Industrials: Sector Is Fairly Valued, but We Still See Compelling Investment Opportunities

In this sector, we recommend CNH Industrial, Allegion, and RTX Corp.

We view the industrial sector as overall fairly valued, but we still see compelling investment opportunities across aerospace and defense, industrial products, construction, and farm and heavy construction machinery.

Our top picks among industrial stocks are:

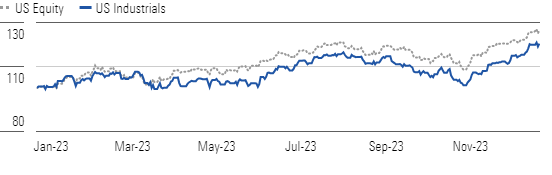

Industrials Underperform Broader U.S. Equity Market Over Trailing 12 Months

The U.S. economy remains resilient even as inflation persists above the Fed’s 2% target and economic growth slows across Europe and China. Third-quarter earnings were generally positive for industrials, with over three-fourths of our coverage beating FactSet consensus EPS expectations. Despite the increased probability of a soft landing for the economy, investors remain concerned about nonresidential real estate markets, particularly commercial and office verticals, as elevated construction costs, tighter lending standards, and higher office vacancy rates will likely dampen construction activity. As a result, companies with significant commercial construction exposure, such as Allegion and Johnson Controls International JCI, have underperformed. Nevertheless, some nonresidential verticals, such as healthcare and education, should see solid construction activity in 2024, and our longer-term construction outlook remains constructive.

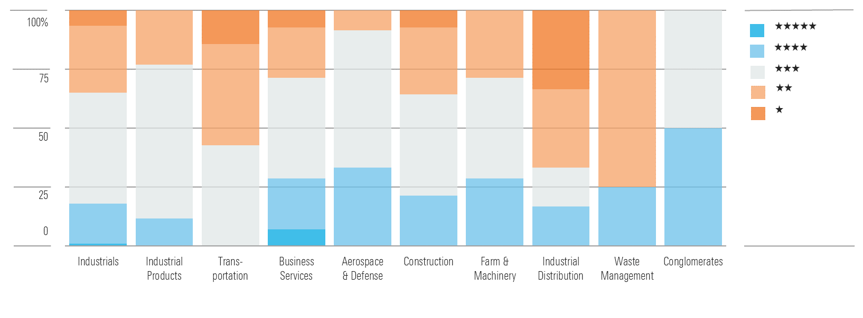

Industrials Sector Fairly Valued, but Some Opportunities Are Available

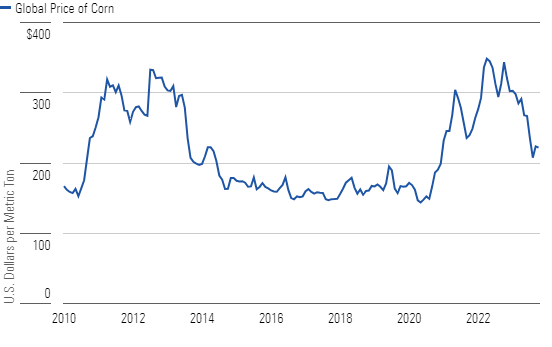

The ag downcycle has led to downward price pressure on ag machinery stocks over the past few months. Lower global crop prices have led to fewer farmers bringing crops to market, particularly in South America. However, the North American region remains favorable, as crop supplies are still relatively low, especially in soybeans. U.S. corn supplies are higher today than in the past few years, which has resulted in lower corn prices. U.S. farm incomes are coming down from record levels, but still sit at relatively high levels, giving us confidence that many farmers will continue to replace aging machinery in the near term.

Corn Prices Are Lower, but We Think Farmers Will Still Replace Aging Equipment

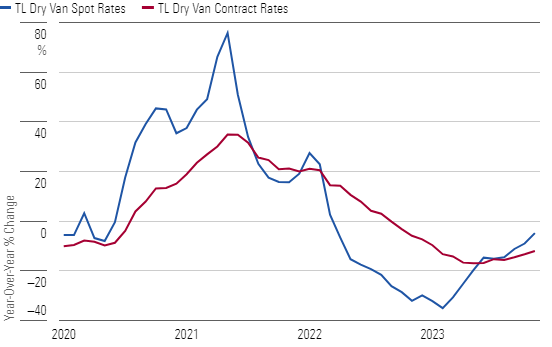

Transportation and logistics firms continued to experience mixed financial performance. Less-than-truckload carriers benefited from the bankruptcy of Yellow Logistics in August driving market share gains for many players. Comparatively, declining spot and contract rates have hurt the brokers C.H. Robinson CHRW and Landstar LSTR as well as truckload carrier Knight-Swift KNX. Even so, we expect the truckload sector supply/demand equation to find a better balance as 2024 progresses, resulting in modest improvement in spot and contract prices.

Dry Van Truckload Spot Rates Have Likely Bottomed

Top Industrials Sector Picks

CNH Industrial

- Fair Value Estimate: $82.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

CNH provides customers with an extensive product portfolio of off-highway products. Specifically, the company addresses two core end markets: agriculture and construction equipment. The firm has meaningfully more exposure within the agriculture industry, accounting for 90% of off-highway profits, which we view as positive, given the replacement cycle in large ag equipment. In our view, both verticals should benefit from near-term tailwinds supported by aging fleet refreshes and increased infrastructure spending. Also, we believe CNH should drive incremental value through the development of precision ag.

Allegion

- Fair Value Estimate: $82.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Allegion is a global leader in security products and solutions. Allegion operates through two segments: Americas and International. At over 70% of sales and 80% of segment profitability, the Americas segment is Allegion’s largest and strongest business, benefiting from leading positions in locking systems, door closures, and exit devices. Looking ahead, we expect both segments to benefit from increased retrofit and upgrade spending across commercial and residential end markets, driven by greater adoption of electronic products.

RTX Corp

- Fair Value Estimate: $82.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

In late July 2023, RTX subsidiary Pratt & Whitney announced a recall of one of its most popular jet engines, which power many Airbus A320s, due to possible contamination of the metal used to make a certain rotor part. The recall will cost the company billions in compensation to its airline customers, many of whose jets will be grounded while the engines are inspected and serviced on an accelerated schedule. Despite this, we see RTX as having a very promising runway of profitable demand in most of its businesses, especially in commercial aerospace, and believe that the stock’s selloff on the recall news was overblown.

Top Industrials Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VZ75Y7YOWNC7PPE5HNPGTGWCUI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)