5 Growth Stock Picks From a Top Fidelity Manager

Fidelity Blue Chip Growth manager Sonu Kalra highlights some favorite names, including Nvidia, Snap, and Eli Lilly.

Wall Street is loaded with stock fund managers hunting for the next big growth story. For the better part of 14 years, Sonu Kalra has stayed one step ahead of the pack, posting top-performing returns as manager of the Fidelity Blue Chip Growth fund FBGRX.

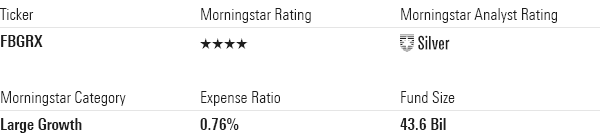

Fidelity Blue Chip Growth, which today has $43.6 billion in assets, took its lumps during the 2022 bear market. But since taking the helm of the Fidelity strategy in July 2009, Kalra has chalked up returns that beat the average large growth stock fund in 10 of those calendar years. More impressively, the fund landed in the top quartile of the competitive category in seven years and within the top 10% twice.

Looking back over the past decade, Fidelity Blue Chip Growth has returned an average of 16.9% per year, blowing away the 13.0% average annual return for large growth funds and ahead of the 14.3% average annual return for the Morningstar US Growth Index.

“Kalra has demonstrated the long-term merit of the strategy,” writes Morningstar strategist Robby Greengold. “Its success on his watch owes mostly to his knack for spotting high-potential up-and-comers, such as Tesla TSLA and Nvidia NVDA, which the mutual fund has ridden over the past decade to spectacular gains. The fund’s total return since his start in 2009 is among the large-growth Morningstar Category’s highest.”

We asked Kalra to talk through his investment strategy and the investment thesis for five stocks: two that have done well in the past year, one that has struggled, and two more of his choosing.

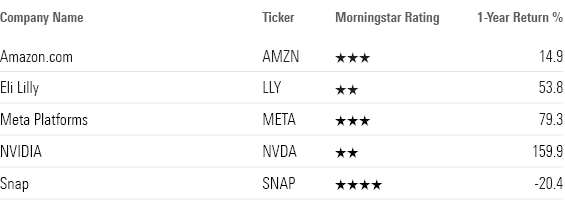

5 Stocks from Fidelity Blue Chip Growth's Kalra

Kalra’s Growth Stock Strategy

When investors see the term “blue chip,” they often interpret it as owning big, stable, and well-established companies. While there are companies that fit this bill in Blue Chip Growth’s portfolio, the “growth” part of the fund’s name is often more likely to come to mind.

Kalra says the end goal is to find companies that can grow earnings by double-digit percentages over the long term. According to him, Fidelity’s research shows that this leads to long-term outperformance. It’s here that Kalra’s definition of “blue chip” comes into play: “When I think about what constitutes a blue chip, we focus on three facets: the business model, the returns a company is generating, and the growth rate.”

When assessing a company’s business model, Kalra says the focus is on its ability to generate free cash flow—what’s left after subtracting operating expenses from revenues—both today and down the road. This helped him see the potential in Amazon.com AMZN as a Fidelity analyst in the early 2000s, when the company was losing money as measured by earnings per share but generating significant cash flows.

Fidelity Blue Chip Growth Key Stats

For returns, the attention is on a company’s returns on equity. Here Kalra puts more weight on trends rather than the most recently reported data. “A very high ROE means a company has a very high-quality business, but what we found is more important is the direction. This tends to predict stock prices much more accurately than the absolute rate of return,” he says. “So you can have a company that has low levels of returns, but if they start to improve those, that’s usually good for future stock price, and vice-versa.”

Lastly, concerning growth, Kalra’s focus is organic revenue growth and its sources. “It’s really the first question that I typically ask our analysts,” he explains. “I want to understand what’s driving that organic revenue growth. Are they selling more units, or are they increasing pricing, or is it because they’ve introduced a new product?”

From there, Kalra divides growth companies into different segments. There are those benefiting from secular growth trends, which include firms in e-commerce, health and wellness, and artificial intelligence. There are cyclical growers, where he looks to take advantage of shorter-term trends in industries like energy or financials, where the market can get overly pessimistic due to swings in the macro-environment. And there are what he calls “self-help” or opportunistic growers—companies benefitting from changes in an industry’s dynamics or consolidation, such as what’s seen among railroads.

