5 min read

Morningstar’s Q1 2024 US Asset Managers Industry Pulse Study

The US equity market rally has erased the margin of safety needed to consider shares of the traditional- and alternative-asset managers.

Key Takeaways

The fourth-quarter rally in the US equity markets has pushed the traditional asset managers we cover closer to our fair value estimates.

Trading multiples for the traditional asset managers have recovered to more normalized territory following the late 2023 rally in the equity markets.

For the alternative-asset managers, the recovery in the US equity markets has pushed most of the group above our fair value estimates.

This has left the trading multiples for alternative-asset managers stretched despite a still-murky near-term outlook for the group.

As the financial landscape rapidly evolves, so do the challenges and opportunities that asset managers experience. Now that the US equity market is stabilizing, there’s little margin of safety left for investors looking at shares of both the traditional and the alternative asset managers, making it critical to understand the industry’s dynamics.

When you’re up to date on the latest Q1 2024 insights for the industry, it can improve your ability to financially empower clients and help them reach their goals. And amid the recent wave of asset manager layoffs, it’s more important than ever to stay up to date on industry trends. Our Morningstar research take an in-depth look at the unique challenges and opportunities for both the traditional and alternative managers.

To read the full research report, download a copy.

Outlook for Traditional Asset Managers

Even as the equity and credit markets recover, AUM growth will continue to be hampered by ongoing outflows from actively managed funds. Here’s what traditional asset managers need to know.

Recovery in the equity and credit markets has lifted near-term fortunes

While equities stumbled somewhat during the third quarter and first half of the fourth quarter last year, stocks (and US stocks in particular) rallied strongly during the final six weeks of 2023 and continued to gain steam in the early part of 2024.

We had been cautious coming out of third-quarter earnings season, but the markets turned quickly as the Fed shifted its short-term interest-rate policy from one of increases (to tame inflation) to one more focused on cuts sometime in 2024.

On the bond side, prices stabilized throughout 2023 as the Fed slowed rate increases, with credit-sensitive corners of the bond market outperforming as the economy has avoided a recession and continues to expand.

