Active ETFs are Soaring. Should You Invest?

ETFs offer a cost-effective tool for investors and a growth opportunity for active managers sorely in need of one.

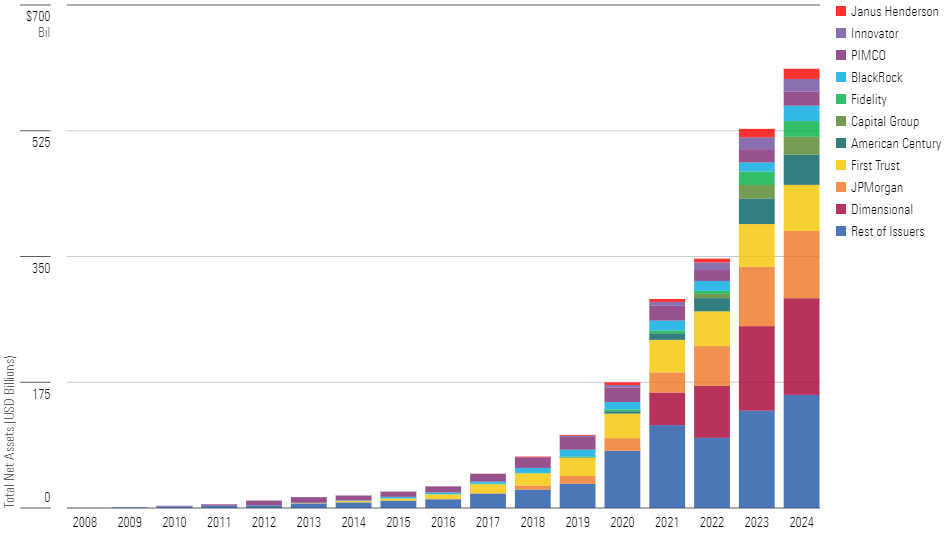

Exchange-traded funds used to be synonymous with passive investing. But since the beginning of 2019, actively managed ETFs’ share of the US ETF market has more than quadrupled—from just over 2.0% to 8.5% as of March 31, 2024.

A few catalysts drove the rapid growth of active ETFs:

- The SEC passed the “ETF Rule” in 2019, which made it easier to bring ETFs to market and gave active managers flexibility to tap into ETFs’ tax efficiency.

- Investors and their advisors have increasingly sought out lower-cost ETFs over mutual funds.

- Portfolio managers have accepted the greater portfolio transparency of ETFs.

- Traditional mutual fund providers began to convert existing mutual funds into ETFs.

This trend is just getting started. Over the past five years, active ETFs have added $375 billion of inflows, while nearly $1.8 trillion has flowed out of active mutual funds.

Our research imparts a few lessons of how investors can find success with active ETFs.

We provide an overview of the active ETF market, discuss the benefits and drawbacks of the ETF structure, compare different approaches taken by active managers, and break down trends and offerings by asset class.

A Rising Tide That Doesn’t Lift All Active ETF Boats

Flows trends favor active ETFs over active mutual funds, but not all active ETFs are growing. Many strategies have adopted ETF wrappers looking for salvation, only to find struggle.

For active ETFs, it’s less John F. Kennedy’s “a rising tide lifts all boats,” and more Warren Buffett’s “only when the tide goes out do you discover who’s been swimming naked.” ETFs’ transparency exposes them for what they are, benefiting some and hurting others.

This leaves a smaller number of asset managers for whom active ETFs are a good fit. Most of the 320 providers who have launched active ETFs have had limited success. Only a handful of issuers have been successful so far, including the ones shown below.

Active ETF Market Composition

The same factors that decide fates across the investment industry determine active ETFs’ winners and losers. These include performance, breadth of offerings, and, most importantly, fees.

Investors’ preference for lower-priced investments continues with active ETFs. Funds in the cheapest quintile of active ETFs hold more than $325 billion in assets, while the most expensive quintile holds just $35 billion. Today’s leader, Dimensional, charges an average fee of just 0.24%, a fraction of the whole group’s 0.69%. It still pays to be cheap.

ETFs offer several advantages over mutual funds, like better tax efficiency, transparency, and lower fees, but they also have a few disadvantages.

Key considerations for investors include:

- ETFs lack capacity constraints, meaning they can’t close to new investors when their fund gets too big for their investment strategy. Investors need to watch the size of concentrated active ETFs that play in small sandboxes. Given their lack of capacity constraints, active ETFs in large-cap categories are best suited for the ETF wrapper, although those markets are also the toughest for active managers to outperform passive peers.