Kala takes a long-term view on his stocks, turning over a low 34% of the portfolio a year, according to Morningstar’s data.

All this comes into a fund that by one measure is very concentrated and by another highly diversified. More than half the fund’s assets are in the top 10 holdings, but it also tends to hold roughly 300 positions. Those other 290 or so stocks are “my emerging growth bucket … that we like, but they don’t have the history,” Kalra explains. Tesla (which the fund bought shortly after it went public in 2010) was one of those names.

5 Stocks from Fidelity Blue Chip Growth's Sonu Kalra

Two Winners for Fidelity Blue Chip Growth

Nvidia

“One of the key things we’ve identified over the last five, 10 years is the increasing importance of semiconductors across technology,” says Kalra. “If you think about semiconductors, they’re the building blocks that go into every piece of technology.”

He says Nvidia is at the forefront of a foundational shift in how computers function because of the move to graphics processing units, or GPUs. GPU technology is central to the software ecosystem that is making the artificial intelligence boom possible. Nvidia is “not only the leader, but I think [their] pace of innovation is extending the lead versus some of their competitors,” Kalra says. In addition, he likens Nvidia’s approach to its products to Apple’s AAPL, where Nvidia’s Cuda software system is leading to an ecosystem for developers. Nvidia was the third-largest stock in Blue Chip Growth’s portfolio at the end of April.

Meanwhile, a key driver of the demand for Nvidia chips is AI. “I think generative AI is one of the biggest secular trends I’ve seen since the advent of the PCs,” Kalra says. “When I think about my investing career, I’ve seen four technology revolutions: the PC, the internet, the mobile, and the move to the cloud. And now I think we’re on the cusp of another technological revolution, which is generative AI, and it has the potential to help companies disrupt and create new business models.”

For Kalra, Nvidia is a way to play a massive secular trend through a “pick and shovels” approach of investing in key suppliers as opposed to the companies embroiled in the increasingly competitive and difficult-to-predict AI product landscape. As one example, he points out that in the battle over internet search between Microsoft MFST and Alphabet GOOG, no matter “which is going to win … they’re going to need chips from Nvidia.”

After losing half its value in 2022, Nvidia stock is now up 192% so far in 2023. Kalra says Fidelity Blue Chip Growth has owned the stock since 2009. Over the past decade, the shares have gained an average of 61% a year. “I think the market has gravitated toward us, rather than us going to where the market is,” he says.

Meta Platforms META

“The overarching secular theme here is that dollars follow eyeballs, and eyeballs are shifting online,” Kalra explains. One of the biggest beneficiaries of that trend, of course, has been Facebook parent company Meta.

However, after many boom years, Meta ran into three major headwinds and stumbled in 2022. The company found itself struggling with Apple’s privacy algorithms, which put Meta at a disadvantage on a critical platform for connecting advertisers to users. The company also faced growing competitive pressures from TikTok and had an expense structure that was out of line with a new growth environment, Kalra says.

In response to those headwinds, Meta made some significant changes. The firm created solutions to offset some of the challenges to usage tracking presented by Apple’s stepped-up privacy protections. It rolled out a short-form video feature, Reels, to compete with TikTok. And it aggressively tackled its expense structure by reducing headcount by roughly 25%. Meta “finally made some really difficult decisions,” as Kalra puts it.

The seventh-largest holding in Blue Chip Growth as of April 30, the firm’s shares lost more than 64% in 2022, but so far this year its stock is up roughly 137%. “Nine months ago, the market was very pessimistic about the future of Meta,” Kalra says. “The steps they’ve taken over the last six months position them well to start on that secular trend of growing earnings by double digits that we tend to look for.”

A Stock That Hasn’t Been Working

Snap SNAP

Kalra says the investment thesis behind Snap is similar to the one for Meta, with the company’s app Snapchat ranking as one of the leading social media platforms for teens and young adults. He notes how Snap says it has roughly 380 million daily active users. “I have three teens in my house and see how much time they spend on Snapchat,” he says. “I see it as a pretty big opportunity because it’s an audience that’s hard to reach, and in many cases, they’re the decision-makers in our homes—at least in my house.”

