ESG Asset Manager Impax Is Down. Is It Worth 50% More?

What could drive Impax shares? Global warming, ‘authenticity,’ and sheer cheapness.

Shares of U.K. asset manager Impax Asset Management are in the doldrums. They are worth a lot more, fans say, and could be lifted by a revival of interest in climate-related investing.

What Is Impax?

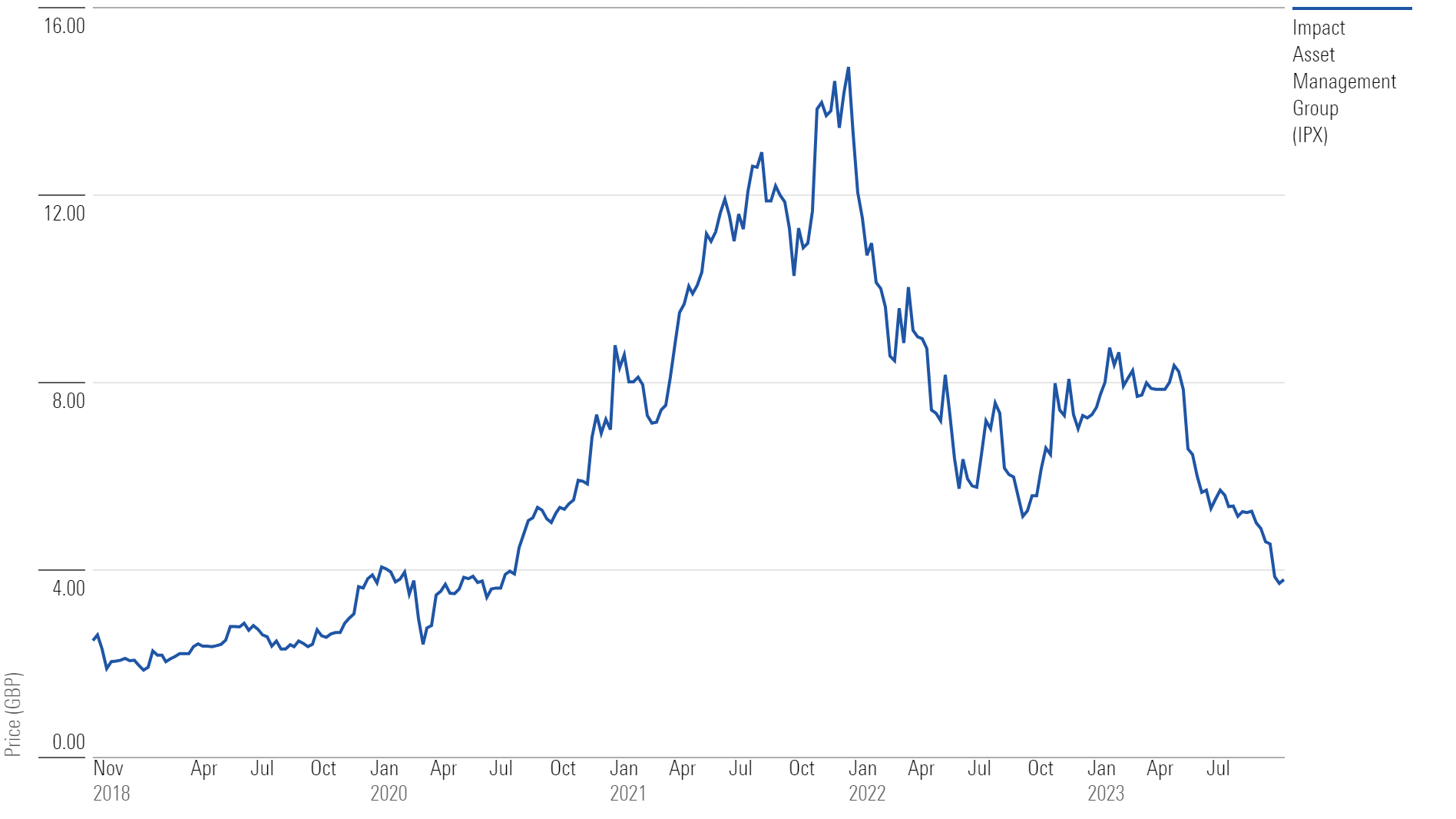

Impax is a prominent practitioner of sustainable investing, which seeks to deliver competitive financial results while also driving positive environmental, social, and corporate governance outcomes. Its predecessor firm launched one of the oldest sustainable-investing funds in the United States, Pax World, in 1971. As sustainable investing gained popularity in the years through 2021, Impax shares soared to a high of GBP 14.72 (USD 18.31) in December 2021. (In the U.S., its shares trade on the Pink Sheets under IPXAF.)