Fund flows, AUM growth, and share price performance track market returns

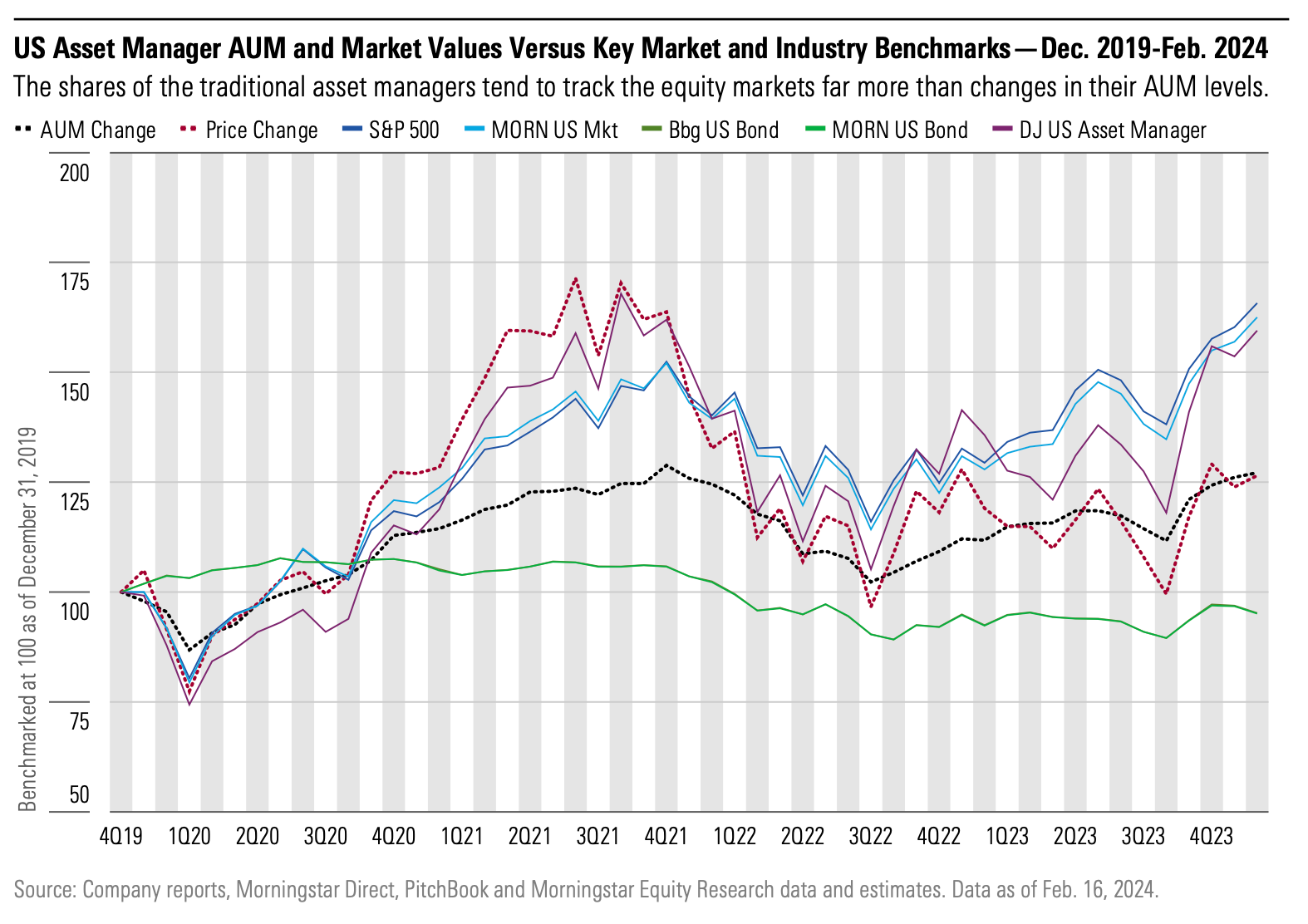

Having risen during much of 2020-21, share prices for traditional asset managers sold off during 2022 as both the credit and equity markets declined double digits. Despite the markets recovering, AUM growth will still be dragged down by outflows from actively managed funds—making the traditional asset managers more reliant on market gains in the future to drive AUM growth.

On top of that, revenue growth will not fully recover until the traditional asset managers see their AUM revert to pre-2022 levels, which in most cases won’t happen until 2024-25 (if not longer). With ongoing fee compression only adding to the drag on top-line growth, there will be a dampening effect on profit margins, given the operating leverage inherent in the business models of the traditional asset managers.

Fee compression continues to be a lingering issue

The traditional asset managers we cover have not seen their management fees decline as dramatically as the rest of the industry because they were already priced below average industry rates for active funds, putting less pressure on them to lower fees. We’ve also seen firms acquire or build offerings with higher fee points that are less susceptible to the growth of low-cost passive products, a trend we expect to continue in 2024.

BlackRock, T. Rowe Price, and Federated Hermes have seen below average levels of fee compression due to product mix shift, while Affiliated Managers Group, AllianceBernstein, Janus Henderson, and Cohen & Steers have been affected less by industry wide fee compression owing to the niche positioning of some of their core offerings.

Outlook for Alternative Asset Managers

The equity and credit markets need to not only improve, but also stabilize for fundraising, deployment, and harvesting activity to recover. For more information, dive deeper into our key considerations for alternative asset managers.

