Markets Brief: Earnings Heavyweights Microsoft, Tesla, and Others on Deck This Week

Netflix shows solid subscriber growth and airline tailwinds grow.

Earnings season is heading into its third week, with major market leaders coming on deck to start reporting results for the fourth quarter of 2022.

First among the big names is Microsoft MSFT, which is set to release fiscal second-quarter results on Tuesday, Jan. 24 after the bell. Tesla TSLA is expected to report fourth-quarter results after the market close on Wednesday, Jan 25.

So far it’s been a relatively uneventful start to the earnings season. Against a more reassuring macroeconomic backdrop, the stock market has been fairly quiet. The Morningstar US Market Index is up 3.8% in 2023.

Here’s what Morningstar analysts think investors should be keeping a close eye on when it comes to their results.

Microsoft Earnings

Dan Romanoff, senior equity analyst at Morningstar, has been keeping a close eye on Microsoft’s Azure cloud business. Broadly, investors should be on watch for any signs of deceleration in growth across the company.

Microsoft posted solid results during its last quarter, but they were overlooked due to the company slightly missing its guidance on Azure growth, which grew 42% instead of the guided 43%. That, coupled with a weaker-than-expected revenue guidance of $52.35 billion to $53.85 billion for the December quarter, led to Romanoff cutting his fair value estimate to $324 from $352.

Earnings per share is expected to be $2.30, while revenue is anticipated to be on the upper end of guidance, at $53.13 billion, according to FactSet.

Tesla Earnings

Tesla’s stock has been dragged down during the past few weeks as potential declining demand, macroeconomic pressures, and concerns over chief executive Elon Musk’s role at Twitter and stock sales have increased investors’ uncertainty over the company’s near-term performance. Shares are down about 36% in the last three months and 60% from a year ago.

The focus of Tesla’s fourth-quarter earnings will be on profitability metrics. The company cut prices in China back in late October by roughly 9%, and by $7,500 in the U.S. in December, which raised concerns about demand for electric vehicles. Furthermore, chief executive office Elon Musk noted at the start of 2023 that quarterly deliveries were still falling short of market expectations.

Tesla has also been ramping up production at two factories, one in Shanghai, China, and another in Austin, Texas, that Morningstar equity strategist Seth Goldstein says should “boost profits from operating leverage.”

The key question will be how the dynamics between price cuts and increased production have affected Tesla’s profitability, and gross profit margins will be crucial to keep an eye on. Gross margins remaining in the mid-20% levels would be considered good news, according to Goldstein, as this would be in line with the second and third quarter.

“It would be great news if we see margin expansion. However, if we see gross profit margins contract to the low-20% range from the initial price cuts in China last year, this would likely mean we see a steeper profit margin decline in 2023 due to price cuts as cost reductions are less impactful,” he says. The company also cut prices by as much as 20% across the globe in early January 2023.

Tesla’s earnings per share is expected to be $1.15 while revenue is anticipated to be around $24.64 billion for the quarter, according to FactSet.

Earnings in the Rearview

Looking back, the second week of earnings results brought in some pleasant surprises, some of which the market rewarded. Here’s some of the major results that the market reacted to.

Netflix Shows Surprising Subscriber Growth

Shares of Netflix NFLX rallied 8.5% on Jan. 20 after the firm posted results that surprised the market. While earnings came in at $0.12 per share versus estimates of $0.55, revenue was mostly in line, at $7.85 billion versus estimates of $7.86 billion. However, what was most impressive was net subscriber additions of 7.66 million, above the guidance of 4.5 million.

The firm will also start to crack down on password-sharing as an effort to further bolster revenue, which may involve giving subscribers the choice to add users to their profile for an additional fee of about 20% of the original subscription cost, says Neil Macker, senior equity analyst at Morningstar.

“While we think this plan will boost revenue, we don’t believe it will significantly increase new subscriber growth from users not added on to existing plans and could increase churn,” says Macker. Still, Netflix’s fair value estimate was increased to $315, from $290, to account for the strategy.

