Global ESG Funds Hit With Outflows for First Time in Q4

European ESG funds drew money in 2023 despite challenging macro, redemptions in active funds.

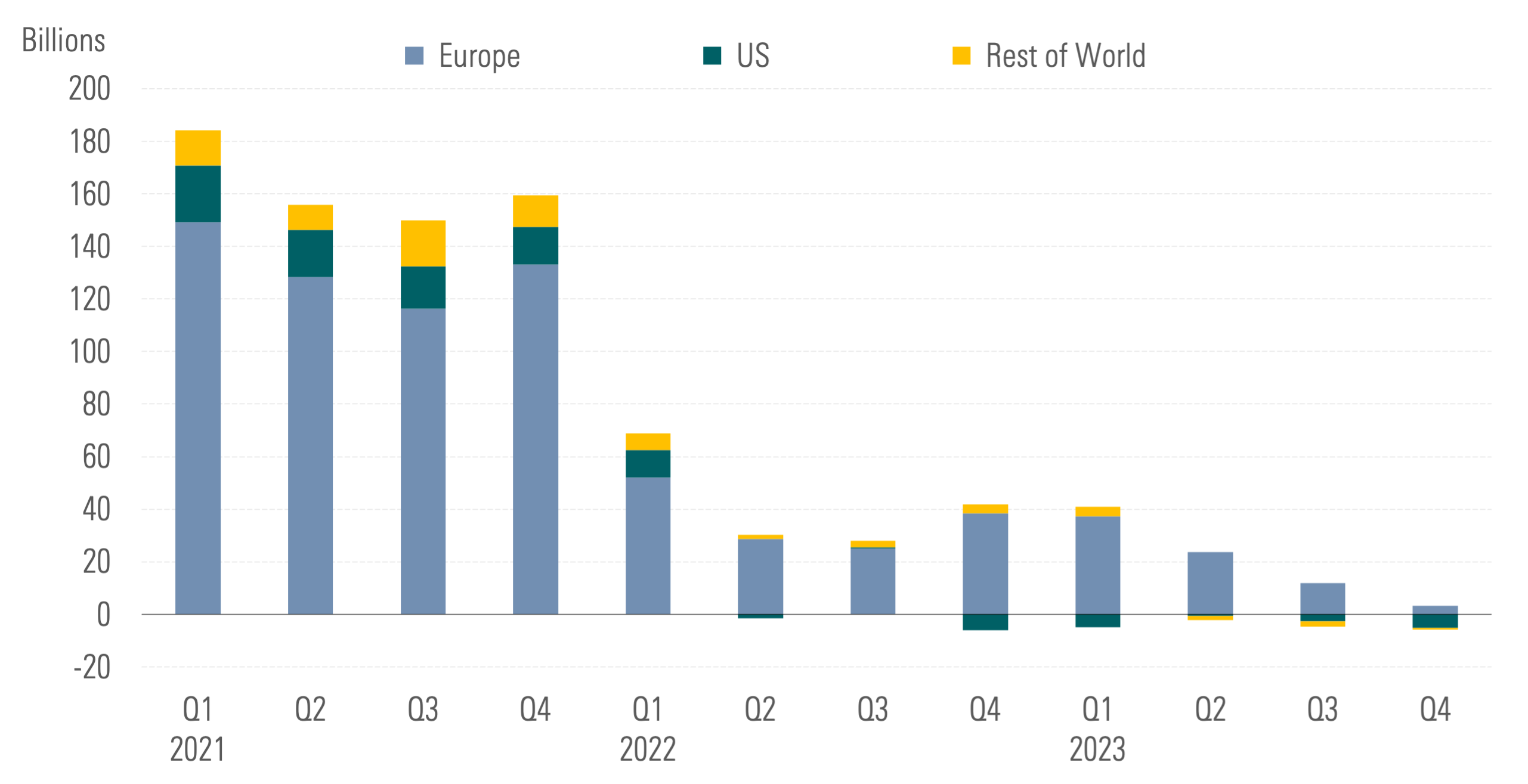

The global universe of sustainable funds, or funds that use environmental, social, and governance approaches, saw redemptions of close to $2.5 billion in the last quarter of 2023, which was the first time that net flows fell into negative territory. At the same time, the broader market of open-end funds and exchange-traded funds also suffered withdrawals against a continuously challenging macroeconomic backdrop of enduring inflationary pressures, rising interest rates, and lingering recession fears. Over the entirety of 2023, however, global ESG funds still gathered $63 billion.