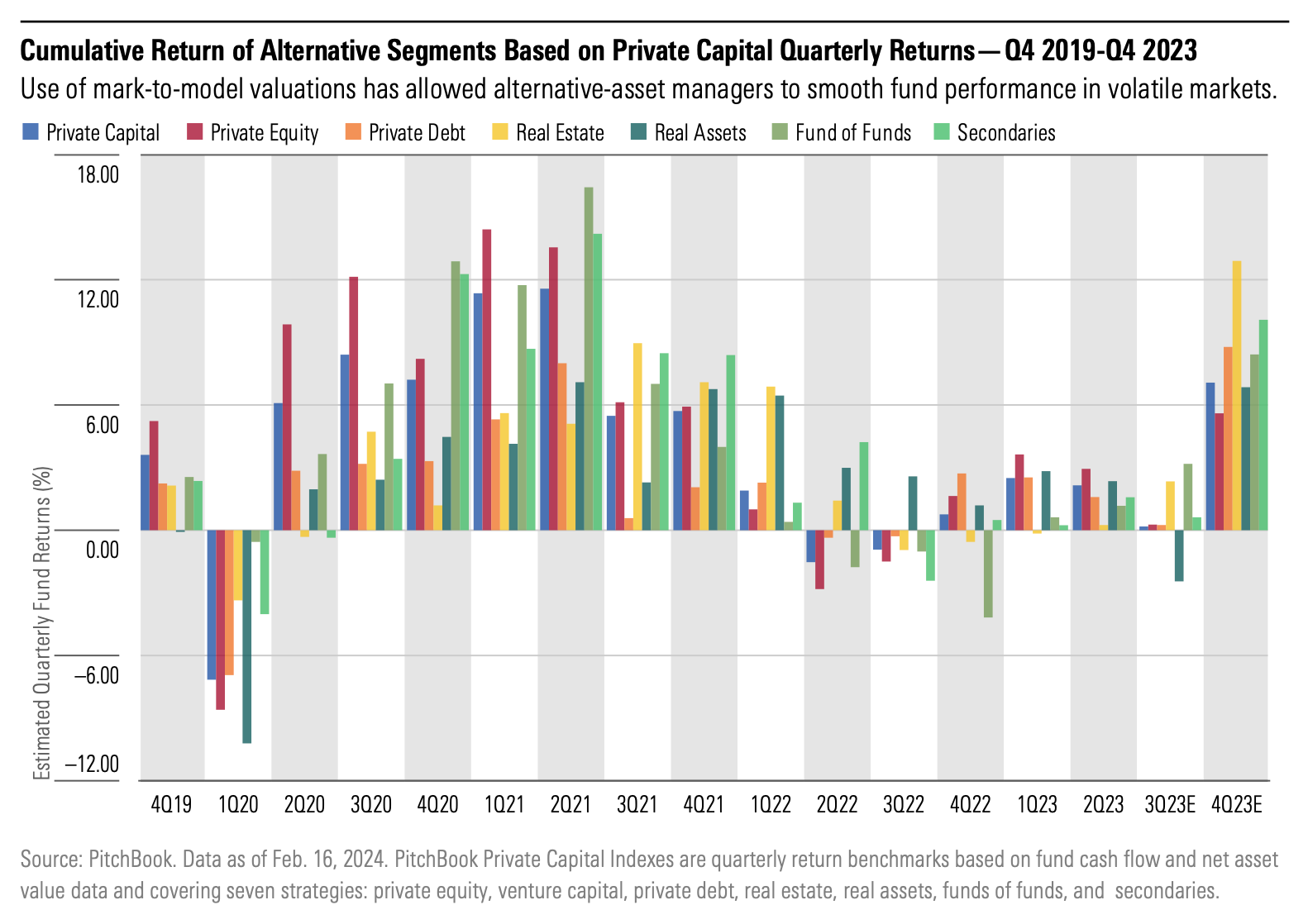

Mark-to-model valuations is helping smooth fund performance

Almost all alternative fund performance took off after the COVID-19 pandemic due to a combination of strong market returns and a huge fundraising and deployment cycle. Fund returns pulled back some in 2022-23, but the use of mark-to-model valuations helps smooth returns during more volatile markets like we saw during those years.

Still, the historical outperformance of alternative funds has not always translated into above-average stock performance. The hit that the shares of alternative managers took during the 2022 selloff demonstrated how highly correlated these stocks can be to market returns. We witnessed this again in late 2023 as the equity market rally drove alternative manager stocks significantly higher.

