2 Sustainable Index Stocks With Room to Grow

WestRock and Carnival surged in 2023 but still look cheap today.

Investors seeking stocks with low environmental, social, and governance risk might be interested in WestRock WRK and Carnival CCL. That’s our conclusion after perusing the Morningstar US Sustainability Index, which seeks to reduce ESG risk while tracking the Morningstar US Large-Mid Cap Index.

The Morningstar US Sustainability Index

The Morningstar US Sustainability Index has returned 9.6% so far this year, versus 9.45% for the S&P 500 and 9.5% for the Morningstar US Large-Mid Cap Index. In 2023, the Morningstar US Sustainable Index outperformed the SPDR S&P 500, driven by companies like Dell Technologies DELL, Nvidia NVDA, and Williams–Sonoma WSM.

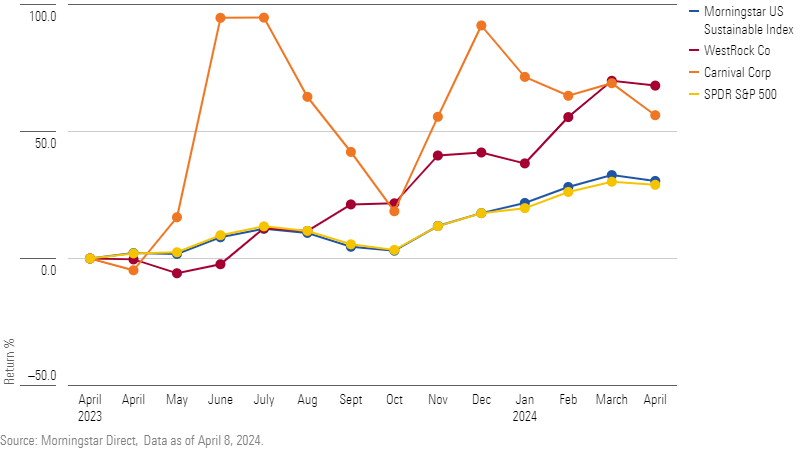

Also driving performance in 2023 were WestRock and Carnival. (This year, WestRock shares are up, while Carnival stock is down.) Yet, even after their 2023 gains, both companies are trading more than 30% below their fair value. In a separate article, we looked at other high-quality undervalued stocks in the index. And for more on sustainable investing, a series of approaches used by values-based investors and others seeking to avoid ESG risk, read this.

One-Year Performance of WestRock and Carnival Compared With the Index

WestRock

Morningstar Rating: 3 Stars

Fair Value: $55.00

ESG Risk Rating: Medium

Price (as of April 8, 2024): $49.25

WestRock manufactures corrugated packaging and consumer packaging products, such as folding cartons and paperboard. It accounts for roughly 20% of the North American containerboard market and is the second-largest producer. The company has returned nearly 60% in the past year.

WestRock was formed from the 2015 merger of RockTenn and MeadWestvaco, which combined two of the largest containerboard and paper companies in North America.

The firm’s corrugated packaging products are used in a variety of end markets, including food and beverage, e-commerce, paper products, and other goods. Corrugated boxes provide a strong yet lightweight packaging option that is cost-effective.

“We assign WestRock a Standard Capital Allocation Rating. This rating reflects our forward-looking assessments of the firm’s financial health, investment strategy and efficacy (both organic and inorganic), and shareholder distribution policy. Our Standard rating is a function of our sound balance sheet, fair investments, and appropriate shareholder distribution ratings,” writes Spencer Liberman, Morningstar equity analyst, in a report. “We expect the company to maintain its dividend going forward as it continues to generate solid free cash flow.”

In a statement in February, WestRock CEO David Sewell said, “During the quarter, we grew external containerboard shipments, while we felt the impact of lower paperboard market demand. We continue to expect significantly improved demand in the second half of our fiscal year.”

Liberman writes: “WestRock is exposed to some environmental, social, and governance risks, including carbon emissions from the firm’s operation and sizable water usage for production. However, we don’t believe these risks could result in material value destruction.”

Carnival

Morningstar Rating: 5 Stars

Fair Value: $27.50

ESG Risk Rating: Medium

Price (as of April 8, 2024): $15.66

CCL is trading at a 45% discount.

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Carnival’s brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it has reached again in 2023.

“We are restoring our narrow moat rating for Carnival, after stripping its moat designation at the start of the covid-19 pandemic, as we see a line of sight to excess economic rents over a 10-year horizon. We believe Carnival’s moat stems from three sources, including efficient scale, brand intangible assets, and cost advantage,” writes Jamie Katz, equity analyst at Morningstar, in a report. “Carnival’s first-quarter performance suggests continuing demand momentum. Net yields were up 18%, helped by an 11% increase in occupancy, along with ticket and onboard gains.”

Carnival is expected to generate “several billion dollars of free cash flow” to repay debt, in order to restore its investment-grade ratings, Chris Kissane, credit analyst at Newfleet Asset Management, told Barron’s recently, adding that Carnival “should have the ability to do that, absent a recession.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)