3 min read

How to Flag Investment Style Drift With the Risk Model

Why we downgraded one of Matthews Asia’s biggest funds.

Like the Morningstar Style Box, the Morningstar Global Risk Model can reveal drift in a portfolio’s style, as measured by stocks’ sizes and value-growth characteristics. It goes further, though, by estimating exposures to an additional five factors that also help discern whether a strategy delivers what it promises.

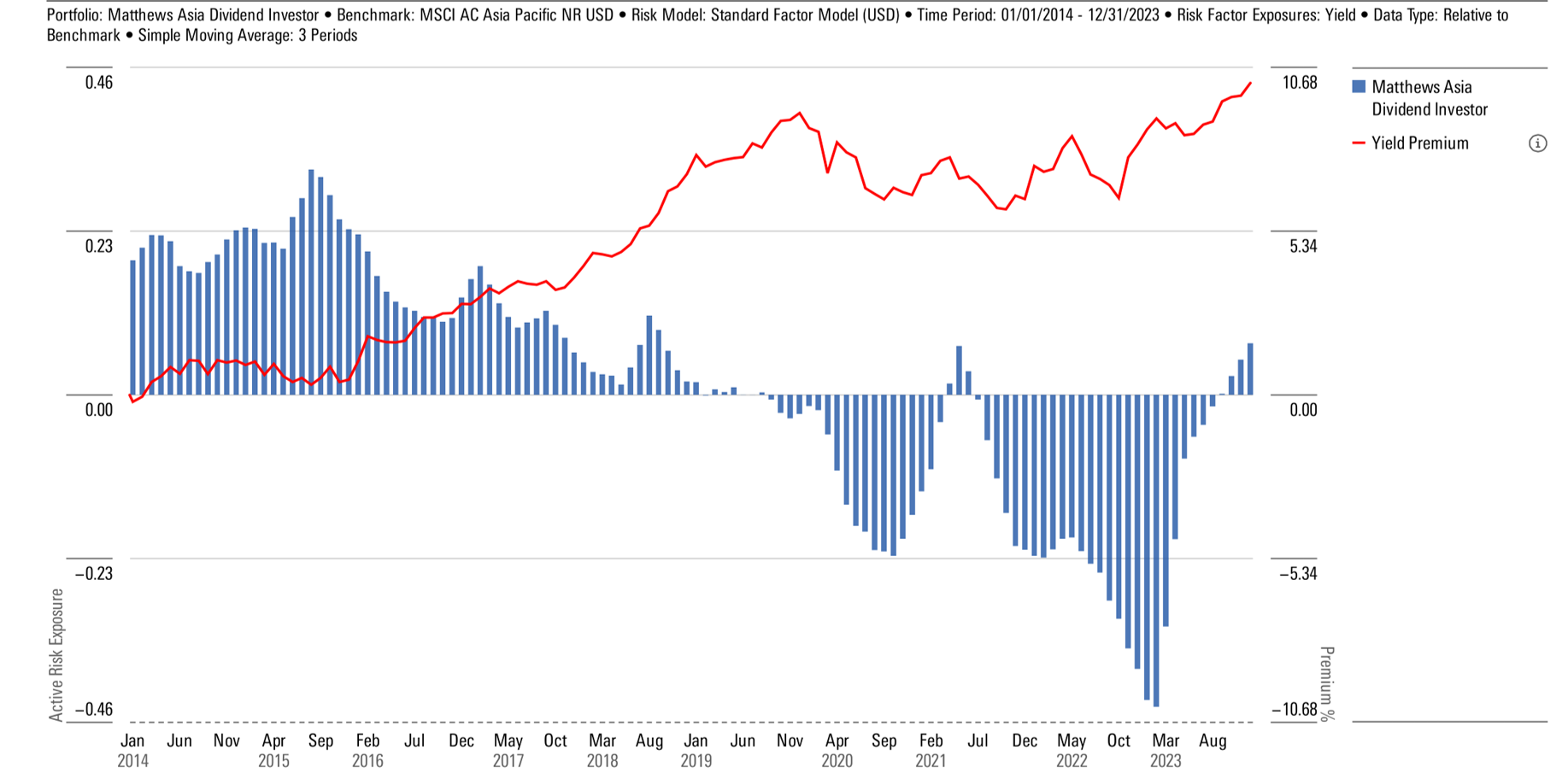

As of mid-2022, the risk model suggested Matthews Asia Dividend MAPIX was failing to meet its own objectives. On paper, the strategy sets out to provide a dividend yield exceeding that of an Asia-Pacific-focused index fund and to temper the volatility and downside of its total returns. It consistently achieved these goals in its early years, but its profile shifted after a 2018 lead manager handoff, and by mid-2022 it bore little resemblance to its pre-2017 self.

The risk model’s Multiple Risk Exposures or Historical Risk Exposure components, which estimate a portfolio’s current or historical factor exposures, supplied the evidence. They help answer these questions:

- What are a portfolio’s absolute factor exposures?

- How do the exposures compare to a benchmark?

- In either the absolute or relative sense, how have those exposures shifted over time?

Analyzing the Evidence with the Risk Model

As of mid-2022, did the portfolio’s average total yield (dividend yield plus share repurchases) exceed those of its prospectus benchmark’s? The Historical Risk Exposure component’s column chart suggested it did not.

Shifts in yield exposure

The portfolio’s yield exposure was 0.20 or more standard deviations below the index’s for a multiyear period, according to the model. (A difference of 0.15 standard deviations often makes a big difference in relative performance.)

Source: Morningstar Direct.

Shifts in quality and volatility exposure

Prior to 2017, the fund’s risk profile was relatively mild. It routinely provided some resilience during severe market pullbacks and often lagged in euphoria-driven rallies.

This tends to be how portfolios focused on stocks with low price-volatility or high quality behave. Indeed, that often described this portfolio well prior to 2018.

But things changed as the portfolio tilted more toward growth stocks and away from companies with high margins, juicy dividend yields, and modest debt.

Source: Morningstar Direct

While the volatility premium has remained negative since 2014, the blue bars show how the managers' strategy shifted. In mid-2016, the fund began increasing active risk exposure. In mid-2023, the fund trimmed exposure relative to the benchmark.

Source: Morningstar Direct

Implications and Aftermath of Investment Style Changes

Following these moves, the fund’s total returns became much bumpier—even more so than the index’s—and its downside protection less reliable. Rather than outpacing the market in environments favorable to stocks paying hefty dividends, it has instead fared better when dividend-light stocks outperformed.

Source: Morningstar Direct.

In early 2023, Matthews International Capital Management replaced its leadership with managers who promised to reorient the portfolio toward the higher-yielding, lower-risk fare it emphasized before. Based on the fund’s most recent portfolios, the risk model helps confirm that they have.