Airlines’ Tailwinds Persist

Fourth-quarter earnings results from United Airlines UAL topped both revenue and earnings per share estimates, showing robust demand for airline services. Despite a brief rally post-results, investors sold off the company’s shares, leading to a 4.6% decline on Jan. 18, the day it reported.

Comments from management indicated that demand for air travel remains strong, and the industry remains under capacity as reasons for a favorable operating environment. Pretax margins reached 9% during 2022, which exceeded the expectations of Brian Bernard, director of equity research at Morningstar, industrials. “Previously, we had projected it would take the airline several years to achieve this level of profitability,” he says.

The stronger near-term performance is a result of recent high demand and undercapacity in the industry. Management expects this to continue and provide a “favorable operating environment,” and even set their pretax margin target to 14% by 2026, which would mark an all-time high. However, given the competitive nature of the airline industry, Bernard sees margins averaging 9% in the long term.

Other major airlines, such as American Airlines AAL and Southwest Airlines LUV, may also show similar signs of strength in demand when they report results on Jan. 26.

Goldman Sachs Has a Rough End to 2022

Goldman Sachs’ GS results included a disappointing 60% decline in net income, owing in part to revenue falling 12% from the third quarter and a 5% increase in operating expenses. Earnings came in much lower than expected, at $3.32 per share versus estimates of $5.56. Shares slid 6.4% post-earnings on Jan. 17.

The uptick in expenses was surprising, according to Michael Wong, director of equity research for financial services at Morningstar. Expenses from recent acquisitions were already reflected in the third quarter. And given “trading expenses were high while trading revenue was low, management should have been preparing the company for a tougher environment,” he says.

The year 2023 should prove to remain difficult, Wong says. Monetary policies are tightening in addition to macroeconomic uncertainty leading to companies becoming more cautious—potentially inducing a self-fulfilling prophecy of a recession. “Until corporations can see the light at the end of the tunnel, investment banking revenue will be subdued, likely until the second half of 2023 if not 2024,” he says.

Events scheduled for the coming week include:

- Tuesday: Johnson & Johnson JNJ, Microsoft, and Verizon VZ report earnings.

- Wednesday: Tesla, AT&T T, and ServiceNow NOW report earnings.

- Thursday: Visa V, Mastercard MA, and T. Rowe Price TROW report earnings.

For the trading week ended Jan. 20:

- The Morningstar US Market Index fell 0.6%.

- The best-performing sector was communication services, up 2.5%.

- The worst-performing sectors were utilities and industrials, each down 2.9%.

- Yields on 10-year U.S. Treasuries fell to 3.48% from 3.51%.

- West Texas Intermediate crude-oil prices rose 1.82% to $81.32 per barrel.

- Of the 847 U.S.-listed companies covered by Morningstar, 352, or 42%, were up, and 495, or 58%, declined.

