Industrial Stocks: Sector Continues to Benefit from Resilient US Economy, but Is Now Overvalued

The top picks in this sector are Sealed Air, Stericycle, and Wesco.

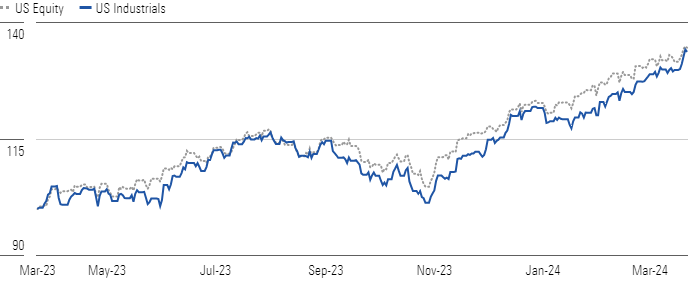

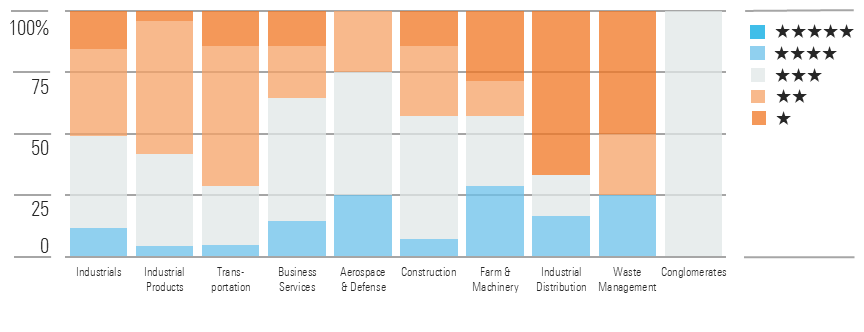

Industrials stocks posted solid gains during the first quarter of 2024 on the back of a resilient US economy, and the group now trades moderately above our fair value estimates on average. Even so, in the year to date, the Morningstar US Industrials Index underperformed the broader US market. The sector’s top-performing industries were waste management, construction, and business services. Conversely, aerospace and defense, transportation and logistics, and conglomerates were notable laggards.

Industrials Lag In TTM Despite Solid Performance

Waste management is a defensive industry. The largest players enjoy robust competitive advantages and predictable free cash flow. We believe investors have been encouraged by record pricing gains, continued margin expansion, and greater investments in potentially lucrative sustainability projects like renewable natural gas and recycling infrastructure. And while we think higher margins will persist over the next few years, we believe market expectations for the industry have become overly optimistic.

Industrials Sector Slightly Overvalued; Opportunities Limited

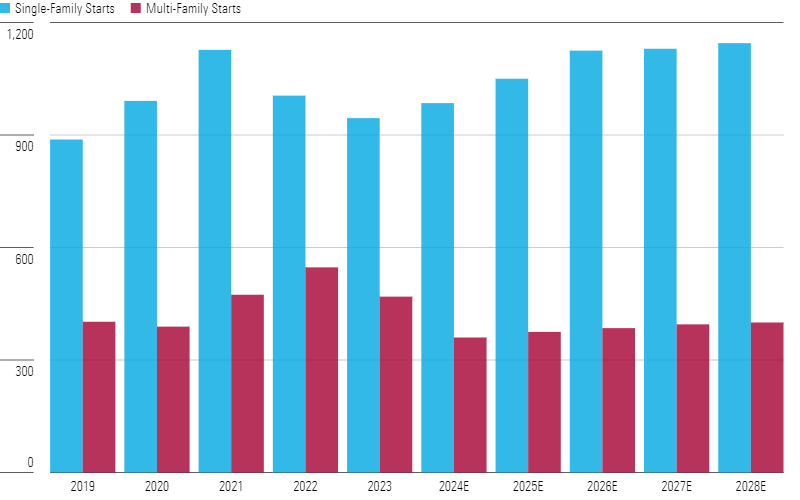

Construction stocks realized strong gains during the quarter. We think the market now has a more constructive view of US residential construction, even though mortgage rates remain elevated. By offering more sales incentives, lowering base prices, and building smaller homes with fewer amenities, homebuilders are making more affordable homes that attract more buyers. There’s some debate about the path ahead for multifamily construction, but we see an undersupply of affordable housing, potentially greater immigration, and lower interest rates as catalysts for more multifamily construction over the next decade.