Unfortunately, he observes that the company stumbled with essentially the same issues that hit Meta. Snap has struggled with Apple’s new privacy guardrails, competition from TikTok, and high expenses. As with Meta, Kalra believes the company is moving in the right direction, including bringing in key hires from firms such as Google and Microsoft to bolster its advertising efforts.

Critically, Kalra sees significant room for Snap to improve its monetization of client usage. “Snapchat generates about $30 in annual revenue per user in the U.S., while Facebook generates almost $300. So there is a 10x differential between the two companies,” he says. “And that’s really the opportunity for Snapchat, to really start to close that gap.”

Still, Snap stock hasn’t seen the kind of mega-rally experienced by Meta. The stock is up roughly 19% in 2023 but is still down nearly 19% from where it was a year ago. “We’re being patient with it,” Kalra says.

Two More Stocks From Kalra

Eli Lilly and Co LLY

When looking for companies with strong growth prospects, a key variable is the potential size of their markets, Kalra says. For pharmaceutical company Eli Lilly, which has been focused on diabetes and oncology, Kalra says two big new markets appear ripe for growth: addressing obesity and early Alzheimer’s. These two areas are opportunities “that can help the company accelerate revenue growth and earnings growth over the next decade,” he says.

Kalra points to how Lilly recently announced strong test results for its drug donanemab, which is designed to slow the progression from mild to moderate Alzheimer’s. “This is really important because if you have mild Alzheimer’s and can stay at that level, you can live a pretty normal life where you can be independent,” he explains. “But as you progress to that moderate stage, you’re going to need daily assistance to live your life, and your quality of life really deteriorates. When you think about the opportunity here, there are about 20 million people that have been diagnosed with Alzheimer’s in the U.S., Europe, and Japan. So there is just a huge unmet need.” When it comes to treating obesity, Lilly is seeing strong results with one of its existing drugs, tirzepatide.

“This is a company that has a very strong core franchise in diabetes, and then two real growth opportunities that they’re embarking on that we think can be large franchises over time,” Kalra says. Eli Lilly stock is up about 26% in 2023 and more than 50% over the last 12 months.

Amazon.com

Like Meta and Nvidia, Amazon has been a long-time holding in Blue Chip Growth, part of the portfolio since 1999 and occupying the fourth-largest position as of the end of April 2023. “It’s been kind of a core holding the fund,” Kalra says. “It hasn’t done as well as some of the other mega-cap tech firms more recently, but we certainly haven’t lost faith in the company.”

When it comes to its core e-commerce business, as huge as Amazon has become, there’s still room to grow, according to Kalra. “The retail market excluding autos is almost $3 trillion and growing by double digits. And when you think about e-commerce penetration, we’re kind of at mid- to high-teens [percentage] penetration,” he says.

In the wake of the COVID-19 e-commerce boom, online retail has slowed toward longer-term trend levels. “Like other tech companies, they’ve seen a slowdown,” Kalra says. But the issue facing Amazon is that during the pandemic it embarked on a massive expansion of warehouse capacity. “They built as much capacity in two years as they had built in the previous 25, and this has led to a lot of inefficiencies and, truthfully, poor operating results where the profitability of the business has really deteriorated,” he says.

However, in late 2022, Amazon announced a 10% reduction in headcount, “and they’re starting to lay the groundwork to achieve profitability margins they had achieved prior to COVID,” says Kalra. “And if they can do that, we think the stock should reflect that improvement in fundamentals.”

On the cloud side, there has also been a slowdown in the growth of Amazon Web Services. But this is where the secular trend of AI comes back into the equation. “A lot of the computing that needs to be done for these large language models needs to happen in the cloud … and we think they will be a beneficiary,” explains Kalra.

Amazon stock has jumped about 55% in 2023, but its medium-term returns are lagging other tech names and the overall market. Amazon stock has gone down an average of roughly 1% per year for the last three years, compared to an average annual return of roughly 13% for the Morningstar US Market Index.

“A relatively simple investment thesis here is they’re the leader in e-commerce and a leader in cloud,” says Kalra. “The company has stumbled over the last 18 months as growth slowed down, but we think they’re making the right decisions that will help bring things back on a better trajectory.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A7YHHS6HQJB7RJU76FB5C2TXV4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)