5 Asset Managers Earn Upgraded ESG Commitment Level Ratings

Fidelity International, Janus Henderson, and the other managers who have improved their use of sustainability factors.

More than ever, sustainability-focused investors should be discerning when selecting asset managers as ESG integration practices, resources, and active ownership activities can vary significantly. Morningstar has upgraded the ESG Commitment Levels for several large European asset managers, including Fidelity International, Janus Henderson, Pictet, Man Group, and Comgest.

Many firms have improved their practices over the past couple of years, raising the bar for the industry overall. Some have ramped up their efforts faster or to a greater extent than others, and this is reflected in the higher number of firms that have seen their Morningstar ESG Commitment Levels upgraded in our latest review.

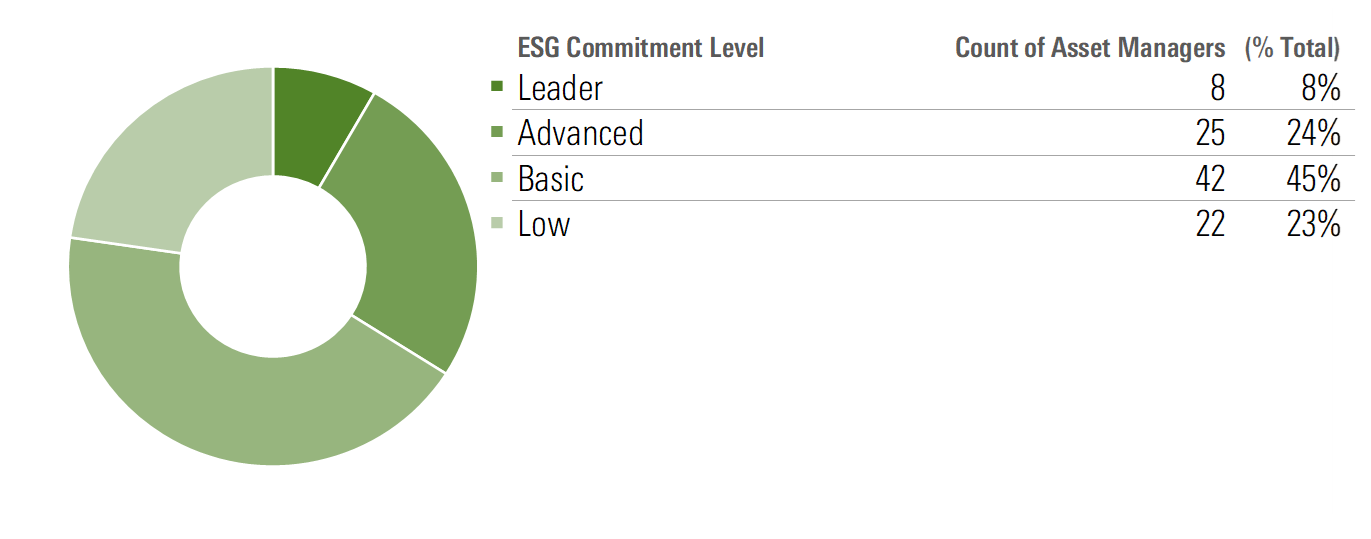

The Morningstar ESG Commitment Level is a qualitative rating that expresses our analysts’ assessments of asset managers’ determination to incorporate environmental, social, and governance factors into their investment processes and deliver sustainability outcomes, relative to peers. The ESG Commitment Level aims to help investors with their asset-manager due-diligence process. The scale runs from best to worst as follows: Leader, Advanced, Basic, and Low.

In our latest review of 12 asset managers, we upgraded the following five managers:

- Comgest—to Advanced from Basic

- Fidelity International—to Advanced from Basic

- Pictet—to Advanced from Basic

- Janus Henderson—to Basic from Low

- Man Group—to Basic from Low

We initiated Nordea’s ESG Commitment Level at Advanced, and the following six managers maintained their ESG Commitment Levels:

- Amundi, HSBC, and Jupiter retained ESG Commitment Levels of Advanced.

- Baillie Gifford, Eventide, and Ninety One maintained ESG Commitment Levels of Basic.

This brings our total ESG Commitment Level coverage to 97 firms. A third of these asset managers now earn Morningstar ESG Commitment Levels of Advanced or Leader, while the largest group of firms—45%—receive ESG Commitment Levels of Basic and 23% earn levels of Low. This distribution reflects the variety of the marketplace, which includes large, diversified asset managers as well as sustainability-focused firms.

Asset Managers by ESG Commitment Level

Upgrades and Downgrades

The pace of change in sustainable investing over the past several years is quite something to behold. Although demand for products focused on environmental, social, and governance issues has tapered in some markets, investor interest in sustainable investing remains high overall. There is broad recognition that sustainability issues, including climate change, should be considered in all investment processes as they represent both investment risks and opportunities. Furthermore, with new and pending disclosure regulation in many parts of the world, such as the European Union’s Sustainable Finance Disclosure Regulation, or SFDR, which came into force in March 2021, the recently released Sustainable Disclosure Requirements in the United Kingdom, and the upcoming SEC-enhanced disclosures about ESG investment practices, buttoning up internal processes for and external messaging around ESG considerations have become compulsory for investment management firms rather than a nice-to-have.

Most asset managers have responded to these trends by investing in people, data, research, and training, resulting in enhanced ESG integration processes, more corporate engagement, and heightened disclosure, among other positive outcomes. The vast majority of firms have improved their practices, which has raised the bar for the industry overall as well as for our ESG Commitment Level evaluations.

That said, some firms have ramped up their efforts faster or to a greater extent than others and relative to where they were when we started assessing them a few years ago. Examples include Fidelity International, Pictet, and Comgest, which earned ESG Commitment Level upgrades to Advanced from Basic.

Other firms that we recently reviewed have similarly made investments in people, processes, and stewardship, but this progress hasn’t been enough to warrant a change in their respective ESG Commitment Levels. This was the case for Eventide, Baillie Gifford, and Ninety One, which stayed at Basic, as well as for Amundi, HSBC, and Jupiter, which maintained ESG Commitment Levels of Advanced.

For further detail, read the report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)