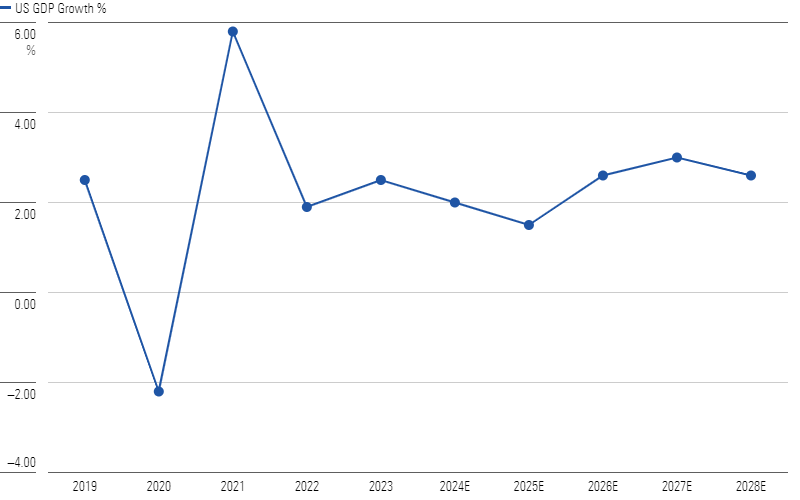

Slowing GDP Growth a Near-Term Headwind for Industrials

We expect GDP growth to decelerate to 2.1% in 2024 and 1.4% in 2025, as we think the economy has yet to fully feel the effect of higher rates. Some industrial firms with short-cycle exposure have already felt some pressure, and that trend may continue in 2024. Even so, we expect GDP growth to rebound in 2026, which bodes well for the sector in the longer term. General Electric has split into GE Aerospace GE and GE Vernova GEV, continuing a trend we’ve seen over the last few years of companies moving away from the conglomerate structure. We wouldn’t be surprised to see more announcements like this in the coming years.

Residential Construction Should Rebound by 2025

Top Industrials Sector Picks

Wesco International

- Fair Value Estimate: $191.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Wesco International WCC is an industrial distributor with three reportable segments: electrical and electronic solutions, communications and security solutions, and utility and broadband solutions. Shares plummeted on disappointing Q4 earnings as the company contends with near-term challenges like inventory destocking and weaker end-market demand. But we think Wesco’s long-term prospects remain strong, supported by increased US infrastructure spending, and therefore think the selloff was overblown and investors have a buying opportunity.

Stericycle

- Fair Value Estimate: $60.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Stericycle SRCL is the largest provider of medical waste disposal and data destruction (primarily paper shredding) services in the US. The firm is in the middle of an operational turnaround, led by a refreshed management team committed to investing in its core businesses while divesting its lower-margin noncore businesses. The company has realized solid organic growth since 2021, and its consolidated gross profit margin has substantially improved. We think Stericycle is at a margin inflection point, and we forecast its adjusted EBITDA margin to expand to around 23.5% by 2027-28 from 17% on average during 2019-23.

Sealed Air

- Fair Value Estimate: $54.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Sealed Air’s SEE two segments, food and protective, supply customers with protective packaging materials and the equipment needed to apply them in manufacturing facilities. Given its integration into the manufacturing process, Sealed Air enjoys more pricing power on consumables than its more traditional peers. The company posted disappointing profits throughout much of 2023 because of inventory destocking and changes in consumer spending, and shares have underperformed. We still think shares are attractive, given Sealed Air’s competitive positioning and favorable long-term prospects.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OBA7UVI75RGFDOHGJTZ2FK542Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/L4B22R7UFVDBJN2ZYJWBSMCIJA.jpg)