Read Time: 10 Minutes

The Practical Guide to Behavioral Finance: How Real Clients Make Decisions

Financial markets aren’t filled with perfectly rational actors. Even professional investors, who make their living conducting investment research, see a persistent gap between real and reported returns.

But, Morningstar researchers argue, rational behavior goes deeper than dollars and cents.

Traditional finance theory would argue that the rational choice stands to make the most profit. But real investors face complex emotions and decisions about money. They don’t always optimize. They feel uncertainty, fear, and greed.

Behavioral finance digs into the psychological reasons behind why we spend, save, and invest the way we do. In this guide, we walk advisors through actionable tactics based on Morningstar research.

Our behavioral finance team studies how people make decisions about risk, money, and investing. With a better understanding of human behavior, investors can make better choices, and advisors can help clients reach their goals.

Key Takeaways

- As a financial advisor, behavioral coaching is one of the most valuable things you can do for clients.

- Heuristics are psychological tendencies that often positively affect our decision-making processes. When these shortcuts lead to the wrong conclusions, they become cognitive biases.

- Behavioral nudges can help clients make progress toward their financial goals.

What Is Behavioral Finance?

When you think about behavioral finance, behavioral biases might come to mind first. You might think of herding behavior and the chaos of meme stocks and Silicon Valley Bank’s demise. Or you may think of the recency bias and how people lost money in 2020 by cashing out at the market lows.

While biases factor into behavioral finance, the field goes beyond cataloging mental shortcuts.

Behavioral finance is the study of how real people make real decisions about money in real environments—all of which are imperfect. In recent years, behavioral scientists have doubled down on making research findings practical and useful.

For financial advisors and investors, this is good news: It means more actionable insights to help guide investment decisions.

Free Download Library

Uncovering Your Real Goals

Behavioral Coaching Pocket Guide

What Motivates Clients to Stay With Their Financial Advisors?

How Do Investors Prepare for a Recession?

Why Clients Hire Their Advisors

Why Clients Fire Their Advisors

Why Money Is Important to Investors

Common Mistakes Advisors Make

Do Clients Value Financial Coaching? Our Research Says Yes

The phrase “behavioral coaching” might sound judgmental. Clients may not want to be painted as incompetent or incapable of controlling their emotions. Morningstar research shows that, on average, clients undervalue emotional support from their advisors.

This contradicts the value that financial advisors offer through their services. Vanguard found that behavioral coaching is the most influential thing an advisor can do—adding 150 basis points on average. As passive funds and robo-advisors multiply, this personal touch can set you apart from the competition.

Luckily, investor appetite for emotional support from their advisors may be heartier than it seems.

One recent study showed that investors often seek advisors to address specific financial needs, which might be expected. Our research also found more emotional factors can contribute to hiring decisions.

The disconnect in our findings may stem from how advisors market their services.

In the early stages, prospects might feel reluctant to talk about their feelings—especially if those feelings make them feel powerless. But they might be interested in your work as a sounding board or a source of peace of mind.

In other words? Behavioral coaching.

Why People Hire Financial Advisors

Related Products and Services

Advisor Workstation

Wealth Platform

Morningstar Office℠

Key takeaway

Hidden biases can affect many of our financial decisions, even long-term goals.

Morningstar’s three-step process can help you guide investors to more meaningful, deeper goals.

What Are Behavioral Finance Biases? Why Do They Matter for Financial Planning?

Each day, investors face hundreds of decisions, large and small, about how to use their money. Do they pay down their debts or invest in real estate? Should they put their savings in an IRA or a rainy-day fund? Is a hot new stock an opportunity or a fad?

Heuristics are a common thought process, like a mental shortcut, that can help us make decisions. Often these shortcuts have positive outcomes. They help us react quickly and make sense of new information.

However, sometimes these shortcuts can lead us to the wrong conclusions. When that happens, those helpful shortcuts become cognitive biases.

Hidden biases can affect many of our financial decisions, even long-term goals. Effective financial planning depends on setting meaningful client goals. When people can commit to a goal, they’re more likely to work toward it successfully.