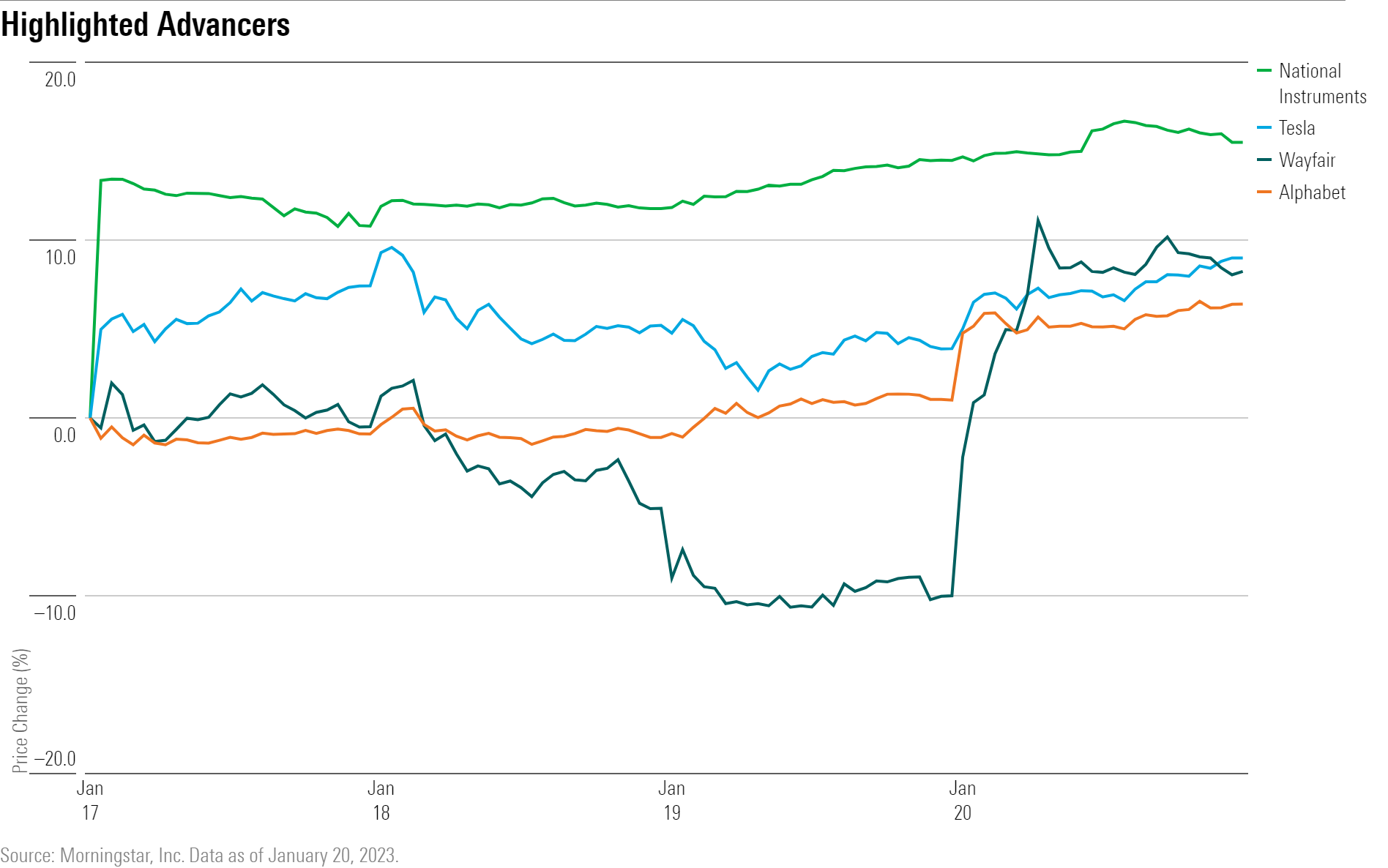

What Stocks Are Up?

Shares of National Instruments NATI rallied after news broke that Emerson Electric EMR was attempting to purchase the company with a $7 billion offer, Reuters reports.

Furniture retailer Wayfair W saw its stock rise after the company revealed plans to slash 1,750 jobs, or about 10% of its workforce. Google’s parent company, Alphabet GOOGL, also saw its stock rise after the company announced 12,000 layoffs or about 6% of its staff.

Tesla’s stock rose ahead of earnings as demand for its cars appears to have rebounded following price cuts announced in early January, Business Insider reports.