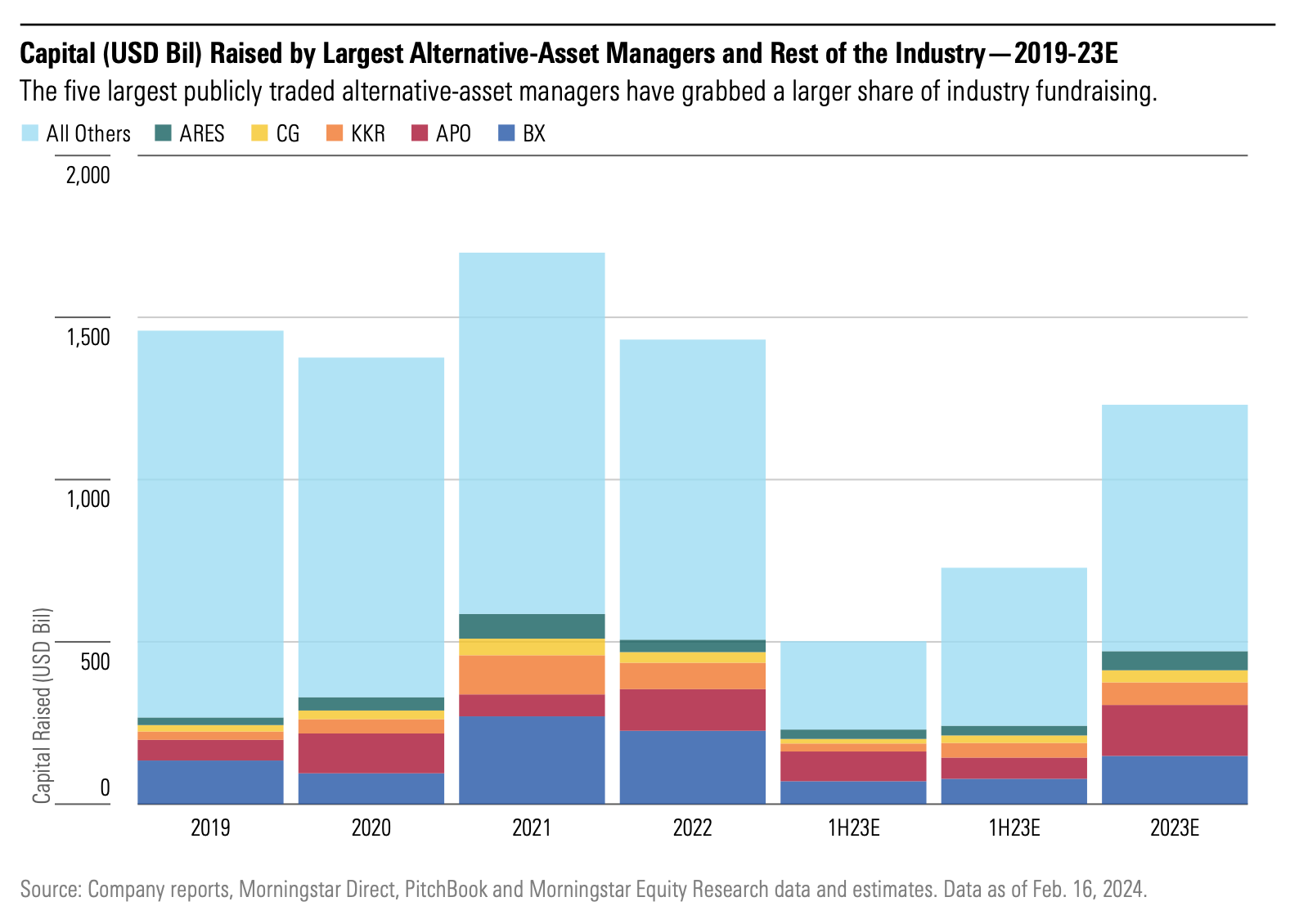

The five largest alternative-asset managers continue to capture a larger piece of the industry’s fundraising pie

Private equity remains the largest alternative-asset category and continues to lead fundraising efforts for the industry in terms of capital raised at the strategy level, accounting for 53% of total fundraising on average the past five years.

While 2023 fell short of being another record year of fundraising for the private capital markets, there was a meaningful uptick in the back half of the year. It would also mark the eighth straight year where annual fundraising exceeded $1 trillion. Much of this has been driven by the growing dominance of the five largest alternative managers—Blackstone, Apollo Global Management, KKR, Carlyle Group, and Ares Management—which continue to outraise their peers.

Alternative-asset managers are sitting on significant amounts of dry powder

With deployments slowing across the industry, the private equity category is expected to have closed out 2023 with $6.4 trillion in fee-earning AUM and $2.2 trillion in dry powder (compared with $6.2 trillion and $2.1 trillion, respectively, at the end of 2022).

Much like we've seen with fundraising, the five largest publicly traded alternative-asset managers have increased their share of both total capital invested and dry powder since the COVID-19 pandemic. At the end of 2023, these five firms—Blackstone, Apollo Global Management, KKR, Carlyle Group, and Ares Management—are expected to have accounted for 22% of total capital invested and held sway over close to 23% of the industry's dry powder, due in large part to their large fundraising haul during 2019-22.

Build Stronger Client Relationships

In a constantly changing asset management industry, it’s important for asset managers to stay ahead and demonstrate their value. When you know the latest trends, you can better support your clients.

Deliver quality investment solutions with Morningstar Direct. The comprehensive platform helps you with portfolio management for deeper insights and lets you show how your data-backed recommendations align with investor goals.