value as of May 2, 2024.

Discounted offerings exist in the large-cap arena, too. Silver-rated iShares MSCI USA Value Factor ETF VLUE traded 14% below its fair value after a rocky performance in April. Fellow Silver medalist Invesco FTSE RAFI US 1000 ETF PRF registered a 9% discount. That may appeal to investors prioritizing breadth, as it sweeps in the full large- and mid-cap market and earns its value stripes through fundamental weighting.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_4a71dba80d824d828e4552252136df22_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)