ESG Fund Flows

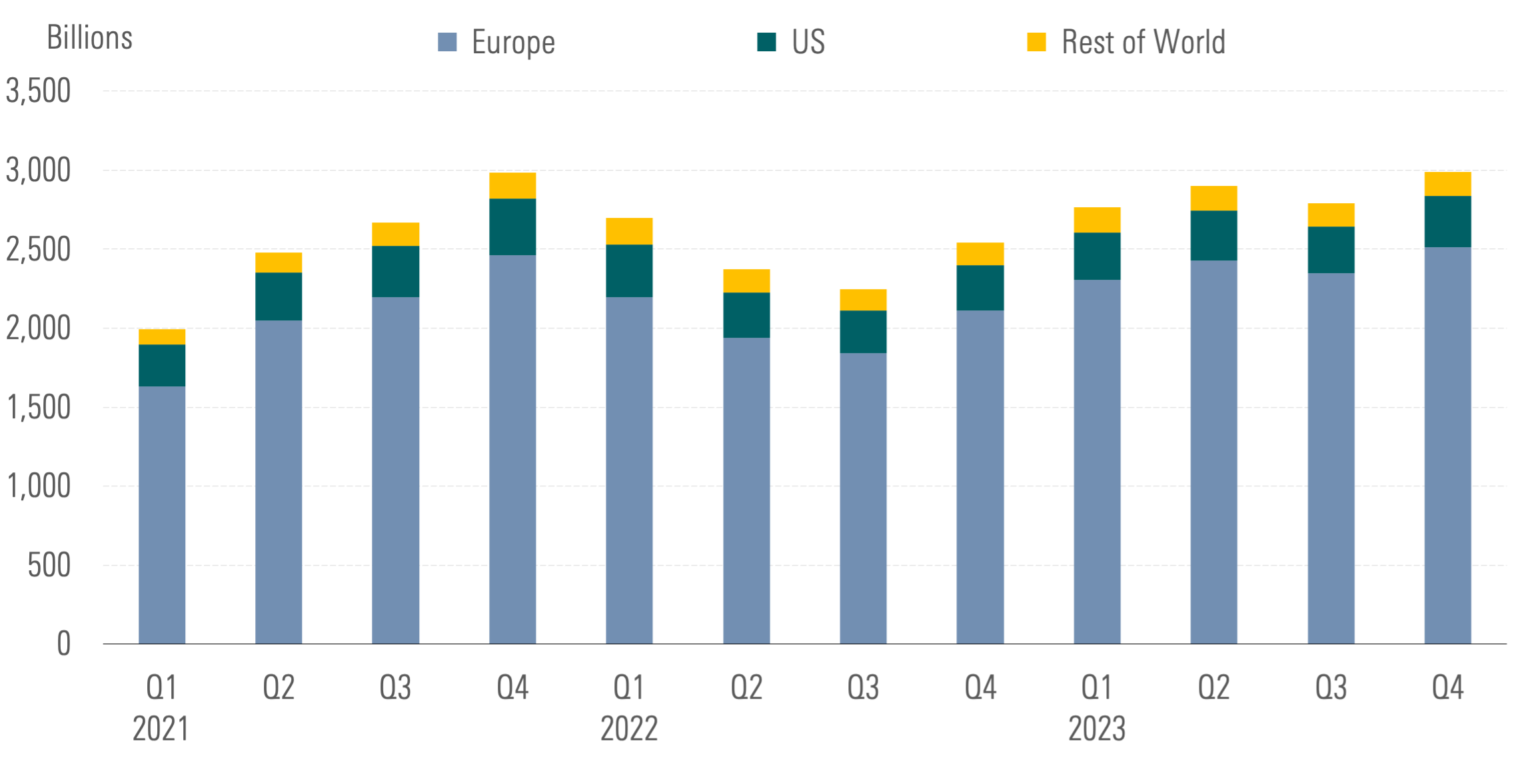

Global ESG Fund Assets Rose in the Fourth Quarter

Globally, ESG fund assets rose by 8% in the fourth quarter to nearly $3 trillion, supported by stock and bond price appreciation. For context, the Morningstar Global Markets Index gained 11.2% in the fourth quarter and 22.1% for the full year. The fixed-income markets, represented by the Morningstar Global Core Bond Index, also advanced by 8% in the last quarter, extending the year-to-date gain to 5.2%.

Quarterly Global ESG Fund Assets ($Billion)

Europe

Europe—by far the world’s largest ESG fund market—continued to experience inflows, albeit very low by historical standards, at $3.3 billion in the fourth quarter.