But asking clients about their goals might not yield the best answers. Research shows that behavioral biases could influence these statements and obscure the most important goals.

Investors might respond with something easy to recall, based on an article we read or a conversation we had (recency bias). Investors also tend to overweight immediate rewards, like short-term purchases, over the promise of future satisfaction (hyperbolic discounting). Both tendencies can get in the way of an effective financial plan.

Failure to understand investors can have consequences.

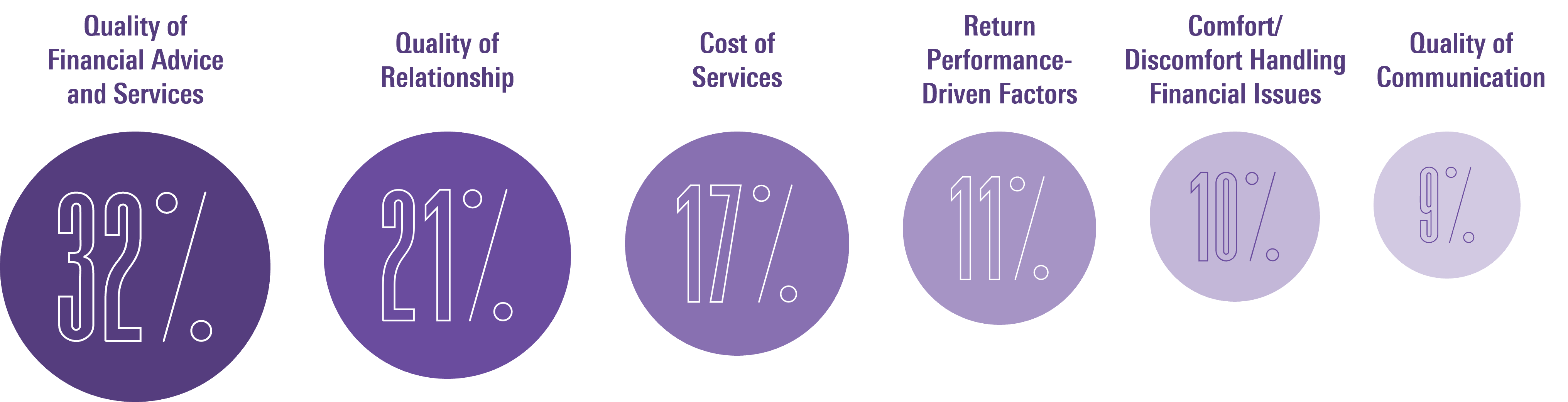

Why investors fire their advisors

In a Morningstar study of why clients fire their advisors, investors cited a variety of reasons—cost, return performance, and relationships. One reason investors said they had fired their advisors for was when their advisor failed to understand their individual needs and goals.

With more time, attention, and resources to understand the client, advisors could have remedied these complaints. Morningstar researchers created a three-step process to guide investors through understanding their overarching long-term aspirations.

Mining for Goals

Why Investors Act on Limited Data

Today’s investors must choose from an overwhelming variety of investment types—cryptocurrency, structured products, and ESG-themed funds. Even savvy investors might only be comfortable with a small slice of this vast landscape.

Our brains are wired to help us act on incomplete information. In our messy, complex world, it’s impossible to know every cost and benefit associated with every decision. Most of the time, heuristics help us make adequate decisions. But sometimes these shortcuts don’t serve us well, which is when they become cognitive biases.

Our brains don’t treat all information equally. The most reliable information doesn’t always get the most weight. Instead, we tend to place more weight on information that readily comes to mind (availability bias). We may also seek out and put greater importance on information that speaks to an existing belief (confirmation bias).

Unfortunately, recognizing your cognitive biases doesn't always reduce your reliance on them—even for experts. Here’s how you can combat biases when investors are seeking information:

- Slow down. People often rely on automated ways of thinking to make quick decisions.

- Play devil’s advocate. When investors call with a plan they want to pursue, list both the reasons why it could succeed and potential drawbacks.

- Encourage your clients to reach out. Remind clients that they can trust you for honest feedback.