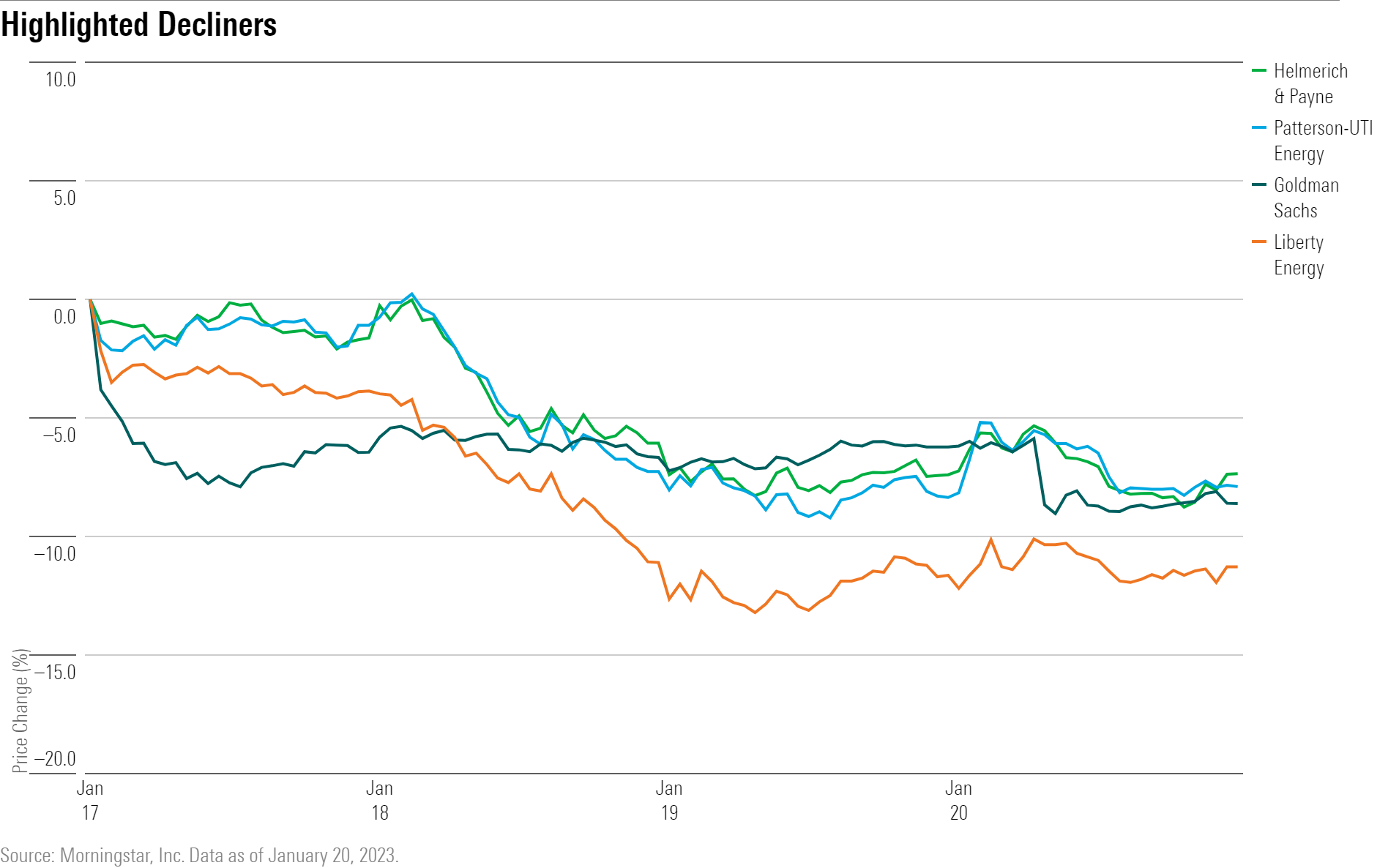

What Stocks Are Down?

Goldman Sachs’ stock slid after reporting lackluster results that showed net income declining by 60%. The firm reported earnings per share of $3.32, missing estimates of $5.56.

Declining natural gas prices led to another slump in energy companies; oil & gas drilling, and oil & gas equipment & services companies were the industries most affected. Liberty Energy LBRT, Helmerich & Payne HP, and Patterson-UTI Energy PTEN were among the worst performers.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-17-2024/t_6d69bf7a8b2241f2a97fbd5fb1886186_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)