But so far this year, Impax shares fetch a recent GBP 4.70 (USD 5.23), down sharply from GBP 7.97 a year earlier.

Impax Stock Drifts Lower

Why Are Impax Shares Down?

First, blame the downturn in equities: Impax is an equity-heavy firm. Also, the Ukraine war triggered a surge in oil and gas companies, leaving in the dust many sustainable funds that eschew fossil fuels. (Fossil fuels are widely agreed to cause global warming.) At the same time, a backlash to sustainable investing began in the U.S., where a number of Republican states have turned against ESG investing as “woke investing.” Recently, the state of Texas put Impax on a list of financial institutions to divest because it claims Impax “boycotts” the oil and gas industry.

Says Neil Bathon, manager of FUSE Research Network, which supplies research about the asset-management industry: “ESG doesn’t come up in meetings with the product development or marketing or salespeople this year. It was the top topic three years ago.”

Outflows in September Quarter

Asset managers live and die on fund flows, which help them grow and provide fee revenue. In the U.S., once-robust flows into sustainable funds have reversed into redemptions. In Europe, flows have also slowed.

For Impax, the September quarter marked GBP 893 million of net outflows as retail investors pulled money from the markets. For the full fiscal year ended September, Impax had net outflows of GBP 92 million. However, positive performance meant that total assets under management were GBP 37.4 billion, up 5% from a year earlier.

Why Impax Shares Are Worth More

Over the longer term, don’t count Impax out. For one thing, the thesis about investing sustainably or about the usefulness of ESG information hasn’t vanished. Using ESG metrics is now mainstream, according to a recent Bloomberg Intelligence survey. Meanwhile, a PricewaterhouseCoopers survey found that 81% of U.S. institutional investors and 84% of European institutional investors plan to increase their allocations to ESG products over the next two years. “There seems to be pretty broad consensus that, yes, ESG issues are indeed material,” Thomas Kuh, Morningstar’s global head of ESG strategy for indexes, has said.

European Investors Are Hungry for Sustainable Funds

The impact of the U.S. backlash is overstated, analysts say. U.S. funds are just USD 8 billion of assets. In Europe, which accounts for 84% of the global sustainable fund market, flows are still positive. And increasingly, sophisticated investors are looking for the most sustainable versions of funds and sustainable specialists to run them. Consider the European Union’s Sustainable Finance Disclosures Regulation fund categories. So-called Article 8 funds promote environmental and/or social characteristics, while Article 9 funds have a specific sustainable-investment objective. Article 9 funds attracted EUR 3.6 billion (USD 3.92 billion) of positive net flows in the second quarter, according to research firm Equity Development, while Article 8 funds had outflows of EUR 14.6 billion. “There is an emerging differentiation between the most credible sustainable funds and those with lesser credentials,” write Equity Development analysts Paul Bryant and Andy Edmond.

Here, Impax has strong credentials. It integrates ESG throughout its investment processes: “You don’t come across companies where that’s done so thoroughly,” says Ronald van Genderen, the Morningstar analyst who follows Impax. “That makes Impax stand out.” That authenticity prompted Morningstar to grant Impax the firm’s highest ranking in ESG commitment.

Demand for climate funds is also strong, accounting for about 20% of the global sustainable fund market. Global climate funds had net inflows of USD 36 billion in the first six months of the year, up 15% from the previous six months—a stark contrast to conventional funds. “We are a mainstream investment manager with a particular philosophy that, driven by technology change, the cost of wind and solar [falling], driven by regulators putting a tax on carbon and tilting the playing field in favor of energy efficiency and renewables, and demand for EVs [rising] are propelling an industrial revolution that we haven’t seen for 100 years,” says Impax CEO Ian Simm in an interview. “We’re only in the early stages. That will produce changes for capital markets and alpha-seeking investors.”

Writes Alexander Bowers, an analyst with Berenberg: “Impax is a pure-play on sustainability and is well positioned to disproportionately benefit from a pivot away from conventional assets in favour of sustainable ones over the next decade.”