- The flexibility of ETFs comes at a price. Since ETFs trade like stocks, they also have bid-ask spreads, or the difference between what buyers offer and sellers ask for shares. When spreads are wide, they add to investors’ costs. Smaller, more unique ETFs can have wide spreads, especially near the opening and closing of the trading day when liquidity tends to be thin.

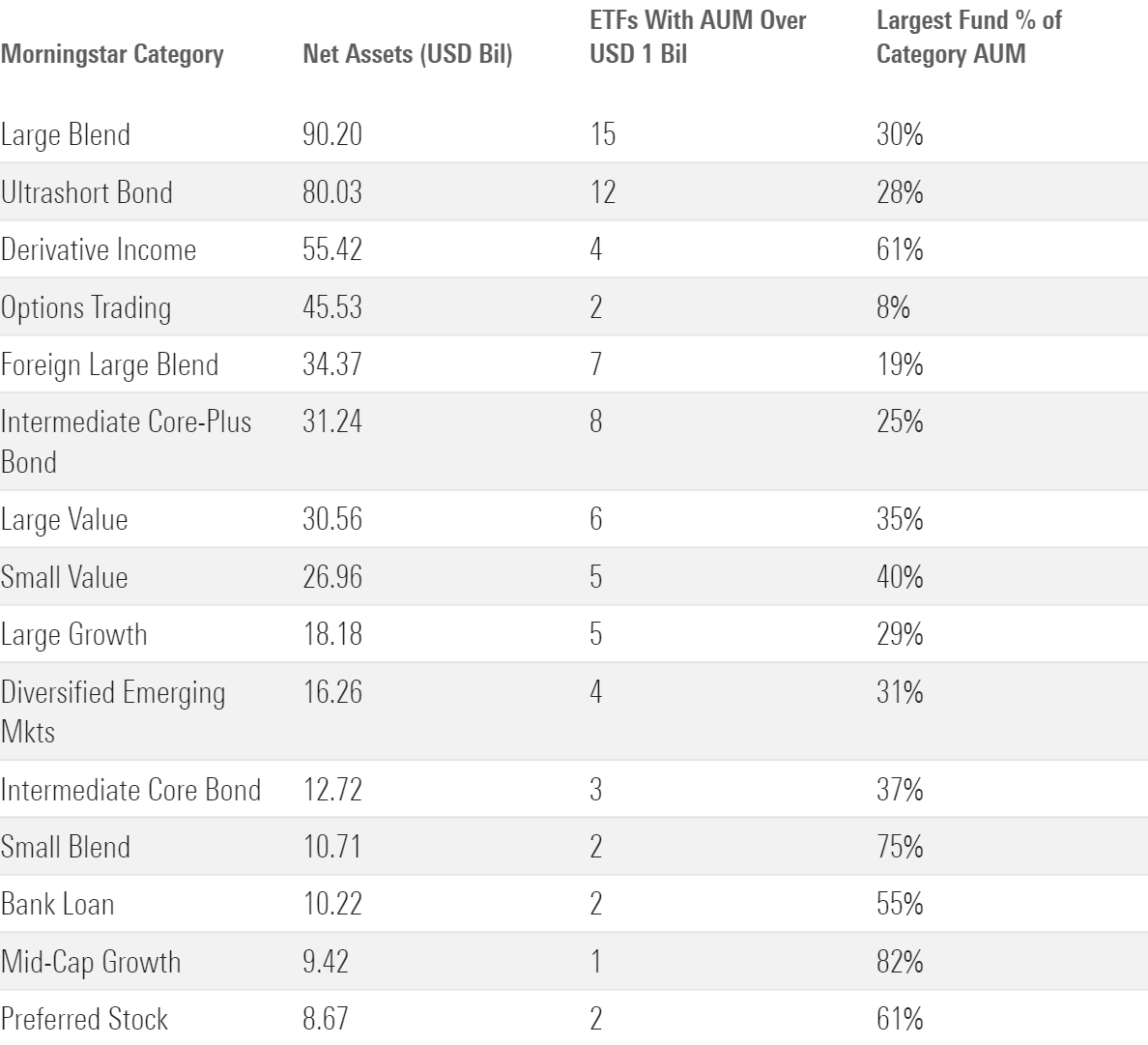

Categories With the Most Active ETFs

Given the benefits and drawbacks of ETFs, it is no surprise to see active ETF assets concentrate in more liquid corners of the market. US large-cap, ultrashort bond, and core bond Morningstar Categories are among active ETFs’ largest by AUM. Options-related active ETFs have also seen success by catching a major trend in covered-call strategies and buffer funds.

As of March 31, 2024, 25 categories had more than $5 billion in assets. Of these, 14 had two or fewer ETFs with more than $1 billion AUM, including nine categories with over 50% of assets in a single ETF. Most notably, JPMorgan Equity Premium Income ETF JEPI, the biggest fund in the third-largest active ETF category, derivative income, had almost $34 billion, or 60% of the group’s assets.