With a foundation of goals-based planning, you can help clients stay on track to what matters most. In Morningstar Advisor Workstation, you can connect goals to investment plans that drive investor success.

Key takeaway

To understand an investor, advisors must begin by helping the investor understand themselves.

In our research, investors consistently cite an advisor acting in their best interest as a top source of trust.

How to Apply Behavioral Finance for Stronger Client Relationships

Many financial advisors wait for a financial crisis to dedicate time to their client relationships—only then do they play the role of financial counselor or coach by helping clients manage their emotions.

At this point, it might be too late.

Research shows that lost returns are among the top reasons advisors get fired. In other words, unless you’ve done your prep work, once markets go awry, your client relationships may already be suffering.

Advisors can strengthen client relationships in two ways, based on Morningstar research.

Build understanding

To understand an investor, advisors must begin by helping the investor understand themselves. Advisors must help investors discover their own needs and goals, to an extent.

Ask good questions and then listen. This sounds simple, but it isn’t.

- There are many promising icebreaker questions at advisors’ disposal. Regardless of which you use, pay attention to how this question affects your client’s mindset.

- Remember, the client should be talking most of the time. Let them fill the silence.

The investor preferences tool in Advisor Workstation can help you plan client conversations so you know when and where to go deeper. The survey tracks not just want clients care about, but how much, so you know what to prioritize.

Build trust

When it comes to trust, both parties accept vulnerability because they believe in the intentions and behavior of the other. To develop trust with a client, start by putting those intentions and behaviors on display. There’s still an element of understanding here, but this time, the investor must understand you.

In our research, investors consistently cite an advisor acting in their best interest as a top source of trust. Unfortunately, many clients may not have a good idea what the term ‘best interest’ means.

Discuss your commitment to the best-interest standard by defining what it means for your relationship with the client and their money. A few possible topics to address:

- How do you get paid?

- What happens if the client accepts your recommendation?

- A breakdown of any costs and fees.

- How often will you monitor their investments?

- How often will you meet with the client?

Key Takeaway

Remind clients that they’re not alone in feeling swayed by market ups and downs, but return-chasing can be costly.

Help clients set their plan and forget it to remain on track.

Regulating Client Emotions in Market Roller-Coasters

Many clients may know the general rule of investing—Buy low, sell high—but may have had trouble abiding by it in the past. Maybe they felt the urge to jump in on the action during the GameStop run in 2022 or to pull money from investments in the early COVID-19 market panic.

When working with clients, it’s important to remind them that they’re not alone in feeling swayed by market ups and downs, but these decisions can be costly. Return-chasing—investing more in an asset when returns grow and investing less when they shrink—has been found to reduce the returns an investor sees compared to those who didn’t chase returns.

We’re so easily swayed by market fluctuations because we’re social creatures. Our tendency to pay attention to and learn from others has allowed humans to do incredible things, but it can also lead us astray.

Herding behavior describes how we feel compelled to act in a way that aligns with what others are doing, for good or ill. When things are on the way up, herding behavior undergirds FOMO. When things are on the way down, it encourages panic selling.

Other cognitive biases can further encourage return-chasing. For example:

- When we see a stock enjoy a meteoric rise, we might assume the stock will continue to do well and overlook other factors due to our tendency to focus on recent events (availability heuristic).

- We may counterproductively decide to sell holdings when they’re down because of the acute sense of pain we feel to lose money due to loss aversion.

Though it can be hard to resist the crowd, a few behavioral guardrails can help investors stay the course during volatility:

1. Reflect on goals. Well-articulated, meaningful goals help people stay motivated and committed to their plans. Using relevant tools, you can help your client set the right goals and then stick to them when they feel the pull of the crowd.

2. Set it and forget it. Help your clients automate investing as much as possible. It can be hard to make the ‘right’ investing decision during volatility. By automating, the client will not have to make that decision at all—it’ll already be made for them.

3. Know when to step away. Constantly watching what others are doing can spike the desire to go with the herd. Help your client set limits to reduce this pressure. This could mean lockout timers on apps, only reading market news once a week, or cutting down on how often they check their portfolio.