Retirement

Retirement Plan Design: A Look at Managed Account Allocation

'Tis the season to compare managed account allocations across siblings.

By Nathan Voris

Read Time: 3 Minutes

While waiting for a Zoom meeting to start last week, several colleagues and I started chatting, sharing wounds from Thanksgiving. The wounds were from both too much intake laced with tryptophan, as well as conversations about politics and religion started by over-served family members. As we began telling Christmas and Hannukah stories, it became apparent that many of my clearest holiday memories, as was the case with others, centered around a strong dose of sibling rivalry.

Most of the stories I had to endure were old and exaggerated, designed to embarrass me and make my boys think their uncle is the cooler of the two of us. Complaints about who the favorite was, who got fired the most times according to our dad, or who threw the biggest parties when our parents left town (spoiler: it was me). The list of hits—that were mostly aimed at me—goes something like this:

- Viewing of my 6 grade school picture, which is so embarrassing my sister-in-law made it into a Christmas ornament for everyone to enjoy on an annual basis. Bad glasses, bad hair, chapped lips. It was a tough year.

- That I have wooden teeth because I didn’t brush them for years. This is a scare tactic developed by my brother, to ensure his kids brushed their teeth. I think one of them still believes it.

- A thorough review of Ohio child endangerment laws of the 1980s, based upon the conditions of the “boys shower” in the basement. Shower is a term used loosely—concrete floors, a single light bulb, a shower head, and sump pump qualify.

- Tales of perhaps the most epic parties during the summer of 1996, when my sister and I had the house to ourselves with no parental supervision for 3 months. Many of those stories involve a dump truck and the demolition of a two-car garage—all of which always end with “that was the best summer of my life,” which rankles my wife, who was not present at the time and really wants the best summer of my life to include her.

After 7-10 minutes of telling stories about each other and our siblings, none of which I was able to gain permission to publish in this piece, we made a slight bend back to work-related discussions and posed the question, “For sibling sets of a similar age, who would be defaulted into the same target-date fund, what would their default asset allocation be in managed accounts?”We all started chatting about how different we are from our brothers and sisters, and it really emphasized the idea of personalization—and that a “one size fits all” approach might not make a ton of sense in a retirement plan design, particularly when alternatives exist.

We show the value of automated personalization for the default managed account participant nearly every day in some form or fashion—for a plan sponsor, an advisor leveraging Advisor Managed Accounts, or a recordkeeper that offers our solution to their plan participants. The list goes on: Optimal asset allocation compared to do-it-yourself and target-date fund users, higher stick rate during COVID, higher savings rates, a thoughtful blend of active and passive management, ability to invest in stable value, acknowledging the implications of company stock and pension plans.

