We looked at if gender affects investment performance. Here's what we found.

By Madison Sargis and Kathryn Wing

Fund Managers

By Madison Sargis and Kathryn Wing

Read Time: 3.5 Minutes

If you had any lingering doubts about whether the gender of fund managers affects investment performance, our latest study shows that it empirically doesn’t.

We know that women are underrepresented in the fund industry. Morningstar began formally studying fund managers by gender in 2015 to better understand where women have made progress or stepped backward within the fund industry.

Some facts and figures stood out to us.

From 1990 to 2017, the distinct number of U.S. active equity and fixed-income funds grew from about 1,900 to roughly 8,500. Simultaneously, the number of fund manager positions increased. But for most of the last three decades, the growth in portfolio manager jobs has disproportionally benefited men.

Men have captured nearly all the newly created roles—about 85-90%. And women have failed to make significant gains.

We set to answer two distinct questions:

To answer this, we created two datasets: one designed to track fund performance and the second designed to track manager performance. For both datasets, we applied the same industry standard performance tests: regression, portfolio-based tests, event study.

As a result, we believe we have a holistic view of the impact of gender diversity on investment performance. You can find our full results in the paper “Fund Managers by Gender – Through the Performance Lens.”

In our study, we find that performance does not explain the low participation rate of women in the fund industry. And the idea that men have outperformed was not supported in the data either. Plus, as is discussed further in the paper and below, we believe we can find some indication that the industry might be better off with more women at the helm of funds.

In our study, we tackled the hypothesis that men produce superior performance when it comes to managing funds. Using that as our framework, we expected to find that funds exclusively run by men would outperform funds run by mix-gender teams, and that funds run by women would be the least successful.

Similarly, managers who are men would outperform managers who are women. However, we found clear evidence to reject this hypothesis. We tested this theory in three ways, which all point to this same conclusion: We do not find a performance difference based on a fund manager's gender.

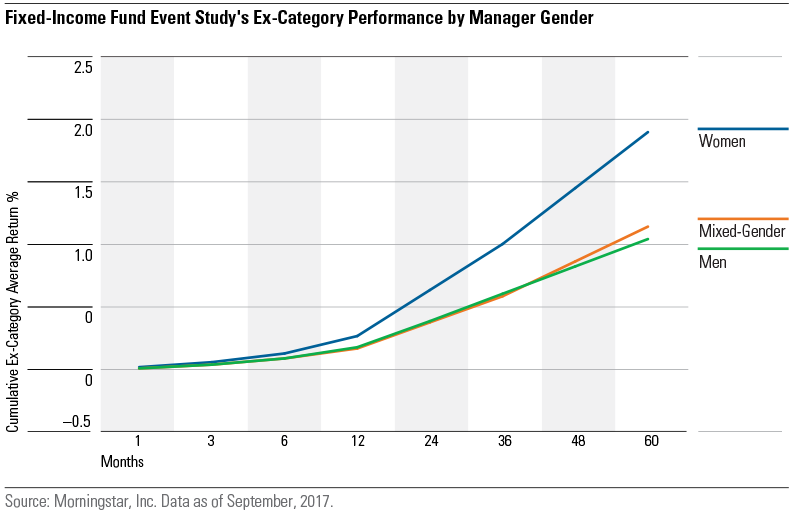

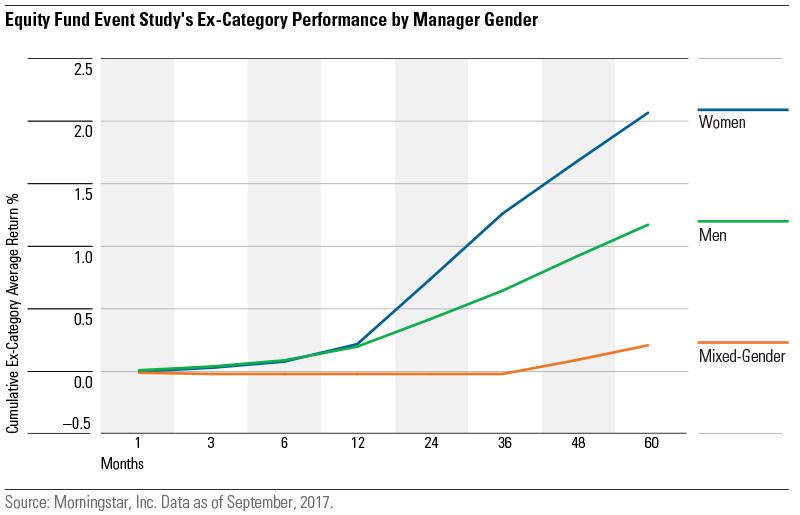

In one of our tests, which is illustrated below, an investor who picks a fund based solely on the manager’s gender could see better results with all-female fund teams in both equity and fixed-income asset classes.

For illustrative purposes only. Access the full research details here.

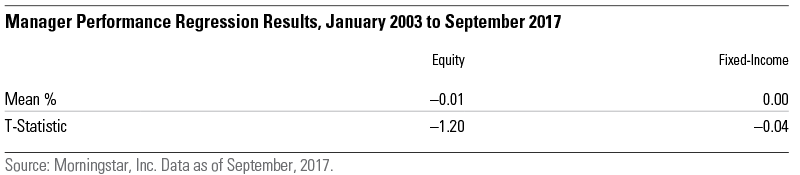

In our study, we also controlled for certain known drivers of fund returns to evaluate this hypothesis that men outperform women. But the results showed that gender has no statistically significant difference for managers in either equity or fixed-income asset classes.

We recognize that studying fund manager performance by gender is a polarizing topic. Our goal isn’t to estimate a manager's performance potential based on gender. Rather, we wanted to see whether performance explains why the participation rate of female fund managers has declined.

In effect, we are asking: Would the industry perform worse with more female fund managers?

If there’s no overall persistent difference in investing with men over women in terms of fund performance, then investment skill is not a sufficient justification for the lack of women in fund management positions.

We plan to continue exploring the topic of fund management diversity—whether that research is focused on gender or educational background, such as advanced degree types or professional certifications. We hope our conclusions could be used raise awareness and to further conversations of diversity within the fund industry.

This research was conducted using Morningstar Direct. If you’re a user, you have access. If not, subscribe for a 14-day free trial.

Important Disclosure

The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission