6 min read

Bridging Public and Private Market Data

A roadmap for broader coverage and deeper integration.

Key Takeaways

The shift from public to private equity markets has created a pressing need for better investment data.

Asset managers, institutional owners and high net worth advisors need broader coverage and better public/private data integration.

Needs include IDs, reference data, evaluated prices, private funds, sustainable investing, and benchmarks.

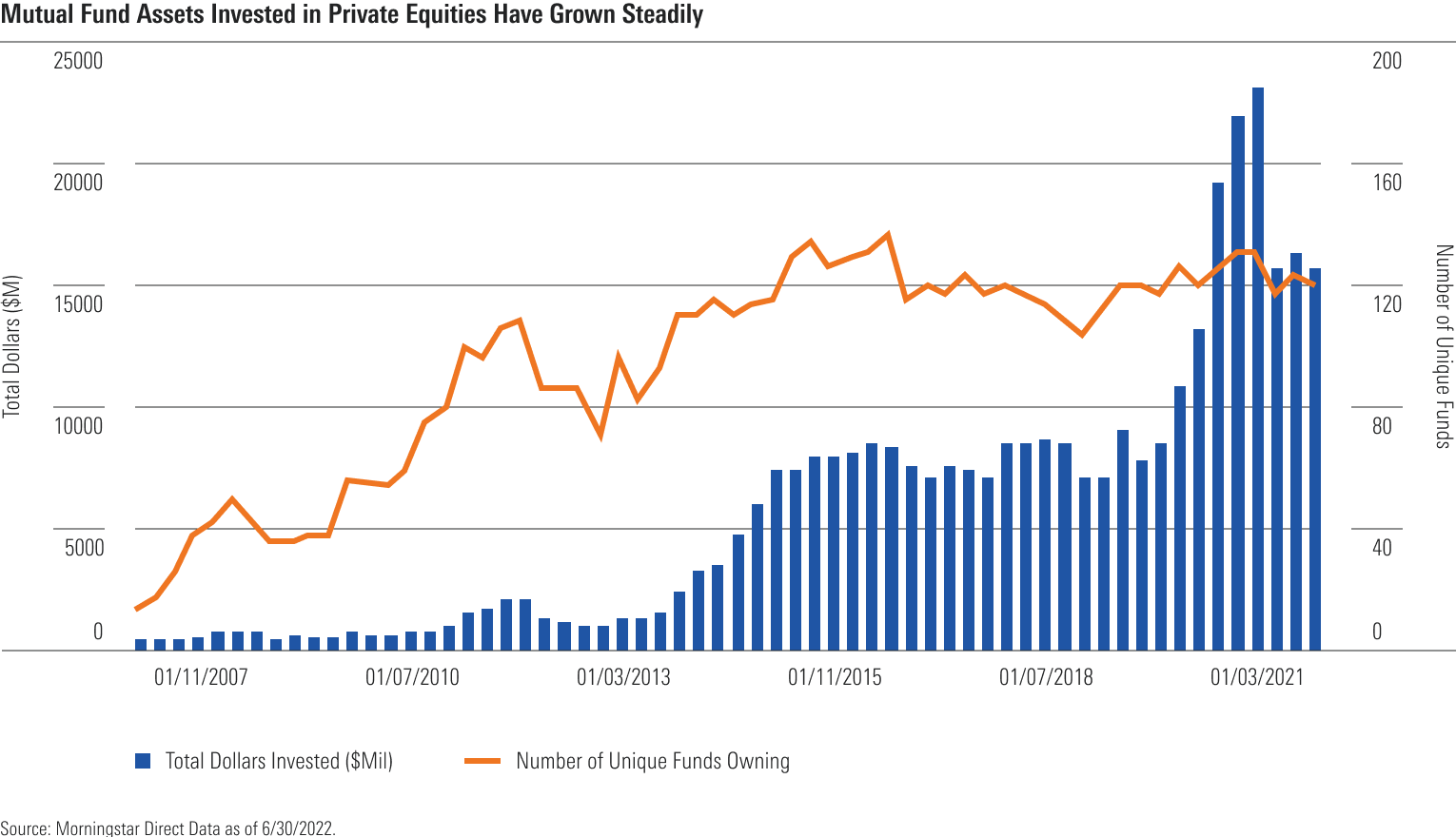

The shift from public to private equity markets has changed the landscape of investment opportunity. Private companies are staying private for longer, while the number of public companies has shrunk. Investor portfolios should reflect the changing landscape: institutional investors have made private market investing a staple of their portfolios (see chart). High-net worth individuals are following suit.

Asset managers, institutional owners and high-net worth advisors have an urgent need for better private market data. Risk and return analysis that would be routine for public market assets can be challenging and operationally complex in the private markets, where companies and funds are not subject to regulatory disclosure requirements. Alongside better data coverage, we also need private market data that supports integrated views across public and private investments. Asset owners and advisors need to understand risk and return at the portfolio level, and tomorrow’s portfolio is a public-private hybrid.