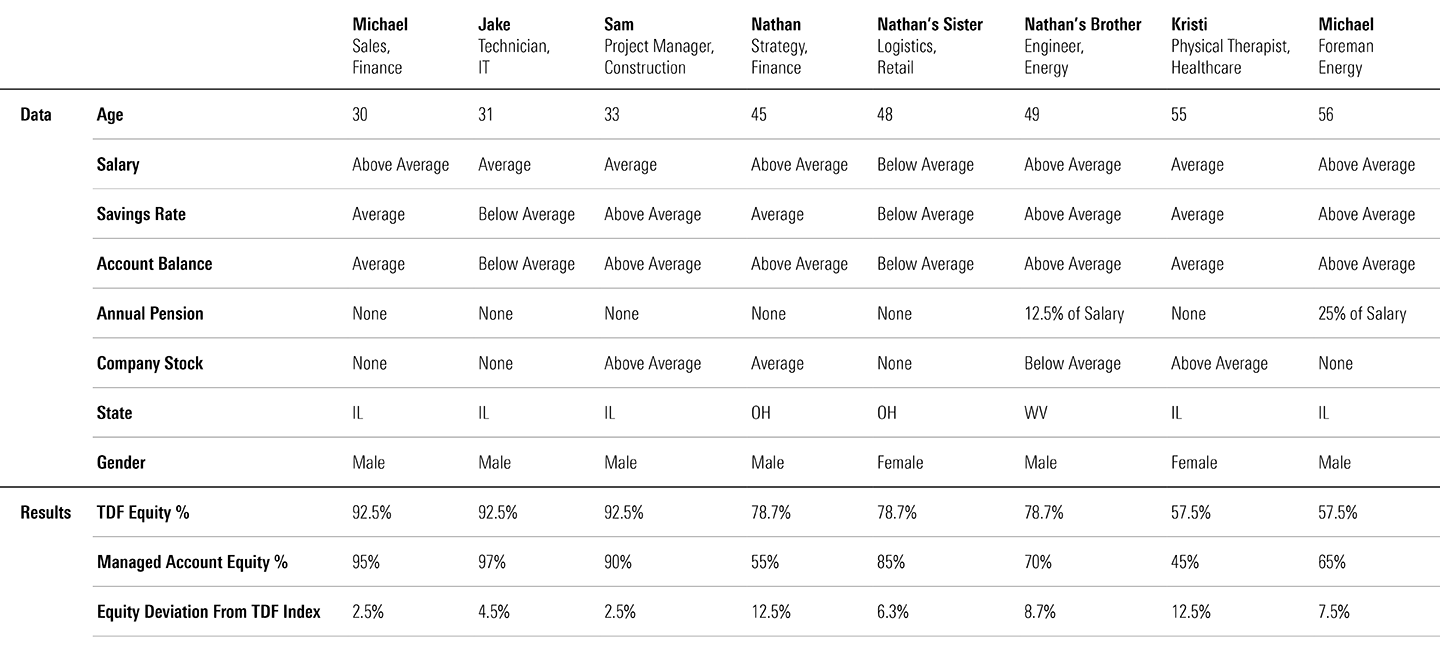

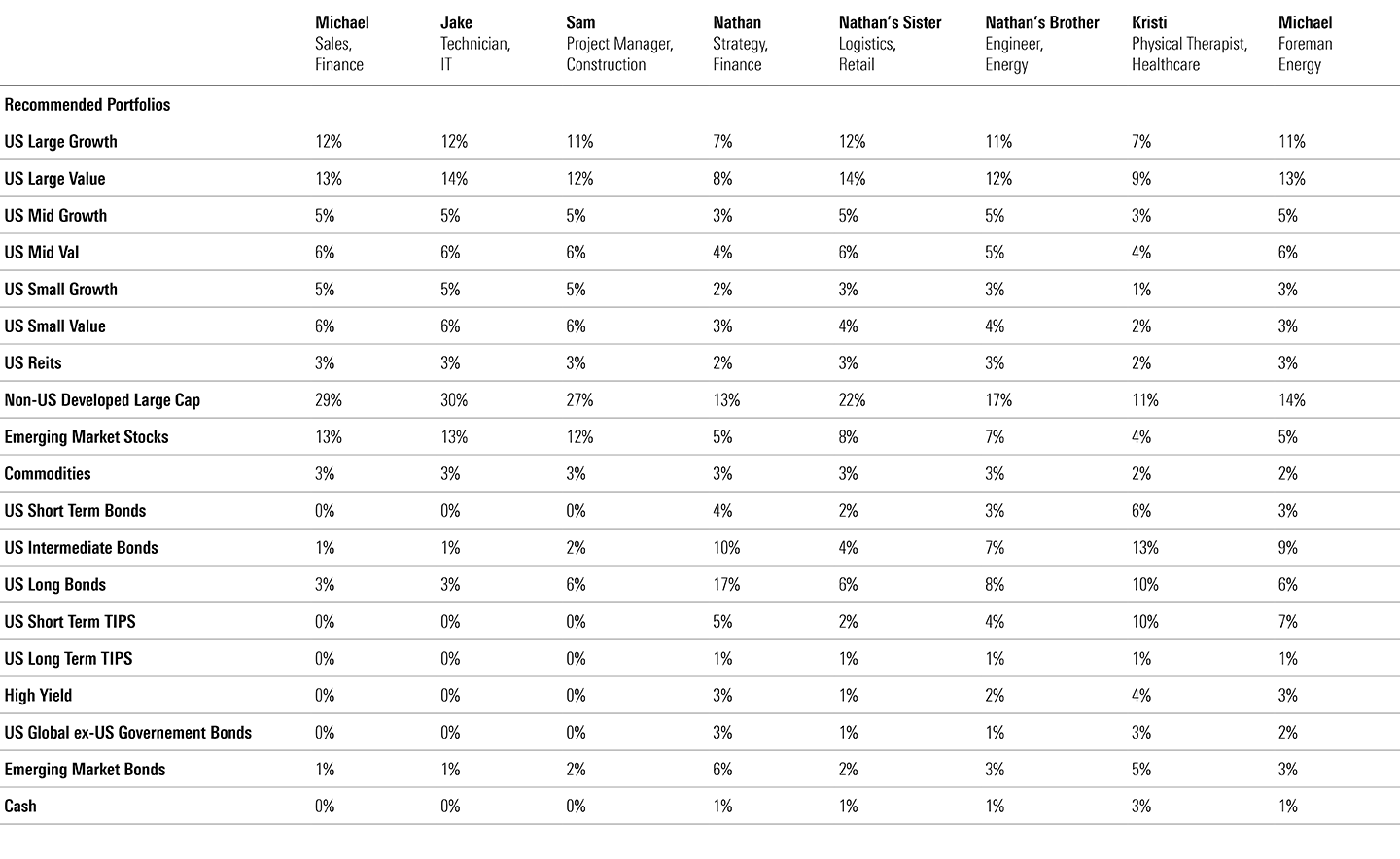

But we’ve never really applied that effort directly to ourselves and to our own families. So that’s what we did. We asked folks who have siblings that are within five years of one another to provide some estimated financial data about their families, just enough to replicate the data set utilized by the average recordkeeper when managed accounts are used as a qualified default investment alternative (QDIA).

The results show a wide variation in portfolio recommendations across the age bands of our sibling groups. Salary and account balance, as well as the presence of company stock and a pension, all play major roles in determining the optimal equity allocation. A significant level of personalization—based upon those key building blocks that drive financial advice—is present across the age groups. Even for the younger age cohort, we see a meaningful difference among allocations.

Sets of siblings or cohorts of retirement plan participants may be similar in age, but the unique dimensions of their financial life are essential components to determine the appropriate level of risk they can take while still being on track to meet their retirement goals. A similar idea applies to the holiday season: Different life variables and resulting customization are especially important at the North Pole. If Santa implemented an “age-only” analysis when determining what the children on his nice list receive, there would be many unsatisfied children unwrapping barbie dolls when they wished for G.I. Joes. Instead, Santa diligently reads letters from each child and tailors his gift based on all he knows. As a result, he achieves a high level of satisfaction at scale, a wonder to all his clients. By defaulting participants into a target-date fund when building a retirement plan design, plan sponsors choose to ignore many of the variables that make each participant unique. In doing so, participants may be misallocated which can lead to suboptimal outcomes and lower participant satisfaction.

If managed accounts and target-date funds were siblings, target-date funds would be showering in the basement, longing for the good old days and complaining to the risk-based models that managed accounts is the favorite.

Enjoy your holidays, and if you need a healthy distraction from family and stories of your youth, no better time than to start a new sibling rivalry and spread the joy of managed accounts in a retirement plan design!

Special thanks to my colleague Michael Levine for his expertise and support when writing this article.

©2023 Morningstar Investment Management LLC. All Rights Reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. Morningstar Investment Management LLC is a registered investment advisor and subsidiary of Morningstar, Inc. The information contained in this document is the proprietary material of Morningstar Investment Management. Reproduction, transcription, or other use, by any means, in whole or in part, without the prior written consent of Morningstar Investment Management, is prohibited. Opinions expressed are as of the current date; such opinions are subject to change without notice. Morningstar Investment Management shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information, data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Please note that references to specific securities or other investment options within this piece should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. The performance data shown represents past performance. Past performance does not guarantee future results.

This commentary contains certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.