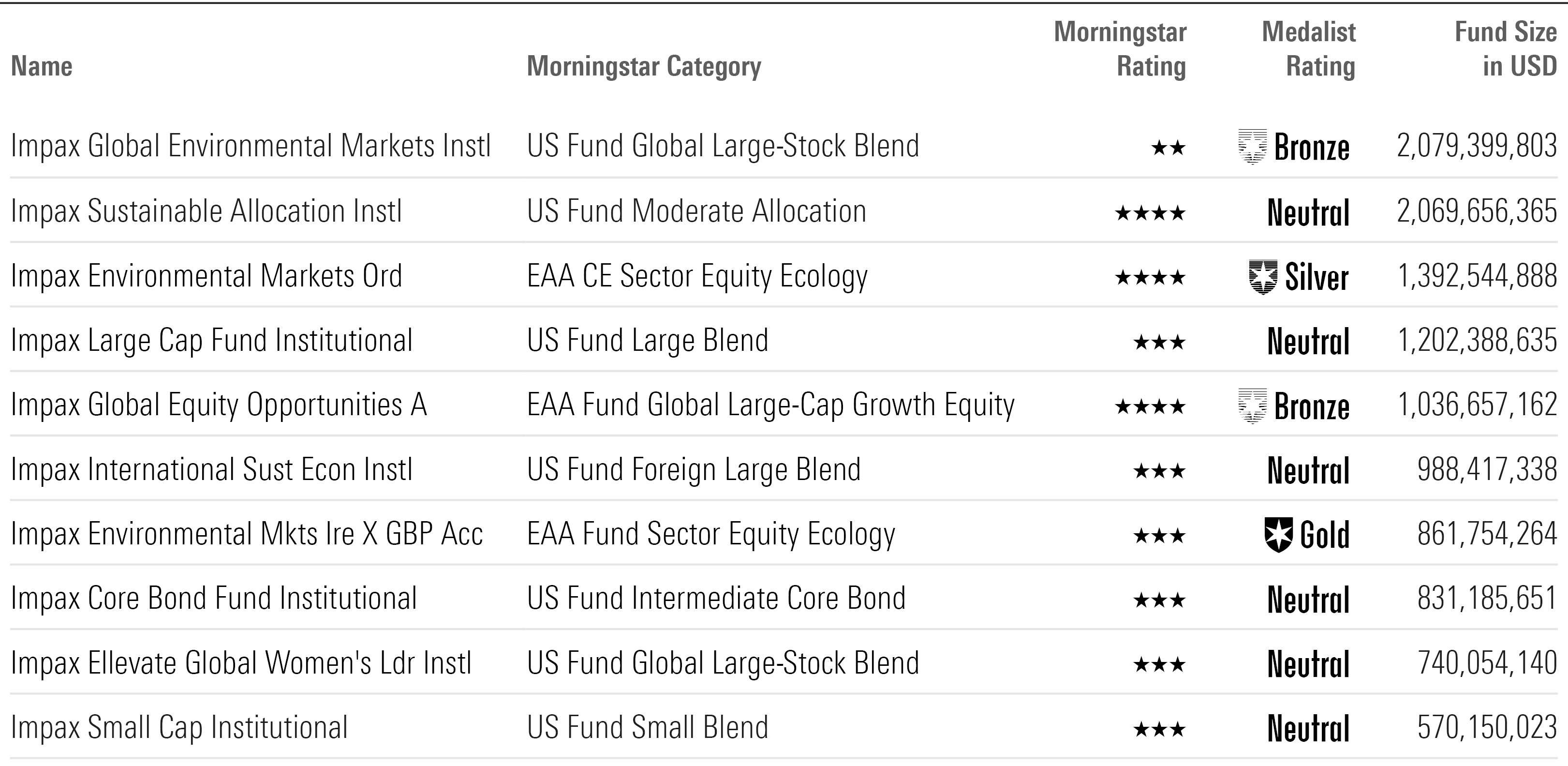

Impax's Largest Funds

Impax Stock Is Cheap

Impax shares are cheap. How cheap? They’re trading well below Morningstar’s quantitative estimate of fair value of GBP 6.12. Equity Development reckons the shares are worth GBP 8, Berenberg’s estimate is GBP 10. Anthony Cross, comanager of Liontrust Special Situations, which owns 6% of Impax, notes that its free cash flow yield is 10%. “Somebody could borrow at 5%, acquire a 10% free cash flow yield, and get rid of duplicate costs.” Cross isn’t saying that Impax will get acquired anytime soon, but in Cross’ estimate, Impax could be worth “40% to 50% more” than it fetches today to an acquirer.

Longer haul, the “areas that [Impax] invests in will see strong growth over the next 20 years,” says Cross. Expect more market-boosting events such as the Inflation Reduction Act of 2022 as nations grapple with their emissions reduction targets. After all, 2023 was the hottest year on record. By some accounts, 2024 may be more extreme. “There is a long-term dynamic of the economy having to adjust to climate change and growth in demand for their investment proposition,” predicts Cross.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IJKB5DGDNJFLPP6SBNF27R3UEA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)