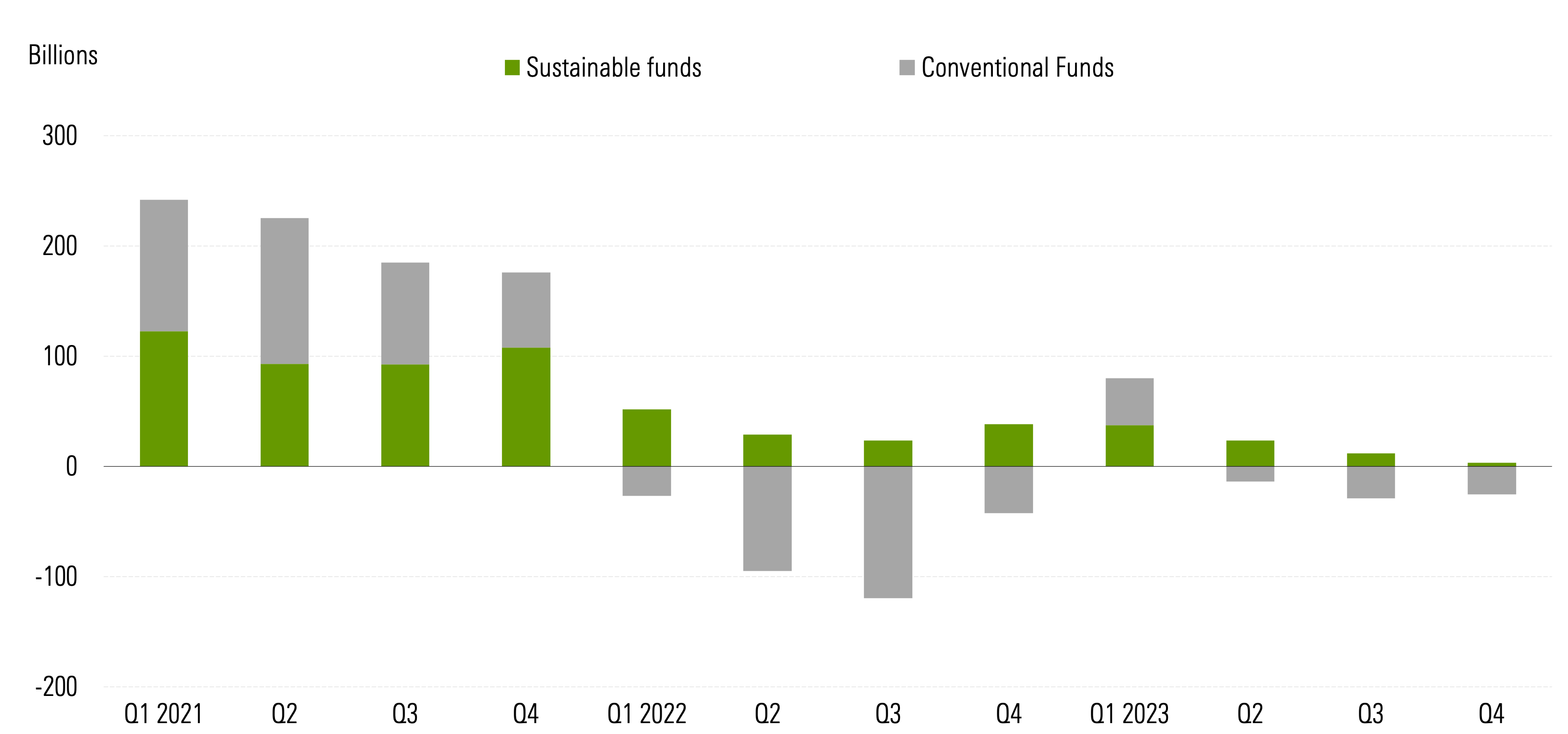

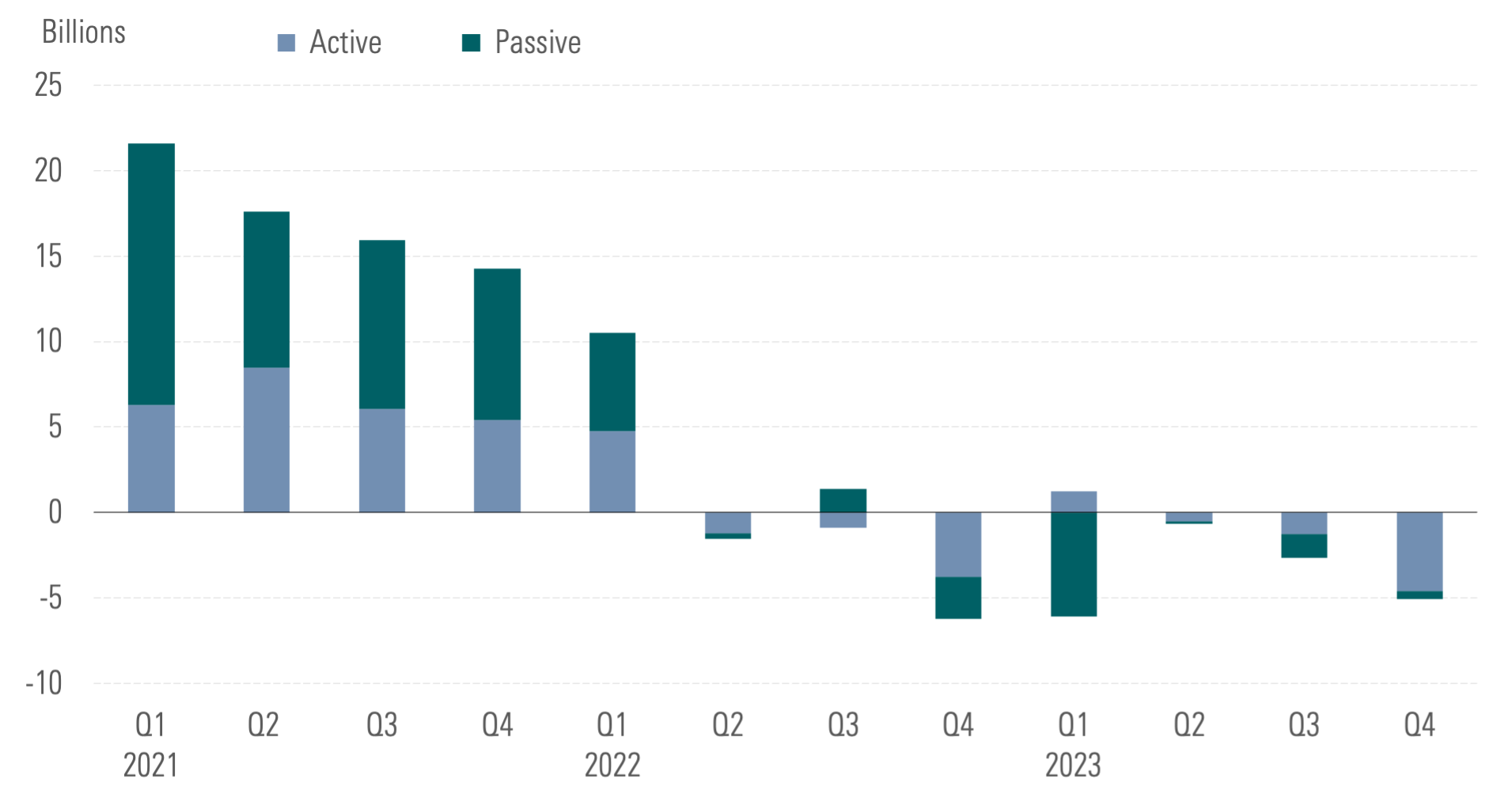

The decline in subscriptions was entirely attributable to actively managed ESG strategies, which bled close to $18 billion in the last quarter. On the other hand, passive investment strategies demonstrated consistent resilience, attracting net new money of $21.3 billion. Still, ESG funds fared better than the European conventional funds, which bled $25.4 billion in the past three months.

ESG Fund Flows Compared With Conventional Fund Flows ($Billion)

Other factors also contributed to the lower inflows into ESG funds in Europe last year, such as the challenging macroenvironment. Among other implications, high interest rates have led investors to favor government bonds, an area that has limited ESG products because ESG integration remains challenging in that corner of the fixed-income market.

