Climate-Related Financial Risk for Investors

How to Measure Material Climate Risks

Read Time: 10 Minutes

According to the National Oceanic and Atmospheric Administration, the last eight years were the hottest ever recorded for both sea and air temperature, resulting in more frequent and severe extreme weather events. The summer of 2023 made the climate crisis feel very personal and very real, as we saw significant heat waves, wildfires, and floods around the globe. No community was spared.

The world’s climate is changing, and the impacts of these changes pose a material financial risk to investors’ portfolios.

In this article, we’ll review the different types of climate risk and why they matter to investors of all types. We’ll also explain how, with the right climate solutions, investors can measure and manage the climate-related risks facing their portfolios.

The World Is Aligning Toward Reaching Net-Zero by 2050

The Earth is already about 1.1°C warmer than it was in the late 1800s. To avert the worst impacts of climate change and preserve a livable planet, global temperature increase needs to be limited to 1.5°C above pre-industrial levels. To accomplish this, greenhouse gas emissions need to be reduced by 45% by 2030 and reach net zero (i.e., as close to zero as possible with any remaining emissions re-absorbed by the atmosphere) by 2050.

A growing coalition of countries, cities, institutions, and businesses have pledged to reach net-zero emissions by 2050. These commitments have implications for future regulation and corporate practices.

- More than 70 countries, including the biggest polluters—China, the United States, and the European Union—have set net-zero targets.

- More than 3,000 businesses and financial institutions are working with the Science-Based Targets Initiative to reduce their emissions.

- More than 1,000 cities, 1,000 educational institutions, and 500 financial institutions have joined the Race to Zero, pledging to take rigorous, immediate action to halve global emissions by 2030.

Many investors and financial institutions have also pledged to reach net zero in their investment portfolios by 2050. That commitment requires reducing the real-world emissions generated by their portfolio companies, or companies they invest in, over time.

Several investor-backed net-zero initiatives and alliances facilitate this:

- Net-Zero Asset Owner Alliance: $11 trillion

- Paris-Aligned Investment Initiative: $33 trillion

- Climate Action 100+: $68 trillion

- The Net-Zero Asset Managers Initiative: $59 trillion

Climate risk considerations for investors

Previously, investors focused on measuring and reporting on the carbon footprint of their portfolios. Their needs are quickly evolving, requiring more holistic measurement and management of climate-related risk to their investments. And certain types of investors need to identify, manage, and report on climate-related risks to meet their fiduciary obligations.

There are two main types of climate risks for investors to balance: transition risks and physical risks.

Free Download Library

Managing Risks for a Changing Climate

A New Tool at The Table

Net-Zero Issues Top of Mind for Global Asset Owners

Global Sustainable Fund Flows

Physical Climate Risks

Physical climate risks are property damages and losses due to the physical consequences of climate change. Hazards like wildfires, floods, hurricanes, and heat waves can pose material risks to companies, with the potential to damage assets, incur repair costs, and hinder productivity.

For investors, it’s becoming clear that the physical climate risks to the companies they invest in are likely to increase in the coming years, even as the global community works toward achieving net-zero emissions.

Direct vs. indirect physical risk

Across the business value chain, physical climate risks can have direct impacts, like impairment costs and productivity loss, and indirect impacts, like supply and demand disruption.

Direct physical climate risk is the likelihood that climate hazards damage the physical assets that a company owns or controls. Climate hazards can trigger:

- Productivity loss when components fail or facilities shut down.

- Safety issues that cause employees to miss work.

- Capital costs to repair damaged assets.

Indirect risk is the likelihood that climate hazards harm services and resources the company uses but doesn’t own or control. It reflects possible disruptions to the global supply chain through:

- Productivity losses from infrastructure outages in the area around a company’s assets.

- Supply chain and transportation disruptions that reduce revenue.

- Costly insurance premiums in high-risk places.

Understanding Direct and Indirect Exposure to Physical Climate Risks

Across the business value chain, physical climate risks faced by a company can have an impact on the end investor, including a change in earnings or an increase in default risk.

By factoring physical climate risk into bottom-up company-level analysis, looking at global supply chains and other ways companies are vulnerable to disruptive events and disasters linked to climate change, investors can understand their direct and indirect exposure to physical climate risks.

With coverage of over 12 million assets, Sustainalytics’ Physical Climate Risk Metrics are a critical starting point to help investors manage their exposure to physical risk. Millions of data points aggregate to an overall company exposure signal and provide insights into potential financial impacts due to physical climate risks between now and 2050.

