3 min read

Morningstar’s 2024 Software Industry Outlook

The market is expected to grow by 14% this year.

.png?format=webp&auto=webp&disable=upscale&width=600)

Key Takeaways

Software companies are often moat-worthy businesses, largely driven by switching costs. It can be costly and risky for customers to switch vendors.

Software as a service (SaaS) has become the dominant software delivery model because of its superior economics and service.

We see total software revenue growing more than 10% annually through 2027.

While ESG risks aren’t pervasive, data security and privacy remain top issues.

Software is truly everywhere in the modern world. From streamlining workflows to making phone calls to following navigation routes in a car, the list continues—and so does the industry’s growth.

By understanding top industry trends, institutional investors can use investment tools to uncover the right strategies for clients’ portfolios. Our Morningstar analysts delve into the software industry, specifically market share and concentration, competitive advantages across different firms, future industry outlooks, and more.

To read the full research report, download a copy.

It’s All About Switching Costs

Moats in the software industry are largely driven by switching costs, with occasional support from network effects or even intangible assets. Once an application is installed, employees become proficient in it, and the client builds business processes around it. A classic example of this is a customer relationship management (CRM) system, which must integrate with e-commerce, inventory management, email, and more, and employees must learn how to use it. Every use case is different and requires different sets of application integrations.

Changing software applications, then, is more complicated than swapping vendors. It could involve significant time and expense to retrain employees, reimagine entire business processes, rebuild connections between applications, and possibly hire an outside consultant to complete any implementation.

SaaS is the Dominant Software Delivery Model

Since its introduction in 2000, the SaaS model has become the most pervasive software delivery mechanism. This is mainly because SaaS delivers better service for the customer via continuous and rapid updates to the software that are instantly available to all users. SaaS also offers superior economics through lower up-front costs for the customer and a more consistent and valuable revenue stream for the software provider.

From a cash flow and profitability standpoint, it takes several years for a SaaS model to equal and eventually surpass an on-premises model. SaaS payments start off smaller, but the model is more profitable, stable, and predictable over time.

The Software Market Should Remain an Area for Growth in the Future

Total software revenue is expected to grow more than 10% annually through 2027. The growth is derived from existing clients in the form of additional seats and new modules and from new vendors and new business formation. Pricing tends to be lumpy, as software vendors may raise prices by 10% once every three years rather than annually by 2% to 3%. 2023 was a busy year for price hikes, as vendors pulled that lever well above normal historical levels.

While Gartner provides widely followed software industry data, Morningstar’s bottom-up forecast is slightly less aggressive over the next two years, which we attribute to our view of heightened macroeconomic uncertainty lasting throughout 2024.

Data Security and Privacy Are Likely to Continue Being an ESG Issue

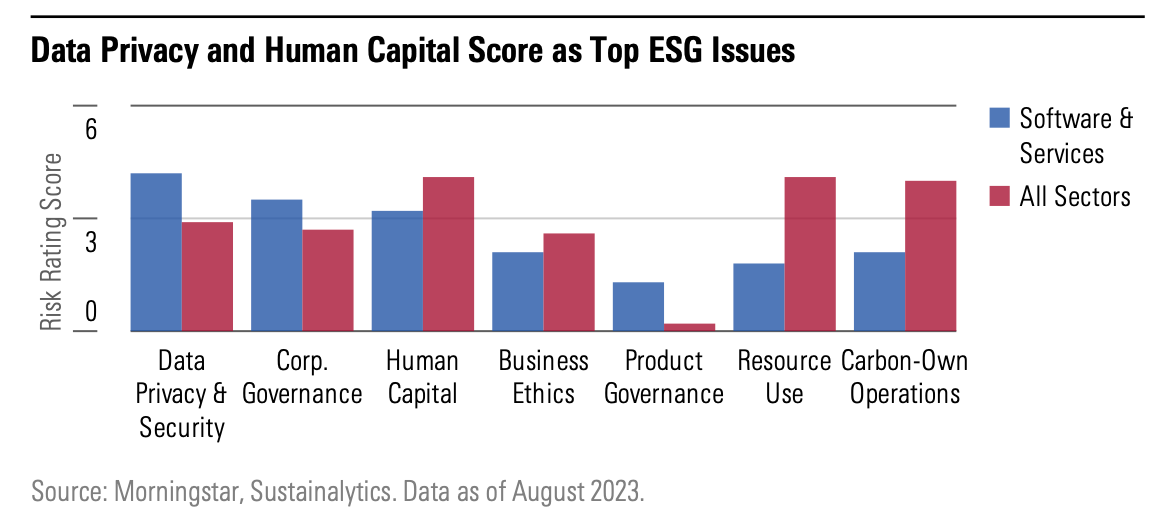

Most software companies have either low or medium ESG risk, which suggests that the industry is less risky than other sectors on average. One area of increased risk relative to overall market ESG Risk Ratings is human capital. In fact, the software industry’s exposure to this material environmental, social, and governance issue is high due to the complex skills that software engineers must possess to develop advanced capabilities such as AI.

Software has high exposure to data privacy and security issues, too. Due to software housing and using data, cyber attacks often target vulnerabilities within the code or design of the application itself. While there’s a risk that the software company suffers reputational damage, we have not seen this result in lasting financial damage to the vendor thus far.

Improve Client Relationships With Technology

In evolving market conditions, it’s important to make better decisions that reflect your clients’ goals. When you know the latest trends, you can deliver personalized solutions and show your value.

Gain access to the data and tools you need with PitchBook. Our award-winning software combines the power of data science with cutting-edge technologies to help you get actionable insights and discover opportunities.