Also, it is fair to assume that some investors took a more cautious approach to ESG investing last year in the wake of the 2022′s underperformance of ESG and ESG strategies that was partly due to their typical underweighting in traditional energy companies and overweighting in technology and other growth sectors. While the technology sector rebounded in 2023, other popular sectors in ESG strategies continued to underperform. Renewable energy companies, for example, have been particularly affected by soaring financing costs, materials inflation, and supply chain disruptions, among other issues.

Additional factors weighing on investor demand for ESG funds include greenwashing concerns and the ever-evolving regulatory environment. The wave of fund reclassifications to Article 8 from 9 under the Sustainable Finance Disclosure Regulation in late 2022, and other issues related to the implementation of the regulation, have caused confusion among investors and other market participants.

United States

Investors pulled $5 billion from U.S. ESG funds in 2023′s fourth quarter, for a total of $13 billion over the past year. Most of the redemptions came from actively managed ESG funds, which shed $4.6 billion during the fourth quarter.

U.S. ESG Fund Flows

In addition to the challenging macro environment, middling returns, and persistent greenwashing concerns, the continued politicization of ESG investing in the United States contributed to a chilling effect on demand for ESG funds. Despite outflows, and although ESG equity funds tended to lag their conventional peers in terms of 2023 returns, market appreciation carried U.S. ESG fund assets higher to $323 billion at the end of the year.