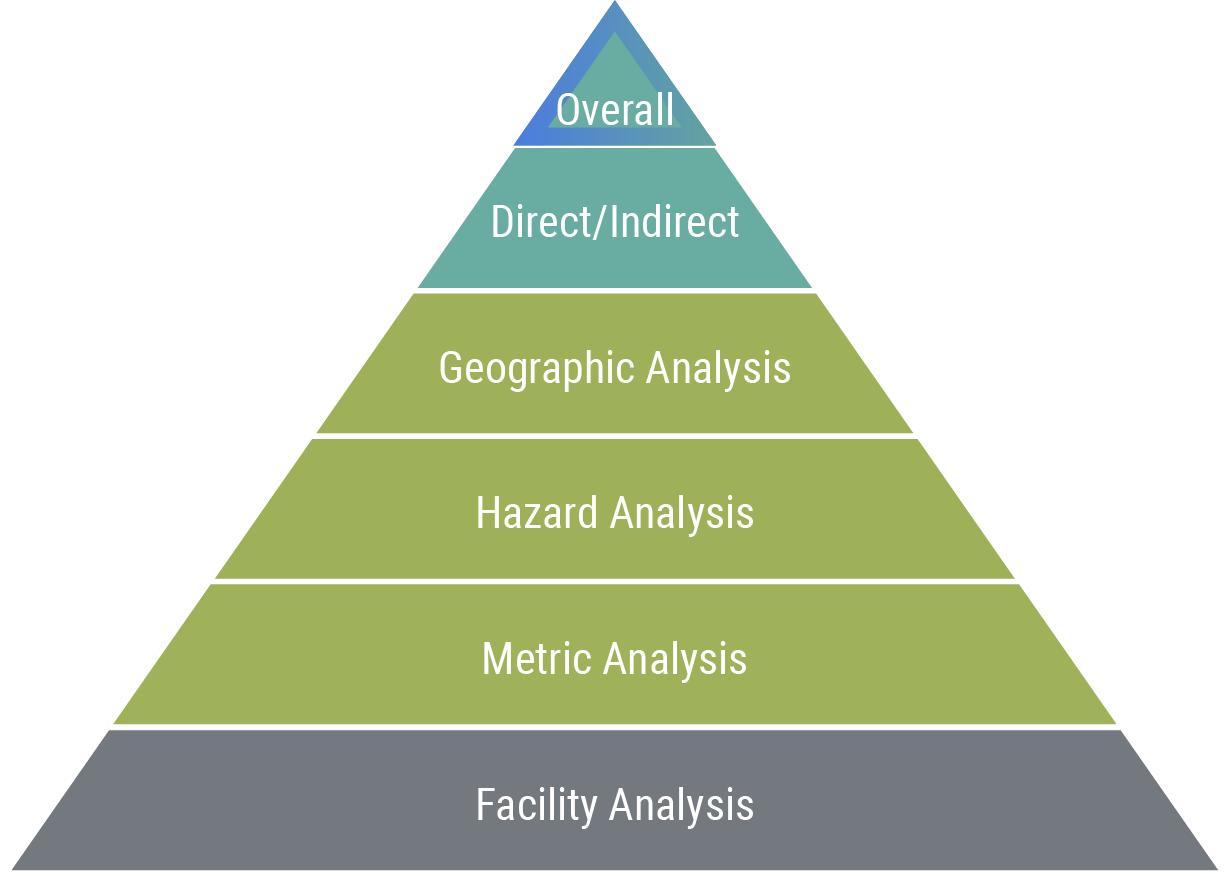

The Sustainalytics Physical Climate Risk Metrics provide visibility into:

Climate Transition Risks

Transition risks are those caused by socioeconomic changes related to the decarbonization of the global economy. Transition risks can result in financial, reputational, and legal impacts due to the evolving landscape of related regulations, emerging technology disruption, and changing consumer preferences.

Examples of transition risks include:

- Increased operating costs related to adopting clean-energy technologies.

- Liability and legal risks resulting from diluted net-zero targets.

- Compliance risk from the “alphabet soup” of mandatory climate reporting and disclosure standards.

With more companies making net-zero commitments, investors need a structured way to decipher complex corporate transition plans and understand if their portfolio companies’ actions align with their stated commitments.

Carbon Emissions Data: The foundation of climate research

Reliable GHG emissions information is foundational to assessing the climate risks faced by companies and to fulfill mandatory and voluntary regulatory requirements and initiatives such as the Task Force on Climate-related Financial Disclosures, International Sustainability Standards Board, and Principles for Responsible Investment.

Morningstar Sustainalytics’ high-quality Carbon Emissions Data is built on the most up-to-date reported carbon emissions disclosure data from over 7,500 companies. Where self-reported data is incomplete, sophisticated best-in-class multi-factor regression models expand the coverage to 16,000+ companies.

Carbon Emissions Data

Low-Carbon Transition Ratings: Looking beyond net-zero targets and claims

The Sustainalytics Low-Carbon Transition Ratings (LCTR) assesses a company’s current alignment to a net-zero pathway. In simple terms, the rating is expressed as an implied temperature rise, which is a forward-looking, science-based assessment of a company’s managed emissions against a net-zero pathway by 2050.

The rating is unique in that it incorporates Sustainalytics’ greenhouse gas emission projections, which assess a company’s “fair share” of emissions contribution across its entire business value chain at a global level, including its supply chain and product use emissions.

Also unique to the LCTR is that it looks beyond a company’s net-zero targets and claims by assessing the management of these projected emissions. It evaluates what a company is actually doing to transform its business to meet stated targets. The rating considers a company’s policies, governance systems, and investment plans, and it enables comparisons across industries and geographies.

By integrating the Low-Carbon Transition Ratings into the investment process, investors can obtain transparency into company actions, respond to regulatory initiatives, and implement net-zero strategies.

Low-Carbon Transition Ratings

Identifying, Quantifying, and Managing Climate Risks with Morningstar’s Climate Solutions

With Morningstar’s complete suite of climate solutions, investors can use in-depth climate data, research, ratings, and indexes to holistically understand climate risks. Make complex decisions with confidence.

Climate Solutions

A Closer Look at Reporting and Regulation

Evolving regulatory requirements and disclosure expectations, like the Task Force on Climate-related Financial Disclosures (TCFD) framework, will require investors to integrate transition and physical climate risks into their decision-making and disclosures.

With additional climate-focused legislation on the way in jurisdictions around the world, the evolving regulatory landscape exposes companies to added risks related to reporting and compliance requirements.

Take a closer look in our guide to climate reporting.