Top 15 Active ETF Morningstar Categories by Assets

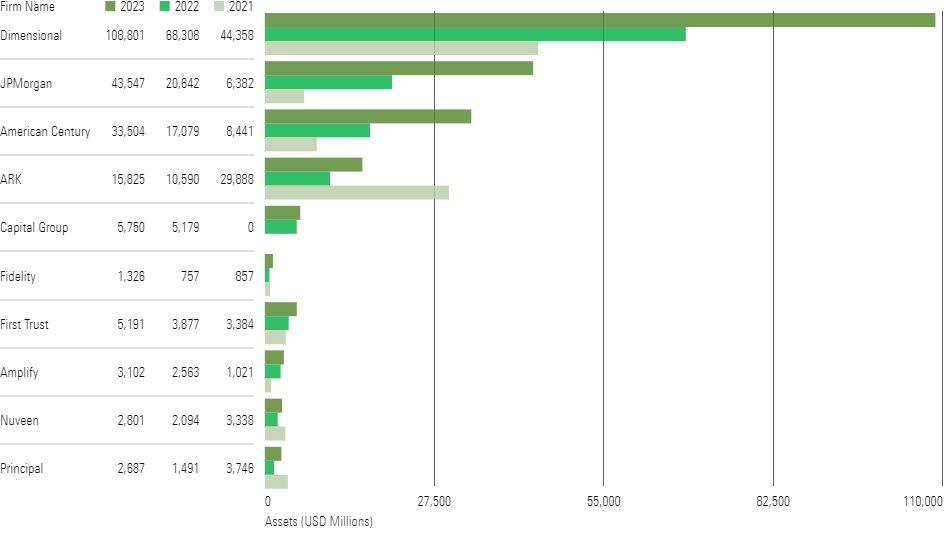

Asset managers like Dimensional and Avantis, who falls under American Century in the first exhibit, have found little competition from active managers in less liquid markets because they take a highly diversified approach that avoids the pitfalls of the ETF wrapper.

Active ETFs are a growth opportunity for active managers, but only a few have been able to take full advantage, so far. They have not been a panacea for traditional active firms in the throes of outflows.

Opportunities for Investing in Active Equity ETFs

Active ETFs have gained momentum among once-skeptical active equity managers in recent years, in no small part because of the SEC’s ETF Rule.

So far, three firms have dominated active equity ETF assets: Dimensional Fund Advisors, J.P. Morgan, and Avantis Investors (a subsidiary of American Century). As of year-end 2023, Dimensional topped the charts with $109 billion, followed by J.P. Morgan with $51 billion and Avantis with $33 billion. Fidelity and Capital Group have had success, too.

Total Equity Assets by Firm

See the full report for further details about active equity ETFs.