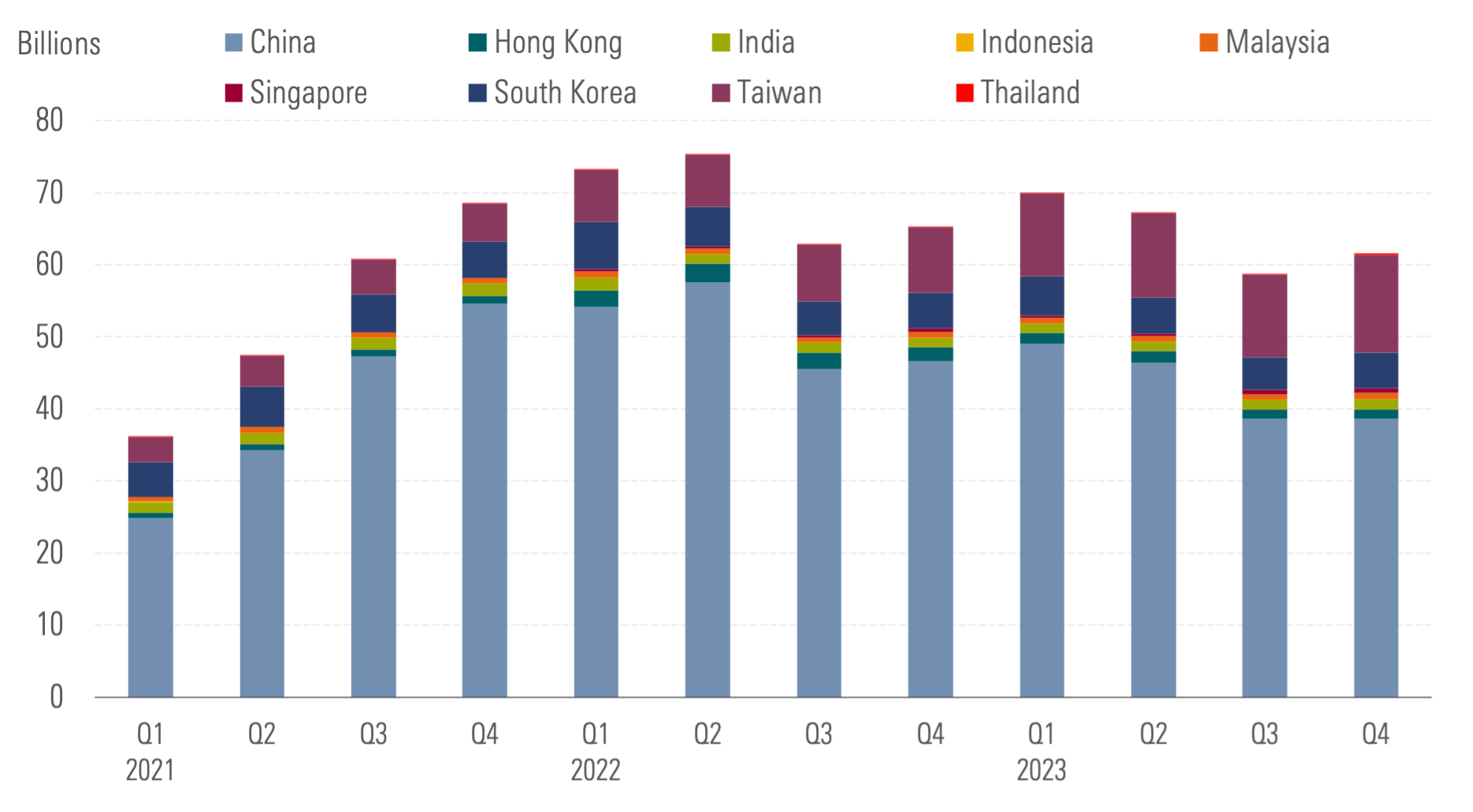

Asia ex-Japan

Excluding China, the Asia ex-Japan region recorded net inflows of roughly $1.4 billion over the fourth quarter. The highest inflows came from Taiwan-domiciled ESG funds.

Asia ex Japan ESG Fund Assets ($Billion)

Total assets in ESG funds across Asia ex-Japan climbed 5% quarter over quarter to $61 billion. Outside of China (for which data was not available at the time of publication), Taiwan continued to lead, housing 22% of the region’s assets. ESG fund assets in Taiwan grew by nearly 50% over the year to reach $13.6 billion at the end of 2023, helped by the great performance of the local market and its technology sector (the MSCI Taiwan Index was one of the best-performing indexes in the region in the fourth quarter of 2023, returning 17.5%, while the MSCI ESG Leaders Index gained 18.4%).

Assets in Thailand-domiciled ESG funds, meanwhile, experienced a sharp increase in the fourth quarter of 2023, from $75 million at the end of August 2023 to $236 million at the end of December 2023 thanks to a series of fund launches. Despite experiencing outflows, India’s ESG fund assets increased by 5.3% to $1.4 billion. Positive market performance across the region helped support the growth in ESG fund assets.

To check out the full report on fourth-quarter Global ESG Fund Flows, click here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)