Building better private market data will be an industry-wide endeavor: we lack shared standards which, in the public markets, provide foundational infrastructure. We plan to be at the heart of this undertaking. Our mission at Morningstar is to empower investor success, and we are expanding the work we do to improve public-market data availability, transparency and comparability to the private markets as well.

In this spirit, we offer a private market data roadmap, noting progress where we at Morningstar have been able to make it.

1. Security IDs

Introduced in 1964 to simplify settlement, the humble CUSIP number is a unique nine-digit ID assigned to stocks and bonds in the U.S. and Canada. In the public markets, security identifiers serve as a kind of glue: they enable data portability and interoperability between vendors, data sets, IT systems and so on. Currently, there is no standard security identifier for private companies. Establishing one would improve information flows and reduce barriers to private market investing.

2. Reference data

Reference data are attributes, such as industry classifications, country codes or inception dates, appended to the security data record. Almost all publicly traded stocks worldwide have been assigned a Global Industry Classification Standard (GICS) code, which encodes a four-level industry classification taxonomy. Thanks to the near-ubiquitous adoption of this standard, investors can easily analyze sector, industry and sub-industry concentration risk. We have nothing like GICS for private market investing.

Pitchbook, a Morningstar company, appends industry verticals, country classifications, inceptions dates and more to our version of a private-company security ID. (Although some third parties have adopted Pitchbook’s security ID, we have a way to go before we can declare it an industry standard.)

Pitchbook’s industry classification system is two-dimensional. We assign industry codes that we have harmonized with the public markets, providing better data integration at the portfolio level. We also assign privately-held companies to 141+ “emerging spaces”—nascent but growing areas of thematic investment like psychedelics and long-duration energy storage that might one day become industries.

3. Evaluated prices

In the public markets we can track intraday prices by the second. The U.S. Financial Accounting Standards Board classifies private equity as Level 3 securities—financial assets that are the most illiquid and hardest to value.

Investors and service providers need reliable prices to value portfolio holdings. Prices must be based on a sound valuation process which satisfies regulators and gives investors’ confidence. There is a cottage industry of third-party valuation services who offer pricing for individual securities at a price point that is out of reach of most investors.

4. Private funds data

Asset owners and advisors want to be able to run aggregate risk and return analysis across both public and private portfolio holdings. Returns data for private-equity and venture-capital funds are generally available on a quarterly basis, meaning that at any point in time, returns data is at best from the prior quarter. (In practice, lag times can be longer, reflecting the pricing and data collection process: net asset values are established through third-party valuations and are collected from both fund managers and their institutional investors.)

Pitchbook publishes private funds returns data, as well as operational and reference data such as the fund’s contact details, investors, information on past deals, strategy, and industry, sector or geographical investment preferences. The next step is to normalize and integrate this private market data with public securities datasets so that asset owners can better construct and analyze public-private portfolios holistically—albeit, with a lag.

5. Data for sustainable investing

Investors have a wealth of ESG data on public companies they can use to better assess risk or invest for impact, and sustainable investment data has begun to expand beyond listed equities. Private-equity ESG data supports pre-investment due diligence, portfolio monitoring for emerging risks, and proactive decision-making to address reputation events.

Further progress is likely to be slow. Sustainable investment data tends to be idiosyncratic: it can be hard to identify patterns across industries, sub-industries or other company peer groups. Without this commonality, the data must be built company by company.

6. Benchmarks

Indexes help investors understand market structure and risks, benchmark investments, and make asset-allocation policy decisions. Better benchmarks would bring greater efficiencies to private market investing and provide investors with the consistent, comparable information they need to make informed investment decisions.

Pitchbook has published quarterly benchmarks for private-fund performance since 2017. Last year, we began publishing Pitchbook Private Capital Indexes spanning private equity, venture capital, real estate, real assets, private debt, funds of funds, and secondaries funds.

In 2023, we launched the Morningstar Pitchbook Global Unicorn Indexes, which create a benchmark for late-stage venture-backed companies with valuations of over $1 billion. Following explosive growth in the past decade, there are more than 1,300 unicorns worldwide, representing $4.5 trillion in aggregate market value.

Indexes are calculated once a day at the close of public markets in the U.S. using a proprietary pricing model. (The market price for a privately held company is established during funding rounds, which can occur 18 months or more apart.)

Morningstar’s pricing model includes three factors:

Past deals factor: price data from the subject company’s prior funding rounds.

Private comparable factor: price data from VC deals involving privately-owned companies that are similar to the subject company.

Public comparable factor: price data from a Morningstar Thematic Index representing the performance of a global public market industry we have mapped the subject company to.