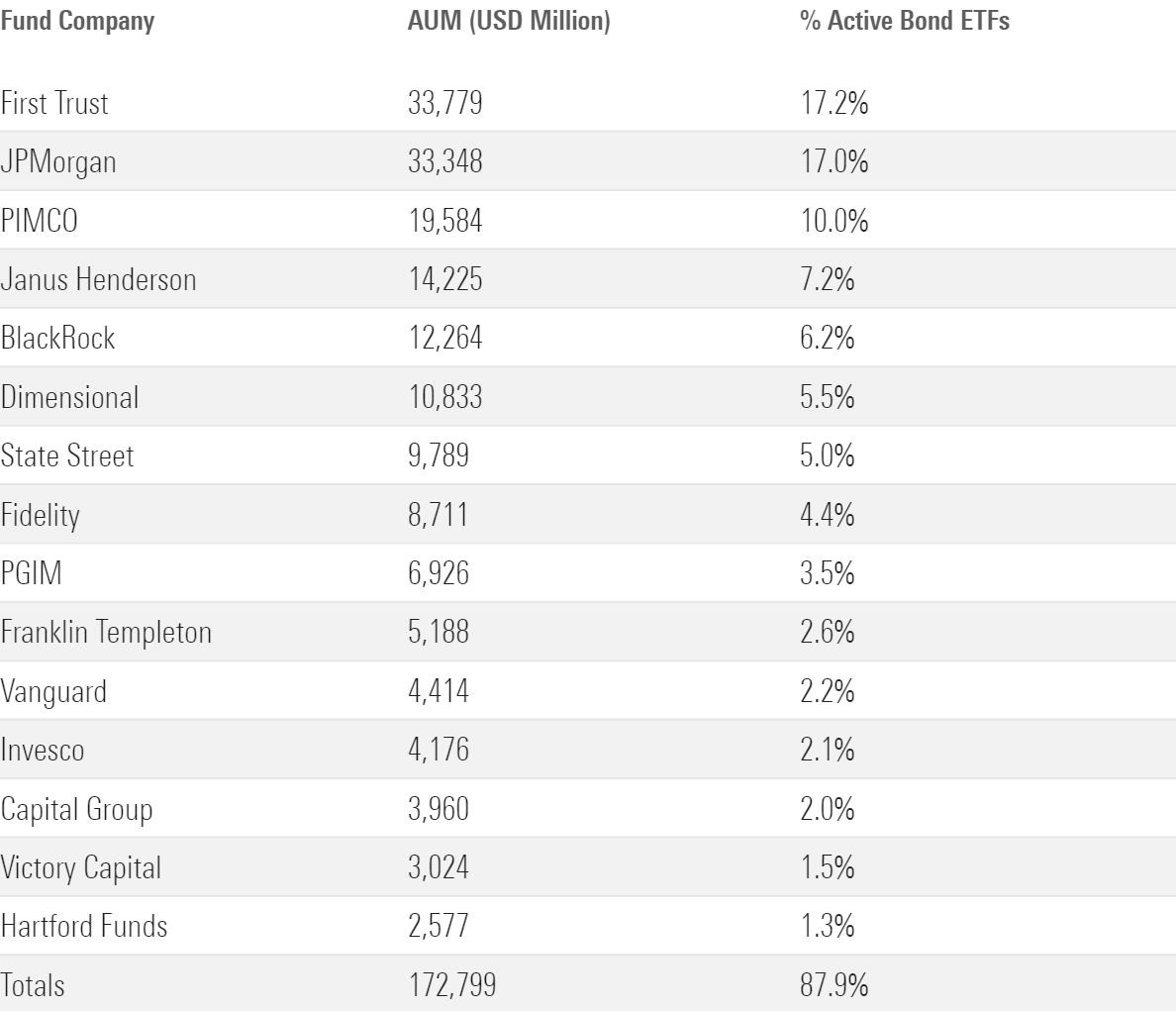

Opportunities for Investing in Active Fixed-Income ETFs

Fixed-income strategies are not new to the active ETF landscape, yet the popularity of these strategies continues to grow and may make sense for investors who favor the flexibility and tax efficiency of an ETF with the benefits of active bond management.

Active bond ETF offerings have seen significant growth over the last few years: About 200 distinct strategies launched since December 2020, including 73 in 2023 alone, more than any other prior year. Still, the market value of active bond ETFs only accounts for about 13% of the fixed-income ETF universe.

The three largest active bond ETF providers, First Trust, J.P. Morgan, and Pimco, continue to add new ETFs to their lineups or, in J.P. Morgan’s case, to convert longtime mutual fund strategies into ETFs.

Newer entrants include other well-respected fixed-income shops that recently warmed up to the ETF wrapper. Capital Group (American Funds), for example, has launched six actively managed bond ETFs since 2022. Likewise, star mutual fund managers, such as BlackRock’s Rick Rieder and Pimco’s Dan Ivascyn, have begun launching their first ETFs.

Top 15 Active Bond ETFs by Fund Company

Active bond ETFs will evolve, but they have been around long enough to prove that various strategies are viable, and even successful, in an ETF format. See the full report for important considerations for active bond ETF investors.

Opportunities for Investing in Active Allocation ETFs

Although active equity and bond ETFs have gained significant traction since the mid-to-late 2010s, multi-asset offerings are still waiting for their moment. As of March 2024, active allocation ETFs tallied less than $8 billion in total assets, well below the roughly $350 billion and $196 billion for equity and bond offerings, respectively.

Without demonstrated interest from investors, providers have been hesitant to launch allocation ETFs, instead focusing on faster-growing vehicles like target-date funds and model portfolios. In total, 105 allocation active ETFs were launched over the last decade, dwarfed by the over 1,100 active equity and bond ETFs combined. And of that small group of launches, 27 have already liquidated, with an average life span of roughly three years.

Retail investors and advisors haven’t demanded active allocation ETFs. Investors have gravitated to target-date funds through their 401(k) plans, using them as “set-it and forget-it” retirement savings options. Many of these investors also probably don’t have much additional money to invest outside those plans and put toward other active allocation ETFs.

There are also very few index allocation ETFs—only 28 as of March 2024, indicating the ETF wrapper hasn’t gained much traction with allocation investors overall.

Signs of Green Shoots

Although asset growth has been slow and product launches measured, Capital Group and BlackRock, two of the largest asset-allocation managers, launched active multi-asset ETFs in 2023.

Check out the full report for more details on the top active allocation ETF offerings, including these new products from Capital Group and BlackRock.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)